And they are doing exactly that. Verbal Easing

We are going to hear a ton of nonsense in the coming months. And then when ECB starts with its own VE, that will be a full blown circus

More QE might be appropriate if U.S. economy faltered- Fed's Williams

The head of the San Francisco Federal Reserve Bank on Tuesday said he would be open to another of round asset purchases if inflation trends were to fall significantly short of the U.S. central bank's target.

Although he said it would take a big shift in the U.S. economic outlook for the Fed to restart its bond buying, John Williams said the possibility of a new downturn in Europe and other global economic woes pose a risk to the United States.

"If we really get a sustained, disinflationary forecast ... then I think moving back to additional asset purchases in a situation like that should be something we should seriously consider," Williams said in an interview with Reuters.

Europe, which faces an elevated risk of a new recession and, according to the International Monetary Fund, a significant chance for an outright bout of deflation, has emerged as a central concern at the Fed.

Though the European Central Bank has acted forcefully to protect the euro zone, "the concern is the next steps that they may need," Williams said. "That worries me a little bit. Will their policy response be as timely and aggressive as needed?"

Despite recent volatility in world financial markets, Williams said he felt investors had a fundamentally correct view of the likely path of Fed policy.

He said he still felt it would likely be appropriate to begin lifting benchmark U.S. rates from zero in the middle of next year. Continued low rates for 10- and 30-year U.S. government bonds do not reflect a market misreading of the Fed's likely policy path, he said, but rather show doubts about the global economy and other issues.

"The markets are pricing in a lot of other things that might happen and a lot of those are negative," Williams said. "The cross currents are really the story."

What QE4: US Monetizable Deficit Drops To Just $483 Billion, Or 2.8% Of GDP

Remember that in addition to its primary function, which is to push stocks higher i.e., the "wealth effect", the Fed's Quantitative Easing has another just as important role: to monetize the US deficit. Which is why the news that was released moments ago from the Treasury, namely that the US deficit for Fiscal 2014 has just fallen to a meager $483 billion, or 2.8% of GDP (mostly thanks to the GSE inbound receipts which in turn were courtesy of the latest dead cat bounce in housing), and down from $680 billion a year ago, is hardly what the BTFDers were hoping for.

But this is great news for the US right?

Sure, it is also horrible news for all those liquidity addicts who hope that the Fed can engage in another $1 trillion or so QE program, because at this rate the US will only issue a net ~$250 billion in debt in 2015 (before the demographic crunch takes the deficit to the moon again after 2016).

It thus means that if the Fed takes away a net $800 billion from the market in 2015 if it does in fact launch another massive, $1 trillion QE, then the Fed's ownership of the entire marketable US bond market, when expressed in 10 Year equivalent terms, would rise from the current 35% to somewhere just about 50%, in the process destroying any remaining liquidity that US bonds may have, precisely what the TBAC was complaining about last summer.

So anyone hoping that today's tumble is merely a precursor to more QE, think again. Then again, there is a simple loophole: just tell Obama and Congress to spend, spend, spend, as fast as possible. Traditionally, they have had zero problems with following this directive.

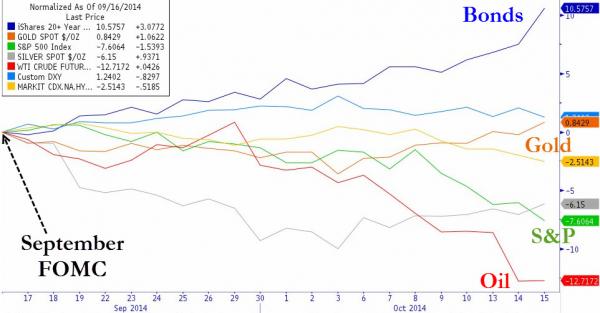

This Is What Happens, Janet, When You Take The Punchbowl Away

It appears the "Fed is ending QE because the economy is recovering" narrative is failing (as the world wakes up to the fact that The Fed is being forced to exit due to having broken the markets). In the September FOMC meeting, Yellen put the final nail in the QE coffin by confirming the money-printing would end in October. This is what has happened since then...

But, as we have noted numerous times before; the "taper" is all about economic cover for a forced move the Fed has to make:

1. Deficits are shrinking and the Fed has less and less room for its buying

2. Under the surface, various non-mainstream technicalities are breaking in the markets due to the size of the Fed's position (repo markets, bond specialness, and fail-to-delivers among them).

3. Sentiment is critical; if the public starts to believe (as Kyle Bass warned) that the central bank is monetizing the government's debt (which it clearly is), then the game accelerates away from them very quickly - and we suspect they fear we are close to that tipping point

4. The rest of the world is not happy. As Canada noted early in the year, and US monetary policy was discussed at the G-20

Simply put, they are cornered and need to Taper entirely; no matter how bad the macro data and we are sure 'trends' and longer-term horizons will come to their rescue in defending the prime dealers' clear agreement that it is time...

Bullard’s surprising suggestion to continue QE lifts markets

A comment from a hawkish Federal Reserve official on Thursday that bond buying should continue beyond its scheduled end lifted stock markets and surprised many observers.

The Federal Reserve should consider extending its bond-buying program beyond October due to the market sell-off to see how the U.S. economic outlook evolves, said James Bullard, the president of the St. Louis Fed, on Thursday.

At the moment, the Fed is buying $15 billion in securities each month, having tapered the QE3 plan by $10 billion at each meeting this year. The U.S. central bank has said it expects to end its QE3 program at the end of October, but Bullard noted that the plan was always data-dependent.

Bullard said the Fed cannot “abide” the recent drop in inflation expectations seen in the Treasury Inflation-Protected Securities.

“We have to make sure inflation and inflation expectations remain near our target. And for that reason, a reasonable response of the Fed in this situation...we could go on pause on the taper at this juncture and wait until we see how the data shakes out into December,” Bullard said in an interview on Bloomberg TV.

“If the economy is still as robust as I am describing it, then I think we could just end the program in December. But if the market is right, and this is portending something more serious for the U.S. economy, than the committee would have an option of ramping up QE at that point,” he said.

The S&P 500 SPX, +0.13% jumped up from its session low as Bullard’s remarks came out.

Bullard is the first Fed official to put the policy of a taper delay on the table, noted Laura Rosner, economist at BNP Paribas.

Although Bullard is seen as a hawk — pushing for instance for the Fed to liftoff interest rates in March 2015 — “he has always been highly sensitive to inflation developments,” Rosner noted.

Thomas Simons, economist at Jefferies, said he would be surprised if the taper delay idea gained traction, even among the doves on the Fed committee.

“It is possible that Bullard is hoping that simply talking about more QE will be enough to raise inflation expectations,” Simons said.

Forget QE4, Presenting QE5

Don't expect another round of QE: Boston Fed's Rosengren

Boston Fed President Eric Rosengren told CNBC on Friday he doesn't expect the U.S. economy to need another round of quantitative easing, but cautioned that he couldn't rule out the option.

"I don't expect that we need to," Rosengren said during an exclusive interview on "Squawk Box." "If the economy got weak enough that it was required, we should do it. I certainly hope and I don't expect that will be the case, but I can't rule anything out at this time."

Speculation over how the Fed will respond to volatility on Wall Street and to concerns over European growth has intensified after Wednesday's wild selloff.

On Thursday, St. Louis Fed President James Bullard helped calm markets when he suggested the central bank could pause the wind-down of its easy money policy and wait for more economic data in December. Both Rosengren and Bullard are nonvoting members of the Federal Open Market Committee, the Fed's policy-setting board.

During his CNBC interview, Rosengren added that Fed officials need time to fully process what's causing widespread turmoil in the financial markets before making a judgement on changing the pace of winding down the current round of quantitative easing.

"Financial markets have been quite turbulent," Rosengren said. "I would remind you though that just a couple months ago we were talking about how little turbulence there was. It's going to take us a little time to fully process what exactly is the reason for the turbulence."

Dimon talking what should be changed to avoid crisis?

He started to believe what his darling daughter wrote - the men is sick not just a thief bankster

Dimon talking what should be changed to avoid crisis? He started to believe what his darling daughter wrote - the men is sick not just a thief bankster

He does it for our "benefit". Maybe he plans to run for a president

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

For years, since the financial crisis, the Fed has used "Quantitative Easing" as a means of easing monetary policy.

Quantitative Easing (or "QE") is the process by which the Fed buys government bonds in order to push down yields, add liquidity to the market, and encourage holders of assets to move into riskier investments.

But QE is almost coming to an end. The Fed has been "tapering" its purchases of government bonds (reducing the amount it purchases every month) and the purchases are about to cease completely.

But suddenly the market is looking wobbly.

The dollar is surging, and the stock market is taking it on the chin. The Dow fell over 270 points today, the latest in a series of volatile days.

What's even more important than stocks is what the market is saying about inflation prospects. This chart shows the market's expectations of inflation over the next five years, and as you can see, it's been diving lately. In fact, it's nearly dropped to levels at which the Fed has done new easing in the past. Falling inflation expectations are cause for worry at the Fed .

But it seems very doubtful that the Fed will go back to the QE well (at least anytime soon).

Buying bonds is politically fraught, and there are perhaps unwanted side-effects, such as creating a shortage of safe assets out in the market. The Fed is very eager to put the QE era behind it.

So what's next?

Probably Verbal Easing (VE). This means using speeches and other official forms of communication to convince the market that the next rate hike won't be coming for a long time.

Our Myles Udland reported earlier about the forecast from BofA's Priya Misra:

For numerous political and economic reasons, it is highly unlikely the Fed would begin another QE program that includes asset purchases for some time, likely on the order of years, after finishing its current program. But breakevens are indicating that the Fed will have to do something to sate the market's expectations.

Misra writes that the Fed's method to ease in the coming months would most likely happen via "jawboning," or what some have called "verbal easing."

Misra writes that this could involve Fed officials refocusing the market's attention on inflation expectations — via charts like the one featured above — and suggest that the Fed could exercise additional patience before raising interest rates. Basically, the Fed would emphasize that it could keep rates, as the popular refrain has gone over the past few years, "lower for longer."

What you have to understand is that at any given time the market has a certain expectation for when the Fed will eventually raise rates. If the Fed can convince the market to recalibrate its expectations, and say move the rate hike prediction back since months, that's a form of monetary easing, without changing any official rate or buying any assets.

So watch for the next series of Fed speeches to focus on resetting market expectations about when the first Fed rate hike will come.

source