Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.03.30 09:45

USD/CAD Technical Analysis: daily bullish ranging within narrow s/r levels for direction (based on the article)

Daily price is above 200 SMA in the bullish area of the chart. The price is on ranging within the following support/resistance levels:

- 1.3534 resistance located in the beginning of the bullish trend to be resumed, and

- 1.3263 support located in the beginning of the bearish reversal to be started.

- "As of Wednesday, March 29, 2017, Crude Oil has a 20-day rolling inverse relationship with USD/CAD and USD/MXN of -0.557 and -0.579 respectively. The inverse correlation shows us as Oil moves higher, USD/CAD and USD/MXN move lower, albeit not perfectly. Therefore, we should watch Oil to get a sense of what may happen next with USD/CAD."

- "Currently, USOIL is trading near the 200-DMA, and a failure to break back above on a sustainable basis may lead to further upside in USD/CAD, which the current channel seems to favor."

- "The spot price of 1.3330 sits above the March 22 low support at 1.32635. Just below the March 22 low is the 50% retracement of the late January to March Range at 1.32517 followed by the 61.8% retracement at 1.31846. Such levels should be watched if Oil gains compound. The resistance in focus in the current move lower is the March 28 high of 1.3414. A reversal below the proven support of 1.3050/150 would need to break to turn the technical view from neutral to bearish."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.04.12 17:42

USD/CAD Intra-Day Fundamentals: Bank of Canada Overnight Rate and range price movement

2017-04-12 15:00 GMT | [CAD - Overnight Rate]

- past data is 0.50%

- forecast data is 0.50%

- actual data is 0.50% according to the latest press release

if actual > forecast (or previous one) = good for currency (for CAD in our case)

[CAD - Overnight Rate] = Interest rate at which major financial institutions borrow and lend overnight funds between themselves.

==========

From official report:

- "The Bank of Canada today announced that it is maintaining its target for the overnight rate at 1/2 per cent. The Bank Rate is correspondingly 3/4 per cent and the deposit rate is 1/4 per cent."

- "The Bank’s Governing Council acknowledges the strength of recent data, some of which is temporary, and is mindful of the significant uncertainties weighing on the outlook. In this context, Governing Council judges that the current stance of monetary policy is still appropriate and maintains the target for the overnight rate at 1/2 per cent."

==========

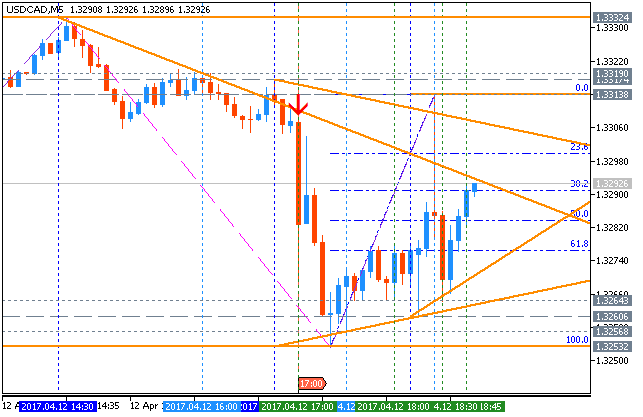

USD/CAD M5: range price movement by BoC Overnight Rate news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.04.21 18:27

USD/CAD Intra-Day Fundamentals: Canada's Consumer Price Index and 62 pips range price movement

2017-04-21 13:30 GMT | [CAD - CPI]

- past data is 0.2%

- forecast data is 0.4%

- actual data is 0.2% according to the latest press release

if actual > forecast (or previous one) = good for currency (for CAD in our case)

[CAD - CPI] = Change in the price of goods and services purchased by consumers.

==========

From official report:

- "The Consumer Price Index (CPI) rose 1.6% on a year-over-year basis in March, following a 2.0% gain in February."

- "On a seasonally adjusted monthly basis, the CPI declined 0.2% in March, after falling 0.3% in February."

==========

USD/CAD M5: 62 pips range price movement by Canada's Consumer Price Index news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.04.22 10:55

Weekly Fundamental Forecast for USD/CAD (based on the article)

USD/CAD - "The news is not all negative for the Canadian Dollar with the latest Bank of Canada policy meeting (April 12) producing a slightly hawkish tone. Bank of Canada senior deputy governor Carolyn Wilkins said in her opening statement that “many of the economic data that we have seen since our last MPR have been stronger than expected,” adding that “is certainly a welcome change.” Canada’s economy is expected to grow by 2.5% this year and just below 2% in 2018 and 2019."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.04.26 15:38

USD/CAD Intra-Day Fundamentals: Canada's Retail Sales and range price movement

2017-04-26 13:30 GMT | [CAD - Retail Sales]

- past data is 2.3%

- forecast data is 0.0%

- actual data is -0.6% according to the latest press release

if actual > forecast (or previous one) = good for currency (for CAD in our case)

[CAD - Retail Sales] = Change in the total value of sales at the retail level.

==========

From official report:

- "Retail sales declined 0.6% to $47.8 billion in February, following a 2.3% increase in January. Sales were down in 5 of 11 subsectors, representing 67% of total retail sales."

- "Lower sales at motor vehicle and parts dealers and gasoline stations were the main contributors to the decline. Excluding these two subsectors, retail sales were up 0.5%."

==========

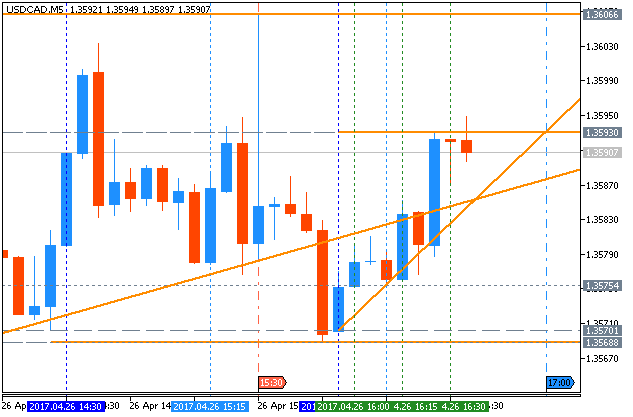

USD/CAD M5: range price movement by Canada's Retail Sales news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.04.29 17:21

Weekly Fundamental Forecast for USD/CAD (based on the article)

USD/CAD - "Next Friday brings us Canadian payrolls data for April. Canadian employment added 19.4k jobs in February, surpassing expectations and causing the CAD to edge higher. Before this, on Thursday, Bank of Canada Governor Stephen Poloz will be speaking in Mexico."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.05.03 10:41

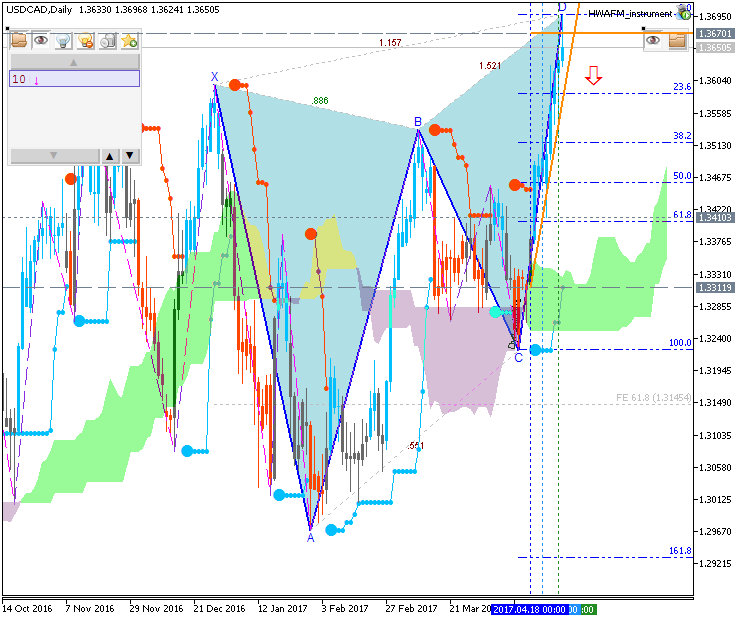

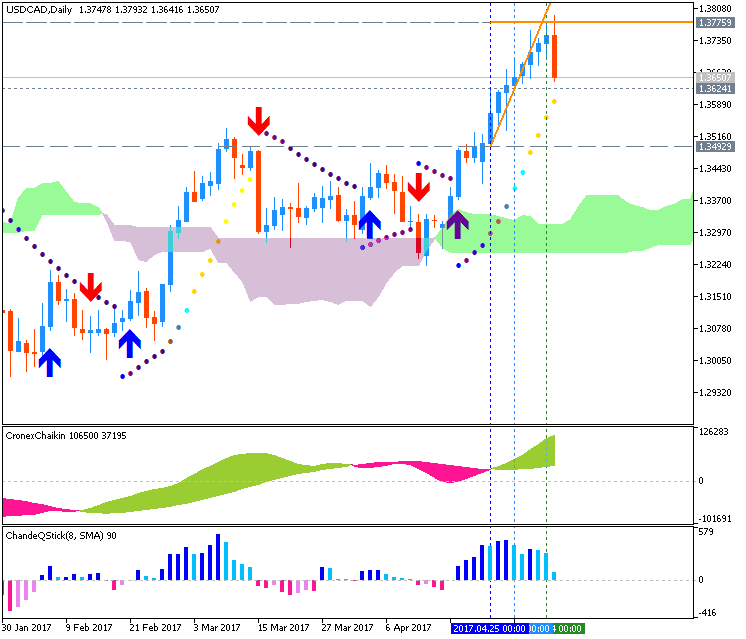

USD/CAD - 300-day high to be testing for the bullish breakout to be continuing (based on the article)

Daily price is above 100-day SMA/200-day SMA in the bullish area of the chart. The price is testing 300-day high to above for the bullish trend to be continuing.

- "The USD/CAD has broken to new yearly highs this afternoon, despite a general US Dollar selloff in the market. As this trend develops, traders should continue to monitor upcoming new that may help provide further direction for the pair. This includes both US and Canadian employment figures which are set for release at 12:30 GMT this Friday. Expectations for US Non-farm Payrolls (APR) are set at 190k, while CAD Net Change in Employment (APR) is expected in at 10.0k"

- "Technically, the USD/CAD remains in an uptrend going into Friday’s news. If the standing trend is set to continue, traders should watch for a breakout above the new 2017 high found at 1.3757. However in the event of a price reversal, traders should look for the pair to first decline below its 10 day EMA (exponential moving average). This line is currently found at 1.3607 and continues to act as a critical values of support. A breakout below this point would suggest a shift in the pair’s short term trend."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.05.04 16:18

USD/CAD Intra-Day Fundamentals: Canada's International Merchandise Trade and range price movement

2017-05-04 13:30 GMT | [CAD - Trade Balance]

- past data is -1.1B

- forecast data is 0.3B

- actual data is -0.1B according to the latest press release

if actual > forecast (or previous one) = good for currency (for CAD in our case)

[CAD - Trade Balance] = Difference in value between imported and exported goods during the reported month.

==========

From official report:

- "Canada's merchandise trade balance with the world posted a $135 million deficit in March, narrowing from a $1.1 billion deficit in February. Exports rose 3.8% in March to a record high $47.0 billion, due to stronger exports of energy products and consumer goods. Imports were up 1.7% to $47.1 billion, mainly on higher imports of unwrought gold."

==========

USD/CAD M5: range price movement by Canadian Trade Balance news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.05.06 09:13

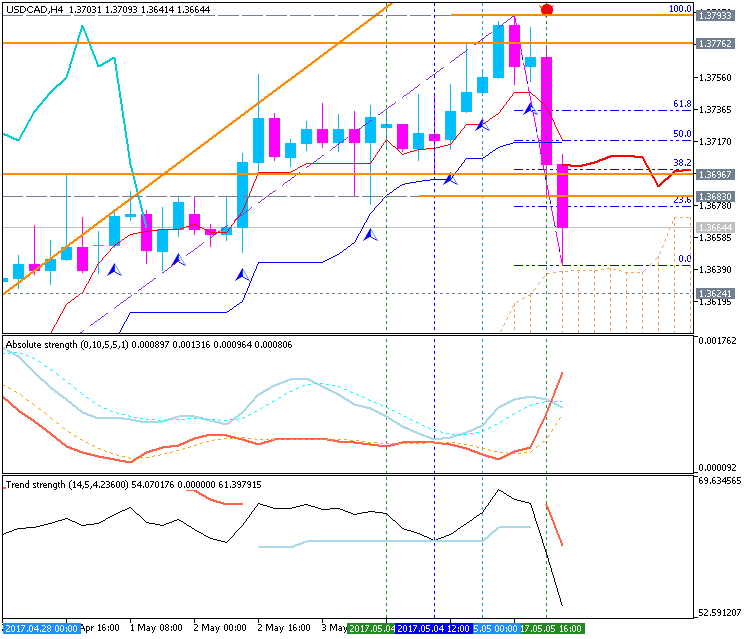

USD/CAD - intra-day correction to the possible bearish reversal (based on the article)

The price is above Ichimoku cloud in the bullish area of the chart: price was bounced from 1.3793 to below for the secondary correction to be started. Absolute Strength and Trend Strength indicators are evaluating the future trend as a correction or the bearish reversal, and Chinkou Span is crossing the historical price to below for good breakdown to be started in the near future: bearish reversal breakdown.

- "Much like the drop in Crude Oil over the last few weeks, the drop in the Canadian Dollar has been fast and furious. In mid-April, USD/CAD was trading near 1.3200 around the same time that Crude Oil was trading north of $53/bbl. Fast forward to the end of May’s first trading week and Crude Oil has an intraday low nearly 20% lower at $43, and the Canadian Dollar traded as low as $1.38 to the USD."

- "The correlation to CAD and Crude Oil is common knowledge even if the strength of the correlation ebbs and flows from month to month. This week, Crude Oil went from bad to worse as there appeared to be a capitulation of long trades that were exited as multiple forms of price support continued to break. The same seemed to happen for the Canadian Currency, which sat at or near the bottom of the G8 SW ranking for most of the week with the Japanese Yen and the Australian Dollar, which is also correlated to commodities like Iron Ore."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.05.06 13:23

Weekly Fundamental Forecast for USD/CAD (based on the article)

USD/CAD - "That followed news a fortnight earlier that Canadian inflation had slowed more than economists had forecast in March as food and clothing prices fell. Measures of core prices also declined, worsening Bank of Canada Governor Stephen Poloz’s concerns that too much slack remains in the economy."

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

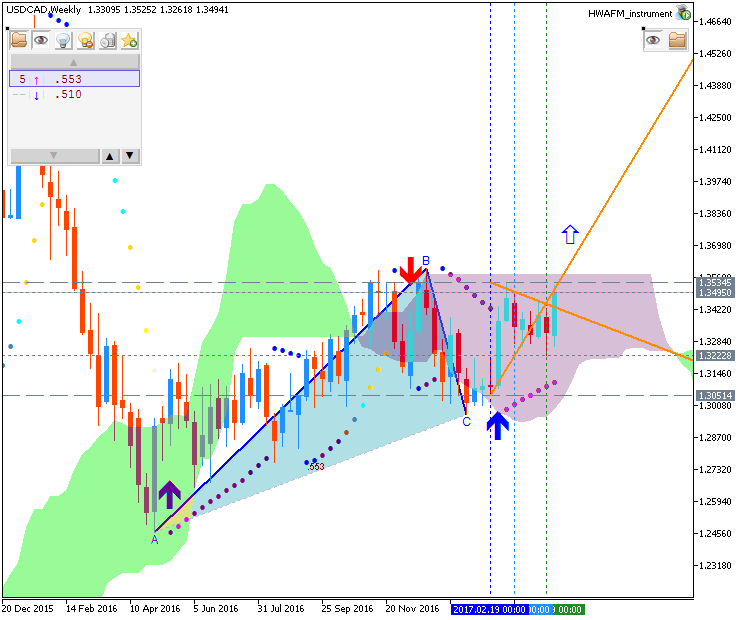

USD/CAD April-June 2017 Forecast: ranging inside kumo waiting for direction of the strong trend to be started

W1 price is located inside Ichimoku cloud for the ranging market condition within the following support/resistance levels:

- 1.3598 resistance level located near and above Senkou Span line (which is the virtual border between the primary bearish and the primary bullish trend on the chart) in the beginning of the bullish trend to be started, and

- 1.2968 support level located in the beginning of the bearish trend to be resumed.

Chinkou Span line is above the price indicating the possible possible bearish breakdown by direction, Trend Strength indicator is estimating the trend as a bullish in the near future, and Absolute Strength indicator is evaluating the trend as a ranging. Non-lagging Tenkan-sen/Kijun-sen signal is for ranging bearish market condition for now and for very near future for example.Trend:

W1 - ranging