You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Dear Dimitri

Till when ever you will not be satisfied,at least i can not go ahead,at first tell me and explain me with a illustration picture of any TF and of any symbol.how you declare and decide Higher level and Lower level,from where you take start.

second point,when you have 2 opposite open positions (at same time) at different levels (high/low) and the price will go either any one side even 1000 pips,you are in loss for 6 pips and or 60 pips (in 4 digit broker with spread 3 per trade and with 5 digit broker with spread 30 pips)-i suppose spread as 3 pips and 30 pips........ you are in loss till you stop/close any one of your position.but with zero profit until you with draw one of your position....... always one of your trade will be in loss and one in profit equally.you only get loss for spread as a result.

regards

Dear mntiwana,

I will retry to clear both points 1 and 2. For point 1, as i am not in front of my PC, i will post an example later today. Point 2: I never said that Opposite positions will be Opened at the same time ...!!! in my example also i have numbered the positions and it was more than clear where the positions were opened. Opened positions (opposite) positions were at a different level also. For research purposes i am always saying that we have to finalize and make a collection, by finding out, of "profitable setups". The logic to keep two or more opposite positions opened has to do with the position management of a Losing Trade. I never said, even in my example, that you MUST KEEP PROFITABLE TRADES ACTIVES.... I use the expression of "keep actives opposite positions OR Hedged positions" just to maintain the logic of our actions under the same expressions.

So to clear it. When we open a position Long OR Short, we wait up to the moment that an inverse signal appears ... at that specific point we will decide how to handle-manage the situation ... usually best is to take the profit ... but i leave a space for a different reaction, depending always from the type of our "profitable signals setup" ............

Hope that i have expressed in an enough clear way my point of view. Waiting for any comment in order to have this point cleared with you.

Best Regards

Dimitri

I asked why you want to hedge in an already profitable approach. You tell nothing new. I trade PA, I know that a short market is not like a long market. Is it because of consolidations?

Dear krelian99,

it is not easy, for me, to clear all points at the middle of a conversation. I have already explained how the Hedging logic must be used, please see the above detailed reply to mntiwana ... As you can see, i agree 100% with you regarding the profitable trade management (the only question mark that is why i leave some space in case of any eventual and particular "profitable setup") special requirements ...

Waiting for your comments and any suggestion.

Best Regards

Dimitri

Dear mntiwana and everybody that follows this discussion,

Attached can be seen requested examples. I have uploaded these two examples in order to have a complete visual representation of what i mean "Profitable Setups". The charts used are of today and on different instruments and different time frames also. Signals are produced from a Bollinger Bands with 55 periods and 0.05 dev.

First example is USDJPY 1 Minute chart, and the first signal is a SHORT one, the second is a LONG one. Difference of levels is evident.

Second example is USDCHF 15 Minutes chart, and the first signal is a LONG one, the second is a SHORT one. Difference of levels is evident.

Having established and clear enough what are our two (2) "Profitable Setups" we can proceed.

As it can be seen both of them are looking very similar colored line wise .... red line is up and blue one is down ... ok, but there is a first difference in the creation sequence of each one. In one case we see the Short Signal be first and Long the second, in the other image we see first the Long and the Short is following.

So if we can make a collection of ideas, combination of indicators or what ever can produce these "Profitable Setups" we will have the base of our system.

I know that many and very logic thinking will come out as a question mark ... I will answer now two of them ...

Question 1: Why the second signal is needed, since in every trade you have to open a position ... ?

Answer 1a: In our approach we add a difficulty, and this difficulty is that the second signal must in a certain level position respectively to the first position.

Answer 1b: As most difficult point is where to exit our trade, now with this logic ... here you are, you have your exit point with profit also ...

Question 2: What is the reason you separate in two cases these "Profitable Setups" ??? Because anybody could simplify the description by saying : the setup we are looking for is to have the Short Position Level at higher point than the Long one ....

Answer 2: Usually most trading systems are based on the logic that we open a position in one direction with a signal and with the opposite or inverse one we open the position for the opposite direction. With this logic, we do not limit possibilities that one type of setup can be satisfied with combination A end the other setup with combination B.

Hope that i have described and expressed well enough and in a clear way with examples the request.

Waiting for any comment and added value thinking to go ahead.

Best Regards to all of you

Dimitri

i don t follow ur logic , are u trying to define some kinda neutral zone which u don't open a trade in it ? & every time price goes beyond or below that zone u open trade?

p.s : if something is not proven by science then it's either a story or pseudoscience! like santa or anunnakii don t follow ur logic , are u trying to define some kinda neutral zone which u don't open a trade in it ? & every time price goes beyond or below that zone u open trade?

Dear KumoBreake,

I think that i have described clearly and with all details my approach and what my target is. To make it short i am trying to find "Profitable Setups". These two setups have to follow specific restriction. The restriction is that both of them will end with a schematic representation of being the SHORT entrance point at a HIGHER Price LEVEL than the LONG. This schematic formation is Profitable.

Let's try to find out these formations.

Best Regards

Dimitri

p.s : if something is not proven by science then it's either a story or pseudoscience! like santa or anunnaki

Dear KumoBreake,

I think that i have described clearly and with all details my approach and what my target is. To make it short i am trying to find "Profitable Setups". These two setups have to follow specific restriction. The restriction is that both of them will end with a schematic representation of being the SHORT entrance point at a HIGHER Price LEVEL than the LONG. This schematic formation is Profitable.

Let's try to find out these formations.

Best Regards

Dimitri

It's really hard to follow you. You write the same over and over again but what is important you don't tell. You hedge with a short position that's higher than the long position and let both (or more) positions run. My question is still: WHY you want to hedge? I see no sense and I think the others don't see it either. Why you don't want to trade the signals the orthodox way? There are some losers but that is absolutely ok.

You forgot religion.

It's really hard to follow you. You write the same over and over again but what is important you don't tell. You hedge with a short position that's higher than the long position and let both (or more) positions run. My question is still: WHY you want to hedge? I see no sense and I think the others don't see it either. Why you don't want to trade the signals the orthodox way? There are some losers but that is absolutely ok.

Dear krelian99,

You insist to the management part which has to do how positions will be held.... This part will be approached detail y when the first part will be completed. The first part is to find the "Profitable Setups". How we are going to manage and handle those setups has to do with your question. It is much better to synchronize our focus and effort to collect those setups.

Thank you in advance for your understanding, waiting for any contribution and proposal to this direction.

Best Regards

Dimitri

yeah i read ur post again , just don't get what ur saying . u keep repeating "profitable setup" and i don't see one . my bad

p.s: don't forget spreads when opening large number of trades! in long run they eat your profit if there's any

yeah i read ur post again , just don't get what ur saying . u keep repeating "profitable setup" and i don't see one . my bad

p.s: don't forget spreads when opening large number of trades! in long run they eat your profit if there's any

Dear kumoBreak,

I keep repeating "Profitable Setup" because is what we are looking for. I call it SETUP because is a combination of Long and Short signals in a specific Level order... as already explained the result of those combinations must be Higher for Short entering point than the Long. Usually we are looking - searching separately for Entering Long, entering Short, exiting Long exiting Short, now we are looking for a specific combination that produce profit.

Thank you for your attention.

Best Regards

Dimitri

Dear kumoBreak,

I keep repeating "Profitable Setup" because is what we are looking for. I call it SETUP because is a combination of Long and Short signals in a specific Level order... as already explained the result of those combinations must be Higher for Short entering point than the Long. Usually we are looking - searching separately for Entering Long, entering Short, exiting Long exiting Short, now we are looking for a specific combination that produce profit.

Thank you for your attention.

Best Regards

Dimitri

Dear Dimitri

Again with lot of excuses,your logic don't get in my dull head,only saying profitable setup and that illustration picture with bands and two low/high level do nothing logic,even i don't know how and where you created that levels,if you don't mind,let pending this unclear logic for some time later that you tried a lot but nobody was able to understand exact including me and agree with,perhaps you have not explained well or possibly there was no perfect workable logic,these all participant members are well experts and having recognized level of concerning knowledge.

let us try one other way for same said purpose "profitable setup" now i will be try illustrate every thing with pictures step by step according to my ability,you and every respectable visitor might be disagree with but i really love your objections and criticism to make it more accurate,at first step we have to work on price line,we will first smooth the price because we are working on lower/lowest TFs,in lower TFs we can not go with candle to candle but a usual smooth trend.

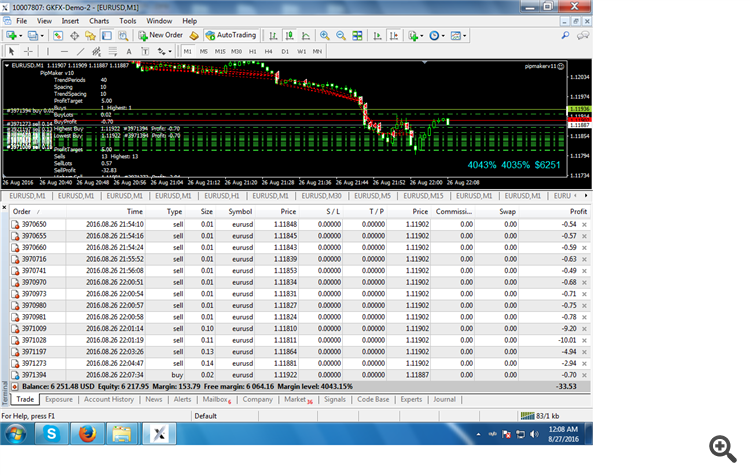

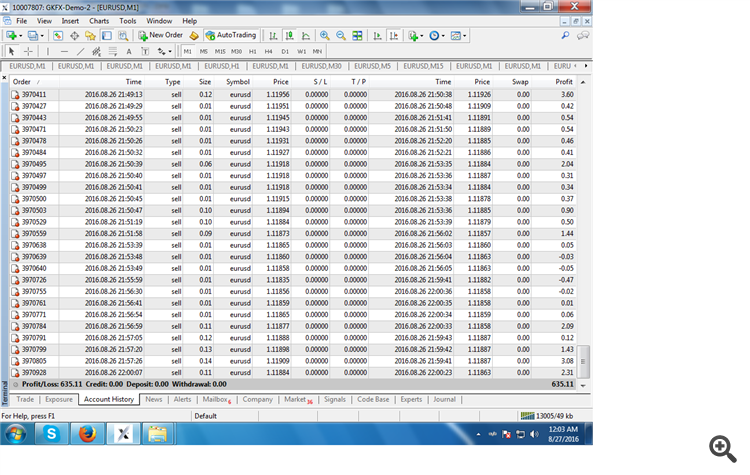

meanwhile here is one unknown ea,unknown means i don't know how it is working and what logic behind,may be some one will be able to explain it ...... i got it from here TSD,working well on my demo account since 3 days,you may try it too if you know it or can understand how it is working,i upload it here for you because it is what you saying multiple orders-sell/buy.

regards