ok thanks.

It is not over yet. They will squeeze some more before they start to bounce back

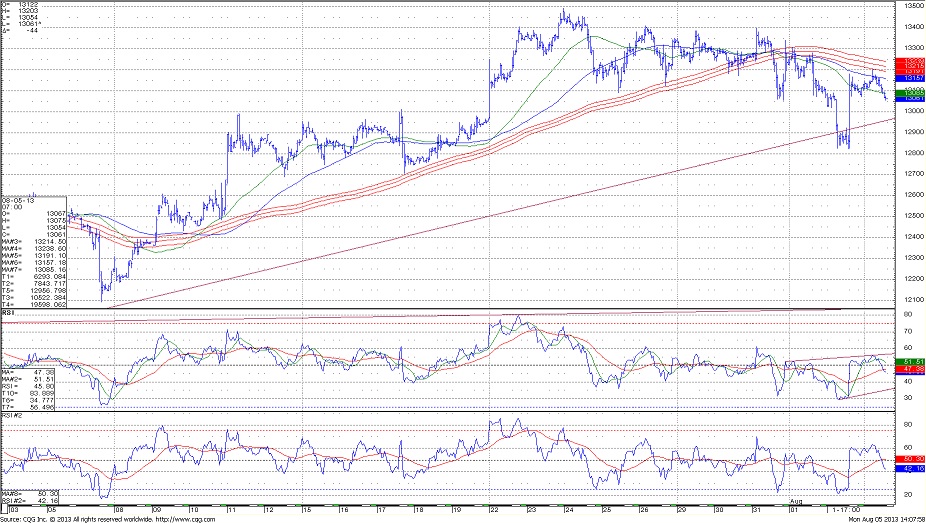

(1306,30) GOLD confirmed on Friday a negative closing in the weekly chart and also the daily one was negative however well off the lows and still above the 1300 level!

The indicators of the daily chart are still well positive but those of the weekly one remain below the line for now as well as those of the monthly chart where we have potential positive reversals. The indicators of the s/t charts are instead showing a mixed picture suggesting further consolidation. The drop toward 1282 formed divergences suggesting a negative tone. While below 1320,50 on an hourly closing we expect another test on the downside suggesting a s/t target at 1276,50!!

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Strategists at Deutsche Bank said much of gold's correction may have already happened, in a note on Monday. Gold has come down over 30% from a peak of around $1,900 an ounce in September 2011. "Lessons from history suggest that although gold-price losses have been extreme, the extent of the price correction today is still some way short of the percentage declines that occurred in 1980-1," said Michael Lewis and other strategists in a note. "However, we would classify events over 30 years as significantly different since at that time, U.S. short-term interest rates rose to 20% with real interest rates also rising rapidly." While they still see Fed policy as a strong headwind to gold returns, "it is possible that the major part of the gold price correction has already occurred," he said. Gold for August delivery rose $15.90, or 1.3%, to $1,228.40 an ounce on Monday.

source ...