What To Expect From ECB? - Views From 17 Major Banks

The following are the expectations for today's ECB March meeting as provided by the economists at 17 major banks along with some strategies to play the EUR into the event as provided by the FX strategists at these banks.

Goldman: We expect rates on hold (ECB Main Refinancing Rate at 0.05%, in line with consensus), and we expect the Governing Council of the ECB to provide more details about its sovereign asset purchase program.

Morgan Stanley:The ECB is set to provide the details of the QE programme today as well as the new staff forecasts, which are likely to be extended out to 2017. Our economists expect an upward revision to the growth forecasts, but also suggest that there might be another downward revision to the inflation forecasts. EUR has already extended the major downtrend, not just against USD but on many of the crosses. The move below the 1.1100 January low now opens the way for a decline towards the 1.07 area, we believe.

JP Morgan: The ECB is expected to give more details of the QE announced on January 22. We expect the ECB to start sovereign purchases the week of March 9 and the €60bn monthly purchases to be split as following: €10bn of covered bonds & ABS, €6bn of European institutions, €2bn of agencies and €42bn of sovereign bonds, of which €3.4bn of inflation linked bonds.

SocGen: Today’s ECB meeting in Cyprus should be accompanied by a few more details about the bond-buying programme, but few fireworks. Re-affirmation of the commitment to buy EUR 60bn per month, some clarity on the logistics (how the issue and issuer limits will be operated, etc) will be important to the bond market, which has gone a long way since the original announcement. Any sign of discord (from the Bundesbank?) would be noteworthy too. But while the risk of a further correction in Bunds is obvious, the FX market seems pretty single-minded where it comes to the Euro. The only way is (or has been, until now) down. Our technical analysts see the next support at 1.08 in EUR/USD and the lack of any kind of meaningful bounce at any stage this year probably means there are now people selling into weakness.

Barclays:We do not expect the ECB to make any monetary policy changes at this meeting given the recently announced expansion of its asset purchase program. However, we think that the ECB will likely release the execution details of the new program with buying likely to start in early March, possibly next week. We are looking for the move below the 1.1100 area to confirm downside traction towards targets near 1.1050. Beyond there we expect a move lower towards a confluence of support in the 1.0765 area,

SEB:At its meeting on Thursday, the ECB Governing Council will mainly focus on the details of its expanded asset purchase program. Otherwise, it will reiterate its forward guidance that policy rates will remain at current depressed levels for an extended period.

BNPP: Much of Thursday’s ECB policy announcement is likely to be about clarifying the details of the QE programme announced in January. One aspect that has drawn market concern in particular is whether the ECB will be able to source EUR 60bn of assets per month. We expect Draghi to reassure the markets on that front as any wavering on the total amount would be very damaging for the credibility of QE. Outside of the technicalities of asset purchases, markets will also focus on the updated staff macroeconomic projections which will for the first time extend to 2017. We are looking for the mid-points of the CPI forecast to remain below 2% over the whole forecast period and suspect Draghi will be careful not to overplay the recent improvement in economic data in his comments. While EURUSD did slip to a new 11-year low on Wednesday, we see the currency entering a period of more gradual ‘flow-driven’ downtrend as opposed to the previous faster ‘announcement-driven’ move.

BTMU:Today, President Draghi will hold his monetary policy press conference and perhaps provide some details for the financial markets – the obvious one being when will the QE buying actually start? Also reporters may try and gauge how strict the ECB is on its self-imposed limits of buying specific issues and from each sovereign. We sense one theme today may centre around questions over the ECB’s ability to meet its goal of buying something in the region of EUR 850bn worth of sovereign debt. Expect Draghi to be very forceful in stressing the determination of the ECB to meet its goal – that is likely to give an impression to the market that the ECB may buy “at any price” and drive yields further lower, of course dragging the euro down too...We will also get 2017 forecasts for the first time and we suspect that the 2017 inflation rate may be put at about 1.7%, close enough for the ECB to argue that it has met its goal of price stability.

Credit Suisse:We expect the ECB to remain on hold and all eyes to be on the QE operational details. We remain bearish on the EUR.

ING:Three factors will be of interest in today’s ECB meeting: details of the QE programme, ECB macro-economic assessment and Greece. Regarding the details of QE, our rates strategists point out the January ECB Minutes suggested that the purchases of government securities will in principle be conducted according to national central banks’ shares in the ECB’s capital key. Regarding the target maturities of bond purchases, the ECB Executive Board member Coeuré has suggested it would be based on market outstandings and will reflect the liquidity of specific segments. This would mean that the ECB (or the National Banks) would not shy away from buying, for example, shorter German maturities with negative yields. One reason for that is that the ECB does not want to distort the yield curve. This is particularly important for the EUR outlook, as currencies tend to be particularly sensitive to short-end rates. While we think that the initial QE effect is by and large priced into the EUR, the ongoing and persistent by-product of it (short-end rates grounded to zero for quarters to come) means that any EUR upside will be limited. Indeed, such ECB stance will facilitate EUR/USD decline once the Fed starts tightening its monetary stance and the US short-end rates spike higher.

Westpac:Mar will be the first month in which the ECB’s new asset purchase program takes full effect. €60bn in bonds are to be bought by the bank each month, from Mar 2015 until (at least) Sep 2016. That compares to the €13bn bought per month until now. Mar will also see the first TLTRO for 2015, although as was the case in late 2014, demand from the banks for liquidity for lending is unlikely to be significant in scale. With the above policies only just being initiated, there is no cause for further action by the ECB in Mar. Indeed, with GDP growth maintaining a circa 1% pace and given confidence has firmed somewhat after the Jan meeting, the Committee is likely to feel comfortable maintaining its current stance for many meetings hence. Key to the outlook for policy will be: the underlying inflation trend sans oil; activity growth; and how the liquidity offered by the ECB is used by market participants. All of this will only be known with considerable time.

UBS: The ECB is expected to address the technicalities of its QE programme and also the matter of Greek access to the ELA. Recent robust readings in inflation and output also raises questions over the scope of the programme, but the release of staff forecasts for 2017 may yield a different interpretation.

RBS:The ECB is set to announce finer details of its QE plan to purchase EUR60bn per month until Sep-2016, with the intention to continue it until there is a sustainable adjustment in the path of inflation towards the 2% target. It will release updated economic forecasts which will help set expectations on how long the QE program may last. However, it is unlikely that the market will be forward-looking enough to see the end of this QE program for some time. Continuing in the background are the debt financing negotiations with Greece. Draghi will be quizzed in the press conference on how and under what conditions the ECB will continue to provide term liquidity to Greece. Greece faces maturing loans to the IMF and refinancing Treasury bills in coming weeks

Credit Agricole: The ECB may account for stabilizing growth conditions. However, central bank President is unlikely taking a less aggressive monetary policy stance. Accordingly the EUR is likely to remain subject to downside risk, in particular against the USD. We remain short EUR/USD.

ECB is driving Euro banks to do that. Soon we shall have to pay to banks if we have money. Their perfect world is starting : all they need is a bunch of fools (us) and all they have to do is to sit on their arses and do nothing - and collect bonuses for "the job well done" (sitting on their arses)

Greater Uncertainty Now Infects The Dollar’s Path – JP Morgan

The US dollar reversed its gains following the dovish statement from the Fed. Was this an overreaction an opportunity to sell EUR/USD as some suspect? Or perhaps there is a real change?

According to the team at JP Morgan, this now infects the dollar’s path.

Here is their view :

“While the needle hasn’t moved much on the directional view, we think greater uncertainty now infects the Fed track and hence the dollar’s path. For one, the Fed’s selfprofessed data dependency has been heightened in import due to references to growth risks from the currency.

...A larger set of decision-making inputs with potentially conflicting signals opens up room for greater uncertainty, as does their relative rank ordering in the Fed’s framework – inflation has clearly climbed the variable hierarchy and the dots assume a bigger role in Fed communication than earlier, but whether this will still remain the case if/when data surprises begin to reverse their current disappointing streak bears close watching.

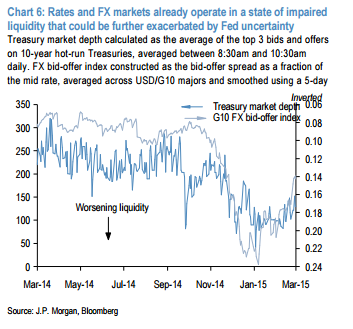

Additionally, as a result of the sharp adjustment in the dots, all three aspects of the Fed funds path – the timing of lift-off, the pace of hikes and the terminal rate – are now open to re-appraisals. This elevated uncertainty is perhaps why gamma swaptions in US rates have atypically firmed even after the passage of the Fed event risk, and spillover onto FX vol over the next few months is likely given how tight rates/FX links have been through this cycle.

Rates and FX markets already operate in poorer-than-normal liquidity conditions that can be further exacerbated by Fed uncertainty, so the stage is set for a noisy run-in to a mid-year lift-off that is not conducive to cavalier directional risk – the macro portfolio remains light on risk, most of it in option format.”

If ECB does that, that will be the end of the financial system as we know it

I, for first, will not keep a single dime in any bank. Better to dig a hole and keep it there than in a bank that will charge me for having some money that I did not spend. If they want penniless slaves, let them be the penniless slaves

I honestly doubt the ECB will have -3.00% interest rate. I think JPMorgan were looking to make headlines from a controversial observation.

I honestly doubt the ECB will have -3.00% interest rate. I think JPMorgan were looking to make headlines from a controversial observation.

Australia is going to start taxing deposits from May

Better start believing - and prepare a pillow for what you have

Australia is going to start taxing deposits from May Better start believing - and prepare a pillow for what you have

They will tax pillows then

Euro’s Reserve Status Jeopardized as Central Banks Dump Holdings

Quantitative easing may be helping Europe achieve its economic targets, but it’s also undermining the long-term viability of the euro by tarnishing its allure as a global reserve currency.

Central banks cut their euro holdings by the most on record last year in anticipation of losses tied to unprecedented stimulus. The euro now accounts for just 22 percent of worldwide reserves, down from 28 percent before the region’s debt crisis five years ago, while dollar and yen holdings have both climbed, the latest data from the International Monetary Fund show.

“As a reserve currency, the euro is falling apart,” said Daniel Fermon, a strategist at Societe Generale SA in Paris. “As long as you have full quantitative easing, there’s no need to invest. The problem for the moment is we don’t see a floor for the currency. Money’s flowing out.”

European Central Bank President Mario Draghi has in the past welcomed the drop-off in reserve managers’ holdings because a weaker exchange rate makes the continent more competitive. Yet firms including Mizuho Bank Ltd. warn the currency’s waning popularity reflects a more lasting loss of confidence in an economy that shrank in two of the past three years.

Sinking Economically

“Global reserve managers may be thinking the euro is going to sink economically if it continues this way,” said Daisuke Karakama, the Tokyo-based chief market economist at Mizuho and a former European Commission official. With yen allocations rising, “they may be expecting Japan’s positive economic growth to continue as a result of” that nation’s record stimulus, Karakama said.

The decline in euro reserves suggests other central banks consider the ECB’s 1.1 trillion euros ($1.2 trillion) of QE bond purchases, which started a month ago, to be the biggest threat to the currency’s global status since its 1999 debut.

Greece’s debt woes aren’t helping, either. The ECB ramped up the emergency funding available to Greek banks Thursday to alleviate the country’s worsening liquidity issues amid drawn-out negotiations over its bailout.

Outright Sales

All this is prompting banks from Citigroup Inc., the world’s biggest foreign-exchange trader, to Goldman Sachs Group Inc. to predict the euro will fall below parity with the dollar this year, from a 12-year low of $1.0458 last month and $1.0617 Friday.

National Australia Bank Ltd. estimates reserve managers sold at least $100 billion-worth of euros in the fourth quarter of 2014.

“Most of the fall in the euro share represented outright selling of euros” rather than simply reflecting declines in the exchange rate, said Ray Attrill, the bank’s global co-head of currency strategy in Sydney.

Of the $6.1 trillion of reserves for which central banks specify a currency, the proportion of euros fell in every quarter of 2014, IMF data show. Last year was also the first time euro holdings fell in cash terms.

Euro Weakening

Yen holdings increased in three of the four quarters and make up 4 percent of the total, up from as low as 2.8 percent in early 2009. Dollars account for the biggest proportion at 63 percent after reserve managers increased their holdings in the final six months of last year. That’s down from as much as 73 percent in 2001.

The changes came as the yen and euro each sank 12 percent versus the greenback last year. The euro has tumbled about the same amount since then, which should further shrink its presence in central banks’ war chests.

While Draghi has acknowledged that a weaker euro helps the region’s economy, he’s repeatedly insisted his policies don’t target the exchange rate. His priority is to avert a deflationary spiral, after consumer prices fell in each of the four months through March compared with a year earlier.

The euro’s also falling against its broader peers, dropping more than 7 percent this year among a basket of its Group of 10 nations tracked by Bloomberg Correlation-Weighted Indexes, the biggest decline in the group. The dollar climbed almost 7 percent on the prospect of higher U.S. interest rates, beating a gain of about 6 percent in the yen.

“QE does not create the conditions for a euro recovery,” Ken Dickson, investment director for currencies at Standard Life Investments Ltd. in Edinburgh, wrote in a note Thursday. His firm oversees about $360 billion. “We retain a preference for the U.S. dollar versus other major currencies.”

'Euro Zone Recovery Is Clearly There': ECB Coeure

European Central Bank (ECB) Executive Board member Benoit Coeure sounded optimistic when speaking about the economic environment in the euro zone in an interview for AFP.

"The eurozone recovery is clearly there. Growth is coming back, all business and household confidence indicators are pointing upwards. And the good news is that this recovery is rooted in domestic demand and in consumer spending in particular," Coeure told the agency.

Helping euro zone economy

To help the euro zone's faltering economy, the ECB launched a massive €1.2 trillion quantitative easing (QE) program in March. Along with the weaker euro and low energy prices, the ECB stimulus "is injecting a lot of fuel" into the economy, Coeure argued, adding that these measures "are only transitory" and now it is up to governments to do more for economic reform.

"It's extremely important to 'convert the try', so that growth can become long term," the ECB board member said, using a rugby term. "This can be achieved via labor market reforms and by more generally creating a business environment that is more conducive to investment," he added.

"The real test will be a pick-up in investment in Europe this year," Coeure elaborated, noting that "favorable financing conditions are needed. That's what were doing, that's the role of the ECB. But people must also have plans and the desire to do business. That's the task of the governments."

Even so, he used some words of caution as there are still many problems that could halt the recent rebound.

The progress is still "insufficient and somewhat unequally spread from country to country," he warned. "Our concern is that the current upturn is merely a cyclical one, that it's merely a flash in the pan."

They are still to cut the rates - waiting before I declare that they recovered

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

A running theme here over the past several weeks has been that the ECB’s €1.1 trillion foray into quantitative easing will be severely hindered by a laundry list of constraints (some of which were unwittingly self-imposed). Another topic we’ve covered exhaustively is the idea that the world’s central banks will likely all, in relatively short order, run up against the natural limits of accommodative monetary policy (indeed, even some Japanese policy makers are starting to agree on this).

Thinking about these two things in conjunction raises an interesting question for the ECB: if a tail event comes rearing its ugly head and the global central bank race to the bottom accelerates, will Mario Draghi, effectively fighting with one hand tied behind his back by virtue of Q€’s limitations, be able to fend off an outright collapse?

Here’s FT with more:

...the ECB is now close to running out of ammunition. The true constraints on further ECB intervention lie in the 25 per cent issue limit and 33 per cent issuer limit on its sovereign bond purchases.

Except for Greek debt, the 25 per cent and 33 per cent caps should not prove binding in a scenario where the ECB keeps its monthly asset purchase pace of €60bn. However, the limits could be reached in worst-case scenarios where the ECB would have to boost the size of its QE programme or implement OMTs targeted on specific sovereigns.

The first type of worst-case scenario would be a new global deflationary shock. It might be triggered by faltering US growth or a sharper-than-expected slowdown in China. The consequence would be fiercer currency wars with balance sheet expansion races among central banks.

In this competition, the ECB would be handicapped: it would not have much room to significantly increase the size of its bond purchase programme. For instance, if monthly purchases had to be raised to €100bn, the 25 per cent issue limit would be reached after only eight months in the case of German government debt.

Given the narrow size of the eurozone corporate bond market, any substantial further expansion of the asset purchase programme would then have to include equities. But this could prove controversial within the ECB governing council.

It seems to us that this “first type of worst-case scenario” is not merely possible, but in fact likely. As we’ve shown time and again, QE’s ability to stoke inflation expectations and boost aggregate demand simply has not been proven — even after $5 trillion in asset purchases. Here’s what we had to say on the subject last week:

And so, stuck as we are in what looks like a chronic condition of oversupply and as it increasingly appears, in Citi’s words, that “the decoupling between EM GDP growth and global trade growth over the past decade [now looks] less like a benign shift away from exports to domestic consumption, and more like a world where GDP was temporarily boosted by a surge in credit, where suppliers ramped up capacity in anticipation of 10% nominal EM/Chinese demand growth continuing indefinitely, but where the limits of such credit-fuelled demand are suddenly being exposed,” more QE simply won’t move inflation expectations and certainly can’t do much to further stimulate aggregate demand (assuming it’s done anything in that regard thus far).

And it really hasn’t done anything. In fact, by keeping borrowing costs artificially low, QE may well be contributing to deflation by allowing insolvent producers to stay alive via cheap debt, resulting in overcapacity everywhere you look.

read more