IronFX - Market Analysis

06.03.2013

The Big Picture A better-than-expected service sector purchasing managers’ index (PMI) from the US, the highest reading in a year, propelled the Dow Jones average to a record high yesterday. The divergence between the US and Eurozone continues; although the final estimate for the Eurozone composite PMI came in above the earlier flash estimate (47.9 vs 47.3), it was still below January’s reading of 48.6 and therefore signalled a further downturn in business activity, in contrast to the US. Markit estimated that the Eurozone figures were consistent with a 0.2% fall in Eurozone GDP.

One key takeaway from the European PMIs is that the divergence between Germany and France is the widest in the 15-year history of the survey, and France is by no means the weakest country in the Eurozone. So the question of whether Europe overall can get back to growth basically boils down to whether Germany can grow enough to offset the weakness elsewhere, which seems unlikely. Next month’s PMIs should be even more interesting as they will take into account the uncertainty caused by the Italian crisis.

Getting back to the record US Dow index, the correlation in weekly changes between the S&P 500 and the DXY index are -43%, meaning that “risk on” tends to be negative for the dollar, but not that strongly. This perhaps explains in part why the dollar’s rally has stalled. Note though that this relationship is hardly constant; it was -71% last August. With bond yields around the world at similar levels, capital flows may be determined more by equity markets than interest rate differentials, and the US market is likely to outperform Europe this year. “Risk on” could switch to being USD-positive if equity flows begin to dominate.

Another reason for USD weakness is probably growing confidence that Italy can avoid disaster. The country’s stock market was up 2.8% yesterday (vs 2.4% for the Eurostoxx) and the BTP spread over Germany came in by 17 bps (although at 329 it’s still 41 bps wider than it was before the election). There is talk that the 5 Star Movement might simply walk out of the Senate if they take a confidence vote. That would lower the threshold for achieving a majority and make it easier to secure enough backing for a new government. Of course a resolution of the stalemate there, even one that resulted in a weak minority government, would be better for EUR/USD than the current uncertainty.

The Eurozone GDP numbers out today will be the details of the flash estimate and may be informative but not market-moving. In the US, the ADP Employment figures will be watched closely ahead of Friday’s non-farm payrolls, even though they aren’t a very good predictor. Factory orders and the Beige Book will also be a focus of attention; the market is looking for a drop in factory orders.

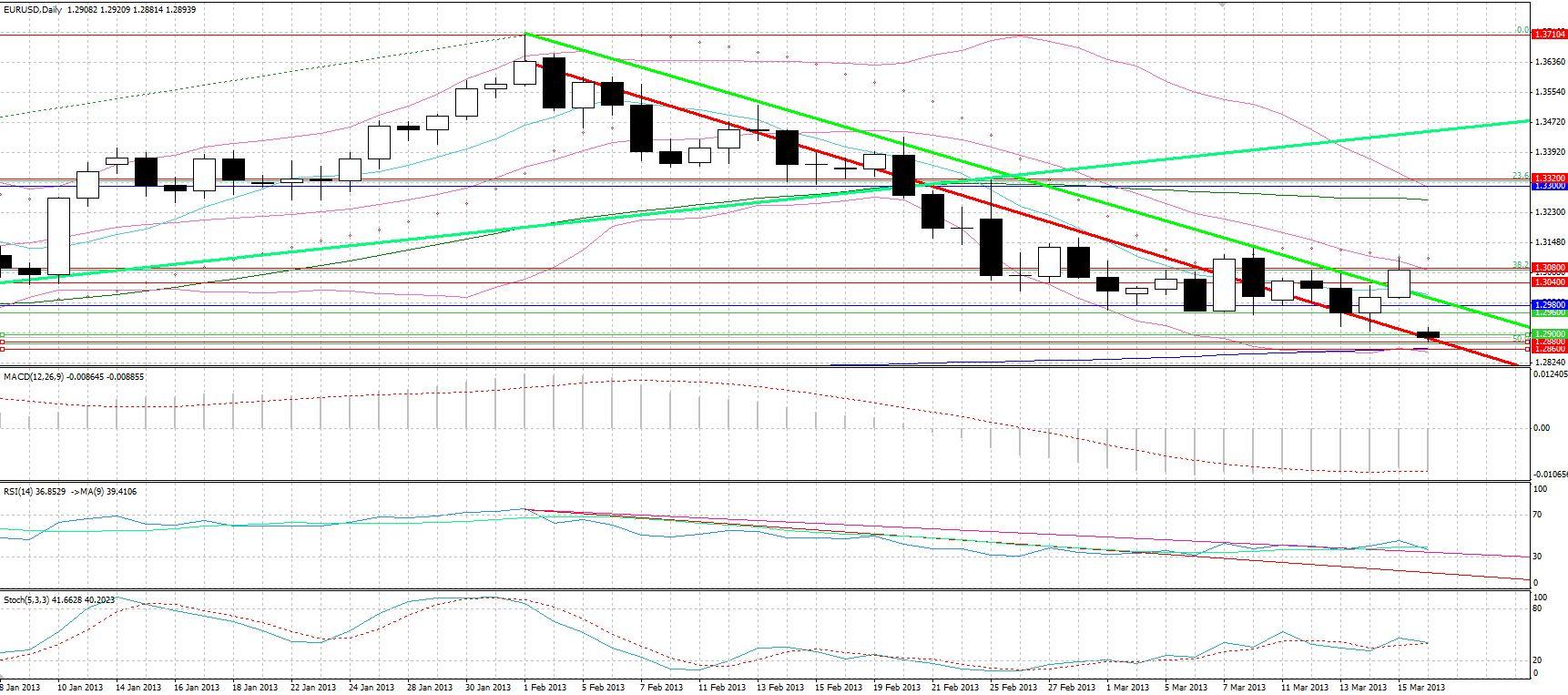

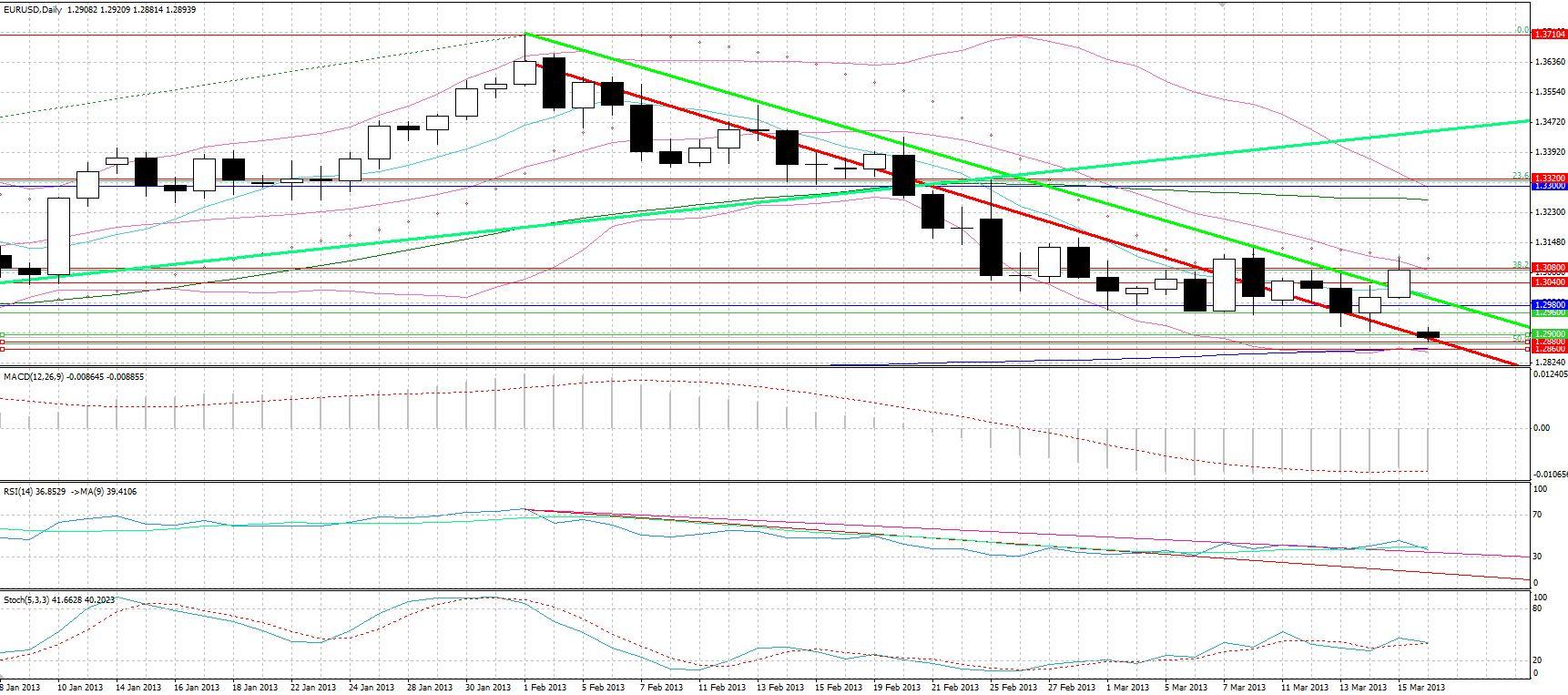

The MarketEUR/USD

• Some modest confidence seems to be coming back into EUR/USD as the panic over Italy subsides. Since the market seems unwilling or unable to take it under 1.30 for very long, it seems more likely to move slightly higher.

The pair is on the verge of an RSI-9-day MA crossover as well as a crossover in Stochastics, although both on a low slope. Rather strong closing resistance today looks to come at 1.308, given the overlap of the 38.2% retracement level of the July-February up move and the downward sloping trendline. We do not see the resistance being broken today, anticipating little movement on the pair today, ahead of the very likely market-moving news from the Eurozone and the US tomorrow and on Friday respectively.

USD/JPY

• The yen is probably on hold until 4 April, when the new Monetary Policy Board under the likely Gov. Kuroda makes its move.

The political tensions in Italy have curbed the yen’s decline for now, but that is subject to change without notice. If fears over Italy fade further, then the euro would gain vs the dollar and the dollar would gain vs the yen, meaning that EUR/JPY would be a leveraged way to play the recovery scenario in Italy.

USD/JPY recovered some of its morning losses later in the session, closing slightly lower, adding to the predominantly sideways trending we have had the past month. As noted yesterday, we see a likely testing of the 92.2-92.5 trendline support, before price rebounds again to preserve the long term bullish outlook and the upward trend.

USD/SEK

• The Swedish krona was supported by a sharp rise in the service sector PMI to 54.6 from 52.6 in January, as new orders and employment made a big contribution. This suggests that the strength of the SEK isn’t hurting the economy that much, including the employment situation. Also there was a Riksbank report saying that the country’s monetary policy hasn’t increased unemployment as much as one of the dovish members of the monetary policy board has argued, which diminishes the strength of his argument for a rate cut.

With the USDSEK essentially meeting the two-day 6.366 target we placed 2 days ago, we feel the need to revisit the pair. Given the resistance at the 61.8% retracement level of its May 2011-June 2012 and the completion of the RSI-9-day MA crossover, our view remains bearish in the long term. Nonetheless, we may find intraday support at 6.335, the former upper trendline of the downward channel, with some continuation pattern forming thereafter before the bearish trend continues, possibly driving prices to 6.281 next week.

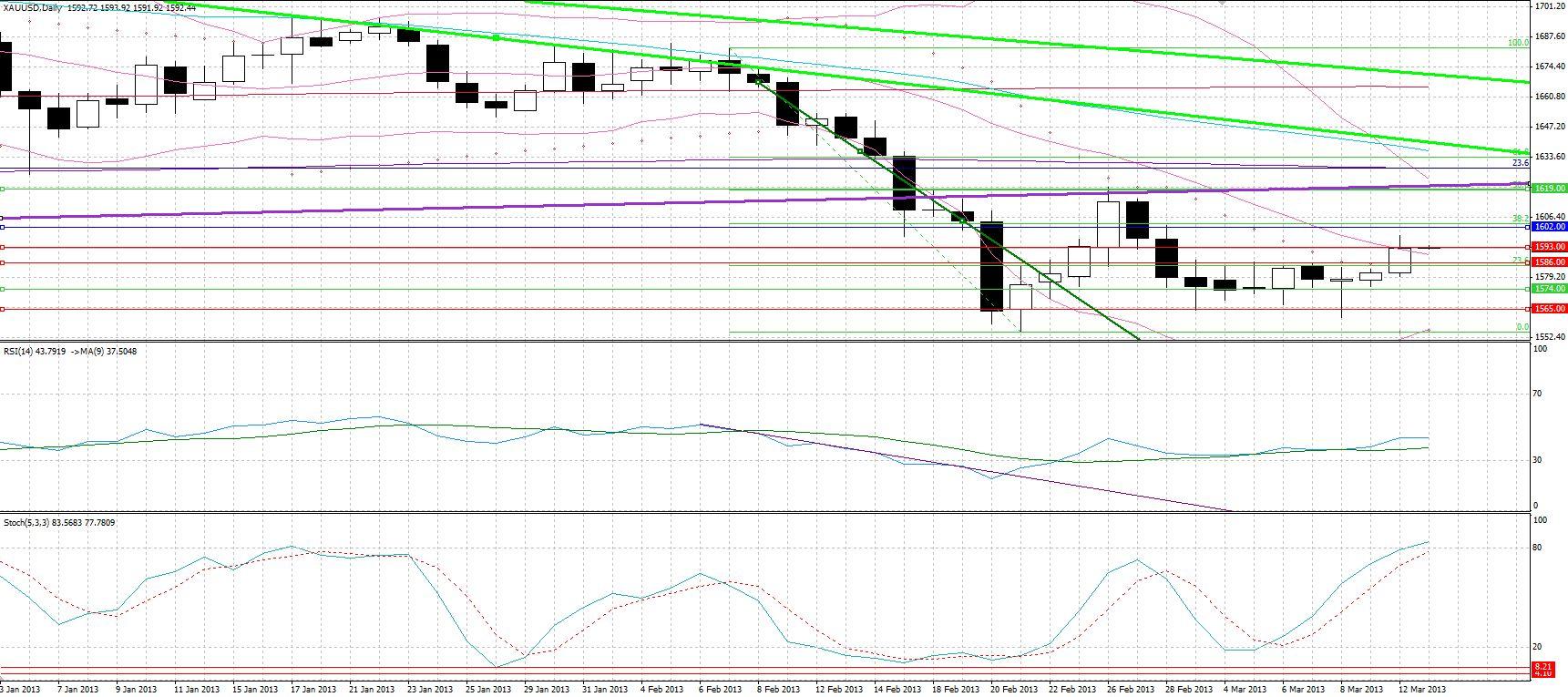

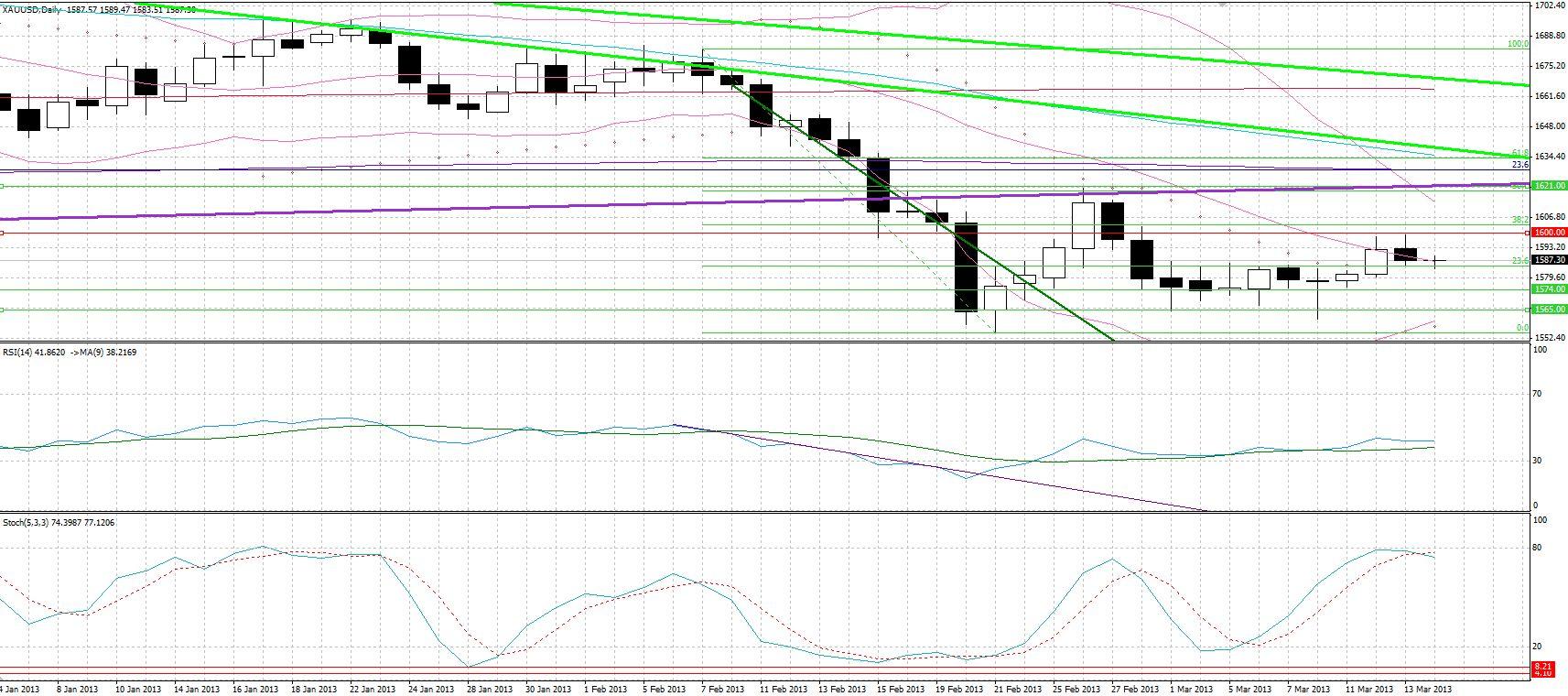

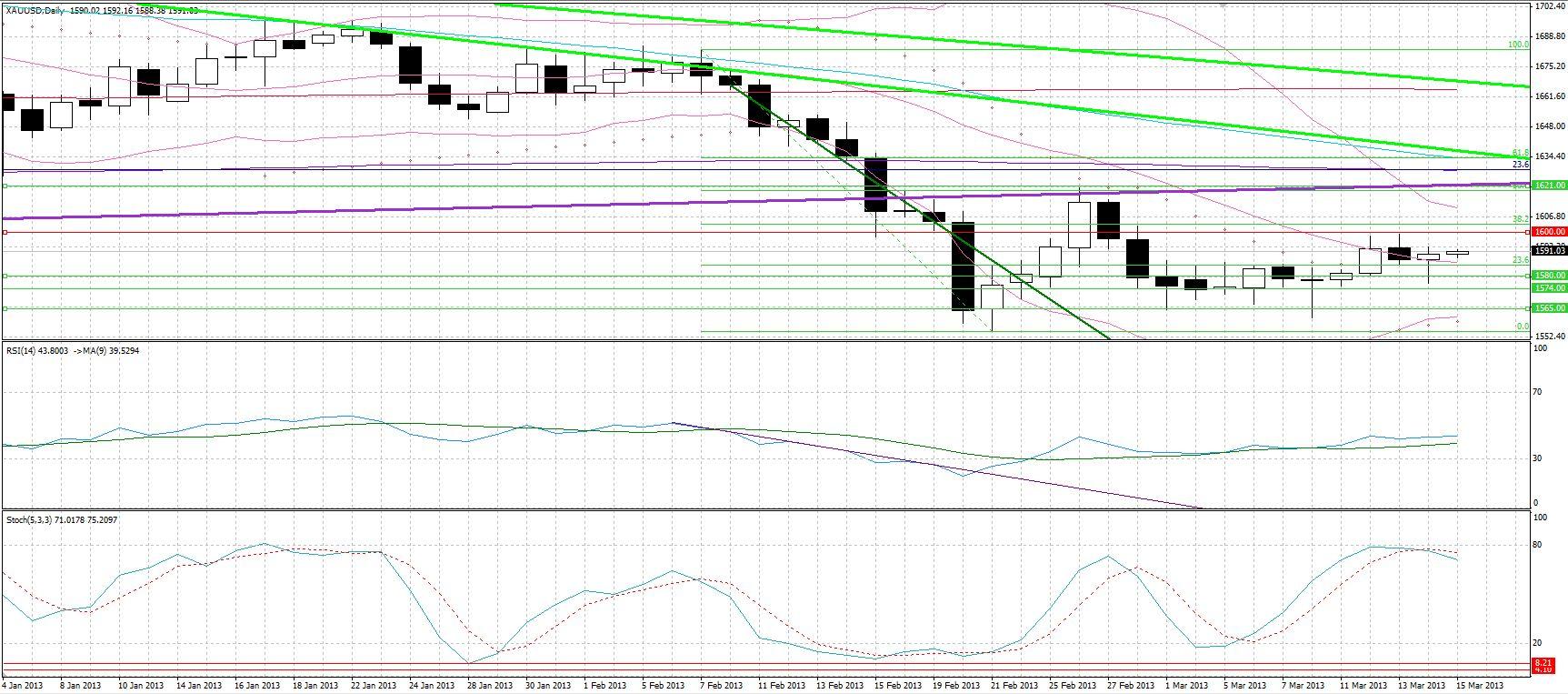

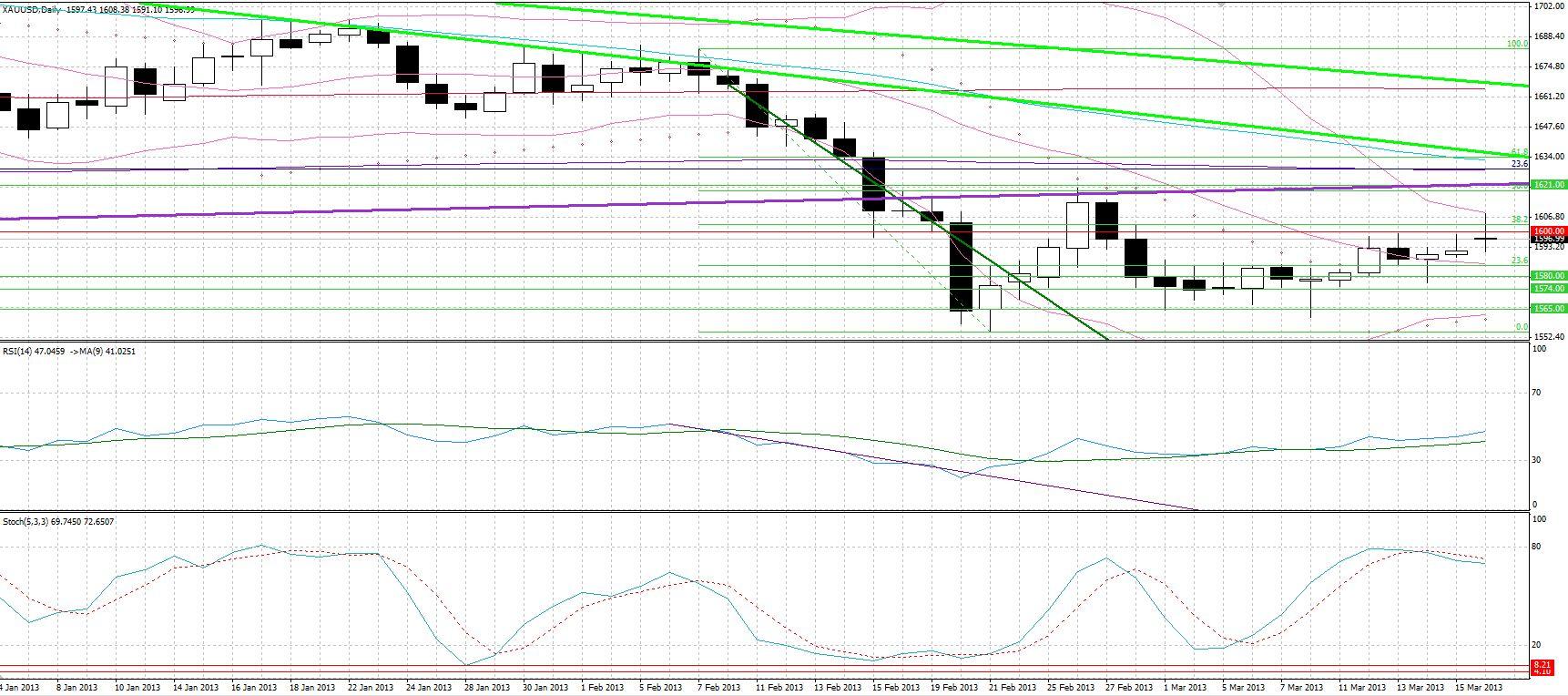

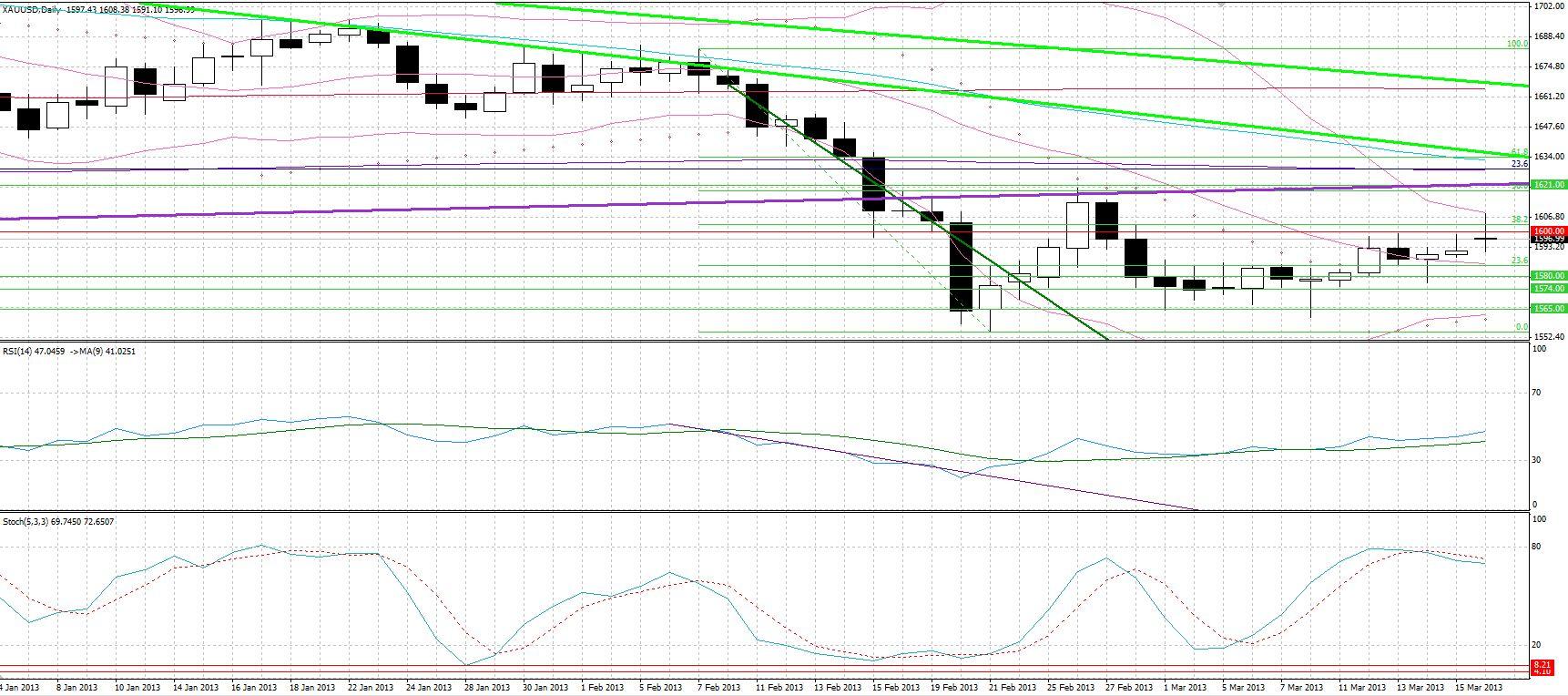

Gold

• Gold was little changed in choppy trading with no major news specific to the sector.

Gold hit the $1586 target, before closing almost unchanged. The asset is likely to hit $1586 again, which has acted as resistance a number of times the past couple of weeks. Nonetheless, traders may want to note that any bullish positions on gold should be closely monitored, with definite targets as the longer term outlook on the precious metal is bearish.

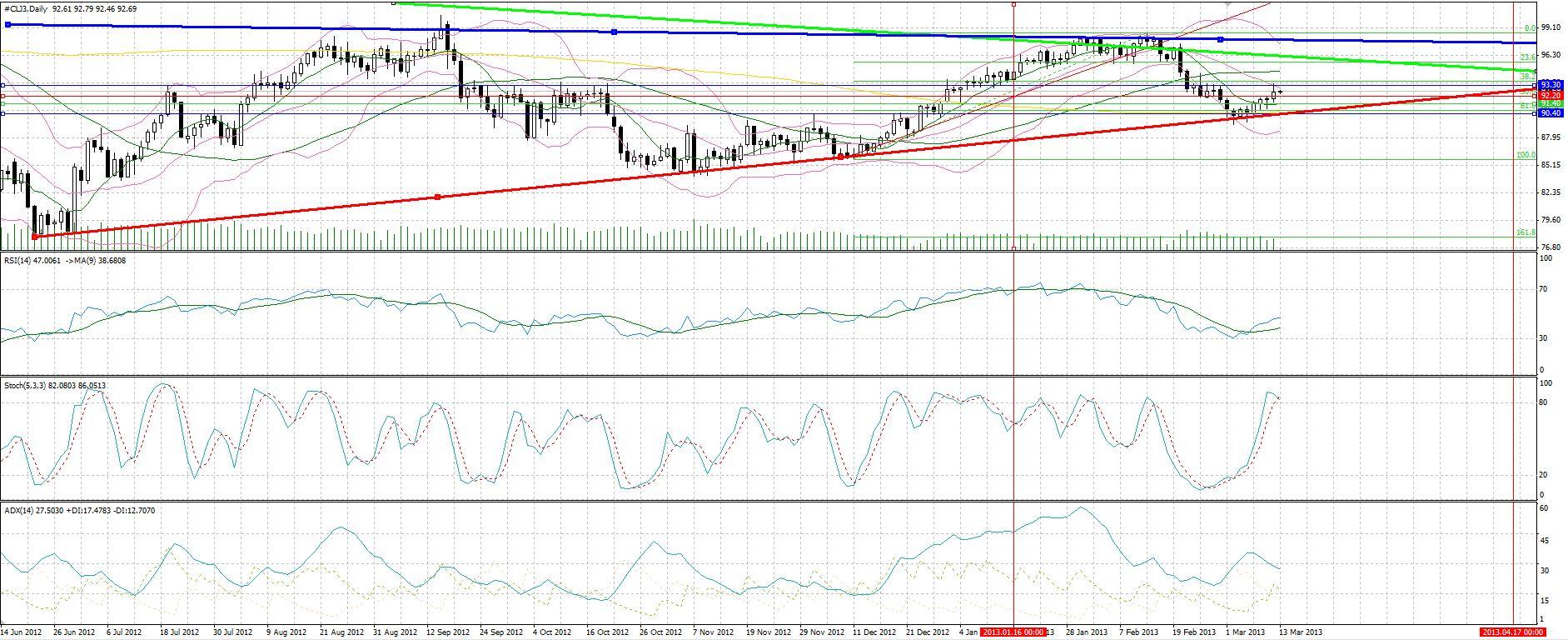

Oil

• Oil was slightly higher following Hugo Chavez’s death. The country has the 2nd largest oil reserves in the world (highest verified reserves), after Saudi Arabia. But under Chavez, Venezuela’s oil production fell 30% even while production elsewhere in the world surged, including the US. Venezuela now has much less impact on the world oil market than it used to, but is still a major provider to the US. Any disruption in supplies to the US due to political turmoil after his death could send prices higher.

The noted $90.5-$91 resistance level is being tested. A break out from this level may see prices climb to $92.1-92.2, close to the 50% retracement level of the mid-December-mid-February up move. Nonetheless, we see any gains on the commodity being short-lived with the overall bearish pattern continuing.

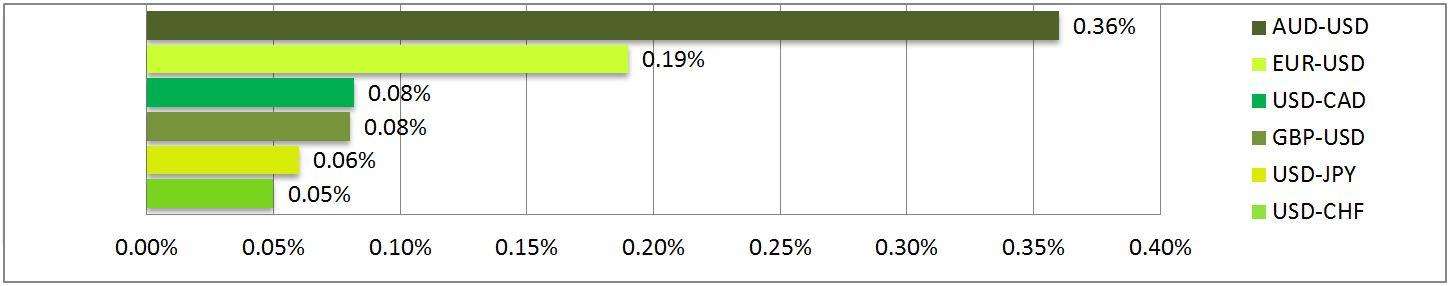

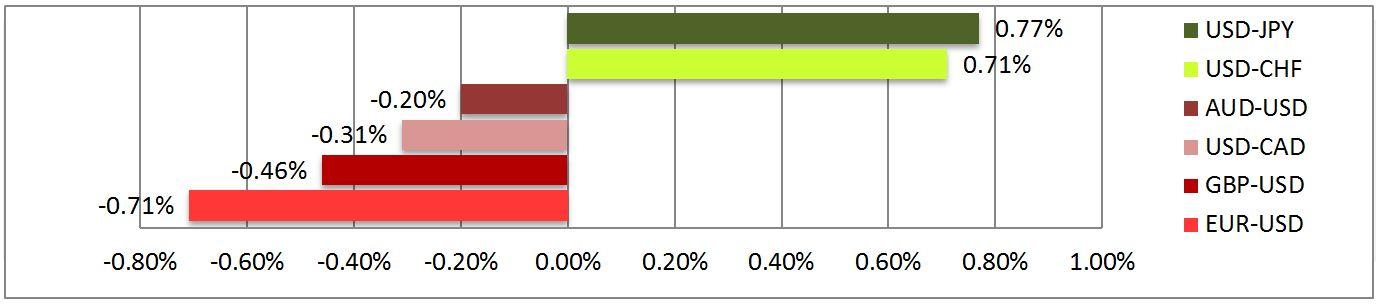

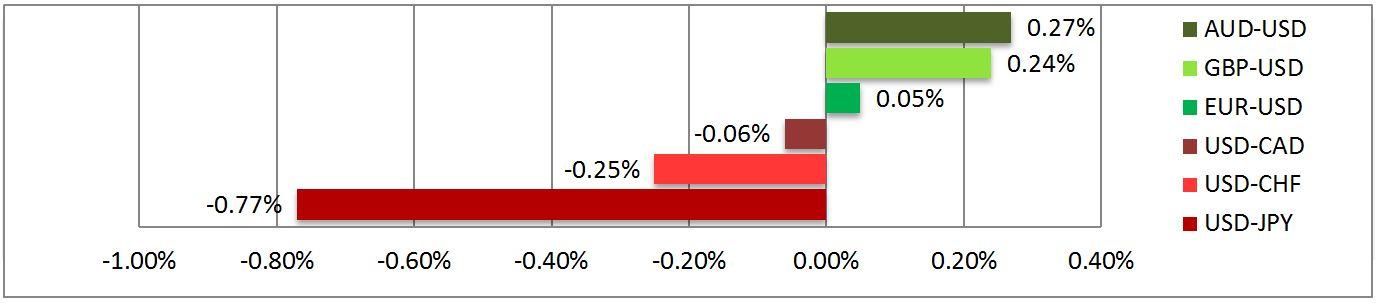

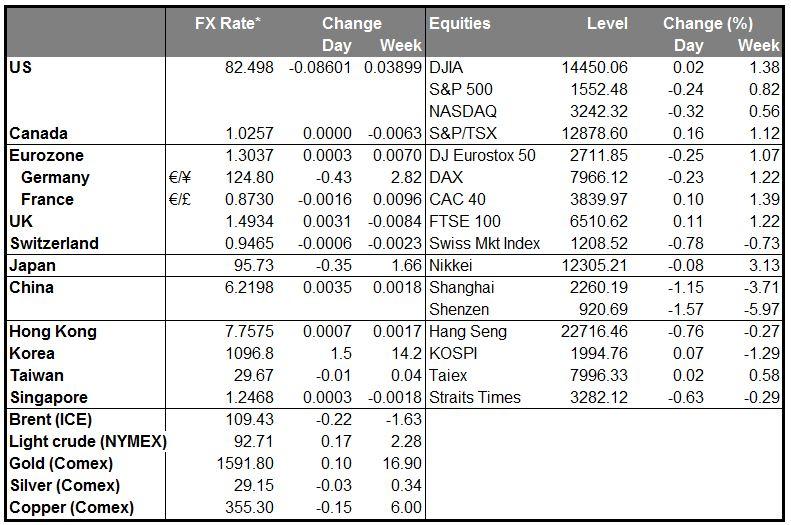

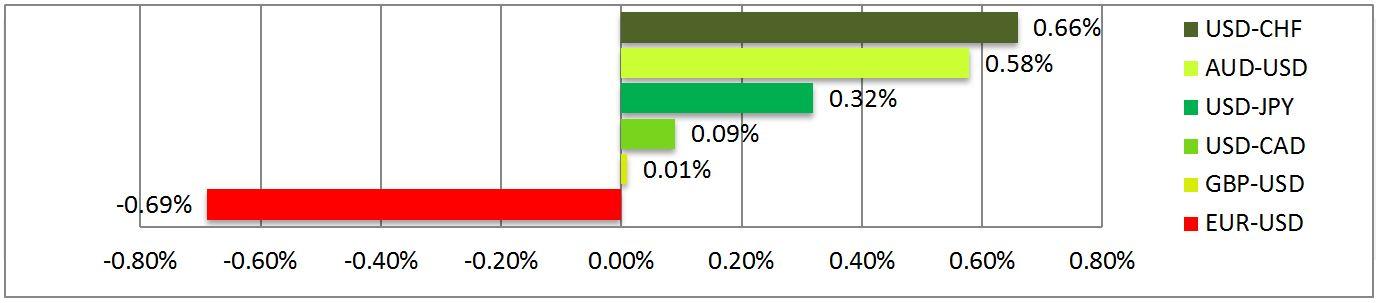

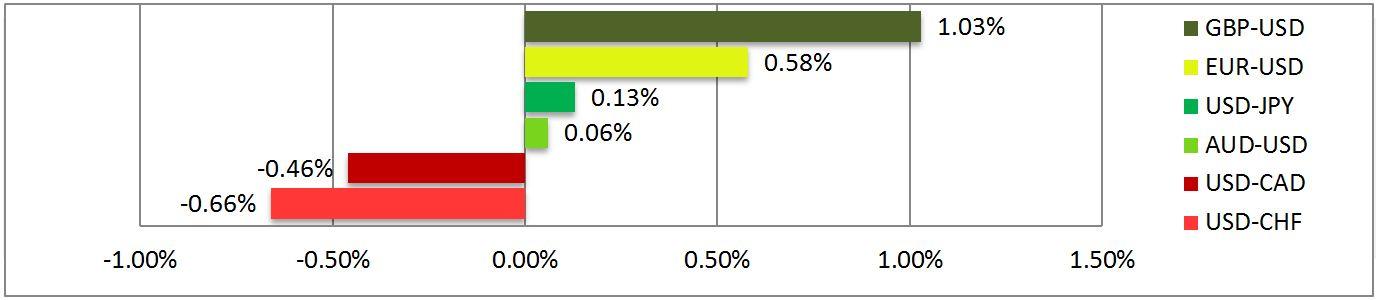

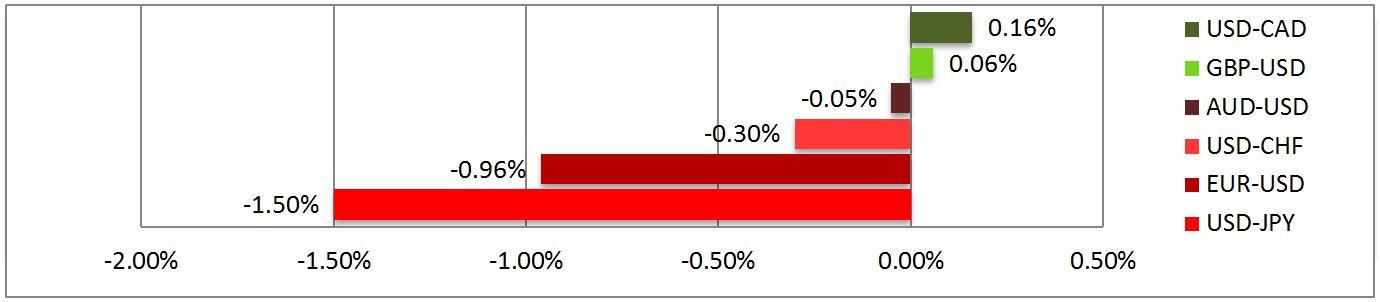

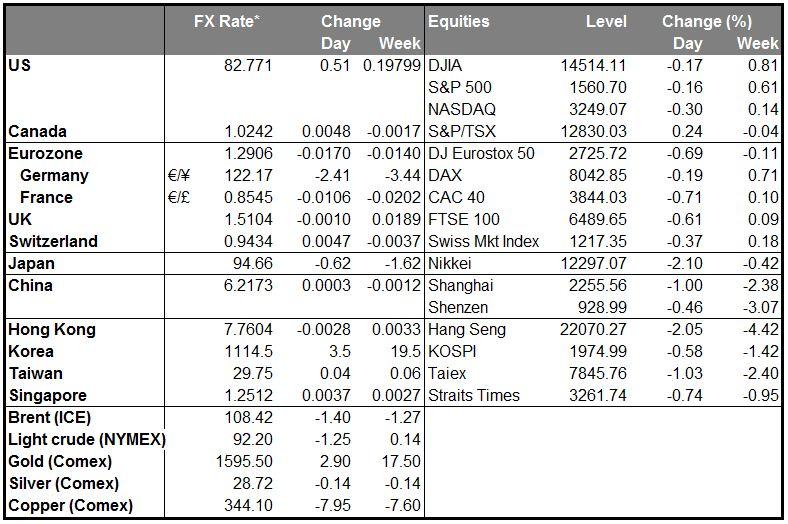

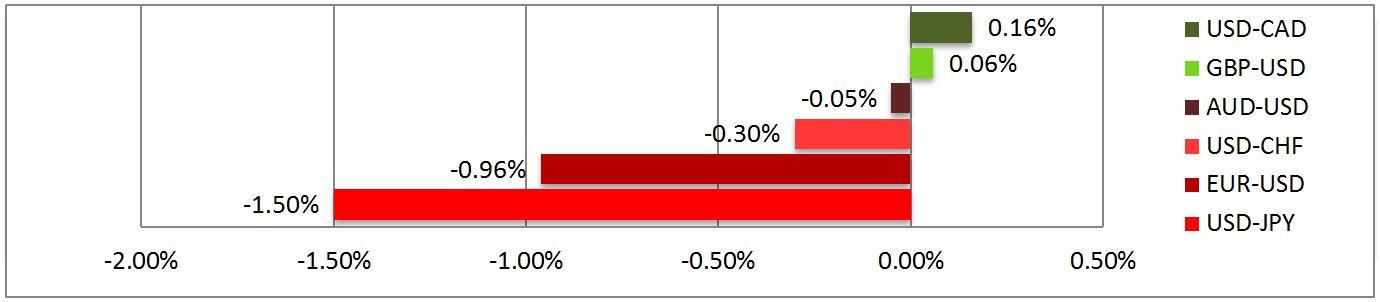

BENCHMARK CURRENCY RATES - DAILY GAINERS AND LOSERS

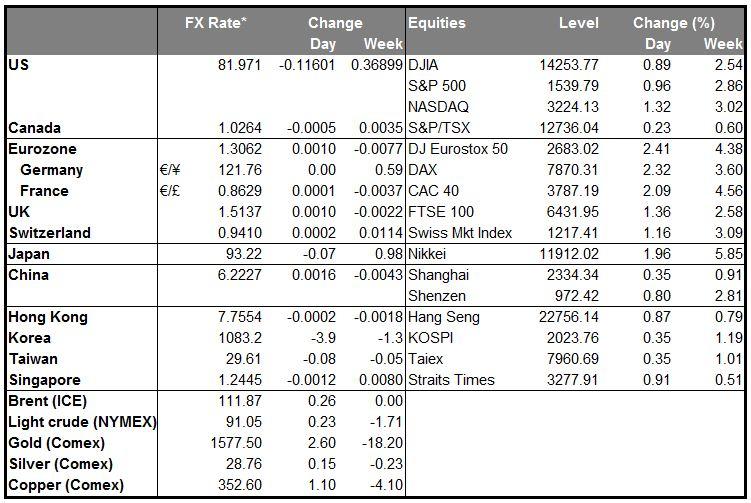

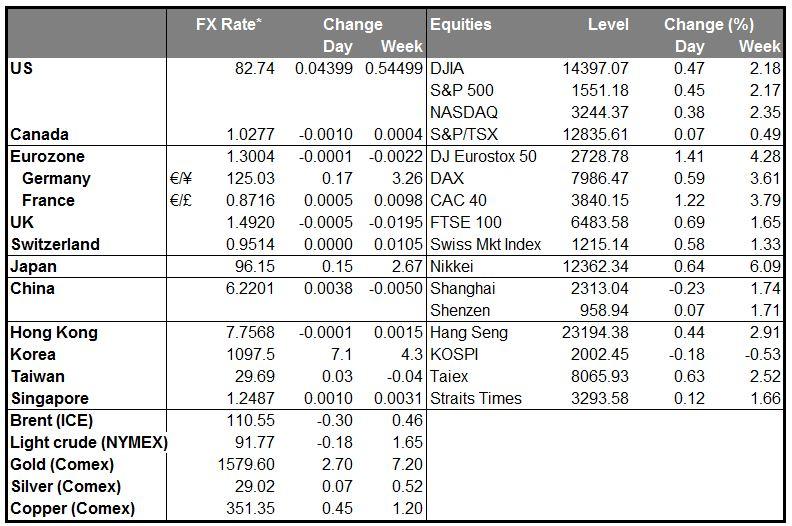

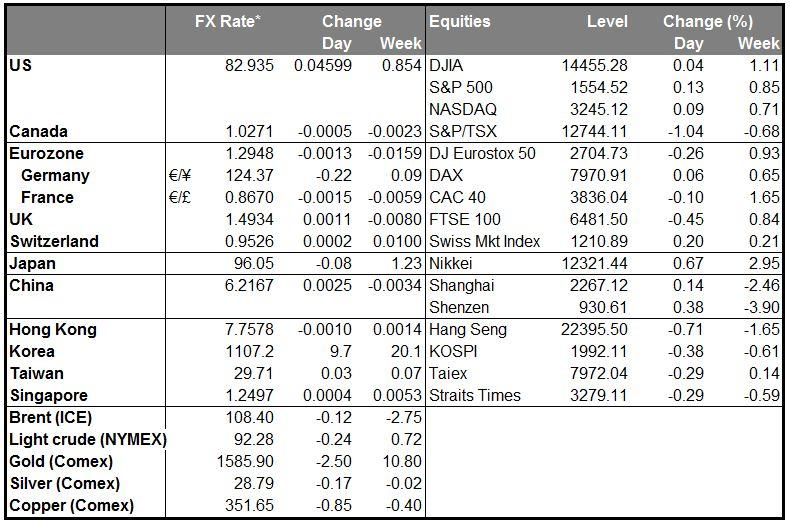

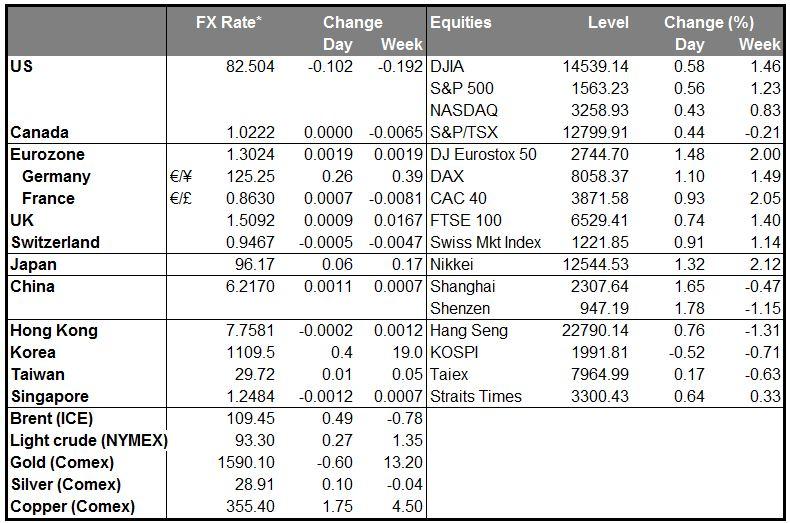

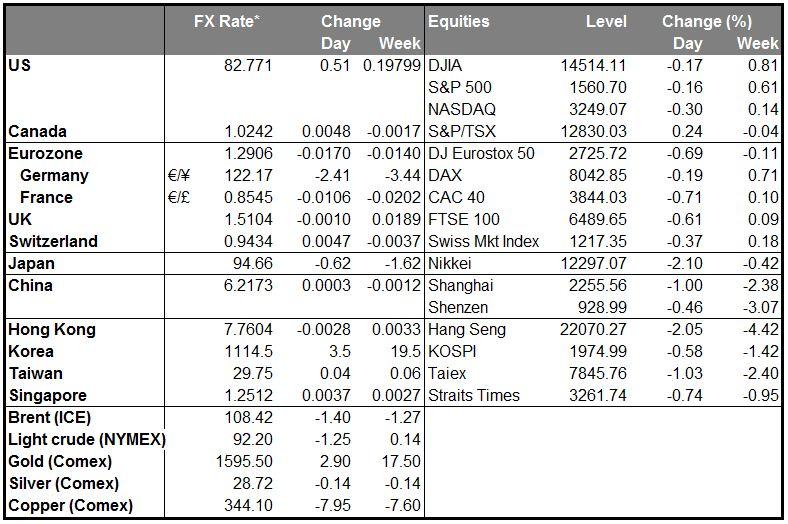

MARKETS SUMMARY

Disclaimer:

This information is not considered as investment advice or investment recommendation but instead a marketing communication. This material has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and that it is not subject to any prohibition on dealing ahead of the dissemination of investment research. IronFX may act as principal (i.e. the counterparty) when executing clients' orders. This material is just the personal opinion of the author(s) and client's investment objective and risks tolerance have not been considered. IronFX is not responsible for any loss arising from any information herein contained. Past performance does not guarantee or predict any future performance. Redistribution of this material is strictly prohibited.

Read less

Market Analysis 07-03-2013: “The end of “risk on = sell USD”

07.03.2013

The Big Picture The USD rose against most currencies even as US stocks continued to rally (DJIA at a record high, S&P 500 up six out of the last seven days). A firm ADP employment report helped to raise expectations for Friday’s payrolls data and gave a good tone to the market despite a fall in factory orders, which in any event was better than expectations.

The “risk on = sell USD” relationship seems to have ended, which means that some other currency – probably the yen and perhaps GBP -- will be used as a funding currency. While GBP short rates are about 20 bps higher than US rates right now, there is virtually no chance of a UK rate hike in the foreseeable future, indeed quite the contrary, and besides, the small rate differential is nothing compared to the potential depreciation in the currency. The return of the “yen carry trade” and perhaps the addition of the “sterling carry trade” should allow USD to rally further.

The Bank of Canada kept interest rates unchanged and BoC Gov. Carney softened his hawkish outlook somewhat, which sent USD/CAD higher. BoC is the only G7 central bank that is warning about a rate hike.

Today will be a big day in Europe: the Bank of England (BoE) and the European Central Bank (ECB) both hold policy board meetings. Neither is expected to change rates, so the focus will be on ECB President Draghi’s comments after the meeting. We think he’s likely to take a dovish stance in order to keep the euro from strengthening. In that respect, the market will be particularly watching to see any change in his views on inflation. In the US, the Fed will release the first of two reviews of bank capital adequacy under stress test scenarios, which could affect the outlook for lending. The weekly initial jobless claims will also be a feature.

The Market EUR/USD

• European stock markets were higher, peripheral bond spreads narrowed further, and Spain is confident enough of investor demand that it is considering issuing another 10-year bond. Even Greek economic sentiment improved. Yet EUR/USD couldn’t make any progress: bearish news for EUR/USD.

The pair confirmed the strong resistance highlighted at 1.308, failing to even spike above this level. The fear of false signals by the Stochastics and RSI-MA crossover was also validated during a larger than anticipated down move, with the pair closing near its lows, finding support at the noted 1.296 level. We now see resistance in the 1.3055-1.308 area but are in favour of bearish positions. Dovish comments by Draghi today may see the rate move to the 1.288-1.29 area.

USD/JPY

USD/JPY moved higher after two members of the Monetary Policy Board proposed various easing measures to start immediately, rather than waiting until the new management is in place at the next meeting. The proposals were defeated by majority vote, but they show that the new Governor already has two allies on the Board. Kuroda + Iwata + these two members = four out of the nine-member board. Kuroda only needs to convince one other member and they’re off! USD/JPY bullish.

The proposals caused a larger than average increase on the rate, with a mini retracement to 92.5 not materializing. With prices seeming to find resistance in the 94.2-94.5 area, we would like to see a breakout from this level before proceeding with bullish positions, noting a target thereafter of 97.6 and a subsequent one at 100.

GBP/USD

The pound weakened ahead of today’s BoE Policy Board meeting. There’s some risk that they will raise their target for QE bond purchases; 11 out of 39 economists surveyed by Bloomberg thought that they would as a majority on the Board now think that the economy needs some new stimulus. Maybe a weaker pound? We remain bearish GBP/USD.

Cable looks like it is in uncharted territory, hence the need for a zoomed-out chart. With our intraday target of 1.5108 being met on March 5th, and with the subsequent one at 1.504 met yesterday, it is worth revisiting the pair. The rather sideways action we have had the past couple of weeks, with resistance at the 61.8% retracement level of the the May 2010 – April 2011 uptrend point to a continuation pattern. We thus see further Sterling weakening, placing an intraday target of 1.4920, with a subsequent one at 1.4860 as we look to the fulfillment of our longer term target of 1.4700.

Gold

• Gold was up slightly, but I notice a big increase in the number of press articles that I read asking “is the rally over?” With USD rising, Eurozone risks fading and no new QE measures likely from the US for now, retail investors are moving out of gold and into stocks, which are getting most of the attention.

Gold essentially hit our $1586 target again, finding noted resistance at this price. Given the increased uncertainty we often experience before major announcements and news, we may see further temporary gains for the precious asset over the next couple of days. A break of the resistance level may call for bullish positions with a target of $1602.

Oil

• Oil lower yet again as inventories in the US rose almost five times more than the market expected despite a fall in imports.

WTI yet again found resistance at $91, with the early gains following the death of Venezuelan President Hugo Chavez being indeed short-lived with the bearish trend enduring. Although we see further weakening for the commodity in general, sentiment in the daily, H4, and H1 charts signal a possible retesting of the $91 level today.

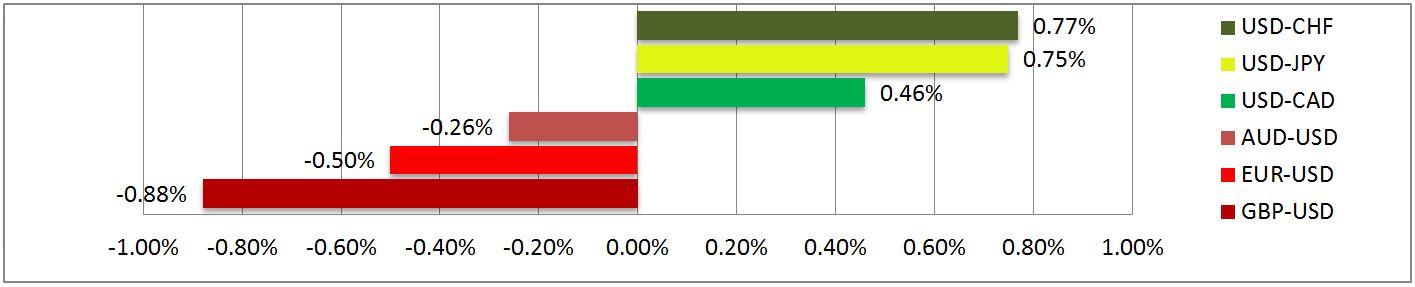

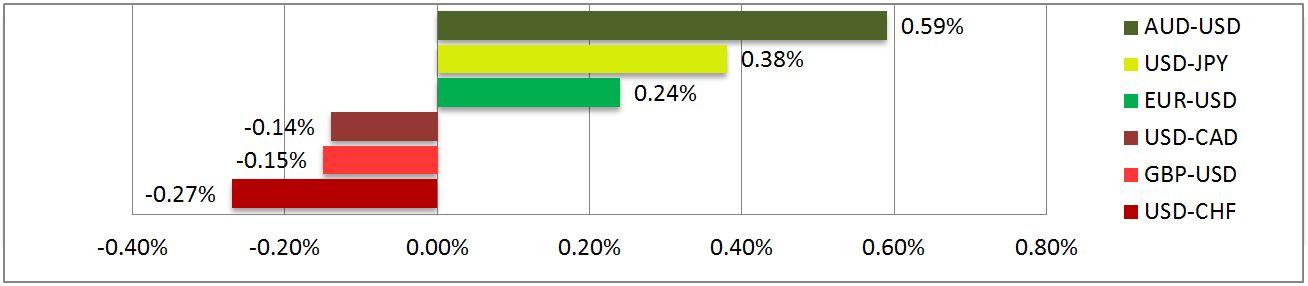

BENCHMARK CURRENCY RATES - DAILY GAINERS AND LOSERS

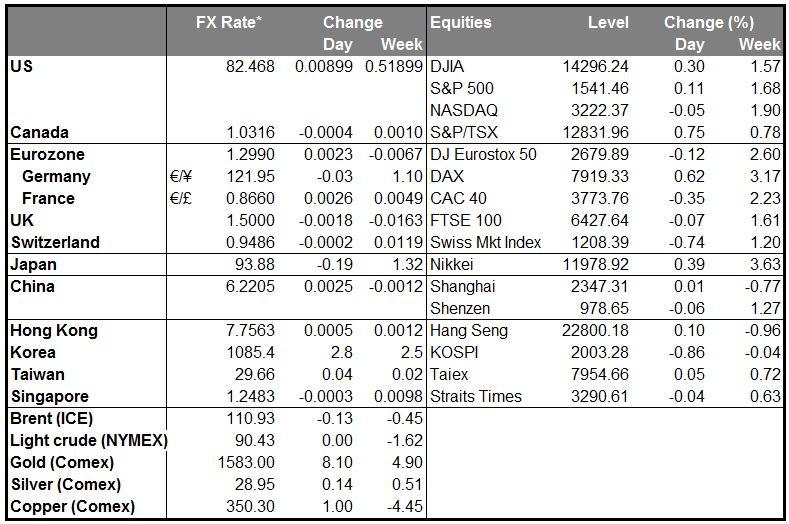

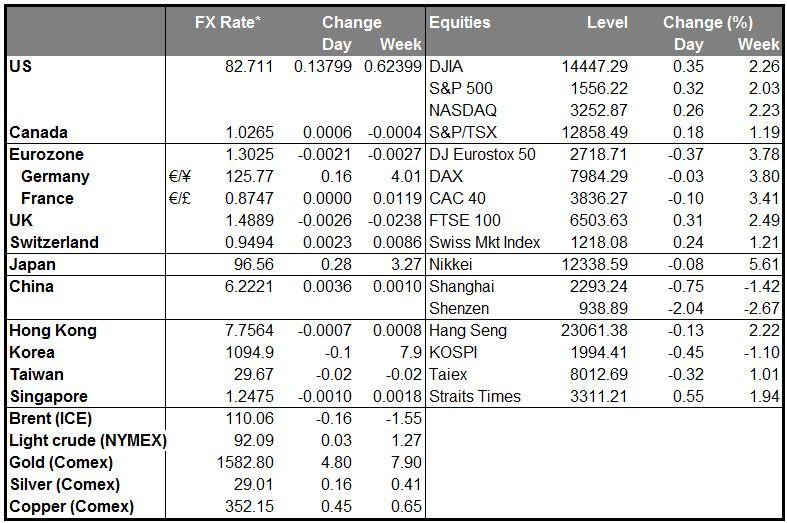

MARKETS SUMMARY

Disclaimer:

This information is not considered as investment advice or investment recommendation but instead a marketing communication. This material has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and that it is not subject to any prohibition on dealing ahead of the dissemination of investment research. IronFX may act as principal (i.e. the counterparty) when executing clients' orders. This material is just the personal opinion of the author(s) and client's investment objective and risks tolerance have not been considered. IronFX is not responsible for any loss arising from any information herein contained. Past performance does not guarantee or predict any future performance. Redistribution of this material is strictly prohibited.

Read less

Market Analysis 08-03-2013: Central Banks on hold

08.03.2013

The Big Picture Despite the flux of dovish statements yesterday by ECB President Draghi, the euro gained versus the dollar. Although the ECB kept rates on hold, it did consider a rate cut in light of the sluggish Eurozone recovery, which forced a downward revision of growth and inflation forecasts. The market focused on a) his statement that the economy will stabilize later this year, b) that "people underestimate the amount of political capital invested in the euro”, and perhaps most importantly c) the fact that he did NOT repeat his statement from last month that the euro poses a downside risk to inflation. That is important because the ECB is only worried about inflation, not the level of the euro, but if a strong euro is going to push inflation down too far, the ECB can take action to prevent the euro from strengthening. On the contrary, he reminded people that the exchange rate is not a policy target and that anyway the exchange rate is near its long-term average, thus not at a rate that should cause concern.

The Nikkei 225 reached pre-Lehman Brothers levels, as the yen continued weakening. The minor economic growth in Japan shown yesterday did not boost the yen as the main topic of concern in the country is deflation.

The Bank of England kept its rates unchanged and maintained its target for quantitative easing at 375 billion pounds. With 26% of surveyed economists forecasting an increase in the stimulus programme yesterday, we may be seeing a change in BoE policy before the change of the BoE Governor in June to avoid a triple-dip recession.

The MarketEUR/USD

• The U.S. nonfarm payrolls is usually the biggest market-moving economic indicator for the pair; traders should anticipate increased volatility, especially following the major euro gains yesterday.

The euro gains are likely to be short-lived. We see a pull-back today towards the trendline violated yesterday, at 1.3035, in light of anticipated strong U.S. nonfarm payroll data. Meeting this initial intraday target may then call for positions that will complete the reversal of yesterday’s move to 1.296.

USD/JPY

• The dollar gained considerably versus the yen, reaching a 3.5 year high, on speculation that improvements in the labour market may force the Fed to decrease or even stop its QE stimulus. With Japan, on the other hand, forecast to increase its own asset-buying policies as, according to forthcoming BoJ Governor Kuroda, the current purchases are insufficient to achieve the 2% inflation target, there are fundamentals driving the pair higher from both directions.

With a break of the 94.5 level resistance level, we are again in favour of bullish positions, eyeing 97.6 before Kuroda takes over on March 20, with a one-month resistance level coming at the 100 mark.

GBP/USD

• With future BoE Governor Carney expected to be handed more powers by the Chancellor of the Exchequer Osborne, we see further Pound weakening.

Cable failed to sustain its early gains yesterday following the unchanged monetary policy decision by the BoE, closing slightly lower. We see further weakening, looking to a fulfilment of yesterday’s intraday target of 1.4920, with a subsequent one at 1.4860 as we gradually look to approach our longer term target of 1.47.

Gold

• Gold is trading lower on speculation that the U.S. nonfarm payroll figures later today will show less of a need to add to the post-financial crisis stimulus that caused the major bull run on the safe haven since 2008.

Gold yesterday failed yet again to break the $1586 resistance level trading slightly lower. With the return of a universal “risk-on” sentiment evidenced by the consecutive new highs in stock indices across the globe, we see less of a need to hold the zero-coupon asset, eyeing longer-term bearish positions.

Oil

• WTI gained following the lowest U.S. unemployment benefit applications in six weeks, narrowing the gap from Brent.

With the U.S. budget woes look to be put aside for now, we may see oil gaining further today towards 92.2.

BENCHMARK CURRENCY RATES - DAILY GAINERS AND LOSERS

MARKETS SUMMARY

Disclaimer:

This information is not considered as investment advice or investment recommendation but instead a marketing communication. This material has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and that it is not subject to any prohibition on dealing ahead of the dissemination of investment research. IronFX may act as principal (i.e. the counterparty) when executing clients' orders. This material is just the personal opinion of the author(s) and client's investment objective and risks tolerance have not been considered. IronFX is not responsible for any loss arising from any information herein contained. Past performance does not guarantee or predict any future performance. Redistribution of this material is strictly prohibited.

Read less

Market Analysis 11-03-2013: Payrolls spark USD rally

11.03.2013

The Big Picture EUR/USD’s pop from the ECB meeting didn’t last long as a better-than-expected US nonfarm payrolls figure caused the dollar to resume its rally. The payrolls data showed broad strength, including a drop in the unemployment rate, a rise in the workweek, and a rise in earnings. The news reinforced the bullish picture for the US economy and the dollar as an “asset currency” rather than a “funding currency.”

But the employment/population ratio, a broader measure of unemployment that Chairman Bernanke has cited on several occasions, was unchanged. The Fed is likely to remain in easing mode until this ratio begins to rise back towards pre-recession levels. With the Fed still easing and yet the economy expanding fairly steadily, it’s a great scenario for USD-denominated assets.

The dollar has managed to hold onto most of its gains in Asian trading Monday. The exception was the Canadian dollar, which gained after it had its own better-than-expected employment data.

The week’s data releases have started out poorly, with several Chinese indicators coming in below market expectations. Industrial output had the weakest start to a year since the disastrous 2009 and both retail sales and bank lending were far below consensus estimates. It was noticeable however that the AUD barely moved on the news.

The main data out this week will be CPI figures and industrial production numbers from the US, Eurozone and China (already out). We would expect the usual split between the US and Europe on the one hand and core and peripheral Europe on the other. Other US indicators out this week include the U. Michigan consumer sentiment index, the Empire State manufacturing index and US retail sales. Elsewhere, EU political leaders hold a summit meeting in Brussels on Thursday and Friday, and Japan’s Diet will vote to confirm the new Bank of Japan Governor and Deputy Governors. The only major central bank meeting is in Switzerland, and they’ve shown no inclination to abandon the EUR/CHF floor.

The MarketEUR/USD

• After Friday’s plunge on the better-than-expected payrolls figure, EUR/USD has moved in a narrow range. We remain fundamentally bearish on the pair.

EUR/USD Friday confirmed our expectation that Thursday’s gains would be short-lived, meeting the 1.296 target we had placed, and thereafter finding resistance at the noted trendline. We see little movement for the day, noting resistance again at the trendline, around 1.3015. A possible intraday target could again be 1.296.

USD/JPY

• BoJ Governor-nominee Kuroda said that he’ll consider buying swaps if he’s confirmed as BoJ governor. News of a 13% plunge in machinery orders in January only reinforces the need for Japan to do something to boost its economy. We remain bullish USD/JPY.

The break of the 94.5 resistance level rewarded us with a strong up move on Friday, driving the pair back into its former trading channel and on course for the 97.6 target we have set for fulfillment before the new BoJ Governor takes over on March 20, with a more optimistic date being March 15th, when the new Governor gets approved. It is left to be seen whether the channel’s support and resistance levels will hold. For now we note possible strong support at the former resistance of 94.5. We see a narrow trading range for the day with weak resistance at 96.55 and possible trendline support at 95.4.

USD/SEK

• The normally robust SEK suffered the largest fall of any major currency vs the USD since Friday’s European opening after Swedish Finance Minister Anders Borg said he’s unsure if the currency’s strength will last and that there may be “exaggerated confidence” in the currency. His reasoning though seemed nothing particularly outstanding, just comments to the effect that if trouble starts up in Italy again, it’s uncertain what impact it would have. His recent statements have tended to shore up the krona and he may just be trying to undo some of their impact. We think the country’s monetary policy is not likely to change because of currency fluctuations and we see this setback as providing a good entry point for new short USD/SEK or EUR/SEK positions.

The pair on Friday met our “Intraday View” target of 6.41, finding resistance as noted. Nonetheless, we see the shedding of these gains over the next sessions, placing an intraday target of 6.366, on our way to our longer term target of 6.281, set for this week. Traders may want to note that the upper trendline of the downward sloping channel may act yet again as support this week.

Gold

• Increasing confidence in the US economy and a rising dollar have put a further damper on gold

Despite gold losing heavily on Friday, it managed to recoup all of its losses. The asset however found yet again resistance, this time marginally lower than $1586, at $1584. We see the sideways movement that has been taking place for over a week now as a continuation pattern of the downtrend. A possible two day target could be $1565, near the recent lows, with further bearish positions likely to find temporary support at $1541.

Oil

• WTI was up and Brent down compared with Friday’s European opening as Saudi Arabia boosted output and Chinese industrial production slowed in February.

For WTI we see a continuation of the rebound from a former trendline, which has support at $90.4. A minor intraday target could be $92.2, with a subsequent at $92.8.

BENCHMARK CURRENCY RATES - DAILY GAINERS AND LOSERS

MARKETS SUMMARY

Disclaimer:

This information is not considered as investment advice or investment recommendation but instead a marketing communication. This material has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and that it is not subject to any prohibition on dealing ahead of the dissemination of investment research. IronFX may act as principal (i.e. the counterparty) when executing clients' orders. This material is just the personal opinion of the author(s) and client's investment objective and risks tolerance have not been considered. IronFX is not responsible for any loss arising from any information herein contained. Past performance does not guarantee or predict any future performance. Redistribution of this material is strictly prohibited.

Read less

Market Analysis 12-03-2013: USD falls modestly on technical (and temporary) retraceme

12.03.2013

The Big Picture A technical market overnight; most of the news was positive for the dollar, or at least negative for the euro, and yet the dollar fell back against most currencies. It seems to me to be just the usual profit-taking on a big move, not the end of a trend by any means. Most attention was focused elsewhere: the stock market rose for the seventh straight day, VIX volatility fell to a six-year low, and Treasury yields rose modestly, showing that confidence in the US economy continues in those markets. That suggests USD should regain its poise in the near future as it is now being buoyed by good news about the US economy.

There was no US data out that would call into question the strength of the US economy. On the European side, the only good news was a rise in the German trade surplus that came from an increase in the surplus with non-EMU countries, while the surplus with Eurozone countries fell. Is this a good sign that the Eurozone economy is becoming more balanced and hence the euro is becoming more sustainable, or does it just mean that import demand in the peripheral countries is collapsing due to austerity?(Or does it come from peripheral Eurozone countries boycotting German goods in retaliation for imposed austerity, something we hear of from Greece?) French industrial production fell by even more than it did in December and was far worse than expectations. Italian bond spreads over Germany widened out as the head of the 5 Star Movement said he (too) wants to form a government, meaning no one will be able to. Not much good news there.

Today we have the German CPI figures, which are expected to be unchanged, although a drop in German inflation could spark thoughts of ECB easing. The focus is likely to be on the UK, where the market is expecting manufacturing production to be unchanged mom (-1.0% yoy) after a strong 1.6% mom (-1.5% yoy) rise in December. The UK visible trade deficit is expected to widen further, although the total trade balance is forecast to be unchanged.

The MarketEUR/USD

• As mentioned above, no real news to move EUR/USD – just a technical picture. The fundamentals still favour a move lower.

EUR/USD failed to meet our 1.2960 target yesterday, despite Italy’s credit downgrade by Fitch following the close of markets on Friday, breaking above the trendline we had noted as a resistance level. The break out from the trendline on the 1-hour chart coincided with a simultaneous RSI-MA crossover and a Stochastics buy signal in oversold territory. The pair was finding resistance at the downward sloping trendline for 12 hours, experiencing increased tick volume as it was pulling back gains to the trendline. We thus see the increase yesterday as a mere technical rally that is not expected to last. With Eurozone record unemployment, with the economy set for a back-to-back contraction in 2013, a first for the common currency bloc, it is hard to be bullish on the currency. In light of our miss we revise our target for the day, to 1.2980, a possible short-lived trendline support level, with the subsequent target being 1.2960.

USD/JPY

• USD/JPY rallied on news that Mitsubishi Heavy Industries agreed to pay the full bonus amount that its labor union sought, the first such concession in 16 years. The news shows first off that PM Abe is starting to be successful in creating expectations of higher inflation and secondly sets the stage for even higher demands next time and from other unions, which could create a virtuous circle of higher wages higher spending higher outpupt. BoJ Deputy nominee Hiroshi Nakaso, a career BoJ employee who served under outgoing Gov. Shirakawa, also signalled his agreement with incoming Gov. Kuroda’s policy views, reassuring the markets that he wouldn’t be bound by precedent and undercut the new Governor.

Early today USD/JPY met the 96.55 target we had placed yesterday, on a day with a very narrow trading range as suggested. This target reinforces our view that we can achieve the 97.6 target within the next 3-6 sessions. A possible minor target for the day could be 96.8, with possible trendline support coming at 95.7.

GBP/USD

• The pound fell in anticipation of a poor UK manufacturing production figure for January, due to be released today. It may also have been affected by the annual report of the Norwegian oil fund, which reported that it sold almost half its holdings of UK gilts last year.

With Cable meeting our intraday target of 1.4920 on Friday and with our subsequent target of 1.4860 being met yesterday, we feel the need to revisit the pair. As highlighted, we see further pound weakening eying 1.4700, placing a shorter term target of 1.4800 we see materialising within the next 3 sessions with resistance coming at 1.5000.

Gold

• Gold rose slightly on signs of increased physical demand in China. There may also be some resumption of fears about the European debt crisis owing to the problems in Italy.

Gold today found yet again resistance just over $1584, and we see that resistance at the $1584-$1586 range holding. With the H1, H4, and daily charts in the overbought zone, we see a decline today. $1574 could be seen as an initial target, with the two-day target placed yesterday coming at $1565.

Oil

• Once again WTI was higher and Brent lower, further narrowing the gap between the two. The resilience of the US economy is boosting oil prices even as inventories continue to rise.

Early today WTI met our $92.2 target, as it managed to recover all of its losses yesterday closing marginally higher, closing its gap from Brent, which yesterday met our intraday target of $109.55. With mixed signals between different timeframes we will opt to stay out from this trade today, choosing alternative trading opportunities. It seems that is possible for us to see a retesting of the $92.2 level today before pulling back again.

BENCHMARK CURRENCY RATES - DAILY GAINERS AND LOSERS

MARKETS SUMMARY

Disclaimer:

This information is not considered as investment advice or investment recommendation but instead a marketing communication. This material has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and that it is not subject to any prohibition on dealing ahead of the dissemination of investment research. IronFX may act as principal (i.e. the counterparty) when executing clients' orders. This material is just the personal opinion of the author(s) and client's investment objective and risks tolerance have not been considered. IronFX is not responsible for any loss arising from any information herein contained. Past performance does not guarantee or predict any future performance. Redistribution of this material is strictly prohibited.

Read less

Market Analysis 13-03-2013: Can “risk-on dollar” resume its climb? Focus on US retail

13.03.2013

The Big Picture The dollar lost ground against most currencies as expectations for Fed tightening eased back and investors cut their long USD positions. Lower stock markets also pressured the dollar, continuing the recent positive correlation between the USD and risk assets.

The dollar even declined against the pound, which initially plunged 1 cent on news of surprisingly weak UK industrial production in January. That increases the likelihood that the Bank of England will ramp up its quantitative easing measures to prevent the country from falling into yet another recession. The fact that cable could recover on the day from a drop like that demonstrates the dollar’s all-around weakness yesterday against large-scale position cutting.

Today we have Eurozone industrial production figures, which are expected to show a modest 0.1% mom drop. In the US the focus will be on the February retail sales figures, which are expected to rise 0.2% mom excluding autos and gasoline, same as in January. This figure will be closely watched to see if the “risk-on dollar” can continue to rally. Recent comments from companies have suggested that consumer demand was weakening in February, but if positive data comes out to refute this anecdotal evidence, USD could resume its uptrend. The market is looking for +0.2% excluding gasoline and autos.

The MarketEUR/USD

News for EUR/USD was mixed. Bundesbank President Jens Weidmann said the Eurozone sovereign crisis is not over and still represents the most significant risk for the German economy. He added that the ECB would continue with its accommodative stance “for as long as is necessary,” echoing comments from ECB President Draghi. While he admitted this statement was “very obvious” – it passes the Gittler Inversion Rule, which is that any statement whose opposite is ridiculous is in itself meaningless – it nonetheless reassured the markets that even this hawkish ECB member was not thinking of changing stance any time soon.

The euro was also affected by a poll that showed 26% of Germans would consider voting in the September federal elections for a party that promised to pull out of the euro.

But at the same time, Spanish yields have fallen for 10 days in a row and they managed to sell more short-term bills than they had hoped at an auction yesterday, suggesting confidence in Spain is coming back regardless of what happens in Italy (where yields have stayed pretty much the same for the last four days). There is an auction of long-term bonds tomorrow that should help to confirm the positive aura around Spain and possibly the euro. EUR/USD moved up a bit when the bid-to-cover ratio rose at the time of the last auction of Spanish debt.

EUR/USD fell just shy of our 1.298 target yesterday with a low of 1.2989, before rebounding and hitting the highlighted 1.308 level that sees the 38.2% retracement level of the July – February up move and the spike trendline. We see the rate heading lower again today, within the area of 1.298 – 1.296, eyeing thereafter 1.29.

USD/JPY

• USD/JPY retraced somewhat as the Democratic Party of Japan said that it would not vote to confirm BoJ Deputy Gov. nominee Iwata. However he can still be approved with the support of smaller parties so we do not see a substantial risk there. We are still bullish USD/JPY.

USD/JPY has been testing the 95.7 support level for a number of hours now. A break of this level may see prices move to the 94.5, stronger support level. Any such break nonetheless is likely to be a continuation pattern that will see prices rise up again. With the 95.7 support holding at the moment, we may want to take this opportunity to go long with an intraday target of 96.3 as the 14-period Stochastics in the H1 chart are near the 10-20 frequent rebound level.

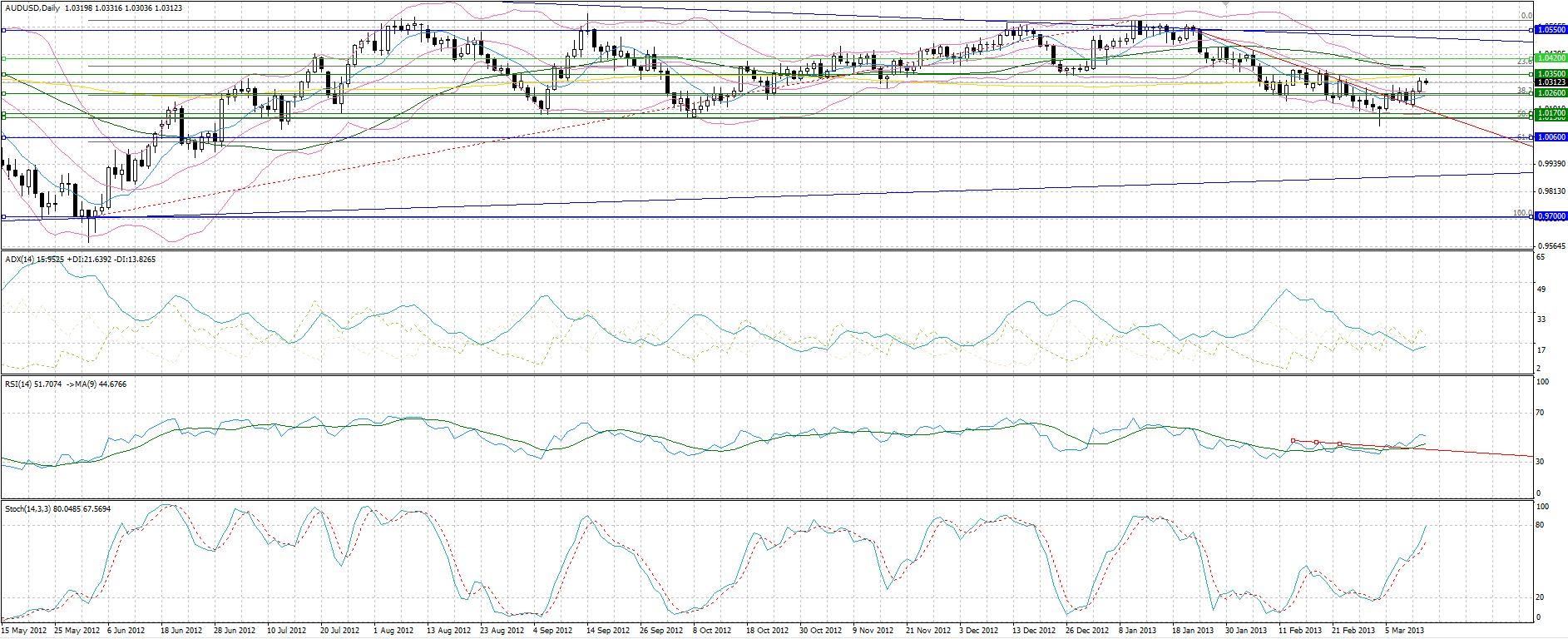

AUD/USD

• AUD rose against USD and NZD overnight as consumer confidence rose to the highest level since Dec. 2012 and home loans fell in January at a slower pace than in the previous month. Today’s Australian employment data is expected to show another 10k rise in employment, albeit with a small rise in the unemployment rate to 5.5% from 5.4%.

The Aussie bounced off its 50% retracement level of its uptrend which started in early June 2012. We see this as a good sign the sideways trading channel is likely to continue providing somewhat clear support and resistance levels. An intraday target of 1.035 is an option with a subsequent target of 1.042.

Gold

• Gold prices rebounded on the statement by Bundesbank President Weidmann about the ECB maintaining its accommodative stance. Together with the weak UK industrial production figures, which imply a further round of QE there, the news suggests continued loose monetary policy.

Gold’s unexpected gain was strong following the break of the $1584 - $1586 well-tested resistance level, which was the 23.6% retracement level of the mid-February plunge. With the fundamentals not supporting a bull run on the bullion, we will not favour long positions. Any future gains are likely to find strong resistance at the almost 2-year old, purple trendline which was broken a month ago and which currently sees price at $1619.

Oil

• WTI gained yesterday on a surprising fall in inventories in the weekly American Petroleum Institute figures.

WTI yesterday further narrowed its spread with Brent as the former gained heavily with the latter plummeting. The rebound at $90 off the 9-month red trendline that took place in the first week of March has boosted WTI. With an ascending triangle formation developing, and being within the ideal breakout period, we are on the look out, particularly for a break out above $98. For today we may want to settle for a target of $93.3.

BENCHMARK CURRENCY RATES - DAILY GAINERS AND LOSERS

MARKETS SUMMARY

Disclaimer:

This information is not considered as investment advice or investment recommendation but instead a marketing communication. This material has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and that it is not subject to any prohibition on dealing ahead of the dissemination of investment research. IronFX may act as principal (i.e. the counterparty) when executing clients' orders. This material is just the personal opinion of the author(s) and client's investment objective and risks tolerance have not been considered. IronFX is not responsible for any loss arising from any information herein contained. Past performance does not guarantee or predict any future performance. Redistribution of this material is strictly prohibited.

Read less

Market Analysis 14-03-2013: Risk on and dollar up

14.03.2013

The Big Picture The profit-taking over, the dollar rally could continue. USD gained against most of its counterparts yesterday, the exception being AUD, after the US retail sales far exceeded market expectations. That’s important for an economy based largely on consumer spending. The “risk-on dollar” continues as stocks also closed modestly higher. AUD bucked the trend because of surprisingly strong employment data.

The Spanish auction of 13-, 23- and 24-year bonds today will be closely watched as a barometer of the market’s appetite for peripheral risk. Yesterday’s auction of Italian 3-year bonds was disappointing, with the bid-to-cover falling from an already low 1.37 to an even lower 1.28, and both Italian and Spanish 10-year yields rose on the day. However, Ireland’s sale of 10-year bonds yesterday, the first since it was bailed out in 2010, was a blowout, with the bid-to-cover of 4x allowing the country to raise the amount sold to EUR 5bn from a planned EUR 3bn and still sell the bonds at around 4.25%-4.30%, around 40 bps points below Italy and Spain. This shows the nervousness that still exists around Spain and Italy.

Today we have Norges Bank and Swiss National Bank meetings. The market expects no change in rates or policy at either meeting. The Swedish unemployment rate is expected to hold steady at 8.4%, an important indicator for the debate about monetary policy there. In the US, the weekly jobless claims are the main indicator.

The Market EUR/USD

• Despite all the drama, EUR/USD’s range for the month is still only 1.6%, which is unusually narrow. We wouldn’t be surprised to see it break out of that range, and given the dollar’s new risk-on correlation, we would expect it to move lower.

EURUSD confirmed our bearish view yesterday as it lost its early session gains which found resistance at the highlighted downward spike trendline shown in green. It met our target of 1.296, closing at that level, as it predominantly traded within the noted range of 1.298 – 1.296. We stay firm to our subsequent target of 1.29, with trendline resistance for the day coming around 1.305, and weaker resistance at 1.298. A possible future reference target once 1.29 is met is 1.286.

USD/JPY

• USD/JPY rose on unsubstantiated talk that incoming BoJ Gov. Kuroda wouldn’t wait for the next scheduled BoJ Monetary Policy Committee meeting on April 4th but rather would hold an emergency meeting shortly after taking office to change policy. Nonetheless the pair couldn’t sustain the gains despite reports that a small political party, Your Party, will support Deputy Gov. Iwata’s nomination, which should guarantee his approval. We still see USD/JPY headed higher.

Our view that 95.7 was a good entry point got confirmed yesterday as the pair managed to recover all of its losses intraday closing with gains, falling 3.8 pips off our 96.3 target. Support nonetheless came slightly lower than expected and hence the need to revise support today to 95.4. We stay confident in our view that the pair is likely to hit the 97.6 target by tomorrow or Wednesday, unless there is some unforeseen glitch in Kuroda’s appointment as BoJ Governor.

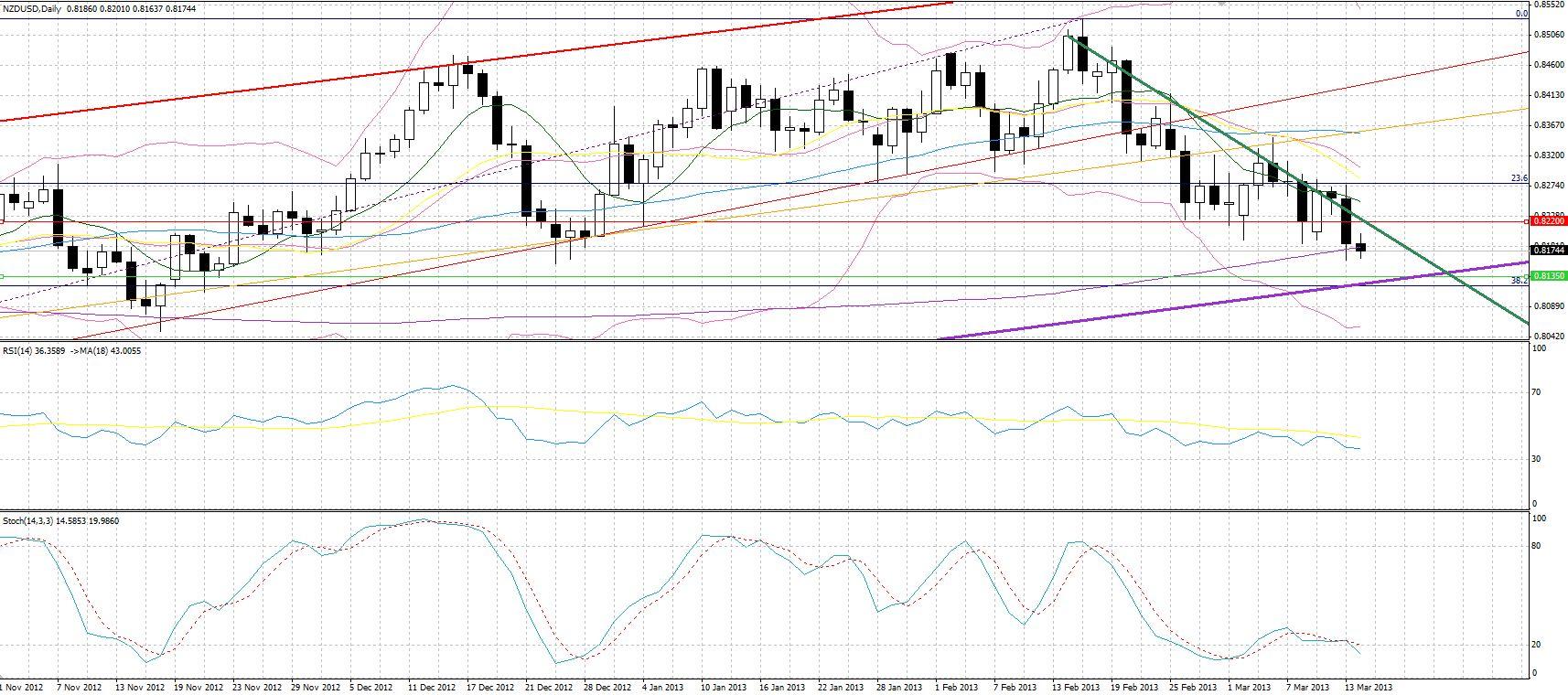

NZD/USD

• NZD came under heavy pressure after the Reserve Bank of New Zealand’s (RBNZ) statement after its meeting was more dovish than expected. The RBNZ was widely expected to leave rates on hold at 2.5%, so that part was no surprise, but the committee stated specifically that “we expect to keep the OCR unchanged through the end of the year.” With the drought there “creating difficult in much of the country,” the likelihood is that they will not want to compound the nation’s problems by causing their already overvalued currency to appreciate further. We expect NZD/USD to fall further from a fundamental point of view.

Kiwi’s downtrend has been rather reliable since mid-February, as it has converged to its 200-day MA. With the pair approaching a four year old support trendline, shown in purple, we may want to consider placing short positions with a target of 0.8135, just above the trendline and the 38.2% retracement level of the June 2012 - mid-February up move. Downward sloping trendline resistance for the day is at 0.822.

Gold

• Gold’s resilience in the face of a higher dollar and firm equities was impressive, but in the end it couldn’t hold up and drifted lower. Given that we expect the dollar to continue to rally, we expect gold to trend lower.

We feel there are better trading opportunities than Gold at the moment. Nonetheless, we feel the need to reiterate our preference for short versus long positions for the precious metal. A possible target support level for the day could be $1574 with a subsequent target of $1565. Intraday resistance may come at $1600.

Oil

• Both Brent and WTI fell as the International Energy Agency cut its forecast for oil demand for 2013 for the second month in a row.

WTI yesterday met our intraday target of $93.3 before closing lower. The fall however, was lower than that of Brent, thus further narrowing the spread between the two. Today’s support may come at $91.5 with a possible intraday target being $93.2, noting a strong uptrend in 14-period strong Stochastics on the daily chart and overselling on H1.

BENCHMARK CURRENCY RATES - DAILY GAINERS AND LOSERS

MARKETS SUMMARY

Disclaimer:

This information is not considered as investment advice or investment recommendation but instead a marketing communication. This material has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and that it is not subject to any prohibition on dealing ahead of the dissemination of investment research. IronFX may act as principal (i.e. the counterparty) when executing clients' orders. This material is just the personal opinion of the author(s) and client's investment objective and risks tolerance have not been considered. IronFX is not responsible for any loss arising from any information herein contained. Past performance does not guarantee or predict any future performance. Redistribution of this material is strictly prohibited.

Read less

Market Analysis 15-03-2013: Risk on and dollar up

15.03.2013

The Big Picture A purely technical day, or perhaps we should say a behavioural finance day, when it may well have been good news itself that pushed the dollar down. The DJIA has been up 10 days in a row, eurozone bond yields were rising and US jobless claims were down, with the closely watched 4-week average making a new post-recession low. All good news for USD and yet the US currency lost ground against almost all of its major counterparts as the market hit trailing stop losses. Investors may be wondering just how long this string of good news can go on and looking for some mean reversion, or they may be starting to position for some disappointment at next week’s FOMC meeting.

The exceptions to the USD downtrend were the NOK, which lost ground after Norges Bank was yet another central bank to start backpedalling on its tightening scenario, and JPY, which fell back a bit after the Diet approved all three of Abe’s candidates for the BoJ board.

Today we have inflation figures from the EU and the US. Eurozone CPI is expected to stay at 1.8% yoy, while core CPI in the US is expected to rise 0.2% mom vs +0.3% in January, bringing the yoy rise to 2.0% from 1.9%. A higher rise would be bullish for the dollar, as it would increase the likelihood of the Fed easing off its extraordinary monetary stimulus. US industrial production, capacity utilization and consumer confidence are also expected to rise, which may bring a bid back to the “risk-on dollar.”

The MarketEUR/USD

• Spanish bond yields were up a substantial 10 bps despite what appeared to be a successful bond auction, suggesting that fears over the Eurozone crisis have not dissipated. Eurozone leaders finish off their summit meeting today. Whatever result comes out of these meetings is likely to be neutral for the euro at best and possibly negative as the split between the Northern countries, which are continuing to urge austerity, and the Southern countries, which are suffering from austerity, continues. A draft communique reportedly offers some flexibility on budgets, saying there should be “an appropriate mix of expenditure and revenue measures, including short-term targeted measures to boost growth.” That could indicate the beginnings of a compromise, or it could indicate the way the leaders will try to paper over their differences. If we look at the real world of actions, not words, talks between Athens and its lenders have broken down over spending cuts and Italy seems no closer to forming a government, yet Germany will attempt to balance its budget a year earlier than planned and still insists that the other countries hold to their budget targets. This North/South split is likely to constrain any EUR gains vs USD, where the fears of a fiscal cliff, then sequestration, then government shut down seem to have faded as the stock market keeps going up and up.

EUR/USD yesterday fell shy of our 1.29 target, later recovering its losses but finding resistance at the green spike trendline we had noted. Should the resilience of the spike downward sloping trendline hold, 1.302 may be a good entry level with an initial target in the 1.296 - 1.298 area, noting the overbought levels in the H4 Stochastics. Likely resistance levels for the day are 1.304, the spike trendline, and 1.308, the 38.2% retracement level of the July-February up move. The RSI trendline break, however, and the likely buy signal in the daily Stochastics are things prudent traders may want to note

USD/JPY

• With PM Abe’s three nominees to the BoJ board now approved, the market is waiting to hear whether they will call a rumored emergency meeting. If they do, that would probably send USD/JPY higher still. But some doubt has crept into the market as Japanese companies revise up their profit forecasts, raising the possibility that they may repatriate profits before the end of the fiscal year on 31 March. That fear could cap USD/JPY next week until we see what Kuroda’s plans are. Finally, the Japanese press report that PM Abe will announce that Japan intends to participate in talks to join the Trans-Pacific Partnership (TPP). According to the Nikkei, joining the TTP would add about 0.7 ppt to Japan's GDP. Just as importantly, it would show PM Abe’s resolve to confront entrenched economic interests, such as the powerful farmers’ lobby, in his fight to revitalize the Japanese economy. That could in fact be bearish for USD/JPY. But we retain our bullish stance on the pair, because any macroeconomic benefits will only be seen over the long term, while the impact of monetary easing will be immediate.

USD/JPY seems to have closing support at the lower trendline of its former upward sloping trading channel. Should this hold, we are likely to see a close at or above 96.4. Support seems to come at around 95.4. We take the sideways action of the past few days as a possible continuation pattern, maintaining our view that 97.6 is a good 4 session target.

GBP/USD

• The pound gained after outgoing Bank of England Gov. King said that policymakers aren’t trying to talk down the pound and said that the recovery in the UK economy was “in sight.” I’m not sure I believe him on either point and I would remain short cable. The pound was also boosted by one story in the FT saying that the Treasury had ruled out radical changes in the BoE’s remit, and another saying that Qatar has begun talks with the UK government to invest up to GBP 10bn into key infrastructure projects in Britain.

Cable’s gains yesterday are likely to be short-lived, with strong resistance coming at 1.52, and weaker resistance at around 1.513, the 20-day MA which has acted as resistance the past 1.5 months. We see a retracement to 1.5 for today with future trailing targets of $1.492 and 1.486.

Gold

• The dollar’s decline naturally pushed up gold prices and assets in gold-backed ETPs rose for the first time in five weeks. Other precious metals rebounded even more, particularly palladium. We feel this is just a technical bounce after the recent declines and would sell into the rally.

The late session USD weakening aided gold to recover its early session depreciation. With the H1, H4 and daily charts downward sloping at or around overbought levels and with some sell signals already triggered, it is likely we will see the precious metal trading lower today with $1580 being an intraday target and $1574 a subsequent one. Resistance is likely to come at $1600.

Oil

• Oil gained as the market started getting ready for the summer driving season. WTI continued to gain on Brent with the differential there narrowing further.

WTI yesterday met our intraday target of $93.2, despite having opened lower. It seems like the bounce off the 21-month old trendline is strong, with the move towards the resistance of the ascending triangle materializing. Nonetheless, with overbought levels being hit, we may see a slowdown in momentum. A minor intraday target could be $93.65, the 38.2% retracement level of the December – February up move, with a subsequent target at $94.3. Support seems to come at $91.8.

BENCHMARK CURRENCY RATES - DAILY GAINERS AND LOSERS

MARKETS SUMMARY

Disclaimer:

This information is not considered as investment advice or investment recommendation but instead a marketing communication. This material has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and that it is not subject to any prohibition on dealing ahead of the dissemination of investment research. IronFX may act as principal (i.e. the counterparty) when executing clients' orders. This material is just the personal opinion of the author(s) and client's investment objective and risks tolerance have not been considered. IronFX is not responsible for any loss arising from any information herein contained. Past performance does not guarantee or predict any future performance. Redistribution of this material is strictly prohibited.

Read less

Market Analysis 18-03-2013: Return of “risk-off” sentiment

18.03.2013

The Big Picture The cash-for-equity swap that was agreed upon by the Eurozone’s Finance Ministers as a part of Cyprus’s restructuring plan disrupted the markets today as the market feared that it created a precedent which is of concern for the Eurozone peripheries. The Cyprus government was able to pledge a link to depositor accounts with future revenue from the country’s natural gas reserves, something the headless Italy, the political-scandal struck Spain and the struggling Greece cannot do, thus raising fears for depositor funds in these nations as well as other debt-laden countries.

With a number of Eurozone’s periphery economies returning to the bond markets over the next week, we see a test of confidence with further pressures for the euro should we experience, as is anticipated, an increase in borrowing rates. Greece plans to sell 1bn euros of 3-month T-bills tomorrow, with Spain auctioning 3- and 9-month bills on the same day, and 3-, 5- and 10- year debt on Thursday. On Wednesday, Portugal plans to sell 3- and 18-month debt, while Italy will be auctioning bonds next Monday, 25th March.

The situation in the Eurozone, however, seems to be much better than it was in previous years, with Ireland completing its first 10-year bond auction since its financial and banking system almost collapsed before securing an EU bailout in 2010. Spain’s, Portugal’s and Greece’s bond prices have also increased following their bailouts, with improving economic indicators.

Elsewhere, the major news of the week is the FOMC meeting, scheduled to take place on Wednesday, with Bernanke expected to disclose new macroeconomic forecasts in his press conference. Should the FOMC participants generally forecast a further decrease in unemployment, this may signal a slowdown in the Fed’s asset-buying activities taking place the second half of the year. The UK’s government 2013 budget announcements will also be closely monitored by the markets, to see whether there will be a change to the Bank of England’s remit of 2% inflation. The Chinese HSBC and Eurozone’s Markit Manufacturing PMIs will be focus points for Thursday, as the market will look to see whether the disappointing figure for the former and the mixed data for the latter were just one-off events.

The Market EUR/USD

• The dollar lost versus the euro on Friday despite better than expected US Industrial Production and Capacity Utilisation data. However, all those gains for the Euro that saw the pair close at 1.3074, just below the 38.2% Fibonacci retracement level of the July - February up move were wiped out with a gap this morning. The reignited Eurozone debt crisis saw the pair open at 1.2908, trading this morning at its lowest level this year.

With the 200-day MA, lower Bollinger band and 50% retracement level of the aforementioned uptrend, there seems to be strong support at the 1.286 – 1.288 area.

USD/JPY

• The yen gained considerably on Friday and today, against the dollar and the euro having depreciated too much and too fast over the past months. The gains today served as a reminder that the currency remains a safe haven currency in times of uncertainty.

With Kuroda stepping in as the BoJ Governor on Wednesday and with rumours that he may call an emergency meeting, we see the yen gains being temporary.

GBP/USD

• The pound gained on Friday following a statement by BoE Gov. King that policymakers are not trying to talk down the currency. Despite the pound acting somewhat as a haven currency following the renewed turmoil in the Eurozone, it lost against the dollar.

GBPUSD’s correction found resistance at the noted strong level around 1.52, the 61.8% retracement level of the May 2010 – April 2011 up move.The successful testing of this resistance level is a good sign that the pair can head for new lows, below the 2 ½-year low we had on March 14th.

Gold

• With increased fear of contagion in the Eurozone and a return to a “risk-off” sentiment, investors and traders are selling euro opting for safer-haven assets, such as gold and investment grade Treasuries.

Gold gaped and spiked following the Asian markets open climbing above $1608, before shedding all those gains in the early hours. Nonetheless, the precious metal is still trading higher than it closed on Friday and is anticipated to continue gaining on market uncertainty.

Oil

• WTI gained on Friday following the positive economic outlook supported by the improved US Industrial Production. However, the pullback that has been taking place today following the uncertain economic environment in the EU has essentially erased the gains we had on Friday as well as Thursday.

WTI met the $93.65 target we had placed for Friday, finding resistance at the 38.2% retracement level of the December – February up move. The minor gap that took place this morning and the subsequent decline have price finding support at the 50% retracement level, above the noted $91.8 support level.

BENCHMARK CURRENCY RATES - DAILY GAINERS AND LOSERS

MARKETS SUMMARY

Disclaimer:

This information is not considered as investment advice or investment recommendation but instead a marketing communication. This material has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and that it is not subject to any prohibition on dealing ahead of the dissemination of investment research. IronFX may act as principal (i.e. the counterparty) when executing clients' orders. This material is just the personal opinion of the author(s) and client's investment objective and risks tolerance have not been considered. IronFX is not responsible for any loss arising from any information herein contained. Past performance does not guarantee or predict any future performance. Redistribution of this material is strictly prohibited.

Read less

Market Analysis 18-03-2013: Return of “risk-off” sentiment

18.03.2013

The Big Picture The cash-for-equity swap that was agreed upon by the Eurozone’s Finance Ministers as a part of Cyprus’s restructuring plan disrupted the markets today as the market feared that it created a precedent which is of concern for the Eurozone peripheries. The Cyprus government was able to pledge a link to depositor accounts with future revenue from the country’s natural gas reserves, something the headless Italy, the political-scandal struck Spain and the struggling Greece cannot do, thus raising fears for depositor funds in these nations as well as other debt-laden countries.

With a number of Eurozone’s periphery economies returning to the bond markets over the next week, we see a test of confidence with further pressures for the euro should we experience, as is anticipated, an increase in borrowing rates. Greece plans to sell 1bn euros of 3-month T-bills tomorrow, with Spain auctioning 3- and 9-month bills on the same day, and 3-, 5- and 10- year debt on Thursday. On Wednesday, Portugal plans to sell 3- and 18-month debt, while Italy will be auctioning bonds next Monday, 25th March.

The situation in the Eurozone, however, seems to be much better than it was in previous years, with Ireland completing its first 10-year bond auction since its financial and banking system almost collapsed before securing an EU bailout in 2010. Spain’s, Portugal’s and Greece’s bond prices have also increased following their bailouts, with improving economic indicators.

Elsewhere, the major news of the week is the FOMC meeting, scheduled to take place on Wednesday, with Bernanke expected to disclose new macroeconomic forecasts in his press conference. Should the FOMC participants generally forecast a further decrease in unemployment, this may signal a slowdown in the Fed’s asset-buying activities taking place the second half of the year. The UK’s government 2013 budget announcements will also be closely monitored by the markets, to see whether there will be a change to the Bank of England’s remit of 2% inflation. The Chinese HSBC and Eurozone’s Markit Manufacturing PMIs will be focus points for Thursday, as the market will look to see whether the disappointing figure for the former and the mixed data for the latter were just one-off events.

The MarketEUR/USD

• The dollar lost versus the euro on Friday despite better than expected US Industrial Production and Capacity Utilisation data. However, all those gains for the Euro that saw the pair close at 1.3074, just below the 38.2% Fibonacci retracement level of the July - February up move were wiped out with a gap this morning. The reignited Eurozone debt crisis saw the pair open at 1.2908, trading this morning at its lowest level this year.

With the 200-day MA, lower Bollinger band and 50% retracement level of the aforementioned uptrend, there seems to be strong support at the 1.286 – 1.288 area.

USD/JPY

• The yen gained considerably on Friday and today, against the dollar and the euro having depreciated too much and too fast over the past months. The gains today served as a reminder that the currency remains a safe haven currency in times of uncertainty.

With Kuroda stepping in as the BoJ Governor on Wednesday and with rumours that he may call an emergency meeting, we see the yen gains being temporary.

GBP/USD

• The pound gained on Friday following a statement by BoE Gov. King that policymakers are not trying to talk down the currency. Despite the pound acting somewhat as a haven currency following the renewed turmoil in the Eurozone, it lost against the dollar.

GBPUSD’s correction found resistance at the noted strong level around 1.52, the 61.8% retracement level of the May 2010 – April 2011 up move.The successful testing of this resistance level is a good sign that the pair can head for new lows, below the 2 ½-year low we had on March 14th.

Gold

• With increased fear of contagion in the Eurozone and a return to a “risk-off” sentiment, investors and traders are selling euro opting for safer-haven assets, such as gold and investment grade Treasuries.

Gold gaped and spiked following the Asian markets open climbing above $1608, before shedding all those gains in the early hours. Nonetheless, the precious metal is still trading higher than it closed on Friday and is anticipated to continue gaining on market uncertainty.

Oil

• WTI gained on Friday following the positive economic outlook supported by the improved US Industrial Production. However, the pullback that has been taking place today following the uncertain economic environment in the EU has essentially erased the gains we had on Friday as well as Thursday.

WTI met the $93.65 target we had placed for Friday, finding resistance at the 38.2% retracement level of the December – February up move. The minor gap that took place this morning and the subsequent decline have price finding support at the 50% retracement level, above the noted $91.8 support level.

BENCHMARK CURRENCY RATES - DAILY GAINERS AND LOSERS

MARKETS SUMMARY

Disclaimer:

This information is not considered as investment advice or investment recommendation but instead a marketing communication. This material has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and that it is not subject to any prohibition on dealing ahead of the dissemination of investment research. IronFX may act as principal (i.e. the counterparty) when executing clients' orders. This material is just the personal opinion of the author(s) and client's investment objective and risks tolerance have not been considered. IronFX is not responsible for any loss arising from any information herein contained. Past performance does not guarantee or predict any future performance. Redistribution of this material is strictly prohibited.

Read less

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

05.03.2013

View archive

The Big Picture Monday was the mirror image of Friday; the dollar declined against most currencies, and the one it declined the most against was the one it had risen most against over the previous 24 hours, AUD. Other currencies that lost ground on Friday regained some of their value, such as the pound.

The EU elite are starting to hear the “unmistakeable anger, which cannot be ignored” about Europe that German President Gauck referred to in a speech recently. Following a meeting of EU finance ministers yesterday, EU Economic and Monetary Commissioner Rehn reversed himself and said that economic strains “may also justify in a certain number of cases reviewing deadlines for the correction of excessive deficits.” This is the same fellow who told Der Speigel the day before that “I see no maneuvering room for abandoning the path of budget consolidation”! The ministers also said they may give Ireland and Portugal more time to repay their bailout loans.

In other words, with Italy, France and the Netherlands refusing to meet the EU budget deficit targets, the EU has no choice but to loosen the targets for other countries, too. That should reduce the political strains in the Eurozone and may boost the region’s growth, which lessens the attraction of the dollar somewhat. It’s not likely to do anything to solve the Italian electoral crisis, though.

No major data due out today. There is Eurozone retail sales for January and the final PMIs for the Eurozone, which are normally not a big deal. In the US there is the ISM services sector index, which is also not particularly market-moving.

The MarketEUR/USD

• With the risk of a taxpayer’s rebellion somewhat reduced, the EUR may come into favour for a few days now. From a fundamental point of view, we wouldn’t be surprised to see it temporarily regain some of its recent losses (although the technical say otherwise) until the ECB meeting Thursday sets the direction.

The pair was little changed yesterday, with a rather short wick. We may be witnessing some consolidation for now. Unless we have surprising Eurozone Retail Sales data, we see a likely continuation pattern forming the next few days, ahead of the ECB monetary policy announcements on Thursday and the market-moving US non-farm payrolls on Friday. We preserve our overall bearish view, with an initial target of 1.296 and a subsequent at 1.291, with resistance coming at 1.31.

USD/JPY

• USD/JPY was little changed, which is a story in itself. PM Abe’s nominee for BoJ Governor, H. Kuroda, appeared in the Diet yesterday and said that the BoJ “will do whatever it can to beat deflation.” The tiny reaction in the FX market compares unfavourably with the impact that ECB President Draghi’s similar comments had on the euro and European debt markets. The market is saying “show us the money.” I think he will and I expect USD/JPY to head higher.

The pair hardly moved yesterday, losing marginally, and opening lower today. We do not see any major down move, simply some sideways movement before the upward trend continues. Traders with bullish positions may want to note that the 92-92.5 support area is likely to be tested over the next couple of days.

AUD/USD

• Although the RBA held rates steady and repeated its assessment that rates can probably fall further, its assessment of the future outlook was confident, with talk of stabilisation in China and prospects for a modest increase in investment. Also Australian retail sales rose in January at twice the pace that the market had expected. We expect that the RBA will continue to emphasize the possibility of loosening policy in an attempt to keep the AUD from rising and hence are bearish on AUD/USD over the medium term.

AUDUSD is at an interesting level at the moment having rebounded from the 1.017 level that has acted as support 4 times in the past 8-months, proving a strong price reference, as prices rebound to 1.055. The current bounce from the 50% retracement level of the June 2012-mid-January up move may however find resistance at 1.026, which sees the 38.2% retracement level and the downward-sloping trendline resistance of the down move, which started in late January. Should we break this resistance, then we may want to note 1.035 and then 1.055 as possible targets.

Gold

• Gold was little changed overnight, although Kuroda’s pledge and dovish comments from Fed Vice Chiarman Yellen that the Fed should continue with its quantitative easing gave a firm underpinning to the market. The prospect of continued loose monetary policy is supportive of precious metals, but our fundamental view remains bearish over the medium term.

Gold looks to be gaining today, with a change in sentiment showing its change in short-term fortunes. Bullish traders may want to consider targeting $1586, with $1593 as a subsequent price goal. Nonetheless, we feel the need to highlight that our overall outlook on the precious asset is bearish, and we thus see any gains being short-lived.

Oil

• WTI eased a bit on expectations of another rise in inventories, while Brent gained a bit owing to a leak on a North Sea oil platform.

WTl met our initial target of $90 falling a bit short of the further target placed at $89. Any gains are likely to meet resistance at the $90.5-$91 area. We maintain our bearish view and the $89 target.

BENCHMARK CURRENCY RATES - DAILY GAINERS AND LOSERS

MARKETS SUMMARY

Disclaimer:

This information is not considered as investment advice or investment recommendation but instead a marketing communication. This material has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and that it is not subject to any prohibition on dealing ahead of the dissemination of investment research. IronFX may act as principal (i.e. the counterparty) when executing clients' orders. This material is just the personal opinion of the author(s) and client's investment objective and risks tolerance have not been considered. IronFX is not responsible for any loss arising from any information herein contained. Past performance does not guarantee or predict any future performance. Redistribution of this material is strictly prohibited.

Read more

Read less

More...