What to expect from the US Non Farm Payrolls at 12.30 GMT today

Goldman Sachs: Change in Nonfarm Payrolls (May): 210K, Unemployment Rate (May): 5.4%, Average Hourly Earnings YoY (May): 0.3%.

Deutsche Bank: 275K, 5.4%, 0.2%.

SEB: 230K, 5.3%, 0.2%.

CIBC: 200K, 5.3%, 0.3%.

SocGen: 227K, 5.3%, 0.3%.

Wesptac:225K, 5.4%.

Morgan Stanley:The focus is likely to switch back to global events and the US in particular today with the release of the US nonfarm payroll data. The market is likely looking for another robust report, given the strong readings from other employment surveys, including the ADP, Challenger and the continued historically low readings of initial claims. This points to a strong labour market report, where the market consensus is for a 226k reading(MS: 215k). Given recent reductions in positioning, where USD longs have been scaled back, we would see potential for USD to rally today if the markets' assumption of a strong reading is seen.

RBS: 245K. 2.3% While still below levels Fed Chair Yellen considers normal, a 2.3% y/y rise in average hourly earnings would match the largest y/y increase since 2009. They expect the unemployment rate to hold steady at 5.4%. FX View: Stronger-than-expected employment should keep the Fed on pace to hike the Fed Funds rate in September, and pulling forward of expectations could support the USD. A stronger USD and pulled-forward rate hike expectations could pressure commodity prices and weigh on commodity exporter currencies.

Credit Suisse: +220K , 5.4% rate , unchanged from the prior month. Hourly earnings are expected to rise from the below-trend reading last month to +0.3% (consensus: +0.2%).

BNPP: +240k 0.2% , 5.4%. Numbers in line with this forecast should be consistent with at least some shift forward in Fed rate hike expectations towards the September meeting and help the USD extend gains vs. the JPY and most other currencies. EURUSD price action might be more complicated on a strong release, with the EUR's recent sensitivity to developments in long-end yields suggesting caution in the immediate aftermath of a strong US report. If, on the other hand, payroll growth were to disappoint, we could see renewed capitulation on long USD positions, particularly vs. higher yielding currencies, as markets continue to lose confidence in the Fed's capacity to hike rates this year.

Credit Agricole: +210k The standard deviation of forecasters is 25k so our outlook still sits above a one-standard deviation miss. Still, the recent tone of economic data supports an upbeat view on payrolls...We think the Fed's bar to hike is low but appetite to hike is strong, which supports our short-term upbeat view on the USD, especially against EUR, JPY and CHF.

Barclays: +225k ,5.3% ,0.2% m/m

BofA Merrill:+220,000, 5.4%This would imply a modest pickup from the 3-month average of 191,000 but slightly softer than the 6-month trend of 255,000. The labor market was exceptionally strong at the end of last year with job growth averaging 324,000 a month in 4Q14, running at a pace that was nearly three times the rate needed to keep up with labor force growth. Some cooling in the pace of job growth was therefore to be expected. Looking ahead, we expect job growth of approximately 200,000 a month, which would imply a healthy improvement in the labor market.

Danske: We forecast +200k(as indicated by the ADP report), which is also the consensus expectation. Manufacturing is likely to remain the weak spot with the service sector the main driver of job growth. Average hourly earnings is likely to get a lot of investor attention, as a rebound from last month and any indication of a more clear upward trend in wage inflation would help convince the dovish FOMC members that a 2015 rate hike is warranted.

BTMU: +240kThat level of gain may well be enough to see the unemployment rate drift further lower. If we get a 5.3% print today that would leave the unemployment rate just 0.1ppt above the top of the FOMC's estimated range for where the rate is expected to average in Q4.

Nomura: +190k ,5.4% and expect the decline in the rate to be slower as we approach the upper bound of the FOMC's long-run forecast for the unemployment rate, at 5.2%.

UBS: +205K rise in payrolls and a further 0.1% decline in unemployment,in line with fairly positive assessments of labour market trends.

Out of 17 market makers none came even close to NFP numbers

Out of 17 market makers none came even close to NFP numbers

That is their usual average of forecasting - see their end of year results in trading (not in commissions taken from clients)

Deutsche Bank Expects A Significantly Below-Consensus August NFP

The August employment report will be released on Friday, and Deutsche Bank expects a 170k nonfarm payroll gain, which is significantly below the year-to-date average (211k) and consensus expectations of roughly 220k.

"To be clear, we do not believe that underlying momentum in the labor market has meaningfully deteriorated. As we have previously noted, August employment has historically tended to disappoint consensus expectations. The last four August payroll reports were all weaker than expected; they were on average 55k below consensus," DB argues.

"The data are even more compelling if we go back further in time. Since 1988, when our sample begins, August nonfarm payrolls have disappointed the financial markets in 21 of the last 27 years, or 78% of the time. The average forecasting error has been -61k. The range of misses, though, has been large. The median forecast error has been -42k," DB adds.

August NFP: What To Expect

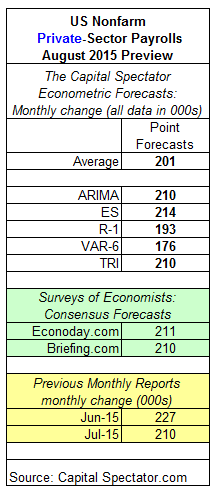

Private nonfarm payrolls in the US are projected to increase by 201,000 (seasonally adjusted) in Friday’s August report from the Labor Department, based on The Capital Spectator’s average point forecast for several econometric estimates. The prediction reflects a modest decrease in the rate of growth vs. July’s 210,000 gain.

Two estimates based on recent surveys of economists point to a slightly higher advance for private payrolls in August relative to The Capital Spectator’s average projection.

Here’s a review of the numbers, followed by brief summaries of the methodologies behind the forecasts that are used to calculate The Capital Spectator’s average prediction:

- ARIMA: An autoregressive integrated moving average model that analyzes the historical record of private payrolls in R via the “forecast” package.

- ES: An exponential smoothing model that analyzes the historical record of private payrolls in R via the “forecast” package.

- R-1: A linear regression model that analyzes the historical record of ADP private payrolls in context with the Labor Department’s estimate of US private payrolls. The historical relationship between the variables is applied to the more recently updated ADP data to project the government’s estimate of private payrolls. The computations are run in R.

- VAR-6: A vector autoregression model that analyzes six economic time series in context with private payrolls. The six additional series: ISM Manufacturing Index, industrial production, aggregate weekly hours of production and nonsupervisory employees in the private sector, the stock market (Wilshire 5000), spot oil prices and the Treasury yield spread (10-year less 3-month T-bill). The forecasts are run in R with the “vars” package.

- TRI: A model that’s based on combining point forecasts, along with the upper and lower prediction intervals (at the 95% confidence level), via a technique known as triangular distributions. The basic procedure: 1) run a Monte Carlo simulation on the combined forecasts and generate 1 million data points on each forecast series to estimate a triangular distribution; 2) take random samples from each of the simulated data sets and use the expected value with the highest frequency as the prediction. The forecast combinations are drawn from the following projections: Econoday.com’s consensus forecast data and the predictions generated by the models above. The forecasts are run in R with the “triangle” package.

Preview: US August Employment - Nomura

Nomura expects the August employment report to show another trend-like +200k gain in payrolls and another decline in the unemployment rate to 5.2%.

"We believe the Bureau of Labor Statistics (BLS) will announce on Friday, 4 September, a net new 220k jobs were added to US nonfarm payrolls in August, near July’s gain as economic momentum appeared to be roughly the same in August," Nomura projects.

"We forecast that private payrolls increased by 210k in August, as we expect a 10k increase in government payrolls. We assess the risks to our payrolls forecasts as balanced," Nomura adds.

US August NFP Preview: Watch The Seasonals - Goldman Sachs

Goldman Sachs forecasts nonfarm payroll growth of 190k in August, below the consensus forecast of 218k and down from July’s 215k gain.

"Worth noting that in recent years, the preliminary August payrolls figure has tended to be relatively soft in the initial release and has subsequently been revised upwards in following employment reports, with back revisions averaging +79k over the past five years," GS notes.

"Likewise, the consensus has a modest tendency to overestimate job growth in August, more so than in other months. For example, consensus forecasts have over*predicted August job growth since 2010 by an average of 30k," GS adds.

"We expect the unemployment rate to decline to 5.2%, in line with consensus. Average hourly earnings for all employees are likely to increase 0.3% month*over*month in August," GS projects.

NFP Analysis: 7 reasons why the Fed is likely to hike in September with big sweetener

The NFP report gave a little for everybody: weak headline number with 173K but positive revisions and annual wage growth rising to 2.2%. Also other factors are mixed: US data such as GDP looks good but the world looks weak, especially China.

So what will the Fed do? Perhaps go ahead but make it “the most dovish hike”. Here are 7 reasons to act in September, 4 potential sweeteners Yellen and her colleagues could offer to markets and a potential market reaction to such a scenario:

- Jobs are good: With a 5.1% unemployment, a zero interest rate seems inappropriate, even though the participation rate is low. Demographics, aka aging, are responsible for a big chunk in the fall in the participation rate.

- Inflation will come: Energy prices push headline inflation lower, but core inflation is OK. With a steady rise in wages, at 2.2%, core inflation will eventually come. It is important for the Fed to be ahead of the curve and not behind it.

- The US economy can absorb a 0.25% hike: The economic growth is not spectacular, but solid and steady enough. Another 0.25% will not make a big difference. The NFP report shows ongoing stability, also in a month that saw global volatility.

- Extreme preparation: The Fed has ended QE in October, urged patience and then removed forward guidance and left the door open. Everybody is expecting them to hike, so why not get over with it and end uncertainty.

- Not be bullied by markets: The Fed is criticized for working for Wall Street. If on every fall in stocks, which is part of the game, the Fed provides more stimulus, this becomes dangerous. Money flows into financial markets in expectations of central bank support, and not into the real economy.

- Show confidence: The Fed, especially under Yellen and Bernanke, has been very dovish. If a dovish Fed is raising the rates, it shows that it is confident in the US economy, and confident that the US could weather global headwinds. It would also be a sign of confidence for the whole world. The jobs report is good enough.

- Have another tool in the shed: Having the opportunity to cut the rates is something the Fed doesn’t have now. In order to regain this tool, it should take the opportunity it has now, after the OK report and regain it if things move away from the current stability.

- Data dependency: Yellen could remind everybody listening to the press conference that the Fed remains data dependent, and that any future move will depend on improvement.

- Signal this the only hike for 2015: This cannot be said directly because the Fed is data dependent, but hinting that this is a one off move, at least for the upcoming month, will sooth markets.

- Remind us about the balance sheet: The Fed ended QE back in October 2014. This means it stopped creating new money and stopped expanding its balance sheet, but it never squeezed it. So, the Fed continues buying a new bond for any bond that matures. The balance sheet remains bloated. The Fed could remind us that this stimulus is not going away anytime soon.

- Say that the Fed will closely monitor the impact: By giving special attention to markets, the Fed could also smooth the reaction.

But with this hike, the Fed could also wrap it up with a lot of candy, to ease the reaction.

4 possible sweeteners

If this scenario of a “dovish rate hike” materializes, we could see spike in the dollar (as a hike is far from being priced in) but with a slide in the dollar later on, as more certainty comes to the markets as they understand the world hasn’t ended.

Nobody guesses that the end result will be almost nothing

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Will Payrolls Propel USD To New Highs?

With less than 24 hours to go before Friday’s non-farm payrolls report, the U.S. dollar is holding up well. The greenback traded higher versus the Japanese yen, Canadian, Australian and New Zealand dollars. While it lost ground versus the British pound, it held steady against the euro and Swiss franc. The dollar has performed extremely well this month as investors reset their expectations for Fed tightening. While everyone believes that the central bank will leave interest rates unchanged this month, investors are looking for hawkish comments and more direct guidance for a September rate hike from Janet Yellen in June. Whether she satisfies the market depends in large part on Friday’s labor-market report. Non-farm payrolls is the next major catalyst for a break higher in the dollar. However the greenback is trading right below a key level versus the yen and an unambiguously strong payrolls report is needed to drive USD/JPY above 125. While most of the economic reports we track point to stronger job growth in May, the most important release -- non-manufacturing ISM showed a slowdown in labor-market activity. Nonetheless the employment index still printed at 55, representing expansionary conditions. So in a nutshell, while a good non-farm payrolls report is likely, it's not a done deal. Still, a firm report will drive USD/JPY swiftly above 125. To hold the move however, we would need to see a steady or lower unemployment rate and most importantly, an increase in average hourly earnings. In fact, earnings is more important than the absolute amount of job growth these days since payrolls have been hovering around 200k for the past year, give or take a few outlier reports like the March release. There’s no doubt that the U.S. economy and the labor market is improving, but the dollar is also overbought so even if it pushes higher on the back of a strong jobs number, it could be hit by profit taking next week as investors cut back on some of their positions ahead of the June 17 FOMC rate decision. In the meantime, take a look at how the leading indicators for the May non-farm payrolls report stack up:

Leading NFP Indicators

Arguments for Stronger Payrolls

Arguments for Weaker Payrolls

read more