NFP to Rise, But Fed Eyes Markets Overseas

June's US non-farm payrolls reading is projected to post a significant rise compared with May when the gauge disappointed, but it is questionable how this will further influence the Federal Reserve's (Fed) policy moves.

The indicator is expected to rebound, with US companies forecast to add 180,000 more jobs in June, after the last reading revealed a catastrophic number showing that US employers added only 38,000 new positions to the labor market in May.

Many analysts have said that the fresh reading could have significantly less influence on the Fed's policy in the coming months, mainly as investors and officials are focusing overseas, namely on the Brexit shock and its impact on financial markets worldwide.

US: July NFP - Deutsche Bank

Nonfarm payrolls could sway odds on Fed rate hike

Market participants looked ahead to Friday’s publication of the U.S. Employment Report for July with the focus on its implications for the Federal Reserve’s return to policy normalization.

After the ADP employment report for July showed a better-than-expected private payroll creation on Wednesday, investors began to turn their attention to the official government numbers.

The July data could be a key indicator for the strength of the labor market after the prior two reports showed opposite extremes. June showed the creation of a stellar 287,000 payrolls, coming just after the May report had marked just 11,000, its weakest growth in six-and-a-half years.

The U.S. Labor Department will release its July nonfarm payrolls report at 12:30GMT, or 8:30AM ET, on Friday.

The consensus forecast is that the data will show jobs growth of 180,000, the unemployment rate is expected to drop back to 4.8%, from the prior 4.9%, while average hourly earnings are estimated to rise 0.2% after gaining 0.1% a month earlier.

An upbeat employment report will point to an improving economy and support the case for higher interest rates in the coming months, while a weak report would add to uncertainty over the economic outlook and push prospects of tighter monetary policy further off the table.

“Market participants clearly expect that only a number of positive data prints will convince the Fed to actually raise rates – so attention increasingly focuses on the data,” Commerzbank warned in a note to clients.

The worse than expected second quarter growth of 1.2% released last Friday dampened the odds that the Fed would be able to hike interest rates this year.

The Fed funds contract for December delivery implied traders saw a 33% chance the U.S. central bank would raise its target range on policy rates after the GDP data was released, down from 43% on the Thursday before the report.

Financial markets ticked up the odds for a hike after the ADP employment report on Wednesday showed a better than expected job creation, but they still showed tightening was unlikely until June 2017.

Fed fund futures priced in only a 9% chance for an increase in September at close of trade on Thursday with the odds for an end-of-the-year hike at 32.1%.

Still, some experts were skeptical of the effect that Friday’s jobs report could have on the Fed’s outlook.

Strategists at Spreadco pointed out that the next Fed meeting isn’t until September 20-21.

“Not only will July’s employment data be old news by then, but the market already doubts that the Fed will tighten monetary policy this year, let alone ahead of November’s presidential election,” they said.

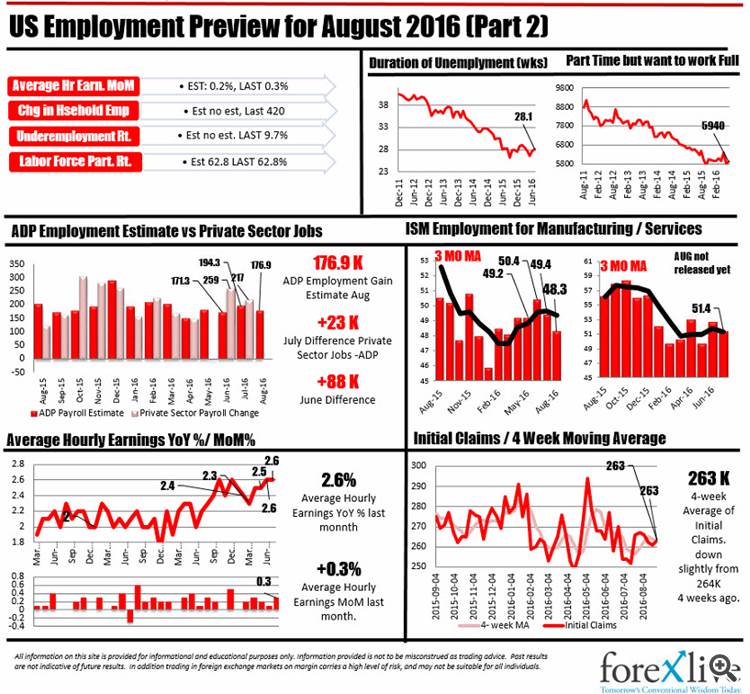

- Both Bloomberg and Reuters median estimate is 180k

- BBG hi estimate 240k. RTRS 238k

- BBG & RTRS lo est 140k

- Unemployment rate est 4.8% vs 4.9% prior

- ADP came in at 179k

- Initial jobless averaged 260.25 in July

- Markit manufacturing PMI employment 53.3 vs 52.3 in June

- Markit services emp PMI 52.6 vs 52.4 in June

- ISM manufacturing emp 49.4 vs 50.4 in June

- ISM non-manufacturing emp 51.4 vs 52.7

BNPP: We Expect 215k for next month NFP; Fed To Hike In September.

With an impressive run of job gains (average 190,000 in the last three months) and an above-expected print from average hourly earnings, a September rate hike from the Fed is in play. Stakes are high for Fed Chair Yellen’s 26 August speech at Jackson Hole, Wyoming, where she will not want to overcommit to a September hike ahead of August’s payrolls report just a week later, but still needs to prepare the markets for a possible move. We expect payrolls next month to post 215,000, which should be enough to deliver a September hike. If this materializes, the three-month average would be 254,000.

Barclays: Solid Labor Markets In The Summer; Fed To Hike In September.

Nonfarm payroll growth came in at a robust 255k in July, outstripping both our (200k) and median consensus expectations (180k). Job growth for the prior two months was revised higher by 18k net, with June employment gains now reported at 292k. The establishment survey was strong across the board, with goods sector employment up 16k and service sector employers adding 201k; these private sector gains were further boosted by +38k in government job gains. The household survey shows an unemployment rate unchanged at 4.9%, as robust household employment was offset by a further rise in labor force participation. Finally, wage growth (0.3% m/m, 2.6% y/y) continued to firm modestly, and the workweek (34.5, previous: 34.4) ticked up for the first time since January. On the whole, this morning’s strong July employment report indicates that labor market health remains intact and, in our view, reduces near-term recession risk for the US economy. Furthermore, the print should boost FOMC members’ confidence in the outlook, especially following the unexpected weakness in Q2 GDP. We continue to expect the Fed to hike rates at its September meeting, and we look to Chair Yellen’s appearance at the Jackson Hole Policy Symposium on August 26 for confirmation of this view.

BofA Merrill: Labor Market Heats Up; We Still See A December Hike.

The July jobs report was everything you could have asked for…and more. Nonfarm payrolls jumped 255,000 in July, significantly above the consensus forecast of 180,000. There were net positive revisions of 18,000 which left the 6-month moving average at a solid 189,000. The unemployment rate held at 4.9% (4.878% unrounded), but for good reasons as a 420,000 increase in household jobs was offset by a notable gain of 407,000 in the labor force. The labor force participation rate (LFPR) has resumed an upward trend, reaching 62.8% in July. Meanwhile average hourly earnings-increased 0.3% mom which allowed the yoy rate to hold at 2.6%. The only piece of data that was not positive was the under-unemployment rate (U6) which ticked up to 9.7%, due to an increase in both part-time workers for economic reasons and those not in the labor force that are available to work. The Fed is likely to be encouraged by the strong jobs report. Provided the strength in jobs is confirmed with othereconomic data - including a return to mid-2% GDP growth in 3Q - the Fed will have sufficient reason to hike this year. We think the Fed will wait until December given that there are still global uncertainties on the horizon, as well as the US election at home. Remember that the Fed is operating with risk adverse policy, which means particular sensitivity to potential shocks.

CIBC: US Jobs Provide An Encore Performance in July; We Still See A December Hike.

Another month, another solid gain in jobs. With much of June’s payroll strength being written off as making up for the prior two months’ weakness, July’s print was built up as a better indicator of underlying momentum. Today’s report showed strong readings almost across the board for the data FOMC members are watching closely. While the wider trade deficit numbers released alongside didn’t do anything to paint a rosier picture of Q2, the solid pace of hiring suggests that consumers will continue to support growth to a large extent over the remainder of the year. Re: Economic Forecast — The healthy pace of hiring over the past two months suggests that the economy can still lean on consumption to be the main contributor to growth. However, given the disappointing first half, our call of a December rate hike remains contingent on upcoming Q3 readings maintaining the decent start we’ve seen in limited data so far. Re: Market — The above consensus gain in payrolls will be positive for the US dollar and negative for fixed income.

Preview: US August Employment Report: 'Sitting Here In Limbo'

For the August employment report, scheduled for release on Friday, September 2, we look for nonfarm payrolls to rise 200k.We expect 190k of these gains to come from the private sector, and in particular service-providing employers, with government payrolls adding the remaining 10k. Initial jobless claims remained low through the August survey week, bolstering our confidence that service sector labor demand remains solid. Within the goods-producing sector, early indicators of manufacturing employment for August look weak and we would not be surprised to see another leg down in payrolls for the sector. This, alongside a continued decline in mining employment, may well lead to an overall contraction in goods-producing employment. Elsewhere in the report, we expect the unemployment rate will decline one-tenth to 4.8%, average hourly earnings to rise 0.2% m/m and 2.5% y/y, and the average workweek to be unchanged at 34.5 hours.

On balance, overall job growth of 200k would confirm the May dip in payroll growth was transitory and erase fears of a slowing labor market.

A strong August employment report also represents the last major data hurdle before the September FOMC meeting, where we continue to expect the Fed will raise rates. Thus, we view a strong August employment report as an absolute requirement for a September move by the Fed.

Barclays already looking ahead to US NFPs and a rise of 200k

Latest client note from Barclays focusses on the next Non Farm Payrolls 19 Aug

Note comes courtesy of our friends at efxnews.com. Click here for a free trial

While ccy pairs remain in yawn fest right now let's see what Barclays are looking for from the next US jobs report and why.

"For the August employment report, scheduled for release on Friday, September 2, we look for nonfarm payrolls to rise 200k.We expect 190k of these gains to come from the private sector, and in particular service-providing employers, with government payrolls adding the remaining 10k. Initial jobless claims remained low through the August survey week, bolstering our confidence that service sector labor demand remains solid.

Within the goods-producing sector, early indicators of manufacturing employment for August look weak and we would not be surprised to see another leg down in payrolls for the sector. This, alongside a continued decline in mining employment, may well lead to an overall contraction in goods-producing employment.

Elsewhere in the report, we expect the unemployment rate will decline one-tenth to 4.8%, average hourly earnings to rise 0.2% m/m and 2.5% y/y, and the average workweek to be unchanged at 34.5 hours.

On balance, overall job growth of 200k would confirm the May dip in payroll growth was transitory and erase fears of a slowing labor market.

A strong August employment report also represents the last major data hurdle before the September FOMC meeting, where we continue to expect the Fed will raise rates. Thus, we view a strong August employment report as an absolute requirement for a September move by the Fed."

This Week's NFP Data To Reinforce Our Fed Call For A September Hike

Fed Chair Yellen delivered the hawkish message we were looking for on Friday, telling her Jackson Hole audience that the case for raising rates has strengthened recently. It took follow-up comments from Vice Chair Fischer later in the morning to generate a meaningful adjustment higher in rates and the dollar though.

Our expectation is that the hawkish message from Fed Chair Yellen last week will pave the way for a September hike, which should help the USD recover some ground.

We expect the data will actually reinforce rate hike expectations. Our economists expect Friday’s employment report to show robust payroll growth of 215k, which will put 3m average job growth at a powerful pace of 254k. Indeed, given strength in the last two reports, even a 125k result on Friday would leave the 3m average running at 224k. Our position metrics suggest USD positioning was short heading into the speech.

We remain positioned via derivatives for a limited recovery in the USD versus the EUR, JPY, GBP and AUD. However, we do not expect the Fed to signal or embark on a series of rate hikes, which should limit the extent to which US real yields can recover from current low levels.

USD Into NFP: Room For Further Upside Vs JPY, AUD

Our economists expect Friday’s employment report to show robust payroll growth of 215k, which will put 3m average job growth at a powerful pace of 254k.

Indeed, given strength in the last two reports, even a 125k result on Friday would leave the 3m average running at 224k. So far this week, July personal income and spending met expectations for trend-like increases, while the core PCE deflator y/y rate held up firmer than expected at 1.6%, better than the 1.5% consensus and not far off the Fed’s 2.0% target.

Our position metrics suggest USD positioning was short heading into Chair Yellen’s speech last week, particularly vs. the JPY and AUD, implying more scope for the USD to gain ground vs. those currencies as US rates adjust higher.

Infograph: Trends in US Employment

NFP is estimated to rise by 180K in August. Down from an above trend 255K last month

- The most jobs this year have been in the Educ and Health sector (call it health care). This has been the trend for a number of years as the Baby Boomer age (among other things). The next highest sector is professionals and business. Manufacturing and Mining (oil industry) are negative this year. Construction is sluggish at only 55K in all of 2016. Not much in the way of goods producing jobs in 2016. All jobs are in the "service" industries.

- The YoY Avg hourly earnings are up to 2.6%.. In 2006-2007 the low was 2.7%. The highs were in the +4.0%. So good and bad but the trend is better.

- The link between ADP and Private payrolls has broken down. The last two months had private sector jobs greater than ADP by 111K in total. In May, the difference was the other way with ADP at 180K while private payroll was near 0K. This month ADP came in at 177K. Do we care?

- ISM employment for manufacturing came in below 50 at 48.3. With Manufacturing jobs for 2016 at -15K for the year, are we surprised? I am more surprised it has been above 50 any time this year. Service ISM has not been released yet.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Barclays: For the June US employment report, we expect nonfarm payrolls to rise by 175k, private payrolls to increase by 170k, and government payrolls to rise by 5k. A number in line with our expectation would represent a modest rebound in hiring relative to the May employment report after adjusting for the effects of the Verizon strike. Telecommunications employment fell 37k in May, about in line with the estimate of the strike-related effects as estimated by the BLS, and we look for this employment to return in June given the conclusion of the strike prior to the survey week. Elsewhere in the report, we expect the unemployment rate to remain unchanged at 4.7%. Finally, we expect average hourly earnings to rise 0.2% m/m (2.7% y/y) and average weekly hours to hold steady at 34.4.

(Source: Barclays, eFXplus)

TD: We expect the sharp downdraft in employment to partially reverse in June, with a forecasted increase of 175k jobs. This print will be supported by the return of 34k Verizon workers who were on strike in May. In addition to the rebound in the telecom sector, a bounce back in the wholesale, manufacturing and construction sectors should also bolster the headline print. The unemployment rate is forecast to increase to 4.8% from the cycle-low of 4.7% on account of an expected rebound in the labor force (following the outsized 820K decline over the prior two months), which should more than offset the gains in household employment. On the wage growth front, average hourly earnings are expected to rise modestly, posting a 0.2% m/m gain, resulting in the pace of wage growth accelerating from 2.5% to 2.7% y/y due in large part to favorable base effects.

(Source: TD, eFXplus)

Goldman: We forecast that nonfarm payroll growth rebounded to +210k in June from just +38k in May. In part the pickup reflects the conclusion of a strike at Verizon Communications—this alone accounts for 70k of the month-over-month swing. However, we also see scope for improvement beyond Verizon, as other labor market data have generally looked encouraging. We expect a small increase in the unemployment rate to 4.8% after its three month decline in May. Data from the household survey have been volatile in recent months, but the broad trends—participation stabilizing and job growth remaining strong enough to reduce slack over time—still look intact. We see a low month-over-month gain in average hourly earnings due to calendar quirks, but the year-over-year rate should edge higher.

source