- MQL5 Wizard: Development of trading robots for MetaTrader 5

- How to become a signal provider and receive monthly fees

- How to copy deals of successful traders in MetaTrader 5

Some electronic payment systems work like the following. If you get paid 1 USD from A but your base currency is set to EUR in Z, then your USD will fluctuate with EURUSD in Z. This means that the best moment to withdraw money is when EURUSD is going down, and viceversa to deposit some money.

Don't you have a fee/commission which is high enough to make what you describe infeasible ?

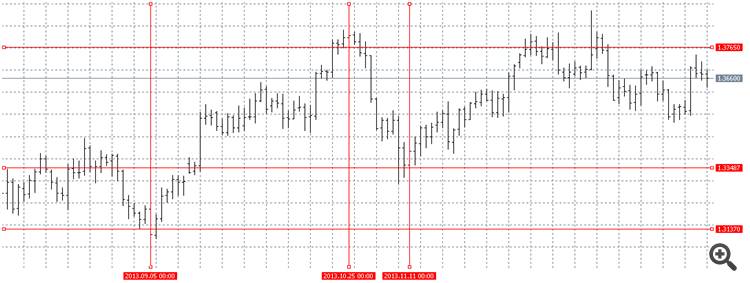

Imagine you get paid $100 from MetaQuotes on 2013.10.25, when EURUSD is 1.3765, but you will transfer into your account your $100 (and convert to euro, where EURUSD is 1.3348) on 2013.11.11. In this case you get $100/1.3348 = 74.92 € - 2%; 74.92 € - 1.50 € = 73.42 €.

Otherwise, if you get paid $100 on 2013.09.05, when EURUSD is 1.3137, and you transfer your $100 on 2013.10.25, where EURUSD is 1.3765, then you get $100/1.3765 = 72.65 € - 2%; 72.65 € - 1.45 € = 71.20 €.

So why would you want to lose 73.42 € - 71.20 € = 2,22 €? That is more than 3% of $100!

Figure 1. Trading your electronic payment system. Daily EURUSD.

Well, as far as I know that fee/commission depends on the operation you're supposed to do next: buy, transfer, pay someone else, etc. Anyway, let's suppose it's always 2%.

Imagine you get paid $100 from MetaQuotes on 2013.10.25, when EURUSD is 1.3765, but you will transfer into your account your $100 (and convert to euro, where EURUSD is 1.3348) on 2013.11.11. In this case you get $100/1.3348 = 74.92 € - 2%; 74.92 € - 1.50 € = 73.42 €.

Otherwise, if you get paid $100 on 2013.09.05, when EURUSD is 1.3137, and you transfer your $100 on 2013.10.25, where EURUSD is 1.3765, then you get $100/1.3765 = 72.65 € - 2%; 72.65 € - 1.45 € = 71.20 €.

So why would you want to lose 73.42 € - 71.20 € = 2,22 €? That is more than 3% of $100!

Figure 1. Trading your electronic payment system. Daily EURUSD.

Ok I see, I misunderstood your point at first. If you don't need this money you can do that, as your really don't know how many times it will take to get a favourable exchange rate. Imagine you get this money on your mql5 account first week of november 2013. Almost 3 months later your are still waiting for a better rate.

Yes, it's a "just in case" measure. An optimal way to diversify your electronic money, however small it may be.

Yes, in French we have an expression "il n'y a pas de petit profit" (there is no small profit).

I agree with that. In Spanish we have another saying, something like 'do not put all your eggs in one basket because you could break all them at some moment'.

Ok I see, I misunderstood your point at first. If you don't need this money you can do that, as your really don't know how many times it will take to get a favourable exchange rate. Imagine you get this money on your mql5 account first week of november 2013. Almost 3 months later your are still waiting for a better rate.

Good topic and discussion, since we have several service/product providers on the Forum, and the 3% example is really significant for any investor.

In my opinion, this bold phrase above, from Alain, is the solution and challenge you have, i.e., you must consider this money as an investment and wait the best moment to withdraw it.

So, if you do it, and have time to wait a favorable average price, you will join your efforts to earn money as a good worker and good investor.

Good topic and discussion, since we have several service/product providers on the Forum, and the 3% example is really significant for any investor.

In my opinion, this bold phrase from Alain, is the solution and challenge you have, i.e., you must consider this money as an investment and wait the best moment to withdraw it.

So, if you do it, and have time to wait a favorable average price, you will join your efforts to earn money as a good worker and good investor.

Agree. But not always so easy, we have to eat

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use