You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.09.26 16:53

Intra-Day Fundamentals - USD/CAD: The Conference Board Consumer Confidence

2017-09-26 15:00 GMT | [USD - CB Consumer Confidence]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - CB Consumer Confidence] = Level of a composite index based on surveyed households.

==========

From official report :

==========

USD/CAD M5: range price movement by The Conference Board Consumer Confidence news events

============

Chart was made on MT5 with BrainTrading system (MT5) from this thread (free to download) as well as the following indicators from CodeBase:

All about BrainTrading system for MT5:

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.09.29 14:50

USD/CAD Intra-Day Fundamentals: Canada's GDP and range price movement

2017-09-29 13:30 GMT | [CAD - GDP]

if actual > forecast (or previous one) = good for currency (for CAD in our case)

[CAD - GDP] = Change in the inflation-adjusted value of all goods and services produced by the economy.

==========

From official report :

==========

USD/CAD M5: range price movement by Canada's GDP news event

==========

Chart was made on MT5 with Brainwashing system/AscTrend system (MT5) from this thread (free to download) together with following indicators:

Same system for MT4:

#USDCAD

Total Profit: 10348 pip

Closed trade(s): 4698 pip Profit

Open trade(s): 5650 pip Profit

_______________________________________________

Trade Setup:

We opened 13 SELL trade(s) @ 1.3466 (day close price) based on 'Peak' at 2017.06.09 signaled by DTO:

https://www.ForecastCity.com/forecasts/Forex/daily-trading-opportunity/U...

Closed Profit:

TP1 @ 1.3440 touched at 2017.06.12 with 26 pip Profit.

TP2 @ 1.3315 touched at 2017.06.13 with 151 pip Profit.

TP3 @ 1.3185 touched at 2017.06.14 with 281 pip Profit.

TP4 @ 1.3000 touched at 2017.06.29 with 466 pip Profit.

TP5 @ 1.2835 touched at 2017.07.12 with 631 pip Profit.

TP6 @ 1.2665 touched at 2017.07.14 with 801 pip Profit.

TP7 @ 1.2465 touched at 2017.07.26 with 1001 pip Profit.

TP8 @ 1.2125 touched at 2017.09.07 with 1341 pip Profit.

26 + 151 + 281 + 466 + 631 + 801 + 1001 + 1341 = 4698 pip

Open Profit:

Profit for one trade is 1.3466(open price) - 1.2336(current price) = 1130 pip

5 trade(s) still open, therefore total profit for open trade(s) is 1130 x 5 = 5650 pip

_______________________________________________

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.10.05 15:54

USD/CAD Intra-Day Fundamentals: Canada International Merchandise Trade and range price movement

2017-10-05 13:30 GMT | [CAD - Trade Balance]

if actual > forecast (or previous one) = good for currency (for CAD in our case)

[CAD - Trade Balance] = Difference in value between imported and exported goods during the reported month.

==========

From official report :

==========

USD/CAD M5: range price movement by Canada International Merchandise Trade news event

==========

Chart was made on MT5 with Brainwashing system/AscTrend system (MT5) from this thread (free to download) together with following indicators:

Same system for MT4:

Forum on trading, automated trading systems and testing trading strategies

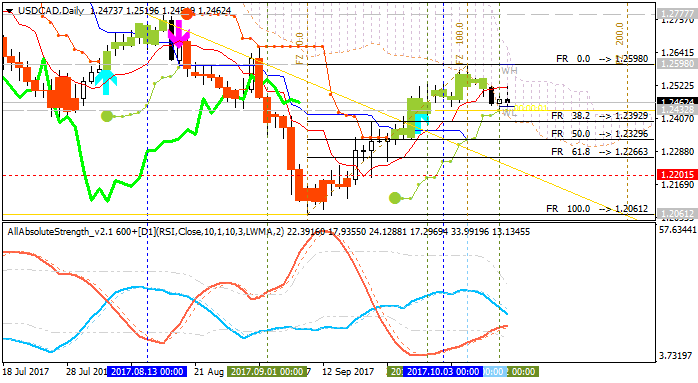

usdcad idea setup for next weeks

Gabriel D Arco, 2017.10.08 15:46

Buy it on pullback around the ma50 at 1.2520 and the down T-line of the chanel

place your stop under the Chanel T-line and the ma50 around 1.2465

the risk reward very interresting.

With the last Data with got it lest week it up the % of fed rates hike in december and 3 hike in 2018 especially the average earning per hours (wage picked up,that want the fed)=inflation on good way

+all ISM nearly at record high

The NFP number e not care much as US get the storm so is a non event

the earning was more important this time

and also 4.2% in non-umployment

buy at 1.2520

target at 1.2665

SL at 1.2470

so is 145 pips gains against 50 pips lost

RR= 1/3.0

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.10.15 18:08

Weekly USD/CAD Outlook: 2017, October 15 - October 22 (based on the article)

Dollar/CAD slipped from the highs in a much-needed correction. The upcoming week’s highlights are the inflation and retail sales reports. What’s next?

==========

The chart was made on H4 timeframe with standard indicators of Metatrader 4 except the following indicators (free to download):

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.10.20 16:59

USD/CAD Intra-Day Fundamentals: Canada's Consumer Price Index and range price movement

2017-10-20 13:30 GMT | [CAD - CPI]

if actual > forecast (or previous one) = good for currency (for CAD in our case)

[CAD - CPI] = Change in the price of goods and services purchased by consumers.

==========

From official report :

==========

USD/CAD M15: range price movement by Canada's CPI news event

==========

Chart was made on MT5 with Brainwashing system/AscTrend system (MT5) from this thread (free to download) together with following indicators:

Same system for MT4:

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.10.25 16:39

USD/CAD Intra-Day Fundamentals: BOC Monetary Policy Report and range price movement

2017-10-25 15:00 GMT | [CAD - Overnight Rate]

if actual > forecast (or previous one) = good for currency (for CAD in our case)

[CAD - Overnight Rate] = Interest rate at which major financial institutions borrow and lend overnight funds between themselves.

==========

From official report :

==========

USD/CAD M5: range price movement by BOC Monetary Policy Report news event

==========

Chart.

The chart was made on M15 timeframe with standard indicators of Metatrader 5 except the following indicator (free to download):

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.10.28 11:40

Weekly Fundamental Forecast for USD/CAD (based on the article)

USD/CAD - "USD/CAD has staged a meaningful rally following the Bank of Canada (BoC) interest rate decision, with the pair at risk of extending the near-term advance as the Federal Open Market Committee (FOMC) appears to be on course to deliver another rate-hike in 2017. Market participants will also be closely watching the fresh rhetoric coming out of the FOMC even as Chair Janet Yellen and Co. are expected to keep the benchmark interest rate on hold, with Fed Fund Futures highlight a greater than 90% probability for a move in December. Indeed, the Fed may merely utilize the November 1 meeting to prepare U.S. households and businesses for another 25bp rate-hike as the central bank anticipates ‘economic conditions would evolve in a manner that would warrant gradual increases in the federal funds rate.’"

-----------

Chart was made on MT4 using iFibonacci indicator and MaksiGen_Range_Move indicator from CodeBase (free to download).

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.10.31 14:41

USD/CAD Intra-Day Fundamentals: Canada Gross Domestic Product and range price movement

2017-10-31 12:30 GMT | [CAD - GDP]

if actual > forecast (or previous one) = good for currency (for CAD in our case)

[CAD - GDP] = Change in the inflation-adjusted value of all goods and services produced by the economy.

==========

From official report :

==========

USD/CAD H1: range price movement by Canada Gross Domestic Product news event

==========

Chart was made on MT5 with Brainwashing system/AscTrend system (MT5) from this thread (free to download) together with following indicators:

Same system for MT4: