Hi Mrtools and Mladen,

Have you seen my little request please ?

Thanks a thousand times for your helps and all your work ![]()

Have a nice day

Zilliq

Hi Mrtools and Mladen,

Have you seen my little request please ?

Thanks a thousand times for your helps and all your work ![]()

Have a nice day

Zilliq

I do not see how RMI calculation can replace RSX calculation in the indicator (at least right now I do not see a way to do that and not to make a simple smoothed RMI). The calculating ways are not compatible

This is the result I got, but not posting it since it seems that in some situations it s not giving logical results

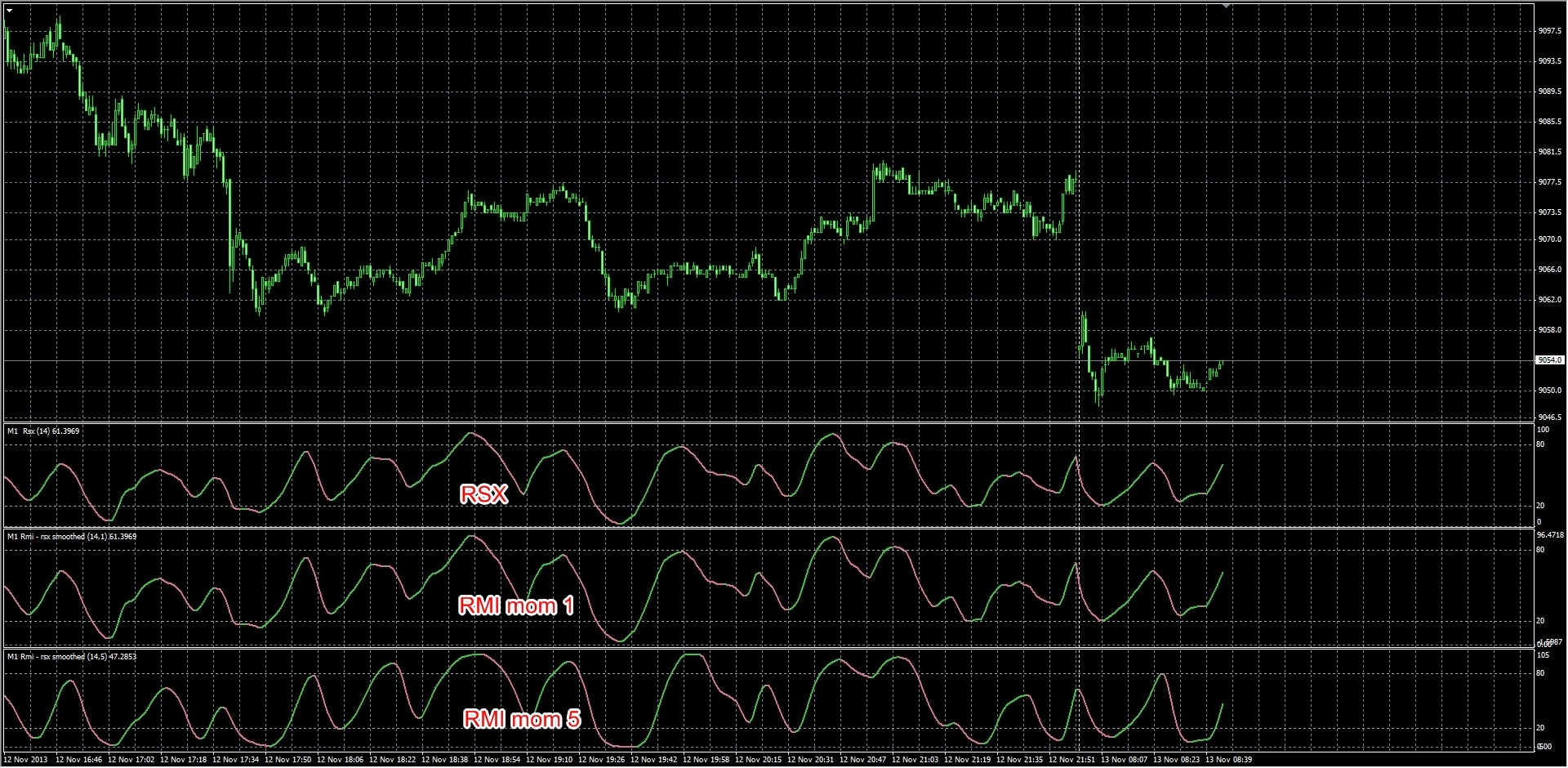

Changed the way it is calculated and here is the result. Upper is RMI using a part RSX calcualtion way, and lower is the original RMI. As you can see this is already closer to expected

Thanks a lot Mladen, you're right the smooth version seems to be better,

As you know we can calculate RMI like that:

hausse = max(0, close - close[a])

baisse = max(0, close[a] - close)

mmHausse = wilderAverage[p](hausse)

mmBaisse =wilderAverage[p](baisse)

RS = mmHausse / mmBaisse

RMI = 100 - 100 / (1 + RS)

If a=1 then we calculate the RSI and if a>1 we calculate a RMI (period of p)

If we change the wilder average by a Smooth average we obtain a RMI smoother (a>1), like on my picture above, like the RSI smoother (a=1)

So, we have perhaps 2 options to obtain a "perfect" "RMX":

1/ Add the "a" parameters in the RSX code to calculate the RSX of p period not with a=1, but a>1 (replace appliedprice by appliedprice [a])

2/ Change the wilder average by the RSX code/algo

Can you try this or may be have you already tried ?

Thanks a lot, always interesting to speak about code with you

Zilliq

Thanks a lot Mladen, you're right the smooth version seems to be better,

As you know we can calculate RMI like that:

hausse = max(0, close - close[a])

baisse = max(0, close[a] - close)

mmHausse = wilderAverage[p](hausse)

mmBaisse =wilderAverage[p](baisse)

RS = mmHausse / mmBaisse

RMI = 100 - 100 / (1 + RS)

If a=1 then we calculate the RSI and if a>1 we calculate a RMI (period of p)

if we change the wilder average by a Smooth average we obtain a RMI smoother (a>1) like the RSI smoother (a=1)

So, we have perhaps to options to obtain a "perfect" RMI:

1/ Add the "a" parameters in the code to calculate the RSX of p period not with a=1, but a>1

2/ Change the wilder average by the RSX code

Can you try this or may be have you already tried ?

Thanks a lot, always interesting to speak about code with you

I avoided wilders average simply in order to add less lag. The rest is the same as in original RMI calculation and instead of using wilders I used the smoothing that is used in RSX. But As I said, they seem to be incompatible - RMI smoothed the RSX way lags behind RSX in this way of smoothing

Grrrr, if RMI is incompatible with the RSX code/algo, we can't do nothing with that  Strange...

Strange...

For your RMI rsx smoothed above do you replace like me the wilder average by the smooth average we use for RSI smoother or not ?

If not, can you try to replace the wilder MA by the smooth MA of the RSI smoother, to compare and use it on MT4 like I use it on PRT

Thanks a lot Mladen, and now in France it's soon midnight and it's the good time to go to bed and sleep

Zilliq

Grrrr, if RMI is incompatible with the RSX code/algo, we can't do nothing with that

Strange...

Strange... For your RMI rsx smoothed above do you replace like me the wilder average by the smooth average we use for RSI smoother or not ?

If not, can you try to replace the wilder MA by the smooth MA of the RSI smoother, to compare and use it on MT4 like I use it on PRT

Thanks a lot Mladen, and now in France it's soon midnight and it's the good time to go to bed and sleep

No, the replacement is not the "smoother", but it is ran through normal RSX smoothing.

I tested it even with momentum period set to 1 and RMI still lags behind normal RSX calculation, so it seems that this way of making a hybrid of RMI and RSX is not giving expected results. It is not a bad indicator, but the lag compared to RSX is a bit too much when we already have a regular RSX

Hi Mladen,

Now I'm sure you're a robot

Because you work when I sleep, because I'm human

Well you do a great and wonderful job, this version works very well, thanks a thousand times as usual

On the picture above I compare RSX, RMI smoothed mom1=RSX, and RMI smoothed with mom=5

And ? You see that the first and second are quite the same, so you succeed in creating a "RMX" I think

This "RMX" is smoother than RSX with a log of only one candle as I see.

Can you explain how you do, because I read the code, but understand nothing...

Have a nice day Malden, you're incredible

Zilliq

Some hours later...

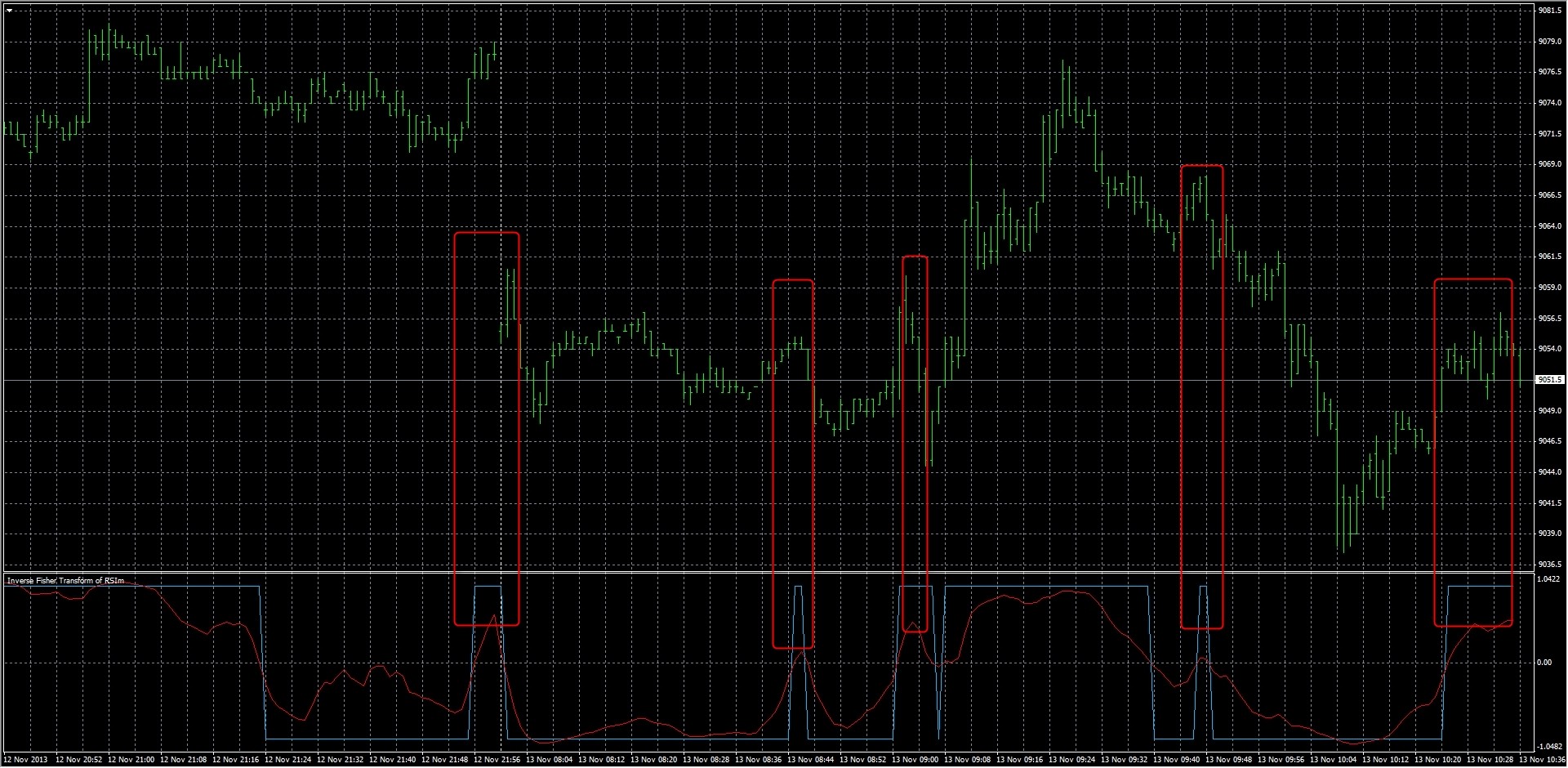

I try different things and it seems that it would be better to have an inverse fisher of this RMX because some times we aren't in the OB/OS zone of intervention, as the IFT of RMX would be (-0.9/0.9 for example)

When you will have time to do and try this ![]()

Thanks a lot for your wonderful work

Zilliq

Ps: Above an example of the interest of the IFT with the RSI to better detect the OB zone (for example)

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Hi guys, hi Mrtools and Mladen,

Please can one of you modifiy the RSX nrp MTF code of you MrTools to obtain an "RMX" (RMI with the algo of the RSX (not smooth with the Jsmooth code))

In another terms, can you add just one parameter "p" to have

appliedprice(p), not appliedprice(1), like with the RSI

if p=1 than we will have the RSX

And if p>1 it will be the "RMX"Why ? Because the RMI is ofter more responsive than the RSI, and I hope that the RMX will be more responsive than the RSX.

And as you will see in my picture (with the same parameters) the RMI smoother (by Jsmooth) (not a "RMX" because we haven't it on PRT), is smoother than the RSI Smoother

So, I hope that the "RMX" will be "better" responsive and smooth than the RSX

And can you modify the colors to have a color in the OB section, another in the OS section, and a third between, to have an "intervention" zone.

Thanks a lot for that and have a nice day

Zilliq

rsx_nrp_mtf_mrtools.mq4