Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.04.06 17:05

Intra-Day Fundamentals - EUR/USD, Dollar Index and Bitcoin/USD: U.S. Jobless Claims

2017-04-06 13:30 GMT | [USD - Unemployment Claims]

- past data is 259K

- forecast data is 251K

- actual data is 234K according to the latest press release

if actual < forecast (or previous one) = good for currency (for USD in our case)

[USD - Unemployment Claims] = The number of individuals who filed for unemployment insurance for the first time during the past week.

==========

From rttnews article:

- "With the monthly jobs report looming, the Labor Department released a report on Thursday showing a much bigger than expected drop in first-time claims for U.S. unemployment benefits in the week ended April 1st."

- "The report said initial jobless claims fell to 234,000, a decrease of 25,000 from the previous week's revised level of 259,000."

==========

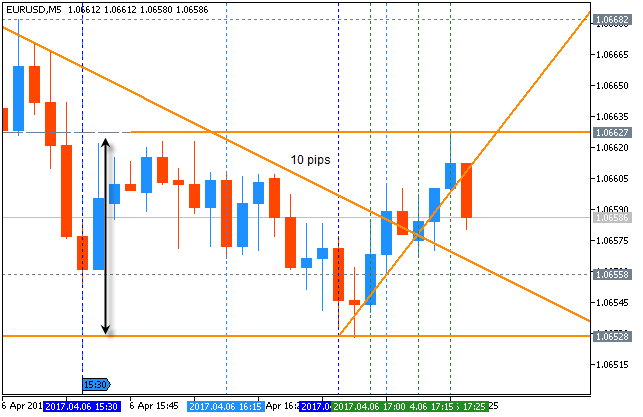

EUR/USD M5: 10 pips range price movement by U.S. Jobless Claims news events

==========

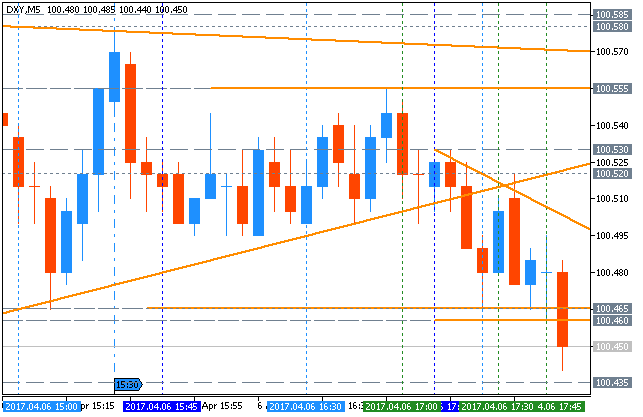

Dollar Index M5: range price movement by U.S. Jobless Claims news events

==========

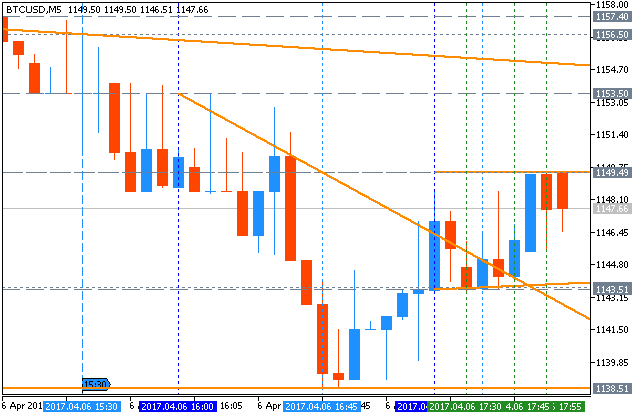

BTC/USD M5: ange price movement by U.S. Jobless Claims news events

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.04.07 17:41

Intra-Day Fundamentals - EUR/USD, USD/CNH, Apple shares and McDonald's shares: Non-Farm Payrolls

2017-04-07 13:30 GMT | [USD - Non-Farm Employment Change]

- past data is 219K

- forecast data is 174K

- actual data is 98K according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Non-Farm Employment Change] = Change in the number of employed people during the previous month, excluding the farming industry.

==========

From official report:

- "The unemployment rate declined to 4.5 percent in March, and total nonfarm payroll employment edged up by 98,000, the U.S. Bureau of Labor Statistics reported today. Employment increased in professional and business services and in mining, while retail trade lost jobs."

==========

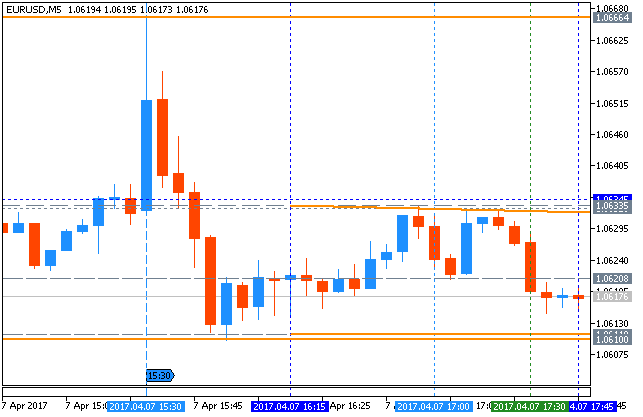

EUR/USD M5: range price movement by Non-Farm Payrolls news events

==========

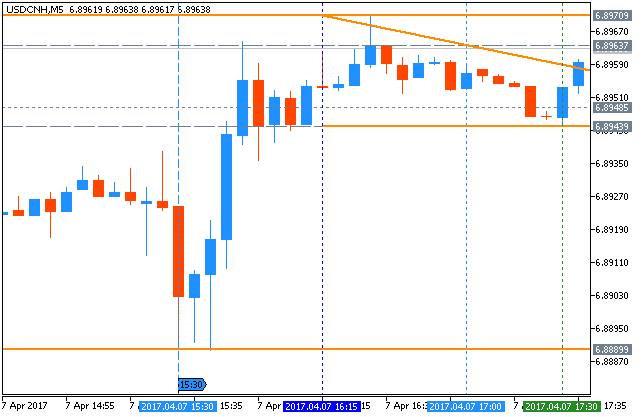

USD/CNH M5: range price movement by Non-Farm Payrolls news events

==========

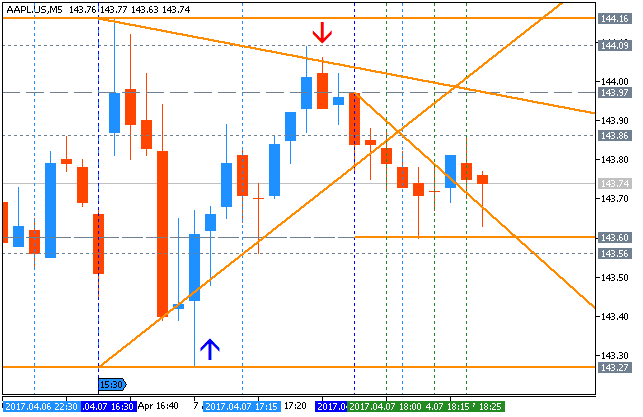

Apple M5: range price movement by Non-Farm Payrolls news events

==========

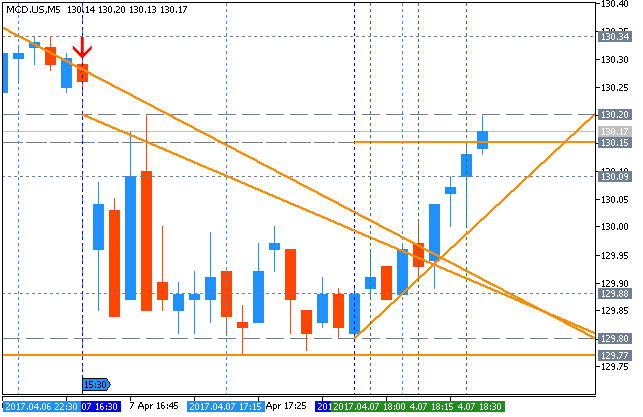

McDonald's M5: range price movement by Non-Farm Payrolls news events

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.04.08 09:59

Weekly EUR/USD Outlook: 2017,April 09 - April 16 (based on the article)

EUR/USD made its way to lower ground, struggling to gain ground. The week including Good Friday features business surveys and also some inflation figures. Here is an outlook for the highlights of this week

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.04.11 07:22

Intra-Day Fundamentals - EUR/USD, NZD/USD and Hang Seng Index (HSI): Fed Chair Yellen Speaks

2017-04-10 21:10 GMT | [USD - Fed Chair Yellen Speaks]

- past data is n/a

- forecast data is n/a

- actual data is n/a according to the latest press release

[USD - Fed Chair Yellen Speaks] = The speech at the University of Michigan.

==========

From wsj article - "Federal Reserve Chairwoman Janet Yellen Sees Monetary Policy Shifting":

- "Federal Reserve Chairwoman Janet Yellen indicated Monday that the era of extremely stimulative monetary policy was coming to an end."

==========

EUR/USD M5: range price movement by Fed Chair Yellen Speaks news events

==========

NZD/USD M5: range price movement by Fed Chair Yellen Speaks news events

==========

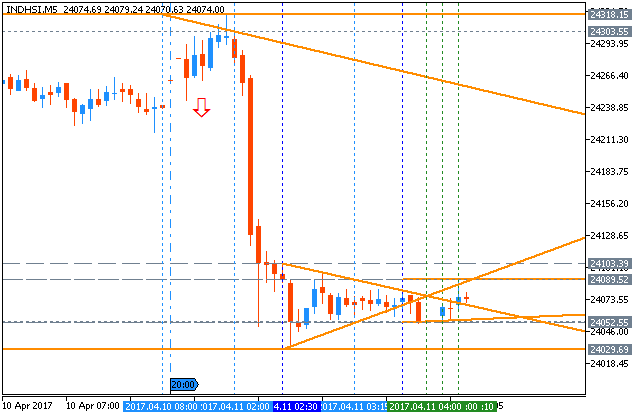

Hang Seng Index M5: range price movement by Fed Chair Yellen Speaks news events

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.04.13 16:52

EUR/USD Intra-Day Fundamentals: University of Michigan Consumer Sentiment and range price movement

2017-04-13 15:00 GMT | [USD - UoM Consumer Sentiment]

- past data is 96.9

- forecast data is 97.1

- actual data is 98.0 according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - UoM Consumer Sentiment] = Level of a composite index based on surveyed consumers.

==========

From official report:

==========

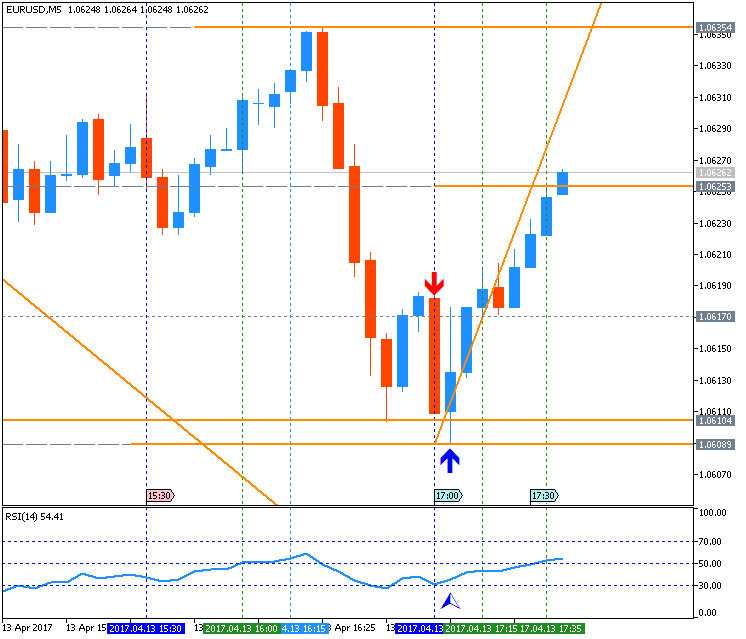

EUR/USD M5: range price movement by UoM Consumer Sentiment news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.04.14 09:27

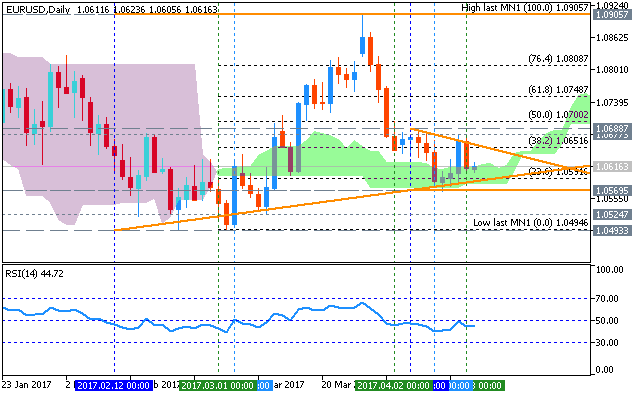

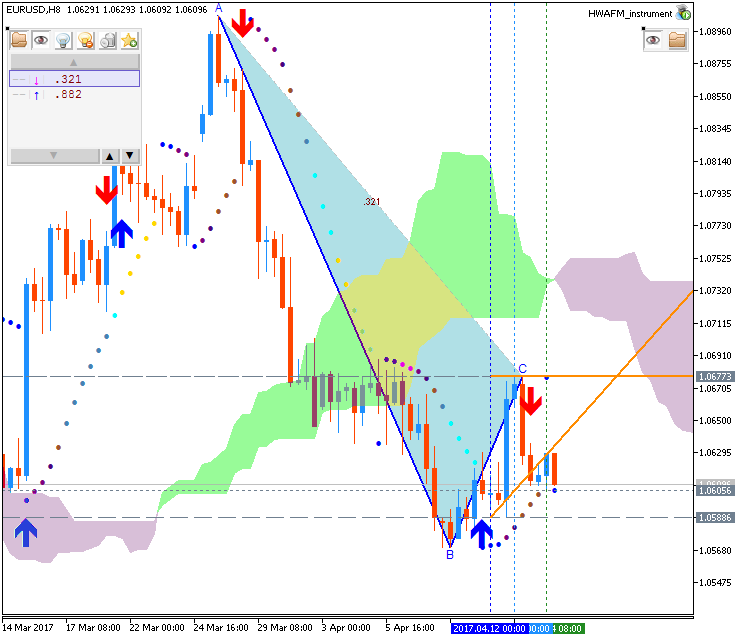

EUR/USD Technical Analysis: ranging near Senkou Span waiting for the bearish reversal (based on the article)

Daily price is located near and above Senkou Span line which is the virtual border between the primary bearish and the primary bullish trend on the chart. The price is going to be tested with descending triangle pattern together with 1.0569 support level to below for the bearish reversal to be started, otherwise - bullish ranging waiting for direction.

"Since the start of the year, EUR/USD daily RSI has oscillated between 60 and 40 (nothing above 70 or below 30). This ‘RSI profile’ indicates range conditions. At some point, these range conditions will break and a trend will emerge. When is that ‘some point’? I don’t know but it’s probably soon because this feeling of peak frustration is typical before a sizeable move. Price wise, a short term trendline is being put to the test. If it breaks, then short term focus is towards the year open at 1.0466 and maybe a lot lower given the 3 wave rally from the January low."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.04.14 15:50

Intra-Day Fundamentals - EUR/USD and USD/JPY: U.S. Consumer Price Index

2017-04-14 13:30 GMT | [USD - CPI]

- past data is 0.1%

- forecast data is 0.0%

- actual data is -0.3% according to the latest press release

if actual < forecast (or previous one) = good for currency (for USD in our case)

[USD - CPI] = Change in the price of goods and services purchased by consumers.

==========

From official report:

- "The Consumer Price Index for All Urban Consumers (CPI-U) decreased 0.3 percent in March on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index rose 2.4 percent before seasonal adjustment."

==========

EUR/USD M5: 18 pips range price movement by U.S. Consumer Price Index news events

==========

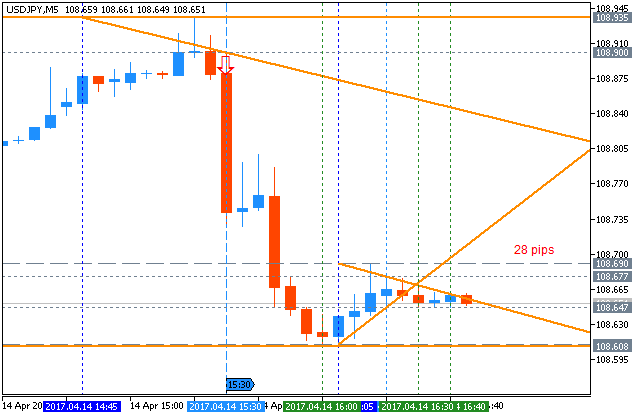

USD/JPY M5: 28 pips range price movement by U.S. Consumer Price Index news events

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.04.15 09:49

Weekly EUR/USD Outlook: 2017, April 16 - April 23 (based on the article)

EUR/USD managed to rebound from the lows ahead of Easter, getting back to the range. Will it stay there? Inflation figures and PMIs stand out ahead of the French elections.

- CPI (final): Wednesday, 9:00. A higher surplus is likely now.

- German PPI: Thursday, 6:00.

- Flash PMIs: Friday morning: 7:00 for France, 7:30 for Germany and 8:00 for the whole euro-zone.

- Current Account: Friday, 8:00. Similar to the trade balance, the euro-zone enjoys a current account surplus. And also here, it narrowed in January and stood at 24.1 billion after 30.8 beforehand.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.04.22 11:30

Weekly EUR/USD Outlook: 2017, April 23 - April 30 (based on the article)

EUR/USD drifted to the upside, driven by the dollar’s weakness. Is there more to come? The big event of the upcoming week is the French elections, followed by the ECB decision.

- French Presidential Elections: Sunday, exit poll expected before markets open, but full results could wait for Monday morning if the race is very close.

- German Ifo Business Climate: Monday, 8:00. Germany’s No. 1 Think-tank reported a rise in business confidence, to a score of 112.3, above expectations.

- Belgian NBB Business Climate: Tuesday, 13:00. A drop of 0.1% m/m is forecast.

- Spanish Unemployment Rate: Thursday, 6:00. The fourth-largest economy in the euro-zone still suffers from a very high level of unemployment, but this has been improving. In Q4 2016, the unemployment rate stood at 18.6%. The same rate is estimated now.

- German GfK Consumer Climate: Thursday, 6:00. A tick up to 9.9 is projected.

- Spanish CPI: Thursday, 7:00. A bump up to 2.5% is expected.

- ECB rate decision: Thursday: decision at 11:45 and the press conference is at 12:30.

- German retail sales: Friday, 6:00. A modest advance of 0.1% is likely now.

- French CPI: Friday, 6:45. A rise of 0.2% is projected.

- Spanish GDP: Friday, 7:00. A similar expansion is predicted now: 0.7% once again.

- Monetary data: Friday, 8:00. The ECB tracks the money in circulation (M3 Money Supply) and private loans. M3 has growth at an annual rate of 4.7% in February. Private loans had accelerated their growth rate to 2.3% back then. M3 is expected to rise at the same pace while the volume of loans will likely accelerate to 2.4%.

- CPI Flash Estimate: Friday, 9:00.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.04.24 07:49

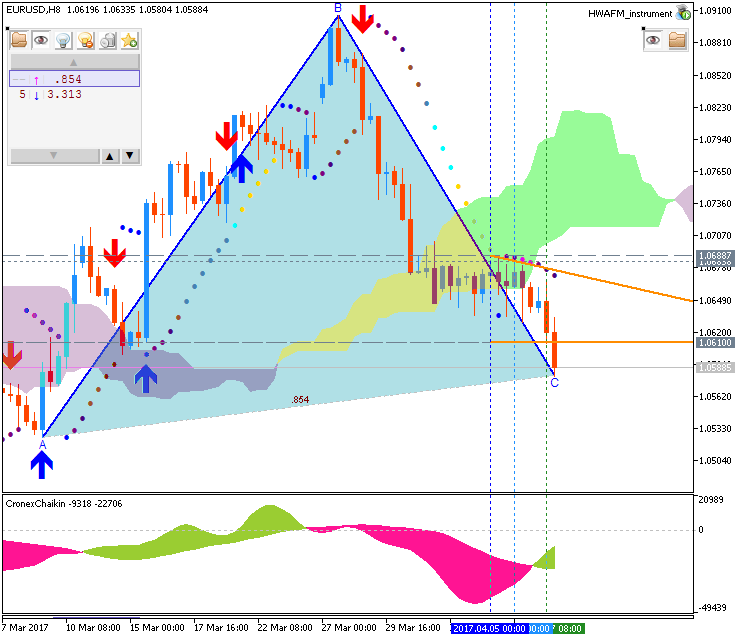

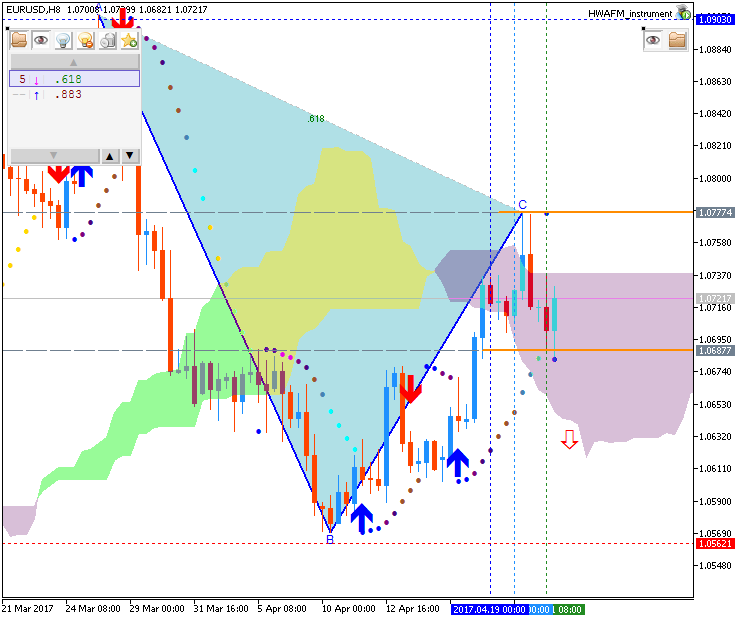

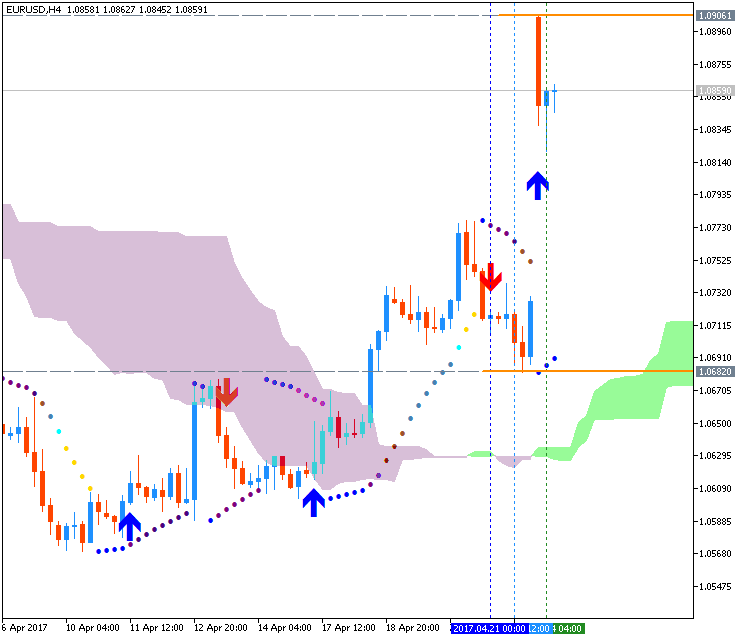

French Election: intra-day breakout with the bullish reversal; 1.09 resistance is the key (based on the article)

Daily H4 intra-day price broke Ichimoku cloud to above for the breakout with the bullish reversal: the price is testing 1.0906 resistance level for the bullish trend to be continuing.

- "The EUR/USD currency pair looked set to open around two cents higher at near $1.09 this Sunday night - around about a 5-month high. And, there could be some “pretty big volatility and wider-than-usual bid-ask spreads” at times. For most of the past week the euro has traded at a touch above 1.07, but rose late today towards the 1.09 mark."

- "It might not hold those gains for long but no nightmare scenario should be worth about 1-2%,” he ventured. Added to that any exuberance in the markets is likely to be tempered by a number of factors."

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

EUR/USD April-June 2017 Forecast: ranging rally within narrow s/r levels

W1 price is below Ichimoku cloud for the primary bearish market condition with the ranging within the following support/resistance levels:

- 1.0828 resistance level located below the cloud in the beginning of the secondary rally to be resumed, and

- 1.0493 support level located far below Ichimoku cloud in the bearish area of the chart.

Chinkou Span line is below the price indicating the bearish ranging condition by direction, Trend Strength indicator is estimating the secondary rally for now, and Absolute Strength indicator is evaluating the trend as a ranging. Non-lagging Tenkan-sen/Kijun-sen signal is for ranging bearish market condition for now and for very near future for example.Trend:

W1 - ranging bearish