BTC/USD: Cryptocurrency Market Rangebound After Eventful Summer

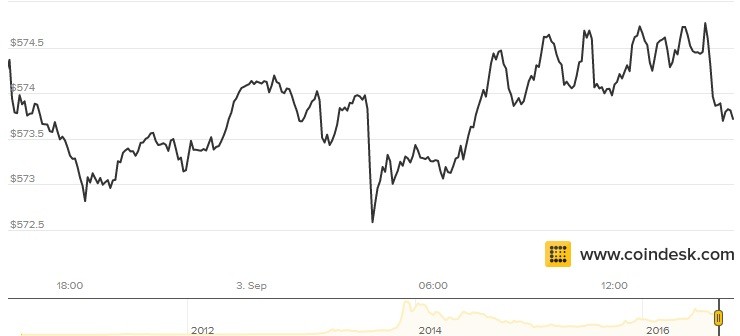

The value of bitcoin was little changed this week, as the market consolidated ahead of the Labour Day long weekend.

As of 12:27 pm ET, the BTC/USD exchange rate was trading at $573.64, down 0.1% from the previous close, according to CoinDesk. The pair traded within a very narrow range of $572.42 and $574.88 during the day. Volumes are expected to remain low ahead of Labour Day.

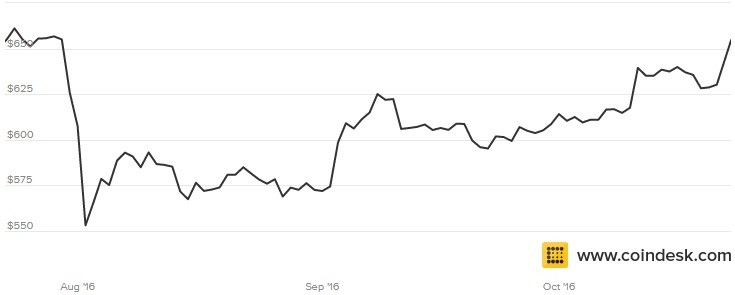

The summer has been anything but smooth for the cryptocurrency market. Bitcoin’s value was riding two-year highs at the start of the season before leveling off through the second-ever halving in July. Bitcoin’s value plunged in August on the news that Hong-Kong based exchange Bitfinex had been hacked. Since then, the BTC/USD has fluctuated between $550 and $600.

The exchange recently announced it has begun to reimburse customers for last month’s security breach. This included purchasing 1% of the blockchain debt tokens it issued to account holders back in August. Bitfinex previously announced it would “socialize” losses across its user base, which involved docking 36% from each account.

Nearly 120,000 bitcoins were compromised in the attack on Bitfinex. This amounted to over $70 million in losses at the time. Bitcoin’s value plunged as much as 15% following the news.

Market observers are also monitoring the status of two proposed bitcoin exchange-traded funds (ETFs). Blockchain technology company SolidX announced in July it had filed a registration statement with the Securities and Exchange Commission (SEC) to launch its very own Bitcoin Trust.

In July the SEC also opened the Winklevoss Bitcoin Trust for public comment. Last month the SEC extended the deadline to make a decision regarding the trust to October 12, 2016. The controversial trust was initially announced three years ago by Tyler and Cameron Winklevoss. The brothers spent two years trying to get listed on the Nasdaq exchange before moving their application to the BATS exchange in June.

Bitcoin Surges Almost 10% On Heavy China Buying Amid G-20 Chatter

After a month of extremely 'odd' stability in the price of virtual currency bitcoin, the G-20 meetings appear to have sparked a resurgence in buying from the Chinese as the dollar is down around 8% against Bitcoin in early Asian trading.

As LiveBitcoinNews.com reports, China, despite the unclear regulatory frameworks and policies established by the government, maintains the largest Bitcoin market in the world, with some major exchanges with substantial trading volumes and demands. Research institutions and financial companies presume that the devaluation yuan pushed the demand for Bitcoin further, causing local investors to purchase Bitcoin at higher prices.

Investors and traders on OKCoin, China’s largest Bitcoin trading platform, have been trading Bitcoin at around US$614 on average over the past 24 hours, due to an overwhelming demand from the local population.

read more

Bitcoin Prices Breakout on Saturday

Bitcoin prices surged on Saturday, reaching their highest level in nearly three months, as buyers returned to the digital currency arena after a volatile summer season.

The BTC/USD exchange rate spiked 3.9% to $654.52 at 3:31 pm ET, according to CoinDesk. The pair is on track for its highest settlement since July 30.

The latest recovery in prices is partially attributed to stronger liquidity, a sign of improved confidence in the market. Since September 21, more than 80% of speculative positions on bitcoin have been long, according to digital currency trading platform Whaleclub.

Prior to the summer downturn, bitcoin was enjoying a period of growing stability thanks to greater mainstream uptake. For many in the investment community, bitcoin’s finite supply and blockchain infrastructure make it ideal for diversification purposes.

Analysts have also noted a major change in market confidence over the past two weeks, as investors looked past a series of negative news headlines involving bitcoin. The currency’s value declined sharply over the summer after nearly 120,000 bitcoins were compromised in a high-profile security breach at Hong Kong-based broker Bitfinex.

Bitfinex is reportedly seeking a deal with the hacker to recover the lost funds. In a blog post on Saturday, the company said it wanted to offer “clear instructions” on how to communicate with the hacker. Bitfinex had previously offered to give 5% of the value of the stolen coins to anyone who provided information that could lead to their retrieval.

Bitcoin Prices Surge to Nearly Four-Month Highs

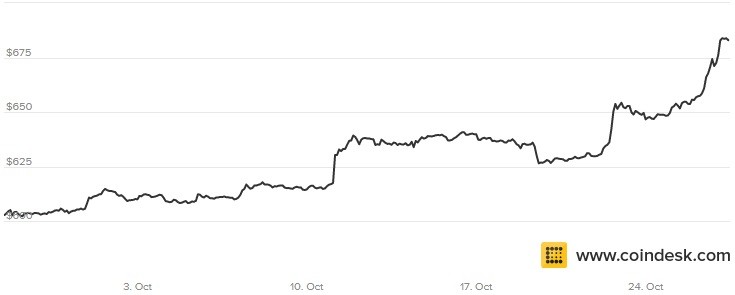

The value of bitcoin surged this week, climbing to its highest level since July in the latest sign that investors were returning to the cryptocurrency space after the summer selloff.

The BTC/USD exchange rate rose 1.2% to $682.17 at 7:58 am ET, according to CoinDesk. The pair traded at a daily high of $685.23. Bitcoin’s price has surged 8.5% over the past week and is up nearly 13% since the start of the month.

Bitcoin prices are recovering after a sharp decline over the summer that was triggered by renewed security risks after Hong Kong exchange Bitfinex reported a major cyber breach.

No immediate catalysts were responsible for the latest spike, although market analysts speculate that Chinese offshore investment is a partial explanation. Bitcoin has received greater buy-in from Chinese investors looking to diversify away from yuan-denominated assets. Bitcoin gives Chinese investors more control over their assets, especially at a time of greater yuan instability.

Beijing reported Thursday that industrial profits rose 7.7% to 577.1 billion yuan in September, down sharply from August’s 19.5% gain, the National Bureau of Statistics reported Thursday. The disappointing reading sent Asian equities lower.

The US dollar was trading slightly lower against a basket of other major fiat currencies Thursday, but remained supported at seven-month highs. The dollar could see heavy action on Friday with the release of preliminary third quarter GDP results. The US economy is forecast to expand at an annualized 2.7% in July-September, up from 1.4% in the second quarter.

Bitcoin Is Soaring: Up Over 10% In One Week On Chinese Buying Spree

Earlier this week, we pointed out that after tracking the recent drop in the Yuan (alternatively, rise in the dollar), bitcoin unexpectedly spiked breaking out of its recent rangebound trade and rising to three month highs following news that China had begun a regulatory crackdown on wealth-management products, which indicated that some of the illicit money parked in these shadow bank conduits, which collectively house just shy of $2 trillion in assets, will slowly drift out of the mainland using such capital outflow "proxies" as bitcoin.

The next day we presented readers a report from Needham in which the investment bank explained, in fine detail the "fundamental" cases behind bitcoin going higher, and as a result the bank raised its price target on the digital currency to $848 from $655. Incidentally, Needham agreed with what has been the main catalyst for the surge in bitcoin since last summer, one we explicitly said would send the digital currency soaring last September (when it was trading in the low $200s, and urged readers to frontrun the imminent and panicked Chinese buying that was about to be unleashed).

Amusingly, while our correct theory that China would use bitcoin to circumvent capital controls was mocked by both Bloomberg and the FT, both are now solidly onboard. “There is a premium in bitcoin pricing in China as a hedge against the yuan," Jack Liu, the Hong Kong-based chief strategy officer at OKCoin told Bloomberg. “Strength is likely to carry into year-end."

Since then bitcoin has tripled, and over the past two days has broken out sharply to the upside once again, now over 10% higher in the just the past week. The latest round of buying took place overnight with major bids emerging from China, which have taken the price of bitcoin on the most popular US trading platform, Coinbase, to $725 as of this writing.

Bitcoin Price Spike Toward $750 This Week as Yuan Falls

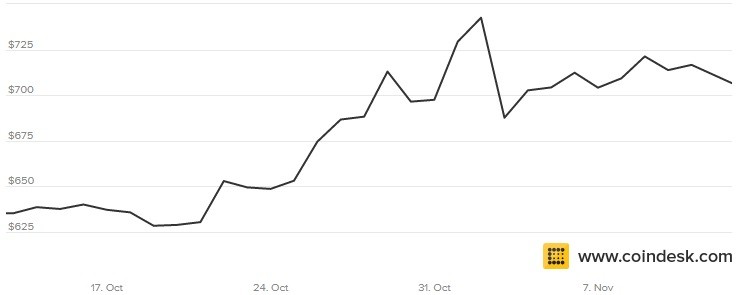

Bitcoin prices flirted with $750 this week, as Chinese investors turned to cryptocurrency as a refuge from yuan-denominated assets.

The BTC/USD exchange rate ran into volatility in mid-week trading, spiking above $740 before retracing all the way back down to the $700 range. The BTC/USD traded at $703.30 Saturday at 2:02 pm ET, virtually unchanged from the previous close.

Bitcoin trading volumes reached 47 million last week, the highest on record. Most of that action has been taking place in China, where bitcoin exchanges have driven 98% of the digital currency’s transaction volume over the past month.

Bitcoin reached a four-month high of $742.66 on Wednesday, according to CoinDesk.

Bitcoin Price Jumps To Multi-Month Best, Will BTC USD Rally On Trump's Election Continue?

Crypto-currency Bitcoin has surged 2% to renewed best levels against the US dollar but will this BTC rally be sustained?

- Price of Bitcoin in US dollars today: 1 BTC = 722.49 USD.

- Price of Bitcoin in British pounds today: 1 BTC = 581.27 GBP

- Price of Bitcoin in euros today: 1 BTC = 661.08 EUR.

This is turning out to be a year of shocks.

First, it was the Brexit, which surprised the markets, as most polls had expected the UK to remain in the EU.

Now, while most markets had discounted a Clinton win, out comes the shocker with Donald Trump winning the US Presidential elections.

Bitcoin Price Consolidates Above $700 After Re-Test of 2016 High

The value of bitcoin declined Saturday, but remained supported above $700 after a post-election rally earlier this week.

The BTC/USD fell 1.4% to $706.42 at 12:48 pm ET, according to CoinDesk. The pair traded within a daily range of $703.88 and $717.76.

A stronger dollar was partly responsible for the reversal in bitcoin’s fortune. On Friday, the US dollar traded at fresh nine-month highs against a basket of other major currencies, as investors continued to anticipate a US rate hike by the Federal Reserve next month.

Bitcoin has surged 11% against the dollar over the past month as part of a broad consolidation trend following mid-summer volatility. The cryptocurrency was also supported by continued buying interest from China, where investors are diversifying away from yuan-denominated assets. India is also a growing source of bitcoin optimism amid the latest rupee controversy.

Bitcoin tested 2016 highs earlier this month, reaching a settlement high of $742.46 on November 2. That was the highest since the June 19 settlement of $764.04.

Singapore to launch blockchain project for interbank payments

Singapore's central bank on Wednesday said it will launch a pilot project with the country's stock exchange and eight local and foreign banks to use blockchain technology for interbank payments including cross-border foreign currency transactions.

The effort is supported by the R3 blockchain research lab and BCS Information Systems, Ravi Menon, managing director of the Monetary Authority of Singapore (MAS), said at the Singapore Fintech Festival

"Under the pilot system banks will deposit cash as collateral with the MAS in exchange for MAS-issued digital currency," Menon said.

This is the first step by Singapore's central bank to explore the use of digital currency.

Blockchain, which originates from digital currency bitcoin, works as an electronic transaction-processing and record-keeping system that allows all parties to track information through a secure network, with no need for third-party verification.

"The next phase of the project will involve transactions in foreign currency, possibly with the support of another central bank," Menon told an audience of bankers and executives from technology companies.

The wealthy city-state is one of the world's leading finance centers and aims to become an important Fintech hub.

Policymakers have sought to attract investment in Fintech, easing regulation and setting up special departments to support the industry.

source

Sweden Begins Planning Transition From Cash To Digital Currency

In the aftermath of the ECB halting production of the €500 banknote, and more recently, India phasing out its highest denomination bills instantly eliminating some 86% of the cash in circulation as increasingly more countries make a move toward a cash-free society, another central bank - the world's oldest - has started planning its own transition away from paper cash.

Sweden’s Riksbank, which was the first central bank in the world to issue paper currency in the 1660s, is preparing to become a monetary pioneer yet again, and has launched a project to examine what a central bank-backed digital currency would look like and what challenges it would pose.

As Reuters writes, the RIksbank could become the first major central bank in the world to create its own virtual money as the use of cash declines, Deputy Governor Cecilia Skingsley said on Wednesday.

The central bank hopes to take a decision on whether to start issuing what it calls an ekrona in the next two years. What is perhaps more notable is that should the central bank launch a digital currency few would notice; the value of cash in circulation in Sweden has fallen to around 1.5% of GDP from 10% of GDP in 1950.

Sweden is already mostly a non-cash nation: just like Citi in Australia, local bank branches are moving away from cash handling while cash machines are scarce in much of the country. Some shops have stopped accepting cash payments altogether. The Riksbank, like other central banks, already provides electronic money through accounts to banks and clearing organisations. But it only provides central bank money to individuals through notes and coins.

Digital currency functions like payment cards, allowing users to make online transactions across borders instantaneously. It has been growing in popularity as more people use the internet to shop. The major difference between digital and paper currency is that every single transaction is logged, and the value of money can be remotely "adjusted", making it impossible to use cash as an value-preserving alternative to negative interest rates. It is also the reason why central bankers loathe cash in a time of negative interest rates.

"Sweden is on the forefront of this. We don't have any other countries to copy, since there is no other country that is so rapidly stopping using notes and coins as Sweden is," said Skingsley, who gave a speech on the issue on Wednesday.

Defending the move to transition away from cash, the central banker told reporters that "there is a large number of people who for various reasons cannot, do not want to have or do not get access to the commercial banks' payment methods." She did not explain, however, that the Swedish population would essentially have ceded full control of their "cash" to the central bank.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Bitcoin: BTC/USD Tumbles, Dollar Regains Momentum after Federal Reserve Summit

The value of bitcoin declined sharply Saturday, as markets recoiled after hawkish comments by top Federal Reserve officials fueled fresh rate-hike worries.

The BTC/USD exchange rate was down 1.9% at $567.27 by midday, according to CoinDesk. Bitcoin was trading near session lows, having declined immediately after today’s open. The digital currency’s market capitalization currently stands at $8.95 billion.

The US dollar rebounded sharply on Friday, climbing 0.8% against a basket of fiat currencies to close at its highest level in two weeks. Traders piled into the greenback after Federal Reserve Chair Janet Yellen told the Jackson Hole Symposium that the case for raising interest rates had strengthened.

Fed Vice Chair Stanley Fischer was much more hawkish, indicating that the Fed could raise rates as early as September should the jobs data continue to show signs of improvement. The Labor Department will issue its August nonfarm payrolls report Friday, September 2.

Bitcoin’s price has plunged some 13% over the past month, wiping billions off the digital currency’s overall market capitalization. The month-long skid was triggered after hackers stole nearly 120,000 bitcoins from Hong Kong-based digital currency exchange Bitfinex. The security breach cost the exchange tens of millions of dollars. It also forced the company to “socialize” losses among its members. As a result, each Bitfinex account was docked 36%.

Bitcoin was in the news this past week after the Securities and Exchange Commission (SEC) extended the deadline to make a decision concerning a controversial new exchange-traded fund (ETF) by Tyler and Cameron Winklevoss. The Winklevoss Bitcoin Trust was announced three years ago at a time when cryptocurrency was associated almost exclusively with clandestine activities on the dark web.

The SEC said it will review the Winklevoss filing over an initial period of 45 days. This period could be extended to up to 90 days, the financial regulator said in its August 23 note.