You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Overview of the main economical events of the current day - 03/07/2013

EURUSD fell below 1.30 for the first time in June

The US dollar showed a significant growth on Tuesday against all major currencies and exceeded the level of 100 yens per dollar for the first time since the beginning of June on the back of better than expected factory orders data for May and also the speech of the Fed head William Dudley. In his speech on Tuesday Dudley repeated that bond purchases could be decreased this year and the Fed could finish buying bonds in the middle of 2014 if the unemployment rate would drop to 7%. He said that he could see strong reasons to accelerate the USA economy growth in 2014.

According to the Ministry of Commerce report released on Tuesday factory orders rose by 2.1% in May in comparison with the prior month, which exceeded the expected growth by 2.0%. April data were also revised upwards to +1.3% from +1.0%. The orders had been rising for three of the last four months. Car sales growth, housing construction increase and energy consumption growth in the USA help the American companies to manage the decline in exports.

The euro fell against the dollar below 1.30 for the first time in June amid the release of the manufacturing inflation report which showed that producer price index had fallen more than expected – by 0.3% at a monthly rate against the forecasted drop by 0.2%. An extra pressure was made by a statement of the EC Eurostat that the unemployment rate in May was 12.2% and not 12.1% as it was announced on Monday. Besides, political tensions in Portugal added some negative as its Minister of Foreign Affairs had offered his resignation and the day before it the Minister of Finance had resigned.

The pound also followed the euro amid the release of construction PMI that showed some growth in comparison with the previous month but didn’t reach the forecasted readings. Construction PMI rose up to 51 in June against 50.8 in May with the forecasted reading 51.2. Some pressure was put by the BoE Deputy Governor Paul Tucker who said that high levels of household debt constrained the growth of the British economy.

The Australian dollar slumped on Tuesday after the Australian Reserve Bank kept the key interest rate at 2.75% for the second time in a row but left the possibility of its decrease in further months open. RBA Governor Glenn Stevens announced that “the inflation outlook may provide some scope for further policy easing if it is necessary to support the demand". ABN Amro Bank forecasts that by the end of 2013 RBA would have decreased the rate to 2.25%.

By MasterForex Company

Overview of the main economical events of the current day - 04/07/2013

Non-Manufacturing PMI in the USA suddenly fell

The US dollar took a break in its growth on Wednesday amid ambiguous statistics and positions balance before the ECB meeting and a holiday in the USA on Thursday. Weak non-manufacturing PMI which accounts for more than 80% of all the economy also helped the decline.

According to the ISM survey Non-Manufacturing PMI in the USA fell to its annual low 52.2 points in June in comparison with the reading in May - 53.7 while it was expected to rise up to 54.1. The subindex of new orders and PMI subindex have fallen while employment subindex has risen. Other US data released on Wednesday also were ambiguous.

According to the data released by the Ministry of Commerce the U.S. trade deficit in May rose to $45 billion while it was forecasted to drop to $40.1 billion. The imports grew by 1.9%, the exports decreased by 0.3% - as a result the US trade deficit has risen by 12%. At the same time labor market data turned out good.

Unemployment claims decreased by 5 thousand to 343 thousand last week although a growth up to 345 thousand was expected. ADP employment change rose by 188 thousand in June with the forecast of +160 thousand.

The euro rose on Wednesday before the ECB meeting on Thursday despite the ambiguous data and the growth of political tensions in Portugal. Retail sales in the euro-zone grew by 1% m/m with the forecasted growth only by 0.3%; and within the year the sales decreased only by 0.1% while they were forecasted to fall by 1.9%. Meanwhile the final services PMI grew less than expected – to 48.3 against the initial estimate of 48.6 points.

The pound showed a significant growth after the release of positive services PMI which is ¾ of all the country’s economy. In June services PMI grew from 54.9 in May to 56.9 – the highest level since March, 2011 while a decrease to 54.5 was expected. New orders growth rate turned out the highest since June, 2007.

The yen grew on Wednesday amid the correction of stock markets and Nikkei futures decrease. The strengthening of the yen was also supported by growing tensions in Portugal. This week several ministers of Portugal offered a resignation including the minister of finance. The yield of 10-year Portuguese bonds rose on Wednesday above 8% for the first time since November, 2012.

The Australian dollar fell on Wednesday to the August, 2010 low after the RBA governor Stevens had announced that AUD was still at a high level despite the decrease by almost 10% since early April. Besides, the further decline of the Australian currency was possible, which would support the economy growth. Retails sales in Australia also turned out worse than expected. The decrease of non-manufacturing PMI growth rate also had a negative effect. Non-manufacturing PMI dropped to 53.9 points in June from 54.3 in May.

By MasterForex Company

Overview of the main economical events of the current day - 05/07/2013

The euro slumped after Mario Draghi’s comments

On Thursday it was a holiday in the USA and the main events of the day were the results of two central banks’ meetings; the Bank of England and ECB. The euro slumped during traditional press conference after the ECB meeting when Mario Draghi said about the outlook of the central bank monetary policy for the first time ever. Earlier the ECB tried not to decide anything in advance. Draghi announced that interest rates would remain at a current record low level or lower for an extended period of time –as long as it would be necessary.

At the meeting the ECB kept the base interest rate unchanged at a record low level – 0.5%. Currently downward risks prevail for the euro-zone economy while inflation risks are generally balanced – he said. This time the ECB sees no risks linked to low interest rates. Inflation expectations in the euro-zone are still restrained and the inflation outlook justifies the appearance of a guide concerning the policy prospects, Draghi said. There was a discussion of a possibility to decrease the rate – 0.50% is not the lowest limit and the ECB was technically ready to the negative rate – he declared.

The first meeting of the Bank of England headed by Mark Carney also made a surprise. The Bank of England decided not to change Quantitative Easing (QE) volume and kept the rates unchanged but suddenly issued MPC Rate Statement which used to be released earlier only in case of changes in the monetary policy, whether it were a rate or QE volume.

The pound slumped after the release of the MRC rate statement that was soft – in particular the attention of the market participants was attracted by the words about a sharp growth of market rates and its negative influence on the economic recovery prospects. Also according to the statement the increase of interest rates is unreasonable from the British economy point of view. Morgan Stanley experts predict a fall of GBPUSD to $1.41 by the end of the year.

The markets are waiting for a key non-farm payrolls report of the USA which is important not only because it signals the economy state, it also can throw light upon the further decisions of the Fed concerning the monetary policy. A more positive report than expected can draw the Fed nearer to the discussion of scaling back QE program. There is an expectation of employment growth by 160-165 thousand people and unemployment rate decrease by 0.1% to 7.5%.

By MasterForex Company

Overview of the main economical events of the current day - 08/07/2013

The main events of the week

The US non-farm payrolls released on Friday turned out significantly better than expected, which allowed the dollar to continue growing over the whole market. According to the Labor Department survey non-farm payrolls increased by 195 thousand in June while a growth by 165 thousand was expected. Besides, the data for the past two months were revised upwards by as much as 70 thousand.

Despite a faster than expected growth of non-farm payrolls the unemployment rate didn’t change in June in comparison with May and it accounted for 7.6% as in the previous month although it was predicted to drop by 0.1%. Average hourly earnings per month have showed the highest growth since the last year end - by 0.4% up to 24.01 dollars. In comparison with the last year it grew by 2.2% - the highest reading since July, 2011.

An average growth of non-farm payrolls for the second quarter amounted to 196 thousand per month, which is a little lower than the first quarter reading that was 207 thousand per month. An average growth for the past six months is 202 thousand. The improvement of the situation at the labor market can draw nearer the start of QE3 scaling back. All this forms a contrast with the positions of the ECB and the Bank of England which announced their intention for extra monetary policy easing last week. JPMorgan and Goldman Sachs experts believe that the Fed could decrease bond purchases in September already and not in December as it had been forecasted before.

The dollar grew for the last week by 1.55% according to the dollar index. Most of all it has risen against the British pound (+2.01%), Japanese yen (+1.99%) and Swiss franc (+1.95%). For the second week already the dollar has been rising along with the American stock market which has risen the same 1.5% for the week according to the DJIA index. During this second week of the month there won’t be so many important events that can influence the balance of forces at the market. There will be a meeting of the Japanese CB and also a release of industrial production data, trade balance and inflation data.

In the euro-zone there will be a release of trade balance data and Germany’s industrial production data. Industrial production of Italy and France is released on Wednesday and the whole euro-zone’s one - on Friday. The industrial production is expected to fall in May in Germany and generally in the euro-zone and to show a slight growth in France and Italy. Concerning Great Britain trade balance data and industrial production data will be released on Tuesday; and a moderate growth of industrial production is expected in May. On Thursday non-farm payrolls of Australia will be released. Inflation data of China are released on Tuesday; and trade balance of the PRC – on Wednesday.

Concerning the USA - FOMC Meeting Minutes will be released on Wednesday, which is likely to confirm a more aggressive attitude of the central bank. On Friday producer price index and a preliminary U. of Michigan consumer sentiment will be released. At the debt market there will be a traditional for the second week of the month the US long-term bond auction. The 8th of July is a start of the quarterly earnings season of American companies for the second quarter which will last till the middle of August.

By MasterForex Company

Overview of the main economical events of the current day - 09/07/2013

The dollar made a pause in its growth

The dollar was correcting on Monday after prior days significant growth and without any considerable macrostatistics data on the USA at the beginning of the week. Having reached important technical levels of many pairs market participants corrected their positions. Correction can continue but on Wednesday FOMC meeting minutes will be released and also the Fed governor Ben Bernanke will make a speech about the coming 100th anniversary of the American central bank which will be celebrated in December of this year.

The euro rose moderately on Monday amid the Eurogroup meeting and the achieved agreement on financing of Greece, stabilization of political situation in Portugal and the speech of the ECB head Mario Draghi in the European Parliament – despite weak trade balance and industrial production data of Germany and investors’ confidence in the euro-zone. At the end of Monday finance ministers of the euro-zone achieved an agreement on bailout aid to Greece. The first sum of 2.5 billion euros will be paid to Athens in July, which will allow the country to escape the crisis of financing threat.

The ECB governor Mario Draghi making speech in the European Parliament repeated again that the monetary policy would stay mild as long as it would be necessary and interest rates would be kept at low levels for a long period of time. Although the situation in the euro-zone hasn’t stabilized yet and downside risks for the economy maintain, the ECB is awaiting a gradual economic recovery in the second half of the year although at a slow rate.

Germany’s trade balance surplus for May decreased to 14.1 bln euros from 17.5 bln prior month – exports fell by 2.4% m/m instead of a sluggish growth. Industrial production of Germany fell by 1% in May in comparison with the previous month while it was expected to decrease only by 0.5%, which was linked to a considerable drop in construction and energy sectors. The recovery of the largest European economy is still unstable amid uncertain prospects of the foreign trade. Sentix confidence index of European investors also dropped in June to -12.6 in comparison with the reading in May -11.6.

The political situation in Portugal stabilized on weekend after the prime minister had appointed the former Minister of Foreign Affairs, who resigned recently, the vice prime minister, which allowed to save the ruling coalition and avoid new elections. S&P rating agency lowered the forecast of Portugal current rating to negative one due to the growing political uncertainty which could undermine the county’s return to the debt market.

Meanwhile the Bank of France increased the prospects of the economic growth in the second quarter up to 0.2% in comparison with 0.1% which was predicted before. Also the Bank’s report released on Monday showed the growth of business confidence in June. Manufacturing business confidence of France grew to 96 in June in comparison with 94 in May.

By MasterForex Company

Overview of the main economical events of the current day - 10/07/2013

The pound fell to its 3-year low

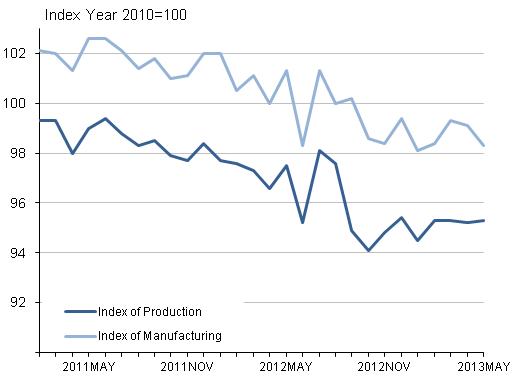

On Tuesday the dollar grew against the euro and the pound, it decreased against commodity currencies and almost didn’t change against the yen. The decline of European currencies on Tuesday started with a sharp fall of the British pound that broke through this year minimums and decreased to 3-year low against the dollar after the release of a weak industrial production report for May and April data revised downwards. Especially strong decrease was shown by manufacturing production – by 0.8% while it was expected to grow by 0.4%.

Source: ons.gov.ukIndustrial production showed a zero monthly surplus while it was expected to rise by 0.2%. At an annual rate industrial production decreased by 2.3% in May, which was connected with 2.9% decline in the manufacturing production and 3.5% decrease in the mining industry. Morgan Stanley experts predict GBPUSD fall to $1.45 by the end of the third quarter and to $1.41 by the end of the year.

The euro hit its 3-month low on Tuesday against the dollar after a member of the ECB executive board Jörg Asmussen in his interview to Reuters, explaining the statements made by the ECB governor Mario Draghi last week, had said that the ECB would probably keep the rates low beyond 12 months. Asmussen also said that he wouldn’t exclude one more round of cheap lending that was used two years ago to aid troubled banks in the euro-zone. However the ECB denied the words of Asmussen having said that there was no any guidance concerning the exact length of time of the monetary policy guideline.

Another negative factor for the euro was a further decline of the credit rating of Italy. Standard & Poor's lowered Italian credit rating from BBB+ to BBB. According to the S&P rate statement this measure reflects the consequences of Italian growth rates slowdown due to its structural weakness and inability to solve the problems at the labor market, service sector and production markets. The agency kept a negative rating forecast, which indicates a possibility of further rating decline in 2013 or 2014 with a probability of 1 to 3.

Australian dollar continued recovering for the second day on Tuesday from almost 3-year low against the dollar amid the close of short positions. According to the Commodity Futures Trading Commission (СFTC) net speculative short position for the pair reached historic high 70.5 thousand contracts on July, 2. Although in the mid-term prospect the AUD will probably stay under the pressure - the probability of the rate decrease at the next RBA meeting in August is currently estimated 59% by the market.

New Zealand dollar followed the Australian one amid the business confidence growth in the country. NZIER business confidence grew to 32 in the second quarter of this year in comparison with 23 in the previous quarter. NZ Card Spending – Retail also grew in June more than expected – up to 1.1% m/m against the forecast of 0.7%. The Canadian dollar was supported by housing starts strong data in Canada for June, which fell much lower than forecasted – especially after the release of a positive building permits report for May.

By MasterForex Company

Overview of the main economical events of the current day - 11/07/2013

FOMC and Bernanke crashed the dollar

Two key events of Wednesday and the whole week – the publication of the FOMC Meeting Minutes and the speech of the Fed chairman Bernanke – led to a sharp weakening of the dollar. Probably it will last till the middle of the next week when Bernanke will deliver a semi-annual report to the two houses of the U.S. Congress.

The released FOMC Meeting Minutes were estimated weak by the market, which lead to fixation of long dollar positions after almost a month of its growth. The minutes showed that FOMC members disagreed about the terms of QE scaling back. About a half of the Fed leaders believe that the central bank must finish the asset purchase program by the end of the year. The rest think that it would be reasonable to continue purchasing till 2014.

FOMC wants Bernanke to make it clear that the increase of interest rates is an issue of a distant future. Almost all the committee members support a soft monetary policy. Many Fed leaders want to see a higher employment rate before decreasing bond purchases.

Ben Bernanke delivered his speech in two hours after the minutes release and also signaled a larger tendency to soft monetary policy. He said that “extra-soft monetary policy is necessary in the near future”. Besides, Fed is likely to raise short-term interest rates only some time after the unemployment rate reaches 6.5%. “The US dollar seems to be doing well recently”, said Bernanke.

The dollar started to weaken since early Wednesday when trade balance negative statistics data of China were released raising the stock markets drop and the yen fall. The yen showed its maximum growth for the month on Wednesday against the dollar amid the start of the Bank of Japan 2-day meeting which was not expected to expand incentive programs.

The signs of the Japanese economic recovery also decrease the prospects of further monetary policy easing this year. Trade balance weak data of China helped the yen to grow. The imports decreased by 0.7% in June in comparison with the same period last year while it was expected to grow by 6%. The exports also fell by 3.1% y/y against the forecasted growth by 3.7%.

The euro grew on Wednesday despite industrial production mixed data. The industrial production in France fell by 0.4% m/m in May, which turned out a little better than the forecasted drop by 0.8%. The industrial production of Italy grew only by 0.1% m/m against the forecasted growth by 0.3%. Germany’s inflation data showed its growth up to its high since December, 2012. Consumer price index rose by 0.1% in June at a monthly rate and by 1.8% at an annual rate.

By MasterForex Company

Overview of the main economical events of the current day - 12/07/2013

Bank of Japan raised its assessment of the country’s economy

The yen showed growth for the second day in a row after the Bank of Japan kept its monetary policy unchanged on Thursday but lifted the assessment of the economy. Economic recovery is cumulating momentum, the exports are growing due to the yen weakening, consumer spending is rising and deflationary pressures are gradually weakening.

So, Core Machinery Orders for May released on Thursday showed growth by 10.5% m/m with the forecast of 1.7%. It will not allow extending incentive measures this year, that’s why the yen reacts with strengthening. USDJPY is likely to maintain at the level of Y100 till the elections in Japan which will be held 21, July and till the consumer price index publication which is expected on 25, July.

The US dollar continued falling on Thursday, which started after the publication of FOMC Meeting Minutes and Ben Bernanke’s speech although at the beginning of the day the dollar tried to correct. For two days it has already lost 2.3% according the dollar index. Extra negative affect was made by the labor market statistics released on Thursday that turned out worse than expected.

According to the US Labor Department data unemployment claims grew by 16 thousand last week up to 360 thousand while a drop to 340 thousand was expected. The 4-week moving average of Unemployment Claims started to grow again and had risen by 6 thousand for the past week. Besides, import prices decreased in June more than expected, which puts downwards pressure on the USA inflation.

After Bernanke’s speech the forecast concerning the first increase of the Fed interest rates was revised at the interest-rate futures market from February to April, 2015. Barclays’ analysts consider the dollar's decline another correction but doubt whether it is long waiting for a soon American currency growth. They predict the EURUSD rate at the level of $1.27 by the end of the third quarter and at the level of $1.26 by the end of the year. Credit Suisse currency strategists believe that the dollar growth resumption will require time and the reduction of a large number of the US currency long positions.

EURUSD is again traded above 1.30. The ECB Monthly Bulletin released on Thursday explains that the horizon of interest rate changes by the ECB will be flexible and will depend on economic readings of the euro-zone. Last week ECB head Mario Draghi promised to keep the rates low as long as it will be necessary. Meanwhile German Bundesbank President Jens Weidmann making a speech in Munich on Thursday declared that that promise was not a serious change of the strategy. The ECB can raise base interest rates in future if the inflation pressure becomes evident.

The Australian dollar lost all the growth of the start of the day and had even decreased by the end. The pressure was put by the labor market survey in spite of seemingly strong figures of employment change growth by 10.3 thousand in June while no surplus was expected. But the entire employment rate growth was due to the increase of part time employment change which grew by 14.8 thousand. Besides, unemployment rate grew by 0.1% to 5.7% - the highest level since September, 2009. New Zealand dollar also fell. Business NZ Manufacturing Index dropped to 54.7 in June from 59 in the previous month.

By MasterForex Company

Overview of the main economical events of the current day - 15/07/2013

The main events of the week

The dollar grew slightly on Friday after two days of sharp decrease. Consumer confidence data released on Friday didn’t help the dollar’s correction. Preliminary U. of Michigan consumer sentiment dropped to 83.9 in July in comparison with the final reading 84.1 for June while a growth to 84.7 was expected. Consumer sentiment subindex decreased for the nearest 6 months probably due to the recent rise of interest rates on mortgages and retail petrol prices.

At the same time producer price index showed a significant growth – the highest one at a monthly rate for the past nine months, which was caused by the energy prices growth. Producer price index grew by 0.8% in June while it was expected to rise only by 0.5%.

The euro was negatively affected on Friday by the growth of political tensions in Portugal; its authorities appealed to the international lenders to defer payments for credits from the middle of July to the end of August. Besides, on Friday evening the Fitch Ratings has downgraded France's Long-term foreign and local currency Issuer Default Ratings (IDR) to 'AA+' from 'AAA'. The Outlook is Stable. The Fitch is the only agency of the “Big Three” to retain the highest rating on the euro-zone’s second largest economy.

For the past week the dollar suffered significant losses having fallen by almost 1.9% according the dollar index. All the major currencies except the Australian dollar have grown. The largest growth was shown by the Japanese yen (+2.00%), the euro (+1.88%), Swiss franc (+1.82%) and the Canadian dollar (+1.81%).

This week the meeting of the Central Bank of Canada will take place and there will be a release of two Central Banks Meeting Minutes: the Bank of Japan and the Bank of England; there will be a release of inflation data (New Zealand, Great Britain, the USA, Canada and Germany); retail sales data (Great Britain and the USA); housing market data (the USA) and labor market data (Great Britain); a large China information block – at the beginning of the week.

The final euro-zone’s consumer price index and trade balance data will be released on Tuesday and also German ZEW Economic Sentiment which is expected to grow. Current Account of the euro-zone will be released on Thursday and Germany’s Producer Price Index – on Friday.

The UK’s producer price and consumer price index will be released on Tuesday and a growth of an annual inflation is forecasted. On Wednesday – labor market data and on Thursday – retail sales data. A special attention will be drawn by the BOE Meeting Minutes which can demonstrate that fewer members of the BOE Monetary Policy Committee voted for the QE program increase. If the Central Bank new governor Mark Carney turns out to vote for keeping the policy unchanged, it may put pressure on the pound.

There will be a lot of important data on the USA. On Monday – retail sales and Empire State Manufacturing Index. On Tuesday – consumer price index, industrial production and Treasury International Capital (TIC) Flows. On Wednesday – housing market data and the Beige Book. On Thursday - Philadelphia Fed Manufacturing Index. But the main event of the week can become the Fed governor Ben Bernanke’s presentation of Monetary Policy Report to U.S. Congress, which will take place on Wednesday and Thursday. The first speech on Wednesday is considered more important. On the second day usually the main points of the first speech are repeated but something new also can be said.

By MasterForex Company

Overview of the main economical events of the current day - 16/07/2013

US retail sales fell short of expectations

The US dollar grew on Monday against the yen, franc and Canadian dollar; it fell against the Australian dollar and New Zealand dollar and almost didn’t change against the euro and the pound. The dollar tried to rise at the first part of the day but its further growth was prevented by weak retail sales data which turned out worse than expected. Retail sales increased by 0.4% in comparison with the prior month, which turned out almost twice lower than the forecasted growth by 0.7%.

However the entire increase in June was due to the motor vehicles: the sales of auto dealers rose by 1.8%. Core Retail Sales excluding the volatile categories of autos, which demonstrate consumer spending trends better, remained unchanged while 0.4% growth was expected.

At the same time Federal Reserve Bank of New York released the first factory report of regional Fed banks for July which turned out to be good. Empire State Manufacturing Index reached 9.46 against 7.84 in June while it was forecasted to decrease to 5. New orders, supply and employment subindices have increased.

The euro was falling at the beginning of the day amid growing political tensions in Portugal and Spain. Late Sunday the leading political parties of Portugal set a July 21 deadline to agree to a "national salvation pact". The opposition leaders urged Spanish Prime Minister Mariano Rajoy to resign after the newspaper El Mundo had published information that put the official in a bad light.

The Australian dollar has risen after the release of economic statistics data of China, the yen also has weakened. Chinese GDP growth rate accounted for 7.5% at an annual rate in the second quarter of 2013, which coincided with the expectations but many market participants feared unpleasant surprises from the report. Last week the Finance Minister of China made it clear that economic growth by the end of the year could be even lower 7%, which is a little lower than the official forecast of the State Council of the People's Republic of China that accounted for 7.5%. China is the largest trade partner of Australia.

The Canadian dollar didn’t support on Monday the commodity currencies’ trend to corrective strengthening and decreased before the Canadian Central Bank meeting which will take place on Wednesday. The Canadian newspaper Globe and Mail published an article which said that the Bank of Canada might surprise financial markets this week and signal a long period of low interest rates as the ECB has done recently. Earlier the Bank of Canada was thought to raise the rate before the Fed since the end of 2014 but now it may make it clear that it will wait till 2015 as the Fed.

By MasterForex Company