Recession At The Gate: JPM Cuts Q4 GDP From 1.0% To 0.1% We already noted the cycle-low Q4 GDP forecast by the Atlanta Fed, which in a release which came out just as the crashing US equity market closed revised the last quarter GDP to just 0.6%, which delay however according to the same Atlanta Fed was due to "nothing more nefarious than technical difficulties."

Curiously, JPM had no problems with the 15 second exercise of plugging in raw data into the GDP "beancount" model. And, according to chief economist Michael Feroli, in the 4th quarter, the same quarter in which Yellen finally felt confident enough to declare the US economy strong enough to withstand a rate hike and a tightening cycle, US growth ground to a halt and as a result JPMorgan just cut its Q4 GDP forecast from 1.0% to 0.1%.

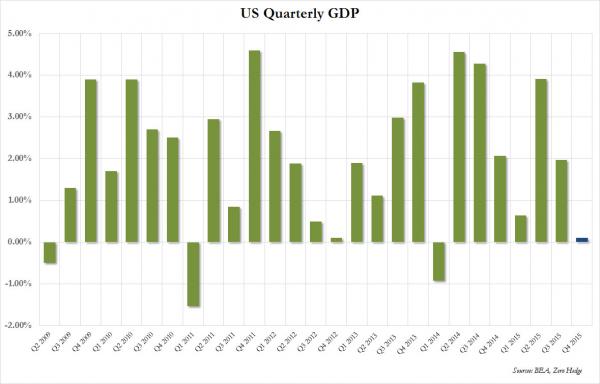

If JPM is right, and if the US economy effectively did not grow in the fourth quarter, this would make it the worst GDP print since Q1 of 2014, and tied for the third worst quarter since 2009, which incidentally was our kneejerk assessment after yesterday's latest round of abysmal economic data.

The cherry on top: JPM also cut its Q1 2016 GDP forecast from 2.25% to 2.00%. Expect many more downward revisions to forward GDP in the coming weeks.

Below is a chart of what US GDP looks like if JPM's forecast proves to be accurate:

Here is JPM explaining why "Q4 GDP growth is still positive, but barely"

Here is JPM explaining why "Q4 GDP growth is still positive, but barely"

We are lowering our tracking of real annualized GDP growth in Q4 from 1.0% to 0.1%.Two reports out today contributed to this downgraded assessment. First, retail sales in December came in rather shockingly weak, which was accompanied by modest downward revisions to October and November retail sales. Second, the business inventories report for November suggest a fairly aggressive push by business to reduce the pace of stockbuilding last quarter. We now see inventories subtracting 1.2%-points from growth last quarter, offset by a disappointing but not disastrous 1.3% increase in real final sales.

We are also lowering some our outlook for Q1 GDP growth from 2.25% to 2.0%.While the inventory situation should turn to being roughly neutral for growth, the quarterly arithmetic on consumer spending got a little more challenging after this morning's retail sales figure, which implies flat real consumer spending in December. We now see real consumer spending in Q1 at 2.5%, versus 3.0% previously. We are leaving unrevised our outlook for 2.25% growth over the remaining three quarters of the year. We will discuss in a separate email the policy outlook, which in any event is currently being swayed more by the inflation data than the growth data.

CNN Reassures Investors: "Don't Panic... America's Economy Is Still In Good Shape" Forget for a moment that U.S. stock markets have seen their worst start to a new year since the Great Depression or that some $2.5 trillion in wealth has been evaporated in less than two weeks.

CNN says it’s hardly the time to panic:Time to panic? Hardly.There are plenty of reasons to relax, especially if you are a U.S investor. Here are the top two:

1. America’s economy is still in good shape.

2. Staying in stocks pays off. Since World War II, investors who remained in stocks for at least 15 years made money

…

Right now, the U.S. economy is growing. It’s not rock star growth, but 2% to 2.5% a year is good, and the Fed is being very cautious.

More importantly, businesses are still hiring. Over 2.3 million jobs were added last year (the latest data on hiring comes out Friday and it’s widely expected to show more jobs added).

Pay no attention to the fact that last week not a single cargo ship was transporting raw materials in the South China Sea, the first time in history that it has happened. The economy is is great shape and this is not proof that global commerce has literally stopped.

Worry not that Walmart, Macy’s and scores of other retailers had an abysmal holiday season and are now set to lay off tens of thousands of workers. Unemployment, when calculated using models that were used during the Great Depression and that were defined out of existence by the government in 1994 show that some 23% of Americans are out of work. But we don’t calculate like that anymore, so we actually have an employment rate of about 95% in America right now.

And though the economy is officially growing at 2.5% per year based on the government’s trustworthy data, we should absolutely not look at the inflation numbers, which according to Shadow Stats are running about 4% per year. If we did, however, go totally fringe and consider inflation within the context of the economy we might notice that this purported growth is actually negative 2% if not worse.

In fact, we’re doing so well that just 45 million of America’s population of 320 million people are on food stamps right now. By all accounts, a really good sign of not just economic growth, but more jobs and an increase in personal incomes.

And with oil trading at under $30 per barrel, we can see nothing but blue skies going forward because, hey, we’re all paying a dollar less for gas now. We’re sure this will have no effect on the domestic real estate market in places like Texas and North Dakota. Nor will this collapse in oil prices cause debt burdened domestic oil companies to close up shop, potentially leading to a domino affect across the entirety of the U.S. economy. Nor will it have any impact on periphery businesses that service those companies, including all of those restaurants that saw below-minimum wage job growth explode last year.

Home buyers may get helping hand from stock meltdown The Federal Reserve recently raised interest rates, U.S. stocks are tumbling and new worries about the Chinese economy seem to emerge daily. So go ahead and buy that house you’ve been looking at.

Well, not necessarily. But consider: all the worries about China that have battered the U.S. stock market in early 2016 have done the opposite for bonds. More money pouring into Treasurys has driven mortgage rates to a two-month low. A 30-year mortgage slipped to 3.92% in mid-January.

The housing market had already been steadily gaining ground even before the latest drop in rates. Indeed, it’s been one of the strongest parts of the economy over the past year. Sales of new and previously owned homes are likely to finish 2015 at the highest level since before the Great Recession.

What’s more, the number of permits to build additional homes is on track to reach an eight-year high.

The final housing numbers for 2015 will start to trickle in this week.

Work on new construction, known as housing starts, is forecast to rise to a 1.19 million annual rate in December from 1.17 million in the prior month. Starts will top the 1 million mark for the second straight year.

US ECONOMY IS NOT GOING INTO RECESSION ANYTIME SOON

This is the panic selling going in the market. So much of blood has been spread over the streets and weak investors have been already thrown out of the markets. It is the time where the markets are bottoming out and the buying opportunity is lined up ahead. So instead of going with the herd, follow your own analysis and trade.

Goldman: Recession Remains Far From Our Baseline View Conversations with investors reveal nervousness about recession risk as well as concerns about company revenues and earnings growth.

-Recession remains far from our baseline view…

…but reverberations from lower oil prices and the China slowdown might weigh more heavily on multinational revenue growth than spillovers to macroeconomic growth would suggest.

-Imports (from the world) by China and oil exporters offer incremental explanatory power for S&P 500 revenue growth after controlling for US economic activity.

-This simple regression suggests that the recent declines in imports by China and oil exporters likely reduced S&P 500 (nonfinancial) nominal revenue growth by several percentage points.

-Perhaps surprisingly, the reduction of imports by oil exporters weighs heavier than that of China.

Goldman Sachs Says Defy ‘Mr. Market’ as Recession Risk Still Low Goldman Sachs Group Inc. is betting “Mr. Market” is wrong in its recession warnings.

While sliding stocks, declining long-term bond rates and higher credit yields are sounding the alert, the New York-based bank’s economics team led by Jan Hatzius is more confident about the outlook for the developed world.

Their model, based on a series of economic and market indicators, points to just a 25 percent risk of recession in the industrial economies in the next four quarters and 34 percent over the next two years. Both undershoot the average risk of the past 35 years despite the recent fears of financial markets.

The probability of a slump in the U.S. is just 18 percent and 23 percent over the two timeframes respectively, while the euro-area threat is greater at 24 percent and 38 percent, according to Goldman Sachs.

“The recent market weakness should provide good risk-adjusted opportunities for those brave enough to defy Mr. Market’s gloomy prognosis about the world economy,” Hatzius and colleagues said in a weekend report.

Not Always Right

Their prognosis is aligned with that of Bruce Kasman of JPMorgan Chase & Co., who says the probability of a U.S. recession in the next 12 months has grown yet is still only about a third.

Of course, economists don’t always get it right. Former U.S. Treasury Secretary Laurence Summers recently noted that the International Monetary Fund failed to predict 220 recessions between 1996 and 2014.

Goldman Sachs bases its current call on a model of 20 economies dating back to 1970 and featuring indicators such as output growth, equity prices and house-price changes. It defines a recession as a year-over-year decline in growth per capita.

Of those it studied, the U.K. faces the lowest recession probability at 3 percent in both the next year and the next eight quarters, according to the model.

Not all are in the clear. The likelihood of contraction is 42 percent in Japan for the next four quarters and 62 percent over two years. Oil-rich Norway’s chances top 80 percent in both cases.

It keeps getting harder to argue the US economy is entering recession The "recession" argument keeps losing credibility.

US economic data releases were sparse this week, but the few indicators we did get confirmed the US economy is not on the brink of recession.

Consumer spending is the driving force of economic growth, as consumption makes up two-thirds of gross domestic product (GDP).

And the first big reading on consumption for 2016 — the January retail-sales report — showed that spending is not rolling over.

Retail sales rose 0.4% compared to December, and 0.1% excluding the volatile costs of autos and gas. Both increases were more than forecast. The retail-sales control group, which is what matters for GDP calculations, jumped by an unexpected 0.6%.

Over the last few weeks, concerns had mounted that the recent market turmoil would soon dampen consumer confidence and spending.

But consumer sentiment remains at a relatively elevated level, even after the unexpected drop in the University of Michigan's index to 90.7. And as TD Securities' David Tulk argued in a note to clients, it's still too soon to tell whether the sell-off in stocks will be followed by an economic downturn.

A downturn in stocks can be a leading indicator of economic activity but doesn't serve as one on a consistent basis.

Federal Reserve Board Chair Janet Yellen also agreed with this, saying this week that concluding an economic recession is close is a premature move.

Speaking Wednesday in her semi-annual testimony on Capital Hill, Yellen said:

"There would seem to be increased fears of recession risk that is resulting in rises in risk premia. We have not yet seen a sharp dropoff in growth, either globally or in the United States. But we certainly recognize that global market developments bear close watching."

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

The "r-word" is back.

After the worst 10-day start to a year ever, investors are anxious about not just the prospects for financial markets but the US economy as a whole.

And now, people are talking about recession.

In an email on Friday, Torsten Sløk, chief international economist at Deutsche Bank, wrote, "Over the past six months I have heard more clients say that despite strong nonfarm payrolls we will soon have a recession. Call it the Groundhog Day recession call. Eventually we will get a recession but the question is if a recession is just around the corner."

But as Sløk noted, there are few signs from US consumers that something has gone awry in the economy.

One of the most influential post-financial-crisis books published was Atif Mian and Amir Sufi's "House of Debt," which argued that what really led the US into recession wasn't just an overheating of home prices but the way homeowners borrowed against these home values and eventually stretched themselves too thin, financially.

And so as US consumers began rolling over — cutting out all kinds of purchases in favor of paying debts (and then, in large numbers, eventually defaulting on those debts) — so too went the US economy. Currently, there are no signs that something similar is happening.

read more