Italian Referendum Preview: Euro To Dollar Exchange Rate Forecasts Ahead Of The Key Event

A high level risk for the EUR to USD exchange rate is to unfold within days, namely the Italian Constitutional Referendum

- The Pound to Euro exchange rate today (03/12/16- FX markets closed): 1.19333.

- The Euro to Pound exchange rate today: 0.83799.

- The Euro to Dollar exchange rate today: 1.06664.

- Forecasters envisage the upcoming Italian Referendum could see greater volatility for the euro that the US Presidential Elections 2016.

The Italian constitutional referendum would not have caught the world’s attention had the Prime Minister Matteo Renzi not made it about himself.

This opens a myriad of options, which is covered in detail by the analysts’ at Nomura.

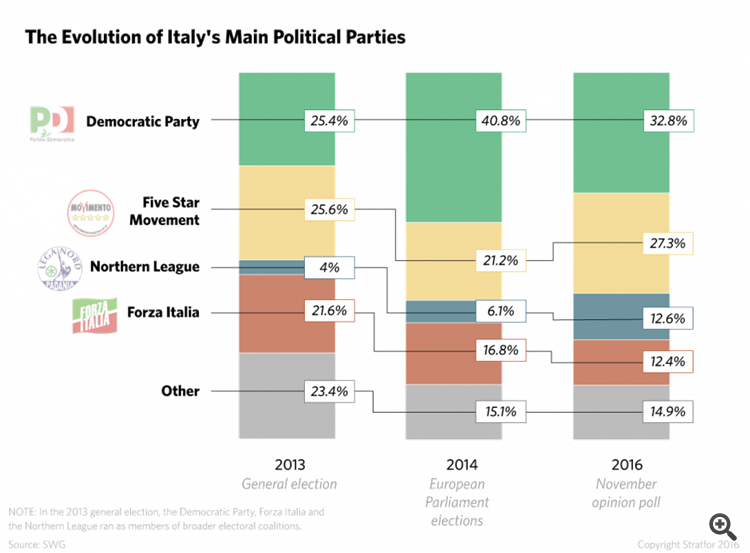

Nomura expects a “no” vote – in line with consensus. However, “the main risk would not be the referendum’s result, but remains an early election, as the Five Star Movement (M5S) could gain a majority in the Lower House under current electoral law, but is likely to be shy of a majority in the Upper House,” said analysts at Nomura.Risk to the markets if the Five Start movement comes to power

The main risk is if the M5S holds a referendum similar to the Brexit. Though it is not certain that they would do so, but the markets will invariably price in the risk to such an event.

Meet the Competitors in Italy's Referendum

Italy is finally holding its referendum on constitutional reforms. Prime Minister Matteo Renzi's proposals would reduce the powers and size of the Senate, granting the Chamber of Deputies more authority and transferring prerogatives from regional administrations to the central government in Rome. The changes would, in theory, sever the link between political instability and financial fragility in Italy. Instead, because Renzi has promised to step down if the Italian people vote against the reforms, opposition parties such as the Five Star Movement and the Northern League — and even some members of Renzi's center-left Democratic Party — have cast the referendum as a chance to force the prime minister and his government to resign.

Even if voters reject the reforms and Renzi resigns, early elections for a new government are not a given. Italian President Sergio Mattarella could ask Parliament to form a new government and appoint a prime minister, probably with the goal of introducing political and economic reforms. The Five Star Movement has said it would not support a caretaker government, but the Democratic Party and its junior coalition partner still control enough seats in Parliament to appoint a new prime minister, provided that they stay united.

Moreover, opinion polls show that the Five Star Movement's popularity is close to that of the Democratic Party, giving it incentive to avoid early elections that could unseat it. In a potential runoff election between the Democratic Party and the Five Star Movement, all opposition parties could side with the protest party to propel it to victory. This prospect might impel the government to change the rules while it still can. Lorenzo Guerini, the deputy secretary of the Democratic Party, has said that in case of a defeat in the referendum, the party would try to modify the country's electoral laws so that new elections could be held in summer 2017.

Whether or not the referendum fails and subsequent early elections

are held, the possibility that the Five Star Movement will eventually

triumph at the national level cannot be discounted, because more and

more Italians have grown weary of traditional political parties. Decades

of mismanagement and corruption have led to voter mistrust in the

establishment parties' ability to turn around Italy's tepid economic

growth and persistently high unemployment. Still, a government led by

the Five Star Movement would face many of the same constraints as its

predecessors.

Italian PM Renzi speaking: Italian people have spoken, result is clear

The 'No' vote has won in the Italian constitutional referendum

- Clear win for 'no'

- Turnout higher than expected

- Renzi says he takes full responsibility for the defeat

- Says he intends to resign

- Will go the President tomorrow

- My government ends here

- Will convene cabinet tomorrow, hand resignation to president

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

On Sunday 4 December Italians will vote in a constitutional reform referendum, which includes provisions to transform the Senate into a smaller “chamber of regions” and a redefinition of competencies shared by the central government and regional authorities. The vote requires a simple majority and has no quorum requirement. Markets have priced in risk premium around the date of the vote, as shown in Figures 6 and 7 – increasingly so since the US election. The front end of the EURUSD implied vol curve has rallied sharply, and appears elevated relative to the G10 average vols.

National opinion polls show that the ‘no’ vote has been gaining ground in the weeks leading up to the vote. Markets’ expectations on the directional outcome of the vote are somewhat consistent. The EURUSD risk reversal skew has moved back to being in favor of EUR puts over calls, following the brief post-US election spike, but is far from the extreme levels seen earlier this year after the Brexit referendum, or during the Euro crisis of 2011-12 (Figure 8). Furthermore, Italian yields have widened against the German benchmark, but also and most notably against Spanish yields, a country that shares many of Italy’s low growth and high unemployment ailments (Figure 9).

In other words, markets view the referendum as important (as per the kink in the vol curve), somewhat biased in favor of a negative outcome (as suggested by the riskie), but idiosyncratic to Italy (as implied by spreads). The part where we tend to disagree with the market’s assessment is the latter. A win of the ‘no’ vote would likely be viewed in markets as detrimental to Italy’s political stability. While this would not be news per se given the country’s tattered history of frequent government turnover, it comes at a challenging time for Italy’s banking system, with several financial institutions struggling publicly with growing NPL portfolios and heightened market focus on the topic.

A victory of the ‘no’ vote would likely have a EUR negative outcome, in our view . It would not necessarily cause the Renzi government to fall, but it would likely cause fears of such an outcome to grow rapidly, especially in the light of the strong performance of the anti-euro 5-Star Movement party in local elections in June of this year and with an eye on national elections in Germany and France in 2017 (potential repercussions from the Italian vote on next year’s electoral consultations in the two largest countries in the euro area alone argue against an idiosyncratic interpretation of the referendum results). Furthermore, given the focus on the local banking industry’s near-term funding needs, widening credit spreads would amount to a tightening in financial conditions, which could amongst other, trigger expectations of a response by the ECB in the form of a more accommodative monetary stance –

A ‘yes’ vote, on the other hand, would likely give way to a positive knee jerk reaction in EURUSD, but is unlikely to drive a lasting rebound in the currency, given political risks looming in France and Germany 2017, the prospects of monetary policy divergence and the still unclear outcome of Brexit negotiations.

As technical-based trades, CS maintains 2 limit order to sell EUR/USD at 1.0730, and at 1.1025.

source