EUR/USD: Trading The FX Risk Rally - Morgan Stanley The risk rally has further legs to go benefiting higher-yielding FX in particular, argues Morgan Stanley in its weekly FX note to clients today.

"Fed Minutes suggest the central bank is in no hurry to hike rates and with ‘now-cast’ GDP indicators rebounding, markets seem to enter a sweet spot allowing equities to recover. Ahead of next week’s G20 meeting in Shanghai, China may consider additional measures to support its economy and rising material prices, like copper, leave the impression that demand has recovered from depressed December levels.

A Fed on hold, rising commodity prices, and stability in the data suggest trading the USD from two sides: long against the traditional funders, but short against high carry currencies," MS advises.

EUR downside risks on the rise.

EUR downside risks on the rise.

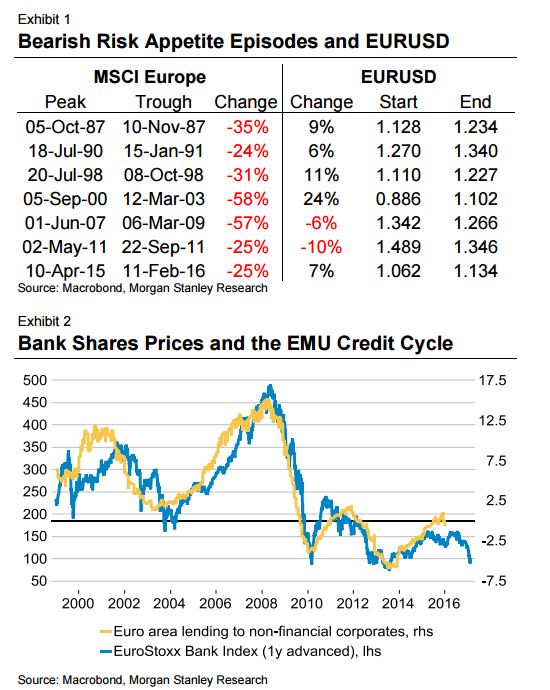

"The profitability of this position may well exceed our original expectations as EUR downside risks have increased. Rising bank funding costs may increase balance sheet consolidation pressures, tightening credit standards. Hence, there is more heavy lifting to be done by the ECB.

EUR has maintained an inverse relationship with risk appetite in the latest risk rally but this correlation may start to ease. Eurozone credit concerns could break EUR’s inverse relationship like it did in 2008 and 2011. The GCC final ruling on OMT and the potential German plan to impose haircuts on holders of EMU debt could further this dynamic," MS notes

"Though we are tactically bullish on risk as outlined last week, we remain medium term bearish," MS argues.

In its strategic portfolio, MS maintains a short EUR/USD position from 1.1360, with a revised profit-stop at 1.1210, and a target at 1.07.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

From Goldman Sachs:

Euro: FX Forecasts: We maintain our EUR/USD forecasts of 1.04, 1.00 and 0.95 in 3, 6 and 12 months, which we reverted to on January 21. This implies EUR/¥ at 127, 125 and 124 in 3, 6 and 12 months.

Motivation for Our FX View: We continue to believe that EUR/USD and EUR/GBP will move substantially lower on diverging growth and monetary policy outlooks. The EUR has already weakened significantly over the last 18 months, but we think this trend has a long way to run. In particular, we see a couple of longer-term fundamental forces at work. First, the flow picture should turn increasingly EUR-negative as Euro area residents send funds abroad and reserve managers allocate away from the EUR. Second, we think there is a structural element to disinflation in the periphery as it continues to improve competitiveness compared with the core of the Euro area. As a result, our view is that inflation will be slower to pick up than during a normal cycle, in line with projections from our European team, which show HICP inflation reverting to target only slowly. This will keep ECB policy accommodative, maintaining downward pressure on the EUR.

Monetary Policy and FX Framework: The ECB is a strict inflation targeter and has recently made more explicit its inflation-based forward guidance. The Euro floats freely. FX policy responsibility is shared between the ECB and Eurogroup.

Growth/Inflation Outlook: Reflecting lower oil prices and more aggressive monetary policy, we expect resilient growth in 2015. We forecast that the Euro area will expand by 1.7%yoy in 2016, a modest improvement over 1.5% growth in 2015, but substantially above the 0.9% recorded in 2014. Nevertheless, we expect core inflation to rise only slowly. Our forecast for core inflation of 1.0% in 2016 is well below the ECB staff's 1.3% projection. We expect core inflation to rise slowly from just below 1.0% to 1.7% by end-2018.

Monetary Policy Forecast: In December, the ECB cut its deposit rate by 10bp and extended its QE programme until March 2017. The downside risks to its forecast have since increased, and in January the ECB made it clear that it would review and possibly reconsider its monetary policy stance as soon as March. We expect the ECB to extend its QE programme at the current pace through September 2017 and cut its deposit rate by another 10bp. Our inflation projections, which show a more moderate increase than the ECB staff forecast, suggest that a decision to reduce policy accommodation remains a long way off.

Fiscal Policy Outlook: Fiscal policy has been highly contractionary in recent years, but turned more neutral in 2014. We expect it to remain close to neutral over the next several years.

Balance of Payments Situation: The Euro area is currently recording a current account surplus of about 3% of GDP on a trend basis, leading to a slightly positive BBoP. Portfolio inflows have slowed, and there are signs that Euro area investors have started to buy more foreign assets. We expect that to continue. Things to Watch: Developments in the European sovereign situation, in particular the implementation of fiscal reforms and long-term fiscal and political reforms, remain the key risk in focus.

source