You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

EUR/USD: Pair Hovers Around $1.13, Awaits ECB Decision The single currency was calm on Thursday, hovering around $1.13 during the London session, with further volatility likely later in the session.

Later in the day, the European Central Bank (ECB) is expected to leave monetary policy unchanged, with the main refinancing rate staying at 0.0%, the deposit rate should remain at -0.4%, and the monthly pace of QE is projected to stay at €80 billion.

ECB head Mario Draghi might sound dovish at his press conference, mainly due to the continuous strength of the euro, but his recent speeches were not viewed positively and the single currency soared in December and March. Therefore, he must choose his words carefully if he wants to avoid another rally in the euro.

"While market consensus seems to be taking Mario Draghi at his word that there will be no more interest rate cuts (well at least taking his word that it wont be at this particular meeting), the way that he delivers his comments during the accompanying press conference is going to be key for price direction of the Euro," Dane Williams at Vantage FX said on Thursday.

read more

ECB SFP lowers 2016 GDP forecast to +1.5% vs +1.7% previously ECB Survey of Professional Forecasters now published

Says the ECB:

The SPF survey for the second quarter of 2016 was conducted between 31 March and 6 April 2016. The total number of responses was 53, which is slightly below the historical average number of responses (58).

source

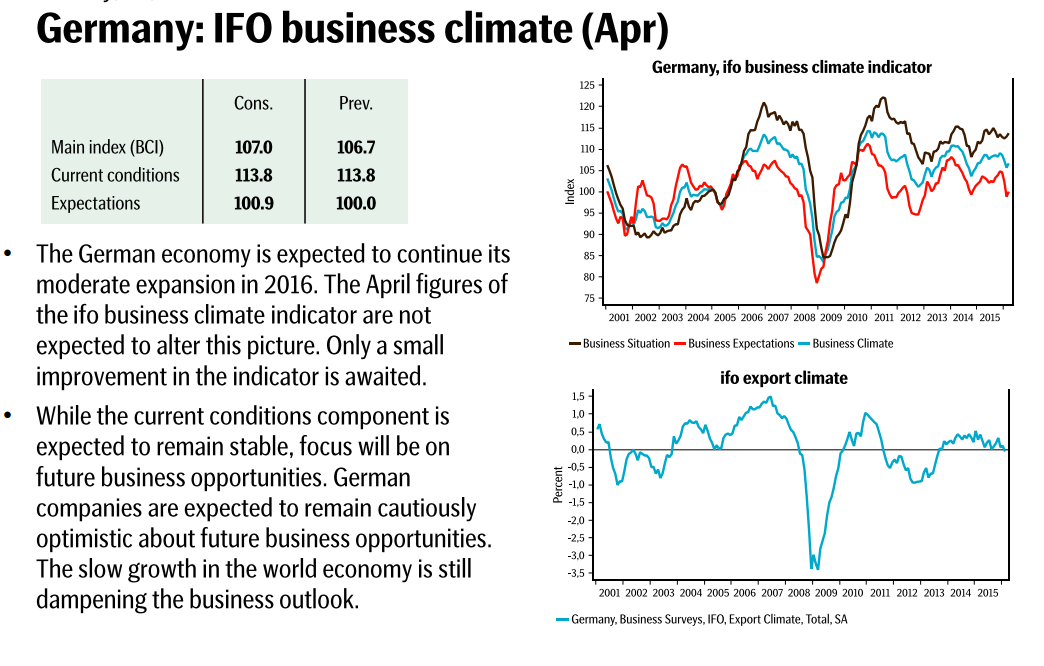

Preview: German IFO (Apr), US New Home Sales (March)

German Businesses Slightly Worse in April: Ifo Sentiment among German businesses ticked lower in April, losing the rising momentum from March and returning back to the negative trend, the latest Business Climate Index from the Ifo showed on Tuesday.

The headline Ifo Business Climate Index reached 106.6 points during the fourth month of the year, below March's 106.7 and expectations of 107.1.

"Ifo adds to latest hopes that the widely-feared sharp global slowdown is not happening. At least the German economy shows solid resistance," Carsten Brzeski from ING noted after the data were made public on Monday.

"Under the surface of solid hard data, a more worrying picture is emerging. The manufacturing sector and exports are still struggling to gain momentum. The economy is no longer driven by the old success formula but by new factors: consumption, construction and services, though it remains to be seen whether this formula is really a formula for sustainable success," Brzeski added further.

The Ifo calculates its headline index on the basis of companies' assessments of current business and the outlook for the next six months. About 7,000 monthly survey responses are received from firms in manufacturing, construction, wholesaling and retailing, and the number represents the net percentage of positive minus negative responses.

read more

People’s Bank of China sets yuan reference rate at 6.4954 (vs. yesterday at 6.4837) In OMOs today, the People's Bank of China injects 110bn yuan through 7-day reverse repos Over the course of this week maturing repos will drain a net 870 bn yuan out of the system

Quick Take: US Q1 GDP (Advance) A string of disappointing monthly reports set us up for a weak Q1 GDP print, so today's news was more of a yawner for financial markets. The headline growth rate of 0.5% was only a hair under expectations, with consumer spending at 1.9% offset by a further weakening in business investment spending, a drag from trade, and a third consecutive quarter in which inventory building slowed. Excluding inventories, final demand was still no barnburner at 0.9%. Core PCE prices were rising at a 2.1% annualized pace in the quarter, the hottest in many quarters.

Looking ahead, a statistical quirk that appears to be weighing on Q1 results even after seasonal adjustment, the strong gains in jobs that are boosting household income, and a now lower pace of inventory building, all point to a much better Q2. But for today, there's not much for markets to react to in a broadly on consensus report.

source

Fed's Favorite Inflation Data Weakens in March US inflationary momentum measured by the Federal Reserve's favorite indicator slowed down this spring, consistent with a broader downturn in economic performance but a solid build-up in incomes augurs well for a possible rebound.

The price index for personal consumption expenditures (PCE) excluding food & energy edged 0.1% higher in March, on par with the print anticipated by forecasters, fresh figures from the Department of Commerce showed on Friday. The reading in February was revised up to show a 0.2% gain instead of a mere 0.1% increase.

Due to some less favorable base effects, the rate of inflation over the past 12 months slipped to 1.6%, as expected. In the previous two months, the so-called core deflator had been growing 1.7% year-over-year, the fastest pace since mid-2014.

That's still notably healthier than the readings seen last year, although it is still short of the Fed's 2% target, as has been the case for nearly four years now.

Prices of all items rebounded by a mild 0.1% last month, reversing a similar-sized drop in February. The year-over-year comparison shows the broad deflator was just 0.8% higher than a year earlier. That's down from February's 1% and 1.3% in January, which was revised up a notch.

read more

Friday was a huge win for US dollar bulls

Dollar steamrolls ahead despite weak non-farm payrolls

The news isn't always important and the size of a move isn't always telling. But combined they can tell the entire story.

When bad news can't make something go down, it probably won't go down at all.

That's the story in US dollar trading today. The lows of the day came moments after non-farm payrolls and the US dollar has been climbing ever since.

USD/JPY fell as low as 106.42 and is trading at 107.10. USD/CAD rose nearly 120 pips from the lows. The euro jumped to 1.1479 only to sink below 1.1400. Cable is down 120 pips from the NFP spike.

It's a near-universal US dollar story, and days like today are the ones that convince you it will last.

The Dollar Index still shows that we're only in the very early stages of a US dollar bounce, but it's a start.

source

FT headline: 'Britain would quit single market after vote to leave EU, Gove admits'

Michael Gove, the justice secretary who is the Leave campaign's most senior government figure says A vote for Britain to leave the EU is also a vote to leave the single market

Mr Gove told the BBC's Andrew Marr Show that with Europe "set on a course of deeper integration" the greater danger was the UK could "lose autonomy economically" if it votes to remain. The country "should be outside the single market but have access to it", he said.

EUR/USD Technical Analysis: Pair Struggles at 1-Week Lows

The EUR/USD continued to fall and flirted with new one-week lows at $1.1371 as bulls continued to dominate the greenback.

The single currency remains under pressure as the safe-haven appeal is weakened by the risk-on moods caused by a relatively upbeat Chinese CPI and PPI data released earlier in the day.

Last Friday's labor market data also had little effect on the dollar bulls, even though non-farm payrolls fell short of expectations, as the increase in wages and acceleration of wage growth fed the hope that retail sales numbers, released at the end of the week, will show a strong rebound in fourth month of the year.

The US dollar extended its winning streak against its peers for sixth consecutive session on Tuesday, with the US dollar index rising 0.8% to 94.22, slightly below two-week highs at 94.25

read more