Euro set to close below key level but another level looms

Barring a last minute jump, the euro will finish the day near the lows and at the worst level since March 16.

Perhaps more importantly, it will close below the 61.8% retracement of the March-April rally. That puts the entire move in jeopardy and points to a return to 1.08.

Given the hawkish comments from Yellen, I expect the weakness in the pair to continue into next week and beyond.

But first the pair will need to clear the 200-day moving average, which is at 1.1101 today. That will be a tough one to break and I wouldn't trust a breakout on Monday with the US off for a holiday.

May 2016 Eurozone economic sentiment 104.7 vs 104.4 exp

Details from the May 2016 Eurozone economic sentiment and final consumer confidence report 30 May 2016

- Business sentiment 0.26 vs 0.16 exp. Prior 0.13

- Industrial sent -3.6 vs -3.6 exp. Prior -3.7

- Services sent 11.3 vs 11.0 exp. Prior 11.5

- Consumer confidence final -7.0 vs -7.0 flash. April -9.3

- Consumer inflation expectation 3.4 vs 2.9 prior

- Selling price expectations -0.7 vs -2.4 prior

EUR/USD: Gradual Or Glacial? A Buy On Dips Or A Sell On Rallies?

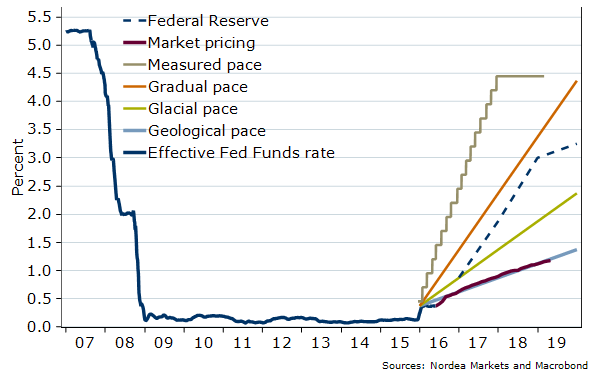

The Fed's fears has gradually receded, prompting a surge in likelihood for a summer hike which has put the USD back on track (+3% in May). A summer rate hike as well as markets glacial pricing of the Fed's hiking cycle offer support for the USD, while we see no change in stance from ECB. Instead, ECB's corporate QE and UK's Purdah rules pose some downside risks to the pair in coming months.

The USD has reasserted itself strongly over the course of May, with the trade-weighted greenback set to see its strongest (3%) gain since the first month of 2015. The Fed’s fears, as we catalogued a month ago, has gradually receded, prompting a surge in likelihood for a summer rate hike.

While a Fed summer hike offers the USD some support from the policy divergence perspective, its December liftoff offered unknowns such as the “undiscountability” of the Death Star which its next hike does not - hence some tempering of optimism should be warranted.

Can't keep the EURUSD down...

Going out at the highs

EUR/USD: Euro Breaks $1.14 on US Dollar Weakness

The US dollar has been under broad selling pressure on Wednesday and the EUR/USD pair managed to get beyond the $1.14 mark as a result. The pair was recently trading around $1.1405, 0.45% stronger on the day at the start of the US session.

"We open a fresh EUR/USD long at 1.1358, stop 1.1240. Softer US retail sales could weigh on the USD while the FOMC is likely at best neutral if not negative for the USD too. The key US core control retail sales group is due a correction after last month's unsustainably strong 0.9% gain," analysts at WIB presented their trading idea on Wednesday.

The main support is around $1.1370, where previous highs are located. Should the pair breach the $1.14 mark, a further rise toward May 11 highs at $1.1445 is expected. The day's outlook is bullish.

What Is the Impact On EUR/USD From The UK Referendum?

Whatever the outcome of the referendum, trading should expect contagion (both good and bad) is not limited to the UK. The macro outlook for Europe and 2017 political risks in Germany, France and the Netherlands are all tied to the UK’s decision. The most immediate wind-test for Europe should be the Spanish elections set for Sunday June 26th (which by themselves create EUR risk as well).

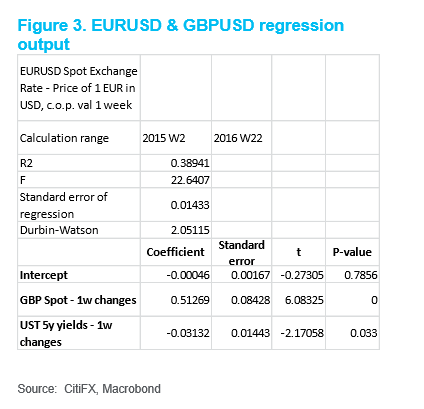

To gauge sensitivities for EURUSD, we run a simple least squares regression of 1-week changes in EURUSD on 1-week changes in GBPUSD and 5-year US treasuries. We are making assumptions that GBPUSD picks up the brunt of the referendum risk with US treasuries capturing both Fed and changes to the US outlook that could drive EURUSD either higher or lower. The output from this is below, and for such a simple test it does a pretty good job explaining changes in EUR.

Elasticity of EURUSD to GBPUSD is roughly 50%, after taking out the Fed & US impact.

This implies for the risk surrounding the UK referendum, a 5-6% rally of GBPUSD on a REMAIN vote could raise EURUSD by 2.5-3%. A 10-12% move of GBPUSD on a LEAVE vote would translate into a 5-6% move lower in EURUSD.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

We are becoming even more selective in how we express our long USD bias – equal attention will need to be paid to both the vulnerabilities on the short leg and the strengths on the USD leg. For EUR/USD, higher US interest rates can have ambiguous implications. What we do know is that owing to unacceptably low inflation in the euro area (HICP -0.2% y/y), the ECB will keep interest rates at current extremely low levels (deposit rate -0.4%) and maintain an easing bias for quite some time yet.

Interest rates could potentially go lower, and given existing slack in the economy, growth is not yet sufficiently strong to exert upward pressure on wages and inflation. Business cycle dynamics and anticipated interest rate paths therefore favour outperformance of the USD. However, the US does not want a materially stronger currency (ie weak export levels, low import prices) whilst the potential for heightened volatility could provide funding currencies (ie EUR) with some support. The global response to higher US interest rates will also be important to gauge. We cautiously anticipate USD gains.

read more