Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.01.18 07:34

How to use Donchian Channels (adapted from dailyfx article)

- First find the trend to determine the trend

- Learn to enter Forex breakouts using Donchian Channels.

- Channels can be used to trail your stop and lock in profit.

The Forex market is known for its strong trends, which can make trading breakouts of support and resistance levels an effective approach to the markets. To plan for such market conditions, today we will review a three step breakout strategy using the Donchian Channels.

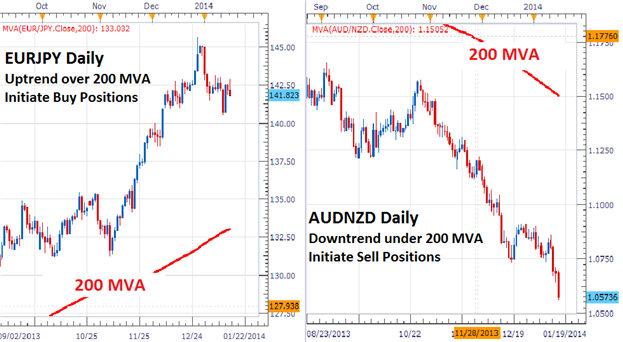

Find the Trend

The first step to trend trading is to find the trend! There are many

ways to identify the trends depicted below, but one of easiest is

through the use of the 200 period MVA (Moving Average). To begin add

this indicator to your chart, and then see if price is above or below

the average. This is how we will determine the trend and our trading

bias.

Given the information above, traders should look for opportunities to buy the EURJPY in its current uptrend as price is above the average. As well, the AUDNZD pictured below offers selling opportunities since the pair is priced under the 200 period MVA. Once we have this information, then we can plan entry placements for a potential breakout.

Trading Donchian Channels

Donchian Channels are a technical tool that can be applied to any chart.

They are used to pinpoint current levels of support and resistance by

identifying the high and low price on a graph, over the selected number

of periods. For today’s strategy we will be using 20 periods meaning

that the channels will be used to identify the 20 day high and low in

price.

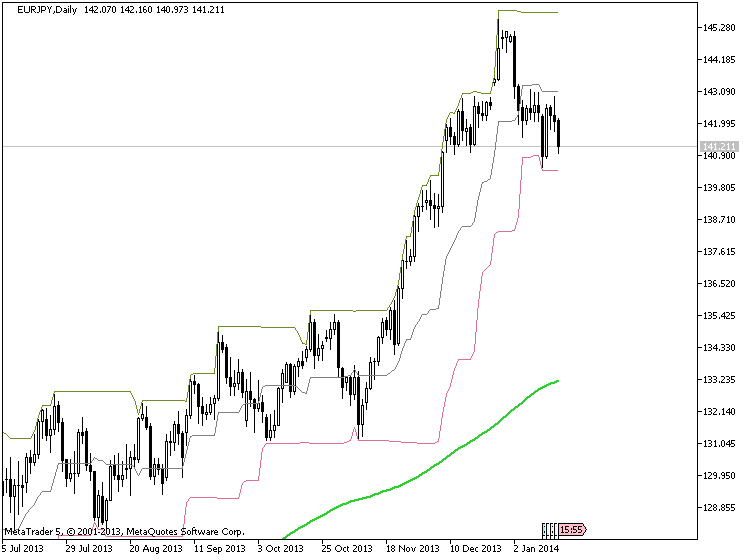

Since the price of the EURJPY is trading above the 200 MVA, traders will want to identify new entries to buy the pair on a breakout towards higher highs. With our current 20 Day high identified by the Donchian Channels at 145.68 traders can set an entry to buy the EURJPY one pip above this value.

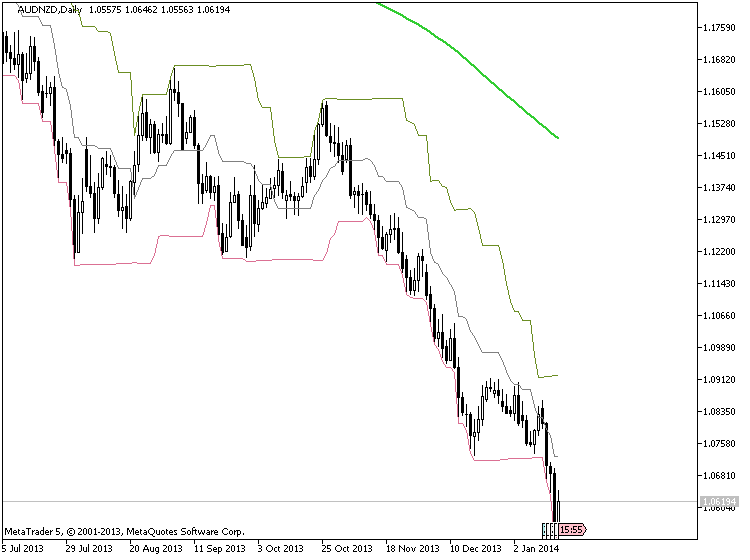

The process of initiating sell positions in a downtrend is exactly the opposite. Again, we will revisit the AUD/NZD Daily graph pictured below. As price is below the 200 MVA, traders will look to sell the pair in the event of price creating a new 20 Day low. Currently that low resides at .8775 and traders can look to initiate new sell positions under that value.

Setting Risk & Trailing Stops

When trading any strategy, setting stops and managing risk should be

considered. When using Donchian Channels, this process can be

simplified. Remember how our pricing channels (representing the 20 Day

high or low), act as an area of support or resistance? In an uptrend,

price is expected to move to higher highs and stay above this value. If

price moves through the bottom channel, representing a new 20 Day low,

traders will want to exit any long positions. Conversely in a downtrend,

traders will want to place stops orders at the current 20 period high.

This way, traders will exit any short positions upon the creation of a

new high.

Traders may also use the Donchian Channels as a mechanism to trail their

stop. As the trend continues, traders may move their stop along with

the designated channel. Trailing a stop in this manner will allow you to

update the stop with the position, and lock in profit as the trend

continues.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.01.18 07:39

After reading this article (above) - you/we can open D1 chart, attached Donchian Channel indicator (see first post of this thread), attach MA with the period 200/method simple.apply to close (this indicator is default one in Metatrader 5) - and we can make some practics (when market will be open). You should have the similar charts after attaching those 2 indicators:

After that - re-read this above article using your Metatrader charts.

That's all news

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2013.10.14 14:40

Price Channels is a helpful technical analysis indicator to determine buy and sell signals based on price breakouts.

- Upper Price Channel: The highest high over a user-defined time period.

- Lower Price Channel: The lowest low over a user-defined time period.

The user-defined time period is generally 20 periods. To further illustrate how a price channel is created a chart of the Nasdaq 100 ETF (QQQQ) is shown below:

Price Channels are used mainly to identify price breakouts. The buy and sell signals are shown below in the chart of the QQQQ's:

Buy when price closes above upper bands. This is like buying a breakout above resistance, the resistance just happens to be whatever the highest high was of the past 20 trading days.

Price Channel Sell SignalSell when price closes below lower bands. This would be like selling a breakout below support, but the support in this case is whatever the lowest low was of the previous 20 trading days.

Price Channels offer an easy to follow method of buying and selling stocks, futures, or currency pairs.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2013.03.22 14:04

PriceChannel Parabolic system basic edition

- indicators and template to download for black background (first post of this thread)

- PriceChannel indicator is on CodeBase here, same for white background, how to install

- Clock indicator to be used with this trading system - Indicator displays three variants of time in the chart: local, server and GMT

Latest version of the system with latest EAs to download

- pricechannel_parabolic_system_v1 EA

- pricechannel_parabolic_system_v1_1 EA with updated indicator

- Fully updated EA with trading system is on this post and latest indicators to download

How to trade

- tp/sl levels and timeframes

- how to trade with explanation

- graphical illustration about where to enter and where to exit with latest version of the system

- how to use AFL Winner indicator with more explanation,

- Updated manual system with templates and indicators - this post

The settingas for EAs: optimization and backtesting

- optimization results for this EA for EURUSD H4

- backtesting results for EURUSD H4 with the settings #1

- backtesting results for EURUSD H4 with the settings #2

- optimization results for EURUSD M15

- backtesting results for EURUSD M15 with the settings #1

- optimization results for GBPUSD M15

- backtesting results for GBPUSD M15 with the settings #1

Trading examples

Metaquotes demo

- MT5 statement is here

- Updated statement is here

- More trading updates

- Updated MT5 statement

- More updates

- 811 dollars for 3 trading days and final statement for scalping

GoMarkets broker, initial deposit is 1,000

- statement (77 dollars in less than 1 hour)

Alpari UK broker initial deposit is 1,000

- statement (517 dollars for one day)

RoboForex broker initial deposit is 1,000

- first statement

- updated statement (257 dollars in 2 days)

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Price Channel:

Author: Николай