You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.08.25 10:47

EUR/USD Intra-Day Fundamentals: German Ifo Business Climate and range price movement

2017-08-25 09:00 GMT | [EUR - German Ifo Business Climate]

if actual > forecast (or previous one) = good for currency (for EUR in our case)

[EUR - German Ifo Business Climate] = Level of a composite index based on surveyed manufacturers, builders, wholesalers, and retailers.

==========

From official report :

==========

EUR/USD M5: range price movement by German Ifo Business Climate news event

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.08.25 19:47

Intra-Day Fundamentals - EUR/USD and Dollar Index: Fed Chair Yellen Speech

2017-08-25 15:00 GMT | [USD - Fed Chair Yellen Speech]

[USD - Fed Chair Yellen Speech] = Speech about financial stability at the Federal Reserve Bank of Kansas City Economic Symposium, in Jackson Hole.

==========

From marketwatch article :

==========

EUR/USD M5: range price movement by Fed Chair Yellen Speech news events

==========

Dollar Index M5: range price movement by Fed Chair Yellen Speech news events

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.08.26 07:11

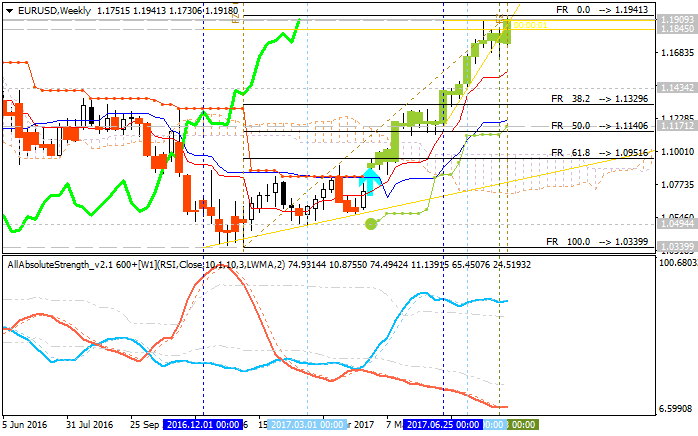

Weekly EUR/USD Outlook: 2017, August 27 - September 03 (based on the article)

EUR/USD was looking good during the last full week of August and remained range-bound. What’s next? The inflation figures stand out as we turn the page into September.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.08.28 12:10

EUR/USD - daily bullish; 1.1941 is the key (based on the article)

Daily price is above Ichimoku cloud in the bullish area of the chart for the ranging within the following support/resistance levels:

Ascending triangle pattern was formed by the price to be crossed to above together with 1.1941 resistance evel for the bullish trend to be continuing.

By the way, the daily price is breaking 1.1941 resistance for the bullish breakout to be continuing:

Same situation is with weekly chart:

As to the price on the monthly chart so the price is going to be started with the bullsh reversal soon:

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.08.29 17:54

Intra-Day Fundamentals - EUR/USD, USD/CAD and USD/CNH: Consumer Confidence Index

2017-08-29 15:00 GMT | [USD - CB Consumer Confidence]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - CB Consumer Confidence] = Level of a composite index based on surveyed households.

==========

From official report :

==========

EUR/USD M5: range price movement by Consumer Confidence Index news events

==========

USD/CAD M5: range price movement by Consumer Confidence Index news events

==========

USD/CNH M5: range price movement by Consumer Confidence Index news events

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.09.01 14:57

Intra-Day Fundamentals - EUR/USD, GBP/USD and USD/JPY: Non-Farm Employment Change

2017-09-01 13:30 GMT | [USD - Non-Farm Employment Change]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Non-Farm Employment Change] = Change in the number of employed people during the previous month, excluding the farming industry.

==========

From official report :

==========

EUR/USD M5: range price movement by Non-Farm Payrolls news events

==========

GBP/USD M5: range price movement by Non-Farm Payrolls news events

==========

USD/JPY M5: range price movement by Non-Farm Payrolls news events

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.09.02 09:15

Weekly EUR/USD Outlook: 2017, September 03 - September 10 (based on the article)

EUR/USD made a big breakout and topped 1.20 but fell quite quickly as well. Will it continue higher? The ECB meeting is undoubtedly the key event of the week, and there are other events as well. Here is an outlook for the highlights of this week.

Today is September 6, 2017. The maximum price of EURUSD was 1.2070 on August 29, 2017. After that, there were no serious events that could seriously move the price anywhere. After that, we had NonFarm = 156K (it's less than 200K) on September 1, which did not affect the situation in any way. (When NonFarm is more than 200K, this provokes serious movement.)