Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.01.26 18:30

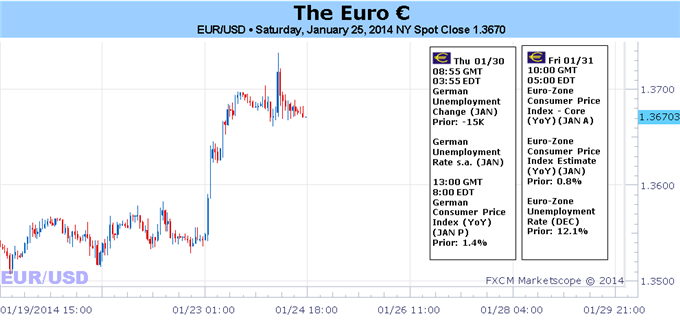

EUR/USD weekly outlook: January 27 - 31

Monday, January 27

In the euro zone, Germany is to release the Ifo report on business climate.

The U.S. is to produce data on new home sales, a leading indicator of demand in the housing sector.

Tuesday, January 28

In the euro zone, Italy is to hold an auction of 10-year government bonds.

The U.S. is to release data on durable goods orders, a leading indicator

of production, as well as what will be a closely watch report on

consumer confidence.

Wednesday, January 29

The Federal Reserve is to announce its federal funds rate and publish its rate statement.

Thursday, January 30

Germany is to produce preliminary data on consumer price inflation,

which accounts for the majority of overall inflation, as well as a

report on the change in the number of people unemployed. Elsewhere in

the euro zone, Spain is to release preliminary data on fourth quarter

growth.

The U.S. is to publish preliminary data on fourth quarter economic

growth. The nation is also to release the weekly report on initial

jobless claims and data on pending home sales.

Friday, January 31

The euro zone is to release preliminary data on consumer inflation and a

separate report on the unemployment rate across the currency bloc

The U.S. is to round up the week with a report on manufacturing activity

in the Chicago region, revised data on consumer sentiment and a report

on personal spending.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.01.26 18:43

EURUSD Analysis (based on dailyfx article)

Fundamental Forecast for Euro: Bullish

- The Euro entered the week directionless, at the behest of growth data losing momentum…

- …but better than expected January PMI readings across the region sparked a midweek breakout.

-

On a technical basis, the EURUSD is primedto rally further after holding key support.

The Euro proved resilient the past week, gaining one percent or more against four of the other seven major currencies, while holding its own against the top two performers, the Japanese Yen and the Swiss Franc. The EURJPY (-0.94%) and EURCHF (-0.72%) tumbles can largely be attributed to a global shift to safer assets, with equity markets sliding and high-rated sovereign debt rallying (German Bunds, US Treasuries).

Yet as concerns cropped up elsewhere, in emerging markets and the Asian-Australasian theatre (EURAUD +2.12%, EURNZD +1.51%) as well as North America (EURCAD +2.12%, EURUSD +1.00%), the Euro’s fundamental backdrop strengthened. The January PMI figures, coming off of a mixed batch in December – which prompted the Euro’s early-January tumble – came in well above expectations, further supporting our core theme for 2014: faster rates of growth return to the European continent.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.01.27 16:40

2013-01-27 15:00 GMT (or 16:00 MQ MT5 time) | [ USD - New Home Sales]

- past data is 445K

- forecast data is 457K

- actual data is 414K according to the latest press release

if actual > forecast = good for currency (for USD in our case)

==========

U.S. New Home Sales Fall Much More Than Expected In December

New home sales in the U.S. fell by much more than anticipated in the month of December, according to a report released by the Commerce Department on Monday, with sales pulling back further off the five-year high set in October.

The report said new home sales tumbled 7.0 percent to an annual rate of 414,000 in December from the revised November rate of 445,000. Economists had expected sales to dip to 455,000 from the 464,000 originally reported for the previous month.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 10 pips price movement by USD - New Home Sales news event

Forum on trading, automated trading systems and testing trading strategies

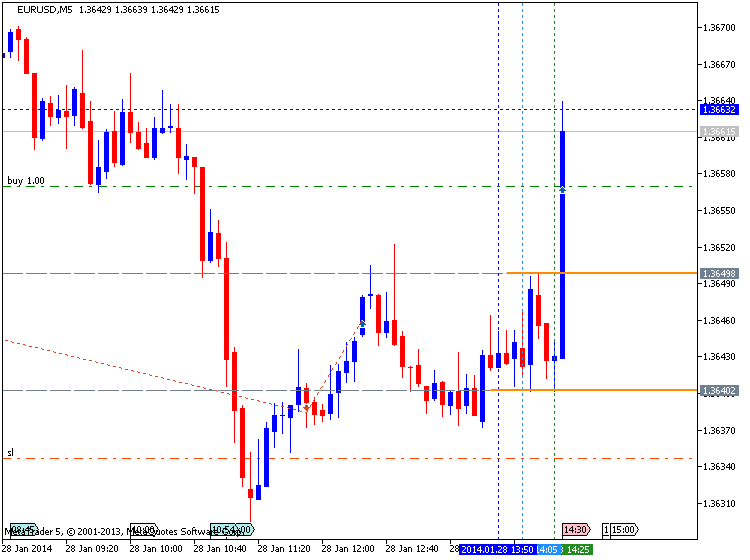

newdigital, 2014.01.28 14:30

2013-01-28 13:30 GMT (or 14:30 MQ MT5 time) | [USD - Durable Goods Orders]

- past data is 3.4%

- forecast data is 1.8%

- actual data is -4.3% according to the latest press release

if actual > forecast = good for currency (for USD in our case)

==========

U.S. Durable Goods Orders Show Unexpected Decrease In December

With orders for transportation equipment showing a substantial decrease, the Commerce Department released a report on Tuesday showing that new orders for U.S. manufactured durable goods unexpectedly dropped in the month of December.

The report said durable goods orders tumbled by 4.3 percent in December following a revised 2.6 percent increase in November.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 32 pips price movement by USD - Durable Goods Orders news event

Forum on trading, automated trading systems and testing trading strategies

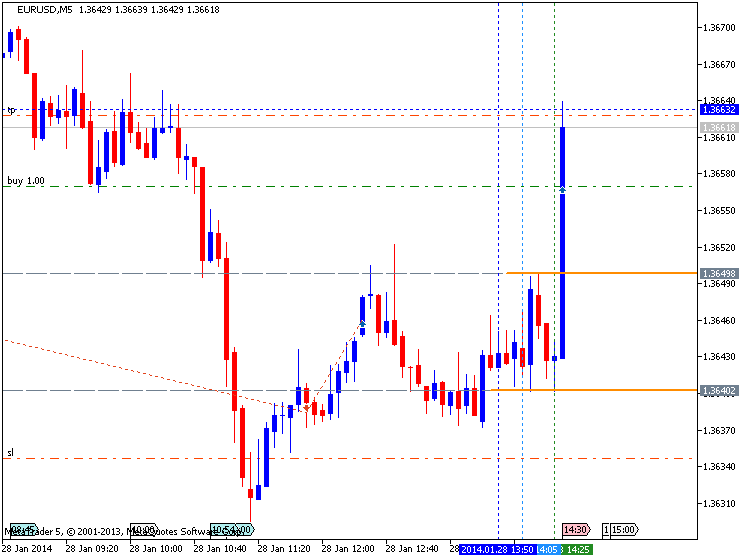

newdigital, 2014.01.28 16:55

2013-01-28 15:00 GMT (or 16:00 MQ MT5 time) | [USD - Consumer Confidence]

- past data is 77.5

- forecast data is 78.1

- actual data is 80.7 according to the latest press release

if actual > forecast = good for currency (for USD in our case)

==========

U.S. Consumer Confidence Continues To Improve In January

Consumer confidence in the U.S. improved for the second consecutive month in January, according to a report released by the Conference Board on Tuesday, with the consumer confidence index rising by more than expected during the month.

The Conference Board said its consumer confidence index climbed to 80.7 in January from a downwardly revised 77.5 in December.

Economists had expected the consumer confidence index to edge up to 79.0 from the 78.1 originally reported for the previous month.

The report showed that the present situation index rose to 79.1 in January from 75.3 in December, reflecting a continued improvement in consumers' assessment of overall present-day conditions.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 16 pips price movement by USD - Consumer Confidence news event

The name of the thread is the question : Breakout or Ranging ... so - the reply is the following - Ranging :) we can see it from the chart for example :

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

temp_file_screenshot_48224.png

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.01.30 16:40

2013-01-30 13:30 GMT (or 14:30 MQ MT5 time) | [USD - GDP]

- past data is 4.1%

- forecast data is 3.2%

- actual data is 3.2% according to the latest press release

if actual > forecast = good for currency (for USD in our case)

==========

U.S. GDP Growth Slow To 3.2% In Q4 But Matches Estimates

While the Commerce Department released a report on Thursday showing a slowdown in the pace of U.S. economic growth in the final three months of 2013, the increase still matched economist estimates.

The Commerce Department said gross domestic product increased by 3.2 percent in the fourth quarter compared to the 4.1 percent growth seen in the third quarter. The GDP growth came in line with the expectations of most economists.

Paul Ashworth, Chief U.S. Economist at Capital Economics, said the most encouraging element of the report was a pick-up in the growth rate of domestic demand.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 16 pips price movement by USD - GDP news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.01.31 12:21

2013-01-31 10:00 GMT (or 11:00 MQ MT5 time) | [EUR - Consumer Price Index]

- past data is 0.8%

- forecast data is 0.9%

- actual data is 0.7% according to the latest press release

if actual > forecast = good for currency (for EUR in our case)

==========

Eurozone Inflation Slows Unexpectedly; Jobless Rate Stable At 12%

Eurozone inflation slowed for the second consecutive month in January, flash estimate released by Eurostat showed Friday.

Another report showed that the jobless rate in the currency bloc remained unchanged in December.

Inflation fell unexpectedly to 0.7 percent in January from 0.8 percent in December. Economists had forecast the rate to accelerate to 0.9 percent.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 23 pips price movement by EUR - Consumer Price Index news event

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

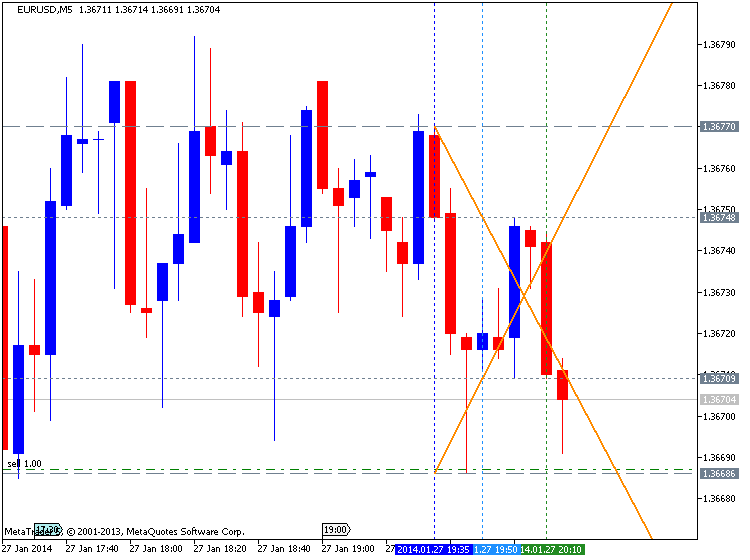

It was breakout on D1 timeframe and new daily bar was opened above Ichimoku cloud/kumo which is indicating the fully reversal from bearish to primary bullish market condition. The price is trying to cross 1.3699 resistance for breakout to be continuing.

It is flat for H4 timeframe for now and price is ranging between 1.3739 resistance and 1.3624 support levels.

If the price will break 1.3699 resistance on D1 timeframe and Chinkou Span will cross with the price on open bar from below to above so we may see for breakout to be continuing.If not so we may see the ranging market condition with possible reversal to bearish market condition.

UPCOMING EVENTS (high/medium impacted news events which may be affected on EURUSD price movement for this coming week)

2013-01-27 09:00 GMT (or 10:00 MQ MT5 time) | [EUR - German Ifo Business Climate]

2013-01-27 11:00 GMT (or 12:00 MQ MT5 time) | [EUR - German Monthly Report]

2013-01-27 15:00 GMT (or 16:00 MQ MT5 time) | [ USD - New Home Sales]

2013-01-27 18:00 GMT (or 19:00 MQ MT5 time) | [EUR - German Buba President Weidmann Speaks]

2013-01-28 13:30 GMT (or 14:30 MQ MT5 time) | [USD - Durable Goods Orders]

2013-01-28 15:00 GMT (or 16:00 MQ MT5 time) | [USD - Consumer Confidence]

2013-01-29 19:00 GMT (or 20:00 MQ MT5 time) | [USD - Federal Funds Rate]

2013-01-30 08:00 GMT (or 09:00 MQ MT5 time) | [EUR - Spanish GDP]

2013-01-30 13:30 GMT (or 14:30 MQ MT5 time) | [USD - GDP]

2013-01-31 10:00 GMT (or 11:00 MQ MT5 time) | [EUR - Unemployment Rate]

2013-01-31 10:00 GMT (or 11:00 MQ MT5 time) | [EUR - Consumer Price Index]

2013-01-31 13:30 GMT (or 14:30 MQ MT5 time) | [USD - PCE]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on EURUSD price movement

SUMMARY : bullish

TREND : ranging

Intraday Chart