You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

eurgbp setup idea for next weeks

Gabriel D Arco, 2017.10.08 15:47

i made my view on short tieme chart setup idea for next week

we can see eurgbp keep is support .

and after make a breakout of 1h chanel

then after make a small range and breakout again

but that i seen is the on and i think we have to wait a breakout of the RSI for see a real next move

Both eur and Gbp have polical problem

one is brexit uncertainly other is Catalonia topic

Have a good sunday

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.10.10 09:08

EUR/JPY - daily bullish ranging withinsymmetric triangle pattern (based on the article)

Daily price is above Ichimoku cloud for the ranging with symmetric triangle pattern within 133.11 resistance level and 131.84 support level.

If the price breaks 133.11 resistance to above so the bullish trend will be continuing with 134.40 as a nearest daily target, otherwise - bullish ranging within the levels.

==========

The chart was made on D1 timeframe with Ichimoku market condition setup (MT5) from this post (free to download for indicators and template) as well as the following indicator from CodeBase:

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.10.12 08:14

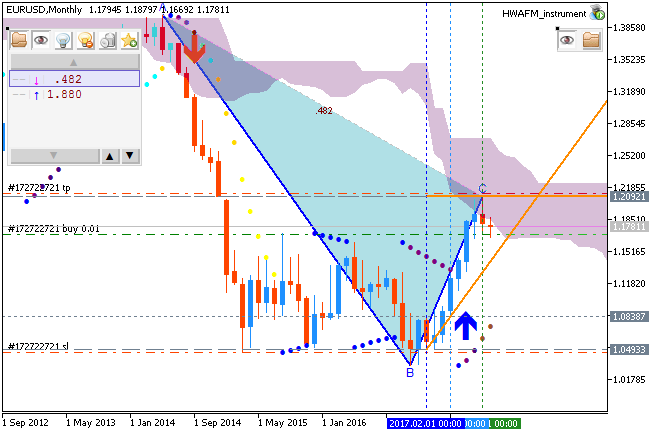

EUR/USD - daily bullish reversal; 1.2092 is the target (based on the article)

Daily price is breaking Senkou Span line together with 1.1869 resistance level to above for the daily bullish reversal with 1.2092 daily target.

==========

Chart was made on MT5 with Brainwashing system/AscTrend system (MT5) from this thread (free to download) together with following indicators:

Same system for MT4:

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.10.13 11:46

Trading the News: U.S. Consumer Price Index (CPI) (based on the article)

An uptick in both the headline and core U.S. Consumer Price Index (CPI) may undermine the near-term rebound in EUR/USD as it encourages the Federal Open Market Committee (FOMC) to implement higher borrowing-costs over the coming months.

What’s Expected:

How To Trade This Event Risk

Bullish USD Trade: Headline & Core CPI Pick Up in September

Bearish USD Trade: U.S. Inflation Report Fails to Meet Market Forecast

EUR/USD Daily

============

Chart was made on MT5 with BrainTrading system (MT5) from this thread (free to download) as well as the following indicators from CodeBase:

All about BrainTrading system for MT5:

==========

EUR/USD M5: range price movement by U.S. Consumer Price Index news event

==========

Chart was made on MT5 with MA Channel Stochastic system uploaded on this post, and using standard indicators from Metatrader 5 together with following indicators:

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.10.14 08:36

EUR/USD - 1.1879 is the key for the bullish; 1.1669 is the key for the daily correction (based on the article)

Daily price is located above 200 SMA in the bullish area of the chart. The price is moving to be above and near 55 SMA with 1.1879 resistance level to be crossing for the bullish trend to be continuing.

==========

Chart was made on using standard indicators with Metatrader 5 together the following:

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.10.21 15:51

EUR/USD - weekly bullish ranging foir direction (based on the article)

Weekly price is above Ichimoku kumo in the bullish ranging within 1.2091 resistance for the bullish trend to be continuing and 1.1422 support level for the secondary correction to be started.

==========

The chart was made on H4 timeframe with standard indicators of Metatrader 4 except the following indicators (free to download):

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.10.22 08:53

Weekly EUR/USD Outlook: 2017, October 22 - October 29 (based on the article)

EUR/USD was under some pressure on the ongoing crisis in Catalonia. The upcoming week is dominated by the all-important ECB decision. What will be the new size of the QE program? Here is an outlook for the highlights of this week.

Look at the EURUSD chart:

This is the daily timeframe. Today, on this graph, we see a flat. In this case, the blue frame clearly shows the reversal figure "Head and Shoulders". That is, we can confidently predict that the pair EURUSD will go down. I think that in a week we will all say that EURUSD has a downward trend.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.10.24 09:54

EUR/USD - intra-day bearish below ranging reversal levels (based on the article)

H4 intra-day price is located below 200 SMA/55 SMA levels in the primary bearish area of the chart: the price is testing the last MA channel level at 1.1714 to below for the bearish trend to be continuing.

==========

The chart was made on MT5 with MA Channel Stochastic system uploaded on this post, and using standard indicators from Metatrader 5 together with following indicators:

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.10.26 14:00

EUR/USD Intra-Day Fundamentals: Minimum Bid Rate, ECB Press Conference and range price movement

2017-10-26 12:45 GMT | [EUR - Minimum Bid Rate]

if actual > forecast (or previous one) = good for currency (for EUR in our case)

[EUR - Minimum Bid Rate] = Interest rate on the main refinancing operations that provide the bulk of liquidity to the banking system.

==========

From official report :

==========

EUR/USD M30: range price movement by ECB Minimum Bid Rate news event

==========

Chart was made on MT5 with Brainwashing system/AscTrend system (MT5) from this thread (free to download) together with following indicators:

Same system for MT4: