Idea 1: Using historical weight measure to learn emotional factor about people gain/lose weight to use on the market (by figurelli)

The idea here is to use some of the most emotional problems and desires of human bean, i.e., lose weight.

Like market prices, we have here supports and resistances, that depends too much from emotional aspects.

So, what about connect historical and real time information from several volunteers and try to identify a relationship with market movements, for instance EUR/USD trends?

But wait, you don't need to start asking for your workmates to help you ;-)

To create a trading system, the ideal solution would be an API or webservice where we connect to a provider of statistical weight historical information, segmented by several ways, like age, place, etc., and there are several apps for Smartphones with such providers that you can look for such statistical data.

- www.metatrader5.com

Idea 2: Creating a trading system based on an Universal Indicator (by figurelli)

There are hundreds of technical indicators. But, in some sense, most of them have similar points, since they are analysing the past.

If we just think about the oscillators ones, like RSI and Stochastic, we can for instance figure out a Fourier Series model to try create a one fits all formula.

But for non oscillators, the best idea I can see is using dynamic and parameterized algorithms, based on all sorts of relationships we can imagine about past prices and volumes.

To do this, we need several input parameters, that we can join in few ones, using bit checking.

So if we create this Universal Indicator, the easy part will be creating a trading system using several kinds of strategies, based on trend reversal and following, for instance.

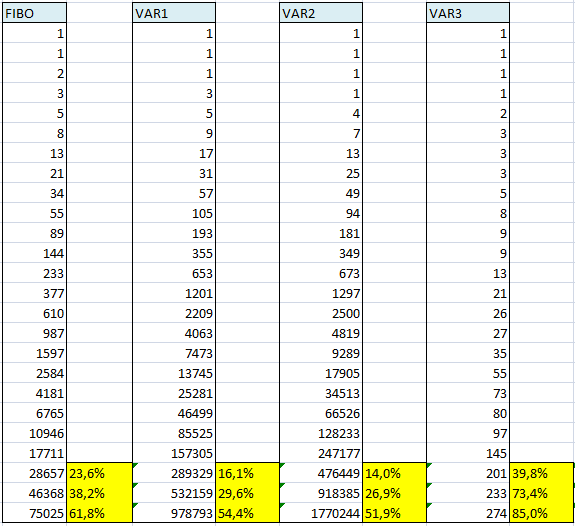

Idea 3: Creating a trading system based on Fibonacci ratios variations (by figurelli)

We all know the famous Fibonacci ratio (23.6%, 38.2% and 61.8%) used to identify the potential retracement of an instrument original move in price.

So, if you are a Fibonacci fan, please go directly to the next idea ;-)

But if you are still here, why do not create a trading system where the ratios are not exactly the same sequence, but based on the same principle, as pictured below.

Here I created 3 variations, where instead of sum the last 2 numbers as the original Fibonacci sequence, we sum a mix of the last 3 and 4 numbers.

The result is new ratios, that we can double check the utility in our trading system.

As a radical variation of this approach, we can even use the ratios as parameters, without any sequence as reference or to figure out, just find what fits best to our backtesting sample.

In this case, take care about your algorithm to compare if the ratios are really in sequence.

Interesting!

Interesting!

Idea 4: Algorithms and Trading Systems based on Chess game strategies (by figurelli)

Well, this is not new in this Forum, for some of you, anyway, just to don't forget to put in the ideas history here (also, this is an invite to you participate in this other topic).

Forum on trading, automated trading systems and testing trading strategies

Algorithms and Trading Systems based on Chess game strategies

figurelli, 2014.01.21 14:50

If you like chess, what about a match where you play against the Market?

But take care, Market is a Grandmaster as strong as Garry Kasparov and Magnus Carlsen playing together against us!

I believe that there are several tatics and strategies from Chess game that can be adapted to a trading system.

So I decided create this topic to join some Chess game strategies with trading systems.

I have similar topics in other languages, but they are focused in general games (Portuguese) and soccer (Spanish).

The idea here in this topic is study chess tactics and strategies and find a way to address them to the market.

And, why not (my dream), play the first match against the Market in near future !!!

Idea 5: a trading system to join and analyze the Depth of Market of several brokers (by figurelli)

The Depth of Market (DOM) just displays the order book and interest of buyers and sellers of the broker you are connected (if the broker enables this information).

However, what about analyze bids and asks for a particular instrument, at the best prices at the moment, not just for one broker, but for several ones?

This is not an easy task and a just one EA trading system, since you have to create the integration system running on several platforms and brokers.

Anyway, it's feasible, since we have all technology to do that at MT5.

So, the idea is integrating several DOM data from several brokers in one database, and create a trading system to analyse and compare this data to find patterns and trade opportunities.

Idea 6: a very resilient trading system with a random validator to risk/money management tuning (by figurelli)

Unfortunately, in MT5, we can not use random data to validate our risk/money management algorithms.

So, as far as I know, all trading systems published here use historical data to validate such algorithms.

But what about creating an internal module in your trading system, using any strategy, to double check your risk/money management in really random conditions?

The solution is quite simple, but we have to think outside the box. And to do this, we must forget random data, and change this to random trades.

Random trades? Yes, the random validator must generate random trades, that will create the biggest problem to your risk/money algorithms.

The main idea is to create two stages of adjustment, as stated below:

Stage 1) Rough-tuning Mode: uses Random Validator that generates random trades to rough-tuning of the risk/money parameters.

Stage 2) Fine-tuning Mode: uses your strategy to generate trades (as usual in all trading systems) to fine-tuning of the risk/money parameters.

In this sense, when you are rough-tuning, you don't use your strategy to generate the trades, just the random validator.

After the adjustment, you can now turn the key to your strategy, using the resilient rough-tuning of your risk/money management and make a final fine-tuning.

In theory, this trading system can work with any strategy, since the idea here is create a more resilient risk/money management, that maybe is the more relevant part of your system.

Idea 7: a trading system connected to a video game and the other way around (by figurelli)

What about earning money while your son win a video game? ;-)

Well, several years ago I had an idea where I imagine a boy playing a race car video game that was connected in some way to the price movements of the market, i.e., to win the race he had to beat the market in somehow. My vision was that this would be someday a reality to extract human intelligence in a different way to solve trading complex work.

I shared this idea some day ago at this pocket topic below, created by arnovinc.

Forum on trading, automated trading systems and testing trading strategies

Human computation applied to automated trading; research project now live

arnovinc, 2014.01.21 20:11

Thanks for your comment, race car trading is a great idea !!! I had the same some years ago to turn high frequency trading into a kind of bobsleigh 3D game (I think I still have a small demo somewhere...) Idea was to travel between 2 mountains with a design that follows in real time market books : buyers on the left, sellers on the right and you have to trade with the Joystick (I think you become mad in one hour). Could be based on the game Tux Racer for example (as it is open source)

I just thought again about this idea by testing those 3D glasses http://www.oculusvr.com/ few weeks ago, imagine you can play inside the market itself for high frequency scalping.... (I think you become mad in less than half an hour then).

Krabott trading signal will be provided on MQL5.com signal market place in some weeks (we are currently testing it to check all interfaces). So we will communicate in less than one month on this system.

Thanks for your work as moderator.

Idea 8: human computation applied to automated trading (by arnovinc)

"Human-based computation is a computer science technique in which a machine performs its function by outsourcing certain steps to humans. The algorithmic outsourcing techniques used in human-based computation are much more scalable than the manual or automated techniques used to manage outsourcing traditionally." (source: Wikipedia)

Forum on trading, automated trading systems and testing trading strategies

Human computation applied to automated trading; research project now live

arnovinc, 2014.01.21 15:57

Hi all, Just wanted to share some informations of a trading research project named Krabott that began in 2009 in a french university lab.

Maybe you heard about Fold-it experience in biochemistery . The Fold it project predicts the 3D shape of proteins given their amino acid sequence, using a game. Teams of on-line volunteers with no special knowledge who were invited to play a collective game came up with better solutions to the puzzles than state of the art computer programs. Some people call this a "human computation" process. (see http://fold.it)

Since 2009, I planed to apply the same recipes to automated trading. The aim is to ask players without any financial or technical knowledge, to design new parameters of existing trading strategies. Name of the project is "Krabott". Calculation engine is based on genetic algorithmes HBGA (described by a researcher A.Kosorukoff in 2000). (see http://www.krabott.com)

After 4 years and a PhD on this subject we now are ready to publish as a signal provider a "crowdcomputed" trading signal, only based on work of severals players, thanks to MQL5.com community this may be ready before the end of february. The signal is not an average opinion of several players, but the result of a trading strategy where all parameters are computed by the crowd.

Would be happy to share ideas and knowledge with anyone interested in this field !

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

I still don't have the topic rules, but I have a lot of ideas to share, some very crazy, to be honest, so if you have the same problem or spirit, let's work together.

The dynamic is quite simple: I will start publishing such ideas, and you are welcome to publish yours, or just give a critical evaluation of the ideas here. And if you know some similar idea, please let us know too.

To become easier identify the ideas, I will create a sequential number and title for any idea here, inside the post of the original author.

In this sense, I will bring new ideas from other forum users, if they are regarding new ideas for trading systems, to be cataloged as new ideas here. If you know something about, please advice us.

If you like some of the ideas, feel free to create a new specific topic about (in this case please don't forget to mention this topic), or even put the theory in practice (in this case, please let we know about).