You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Overview of the main economical events of the current day - 31/07/2013

The Markets are Waiting for the FOMC Meeting Results

The dollar was traded upwards on Tuesday against almost all major currencies before the announcement of the FOMC meeting results which will be held on Wednesday. The Federal Reserve is supposed not to reduce stimulus volumes in July but it will clear up further plans concerning the strategy of the exit from the stimulus programs. ScotiaBank experts believe that the FOMC can declare straightly about the reduce of QE3 in September lowering at the same time the target level of unemployment from 6.5% to 6%, its achievement will serve as guidemark for the first rates increase.

The US data released on Tuesday were rather weak. So, CB Consumer Confidence decreased more than expected in July – to 80.3 points while a drop to 81.1 points was expected. S&P/Case-Shiller Composite-20 HPI rose by 12.2% in May compared with the same period in the previous year while a growth by 12.4% was expected. Although housing price data turned out a little lower than forecasted, price growth was marked in all 20 countries.

At the same time euro-zone statistics data have been generally positive, which allowed the euro to maintain and not to fall by the end of the day. Euro-Zone Economic Confidence from the European Commission grew in July to its high since May, 2012 and amounted to 92.5 p. against 91.3 p. in prior month. Spanish economy decline rates slowed down – Spanish GDP decrease in the second quarter accounted for only 0.1% after the fall by 0.5% in the previous quarter, which suggests that the recession should be over soon and the economy could return to growth.

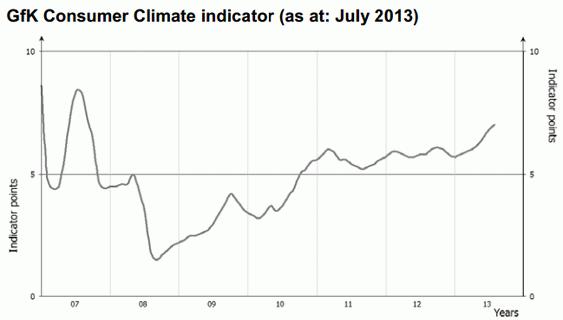

Inflation in Germany grew more than expected in July to 1.9% at an annual rate while its drop to 1.7% was expected. German consumer sentiment rose to almost 6-year high in August amid a good situation at the local labor market and moderate inflation. The leading GfK Consumer Climate rose to 7 p. in August compared with 6.8 p. in July.

Source: gfk.comThe yen dropped after the release of weak Japanese data but then recovered. Industrial production in Japan fell by 3.3% compared with the prior month after 6-month growth, which has become the worst reading since October, 2012. Household Spending decreased by 0.4% in June at an annual rate, while a growth by 1.3% was expected. At the same time unemployment rate dropped to its low 3.9% in June since the end of 2008 from 4.1% that maintained a few months in a row.

The Australian dollar slumped after the speech of the RBA Governor Glenn Stevens. Speaking just a week before the next RBA meeting he said that despite the AUD decline, the current inflation couldn’t prevent the further interest rates decrease if it would be necessary for economic stimulus. He added that further fall of the Australian dollar wouldn’t be a surprise. The AUD was also negatively affected by a sharp decline of Building Approvals in June, which fell by 6.9% against the expected growth by 2%. At an annual rate the reading dropped by 13% while no changes were forecasted.

By MasterForex Company

Overview of the main economical events of the current day - 01/08/2013

The Dollar Dropped after the FOMC Statement

The dollar was traded upwards on Wednesday after the release of strong employment data and GDP for the second quarter. However, then it lost all positions after the publications of FOMC Statement by the end of the meeting. The monetary policy was kept unchanged but there were no hints on tapering off of QE in September, which was expected by some market participants.

Inflation and unemployment target levels were kept unchanged at the same levels of 2% and 6.5% respectively. The decision was approved on 11-1 votes with the president of the Federal Reserve Bank of Kansas City Esther George dissenting from the majority opinion as she was still concerned about financial imbalances and inflation which may result from the continuation of QE.

The text of the FOMC Statement itself almost wasn’t changed. Although it was marked that economic activity in the country during the first half of the year was raised at a modest rate, not moderate one – as the economic growth was determined before. Besides, it was said that a stable low inflation, which has been lower than the target 2% level for a long time, can jeopardize the country’s economy. Due to weak inflation the terms of QE tapering off may be put off for a longer period of time.

In the US rather strong data were released. According to the report of the research organization ADP Employment Change increased by 200 thousand in July while a growth only by 180 thousand was forecasted. The data for June were also revised upwards. Now all the market attention is drawn by the official employment data which will be published on Friday.

The US economic growth rate in the second quarter, according to the first estimate, accounted for 1.7% at an annual rate while a growth only by 1% was expected. Consumer spending, which is up to 70% of the US GDP, grew by 1.8% in the second quarter, which has exceeded the growth expectations by 1.6%. Chicago PMI, which grew to 52.3 p. in July with the forecasted growth to 53.7 p., turned out a little worse.

The released euro-zone good non-farm payrolls supported the euro on Wednesday, which allowed closing the day with a slight growth despite weak retail sales data in Germany, which fell by 1.5% m/m. Unemployment Change in Germany decreased by 7 thousand unexpectedly in July while the reading was forecasted to maintain, which testifies the acceleration of economic growth rate of the largest European economy. Unemployment rate in the euro-zone hasn’t changed in comparison with the revised May reading while its growth to 12.2% was expected. Unemployment rate also dropped in Italy by 0.1% to 12.1% against the forecasted growth to 12.3%.

The report on Canada’s GDP published on Wednesday managed to support the Canadian dollar. According to Statistics Canada, the country’s gross domestic product rose by 0.2% in May from April. Canadian economic growth has been witnessed for the fifth month in a row. At an annual rate the GDP grew by 1.6% and the data coincided with the expectations. The growth in retail sales and wholesale trade was evened by the weakness in the commodity sector. On the contrary, AUD continued falling and broke through a significant level of July support at 0.90.

By MasterForex Company

Overview of the main economical events of the current day - 02/08/2013

The US Manufacturing PMI Reached Its High for More than Two Years

The US dollar showed a significant growth on Thursday, the highest for more than a month according to the dollar index after the release of non-farm payrolls and manufacturing PMI statistics data which turned out much better than expected. All this happened before Friday release of the US non-farm payrolls report which might turn out better than forecasted after the ADP report.

Unemployment claims dropped to 5-year low by 19 thousand at once to 326 thousand last week while a growth to 345 thousand was forecasted. An average indicator’s reading for 4 weeks, which smooths out short-term fluctuations, also fell by 4.5 thousand to 341.25 thousand.

The ISM manufacturing PMI in the USA rocketed in July to its high of 55.4 since June, 2011against 50.9 in May with the forecast of 52. The reading higher than 50 indicates expansion of industrial activity. Production, new orders and employment sub-indices rose significantly while inventories and prices dropped.

The euro was traded downwards on Thursday amid the ECB meeting which resulted, as expected, in the central bank keeping the interest rates unchanged. The ECB president Mario Draghi announced during the press conference that the balance of risks for the economic growth outlook was still shifted to the negative side, that inflation expectations in the euro-zone remained moderate; and he also repeated that interest rates were likely to be near record lows within a long period of time.

Meanwhile, the euro-zone manufacturing PMI in July grew for the first time in two years: the final PMI exceeded the threshold of 50 p. and reached 50.3 p. while the preliminary reading of 50.1 p. was forecasted to maintain unchanged. Production growth in Germany was the fastest in 1.5 years and Italian manufactures said about activity growth for the first time in two years.

The pound lost all its growth which was observed after the release of manufacturing PMI that reached 28-month high 54.6 points from the revised upwards reading of 52.9 in June. Production and new orders growth in the UK was the highest from February, 2011. As it was expected, according to the results of the meeting the Bank of England left both the interest rate and the Asset Purchase Facility volume unchanged. However, unlike the previous month, no rate statement was published.

The yen decreased considerably amid Japanese stock market growth after the release of more positive Chinese manufacturing data than expected. The official report showed that Chinese manufacturing PMI had risen to 50.3 by the end of July compared with 50.1 in June. Meanwhile, the same HSBC index mismatched the official one – it dropped to 47.7 from June reading of 48.2.

By MasterForex Company

Overview of the main economical events of the current day - 05/08/2013

The Main Events of the Week

The US dollar fell on Friday against all major currencies except commodity ones after the release of Non-Farm Payrolls for July that fell short of expectations. Despite unemployment rate decrease by 0.2% from 7.6% to 7.4% at once (the lowest since December, 2008) Non-Farm Employment Change amounted only to 162 thousand against the forecast of 185 thousand. Besides, the reading for two past months was revised downwards by 26 thousand at once. Average hourly earnings dropped by 0.1% m/m, the decrease happened for the first time since December, 2011.

Income growth in June also fell short of expectations. Personal Income grew only by 0.3% while a growth by 0.4% was forecasted. Besides, both personal income and spending for the past month were revised by 0.1% downwards. Factory orders for June turned out worse than forecasted – they rose by 1.5% compared with the prior month against the forecasted growth by 2.3%.

By the end of the week the dollar had risen by 0.3% according to the dollar index. It showed a growth against all currencies except the euro and Swiss franc. Most of all fell the Australian dollar (-3.89%), New Zealand dollar (-3.06%) and Canadian dollar (-1.13%). This week there will be meetings of two central banks (of Australia and Japan), there will be a release of non-farm payrolls, industrial production data, trade balance and retail sales data; early month Chinese information block will be published.

In the euro-zone on Monday there will be a release of service PMI (a slight growth is expected in comparison with the prior month) and retail sales. Industrial production of Italy will be released on Tuesday, on Wednesday – Germany, on Thursday – Spain and on Friday – France; also a slight growth at a monthly rate is expected. Trade balance of France will be released on Wednesday, on Thursday – Germany and on Friday – Italy. On Tuesday there will be a release of industrial production of Germany and Prelim GDP of Italy for the second quarter. The GDP in the second quarter is expected to decrease a little less than in the first one.

In the UK on Monday there will be a release of service PMI, on Tuesday – industrial production and on Friday – trade balance. On Wednesday the Bank of England governor Mark Carney will introduce a BoE Inflation Report. The Bank of England is expected to introduce a Forward Guidance which will increase the transparency of future monetary policy and show the guide marks concerning both terms and conditions under which the policy will be tightened and thresholds of unemployment and other indicators.

In Australia on Tuesday there will be a release of trade balance, on Thursday – non-farm payrolls and on Friday - RBA Monetary Policy Statement. The meeting of the Australian Reserve Bank will be held on Tuesday and a rate decrease is expected. In New Zealand there will be a release of quarterly non-farm payrolls on Wednesday. In Canada a trade balance will be released on Tuesday and labor market report – on Friday. Japanese central bank meeting will be held on Wednesday. On Thursday Chinese trade balance will be released, on Friday – inflation data, industrial production and retail sales data.

There won’t be a lot of significant data on the USA. On Monday there will be a release of ISM Non-Manufacturing PMI and on Tuesday – trade balance. Also it should be marked that FOMC Members will start making reports since August, which they almost didn’t do in July. Besides, from Tuesday to Thursday there will be a traditional for the second week of the month long-term U.S. Treasury bonds auction.

By MasterForex Company

Overview of the main economical events of the current day - 06/08/2013

UK Services PMI Growth Rate Reached More Than 6-Year High

The US dollar was traded on Monday downwards against most major currencies despite service PMI growth. The pressure was put by the Friday labor market report that turned out worse than expected, which may make the Fed put off the start of QE tapering off. ISM Non-Manufacturing PMI rose significantly in July having reached the level of 56 p. (the highest since February) from June reading of 52.2 p. while a growth to 53.1 p. was forecasted. PMI, prices and new orders showed the highest growth while employment decreased by 1.5 p., which has become a negative moment.

The pound grew amid a significant increase in the UK service sector – up to more than 6-year high. Non-Manufacturing PMI rose to 60.2 p. in July from 56.9 p. in June having exceeded the forecast of 57.3 p. considerably – and it reached the highest reading since December, 2006. The index has been higher than 50 p. for seven months in a row already, showing a constant growth all this time.

The euro was traded downwards on Monday after it didn’t manage to overcome the level of 1.33 against the dollar despite service PMI growth. The released statistics turned out neither the worst nor encouraging. The euro-zone service PMI rose to 49.8 p. in July against 48.3 in June having exceeded the preliminary reading slightly but still not having reached 50 p. that separated the growth from reduce. At the same time the euro-zone composite PMI exceeded 50 p. for the first time since January, 2012 and grew to 50.5 p. in July against 48.7 p. in June. Euro-zone retail sales dropped by 0.5% in June while a decrease by 0.7% was forecasted; and at an annual rate the sales fell by 0.9% with the forecasted decrease by 1.3%.

The yen rose after the decrease of the Japanese stock market amid the US weak employment data – Nikkei 225 fell 1.4%. The Australian dollar recovered after it had updated new 3-year lows after the release of weak retail sales data. Retail sales in June maintained unchanged compared with the prior month while sales growth by 0.4% was expected. Besides, Australian Minister of Industry declared on Monday that the Australian dollar must slump and local producers needed AUD at $0.80.

New Zealand dollar was traded downwards on Monday amid the export suspension of some dairy products to China due to bacteria in them – although it had partly recovered its lost positions by the end of the day. The world's largest exporter of dairy products, New Zealand's Fonterra, announced on Saturday that some of its products might contain bacteria that caused botulism. As far as Fonterra, the largest company of New Zealand provides 25% of the country's exports, any course of events that can reduce the exports, has a negative impact on the rate of the national currency.

By MasterForex Company

Overview of the main economical events of the current day - 07/08/2013

The Euro-Zone Statistics Data Are Encouraging

The US dollar was traded downwards on Tuesday against most major currencies amid the release of positive euro-zone data despite the US trade balance improvement. Also the statements of some FOMC members had a negative effect on the dollar. Thus, though Atlanta Fed President Dennis Lockhart announced on Tuesday that the statement concerning tapering off of the bond purchase program might be done at any Fed meeting this year, he added that the Fed was ready to put off and reconsider the issue about bond purchase tapering off if the data was disappointing. FOMC member Evans also said that asset purchase could last under “certain conditions” – even if the unemployment rate is lower 6%.

According to the US Department of Commerce trade balance deficit decreased by more than 22% in June from $44.1 bln to $34.2 bln – the lowest reading since October, 2009- which may lead to the revision of the GDP growth for the second quarter upwards at the end of the month. The exports grew by 2.2% (the largest growth since September, 2012) mainly due to the export of manufacturing equipment and services at a record cost. The imports fell by 2.5%, which has led to a sharp decrease of the trade balance deficit. At the same time IBD/TIPP Economic Optimism Index showed a decrease of consumer confidence in August by 2 p. to 45.1 against 47.1in July.

The euro rose higher 1.33 on Tuesday against the dollar amid positive German and Italian data which say about a possible recovery of the European economy in the second half of the year. German factory orders rose significantly by 3.8% in June compared with the prior month against the expected growth only by 1%. At an annual rate the growth accounted for 4.3% while a growth only by 0.3% was forecasted. Italian GDP in the second quarter fell less than forecasted. The decrease accounted for 0.2% at a quarterly rate and 2% at an annual rate – against the expected drop by 0.4% and 2.2% respectively. Though Italian economy is still in recession, GDP rate data are encouraging.

The pound slowed down its growth and finished the day unchanged before the BoE Inflation Report publication despite industrial production growth that had considerably exceeded the forecasts. According to the Office for National Statistics industrial production of the UK rose by 1.1% in June compared with May against the forecasted growth by 0.7%. Manufacturing production increased by 1.9% against the forecasted growth by 1% - which turned out the highest growth within the year. Halifax House Price Index also considerably rose in July by 0.9% in comparison with June while a growth only by 0.5% was forecasted. The signs of the economy improvement have a positive у impact on consumer confidence.

The yen was traded upwards on Tuesday before the Japanese central bank meeting and on the back of stock market decrease. The Bank of Japan is expected to refrain from expanding stimulus programs at its meeting on 7-8 of August. The Australian dollar grew significantly after the Australian Reserve Bank decision to lower the base interest rate by 0.25% to record low of 2.50%. The decision was expected and therefore fully included in prices, which led, in fact, to profit-taking on short positions. The AUD net short position, according to the CFTC, has reached new record levels.

New Zealand dollar also grew after the fears of dairy exports from the country had been slightly reduced. The message of the Fonterra Company about its readiness to double any quality standards forwarded by China and also a successful GlobalDairyTrade auction where the prices had fallen relatively moderately, were supportive. Though Russia and China suspended the import of some New Zealand dairy products, the prime minister of New Zealand declared about his intentions to visit China to persuade Chinese authorities to change the decision. The Finance Minister Bill English said that the banned exports cost was not high and he didn’t expect it to impact the country’s GDP.

By MasterForex Company

Overview of the main economical events of the current day - 08/08/2013

The Bank of England Announced a New Strategy of Monetary Policy

The US dollar continued being traded downwards on Thursday against almost all major currencies amid the yen growth and the release of euro-zone strong macroeconomic indicators which show the signs of economic improvement. After 4-day decrease the dollar dropped according to the dollar index to its low since June, 20. There were no any significant US statistics data on Wednesday. The president of the Federal Reserve Bank of Cleveland Sandra Pianalto marked in her speech that there happened a significant improvement at the labor market and in case of its further recovery, they were ready to start QE tapering off but when it would happen, she didn’t specify.

The euro was supported after the release of German positive data which considerably exceeded the forecasts. German industrial output growth rate in June turned out the highest since April, 2012 – 2.4% m/m with the forecasted growth only by 0.3%. At an annual rate the reading has grown by 2% with the forecasted drop by 0.3%. Besides, Fitch affirmed Germany’s AAA rating with a stable outlook and raised GDP growth outlook to 1.5% in 2014 from 0.4% in 2013. Fitch declared that German government had beaten some budget targets with structural budget balance having moved into surplus this year for the first time since reunification.

The pound grew on Wednesday after the release of the BoE Inflation Report where the Bank of England provided a Forward Guidance for the monetary policy in the form of unemployment threshold. The Bank governor Mark Carney announced that the British CB had no intention to raise a base rate until unemployment rate fell lower 7% - and it is unlikely to happen before early 2016. The Bank of England expects inflation to slow down to the target level of 2% by the 4th quarter of 2015.

However, Mark Carney noted that price stability was in priority for the CB: if the growth rate of consumer prices exceeded the target level by more than 0.5% in the nearest 1.5-2 years, the bank’s promise about the rate wouldn’t not be in force. At first the pound reacted with a decrease but then it rocketed after the outlook for country’s economy growth for the nearest years had been raised. The CB raised the UK GDP growth outlook for 2013 up to 1.5% from 1.2% expected in May and the forecast for 2014 – up to 2.7% from 1.9%.

The yen strengthened significantly and reached 6-week high Vs the dollar after 4-day rise – before the announcement of the BoJ meeting results on Thursday and amid the decrease of Japanese stock market which slumped according to Nikkei 225 by 4% at once on Wednesday.

New Zealand dollar continued recovering having almost no reaction on employment report which turned out within expectations though unemployment rate in the second quarter rose by 0.2% to 6.4%. The scandal concerning the quality of dairy products gradually fades.

The Canadian dollar dropped on Wednesday amid the release of negative statistics. Building Permits in Canada dropped in June for the first time for the last six months by 10.3% which has exceeded the expectations by more than 8 times. Ivey PMI moved to a negative territory in July and dropped to 48.4 from 55.3 in June.

By MasterForex Company

Overview of the main economical events of the current day - 09/08/2013

China’s import rocketed in July

The US dollar was traded downwards on Thursday against all major currencies and fell to 7-week low according to the dollar index amid Unemployment Claims which according to the US Labor Department rose by 5 thousand last week from 328 thousand to 333 thousand. Last week data were revised for the worse by 2 thousand. Meanwhile FOMC member Richard Fisher said again on Thursday in the interview to German newspaper Handelsblatt that he considered reducing of assets purchase in September possible if the situation in the economy worsened significantly.

The euro continued rising and approached to the level of 1.34 Vs dollar. According to the Federal Statistics Office of Germany trade surplus grew significantly in June up to €15.7 bln Vs revised upwards May reading €14.6 bln, consensus €15.2 bln. German Current Account Surplus also turned out higher in June than forecasted. It grew from €11.2 bln in May to €17.3 bln having exceeded the forecast of €16 bln.

The yen rose at first after 2-day meeting of the Bank of Japan that finished on Thursday where its policy was kept unchanged in expectation of new economic growth data which will be published next week. However, then the yen lost all its growth amid stock indexes strengthening. Bank of Japan Governor Kuroda introduced a more positive economy estimate on Thursday and called upon increasing sales-tax.

The Australian dollar had grown by the end of the day having almost no reaction on bad non-farm payrolls. Employment rate in Australia decreased by 10.2 thousand in July while a growth by 6 thousand was expected. However, unemployment rate didn’t change and maintained the same 5.7% Vs growth to 5.8% consensus. The AUD was also supported by other commodity currencies – Chinese trade balance for July. Though Trade Surplus dropped from $27.1bln prior month to $17.8 bln – China’s import grew by 10.9% and the export from Australia to China increased by 25%.

The Canadian dollar rose significantly in anticipation of Canadian non-farm payrolls having shown the most considerable one day growth almost within a month. Extra 10, 000 jobs are expected to have been added in the Canadian economy in July and unemployment rate have remained at the same 7.1%. The released New Housing Price Index grew in June a little more than expected by 0.2% Vs growth by 0.1% Consensus.

By MasterForex Company

Overview of the main economical events of the current day - 12/08/2013

The Main Events of the Week

The US dollar was traded downwards on Friday Vs the yen and commodity currencies and slightly upwards Vs major European currencies. The Canadian dollar had ignored the employment report for July by the end of the day which turned out worse than expected. Employment rate in Canada fell unexpectedly by 39.4 thousand (expected growth by 10 thousand) and unemployment rate increased by 0.1% up to 7.2%.

Chinese statistics data supported commodity currencies which showed industrial output growth and moderate inflation. Industrial output grew by 9.7% in July at an annual rate (Vs Consensus 8.9%) and fixed-asset investment rose by 20.1%. The euro was traded downwards after having reached 7-week high against the dollar. Some pressure was put by French industrial output which shrank by 1.4% m/m while a growth by 0.3% was expected.

By the end of the week the dollar had lost 1% according to the dollar index still being under pressure after the publication of key Non-Farm Payrolls report that turned out disappointing. The largest growth Vs US dollar was shown by the Australian dollar (+3.28%), Japanese yen (+2.81%), New Zealand dollar (+2.73%) and British pound (+1.44%). This week there will be a release of GDP, inflation, industrial output and retail sales data.

The main event of the week may become Wednesday release of preliminary GDP for the second quarter of major countries and the whole euro-zone. Euro-zone GDP is expected to grow for the first time in 6-quarter recession. German and Euro-Zone ZEW Economic Sentiment and euro-zone industrial output will be released on Tuesday – indicators’ growth is expected. It is a day off on Thursday in France and Italy and on Friday there will be a release of euro-zone inflation, trade balance and current account data.

On Wednesday in Great Britain there will be a release of Bank of England Meeting Minutes and non-farm payrolls report. MPC Official Bank Rate Votes and Asset Purchase Facility Votes will attract attention. The Meeting minutes are expected to show a unanimous vote to keep everything unchanged. Unemployment rate will also draw attention as the Bank of England tied its monetary policy to this indicator and promised to toughen the policy until unemployment fell to 7%. Producer and Consumer Price Indexes will be released on Tuesday and retail sales – on Thursday.

In New Zealand also a quarter retail sales report will be published on Wednesday and Business NZ Manufacturing Index – on Thursday. In Australia NAB Business Confidence Index will be released on Tuesday and Westpac Consumer Confidence Index – on Wednesday. Japanese Flash GDP for the second quarter will be released on Monday.

There are rather a lot of US data. On Tuesday – retail sales. Producer Price Index will be released on Wednesday and Consumer Price Index – on Thursday. On Thursday capital inflow, industrial output and Philadelphia Fed Manufacturing Index will be published. On Friday House Price Balance (Building Permits and Housing Starts) and also Prelim U. of Michigan Consumer Sentiment will be published.

By MasterForex Company

Overview of the main economical events of the current day - 13/08/2013

Japanese GDP Growth Rate Slowed Down in the Second Quarter

The US dollar was traded upwards on Monday having continued its Friday corrective growth amid a poor news background in anticipation of the release of various US macrostatistics data planned for this week which can support the expectations concerning Fed incentive measures reduce. In particular, US retail sales data will be published on Tuesday.

On Monday there were almost no significant statistics data except Japanese Preliminary GDP for the second quarter. According to the preliminary estimate Japanese GDP for the second quarter rose only by 0.6% while a growth by 0.9% was expected. Prelim GDP Annualized accounted for 2.6% (Consensus growth by 3.6%) Vs 3.8% in the first quarter.

Prelim Nominal GDP has risen by 0.7% at a quarterly rate which turned out lower than forecasted growth by +1.0%. Consumer Spending increased by 0.8%, which exceeded the expectations but Business Spending decreased by 0.1% against the expected growth by 0.6%. However economic growth of Japan for the first six months has been the best for the past three years.

Japanese revised Industrial Production for June decreased by 3.1% at a monthly rate, which coincided with the expectations. At an annual rate Industrial Production in June dropped by 4.6%. At the same time Domestic Corporate Goods Price Index (DCGPI) (analogue of the PPI) grew by 0.5% m/m in July, which exceeded forecasted growth by 0.2%.

The euro continued its correction downwards and tested the level of 1.33 Vs dollar. Preliminary GDP of Greece for the second quarter showed economic growth rate decrease by 4.6% at an annual rate although turned out better than forecasted -4.8%. Meanwhile former ECB president Jean-Claude Trichet declared on Monday that Europe had made progress and the risk of the euro-zone collapse had probably disappeared but the reforms must be continued further.

The Australian dollar reached 2-week high on Monday’s Assian session but then slightly dropped after the dollar’s growth. Some support at the beginning of the day was provided by good Chinese economy statistics published last week which dispelled the fears concerning Chinese economic growth slowdown. New Zealand dollar was also traded downwards. According to Real Estate Institute of New Zealand (REINZ) report housing prices fell in July for the first time for the past 6 months. REINZ Housing Price Index dropped by 0.5% compared with June.

By MasterForex Company