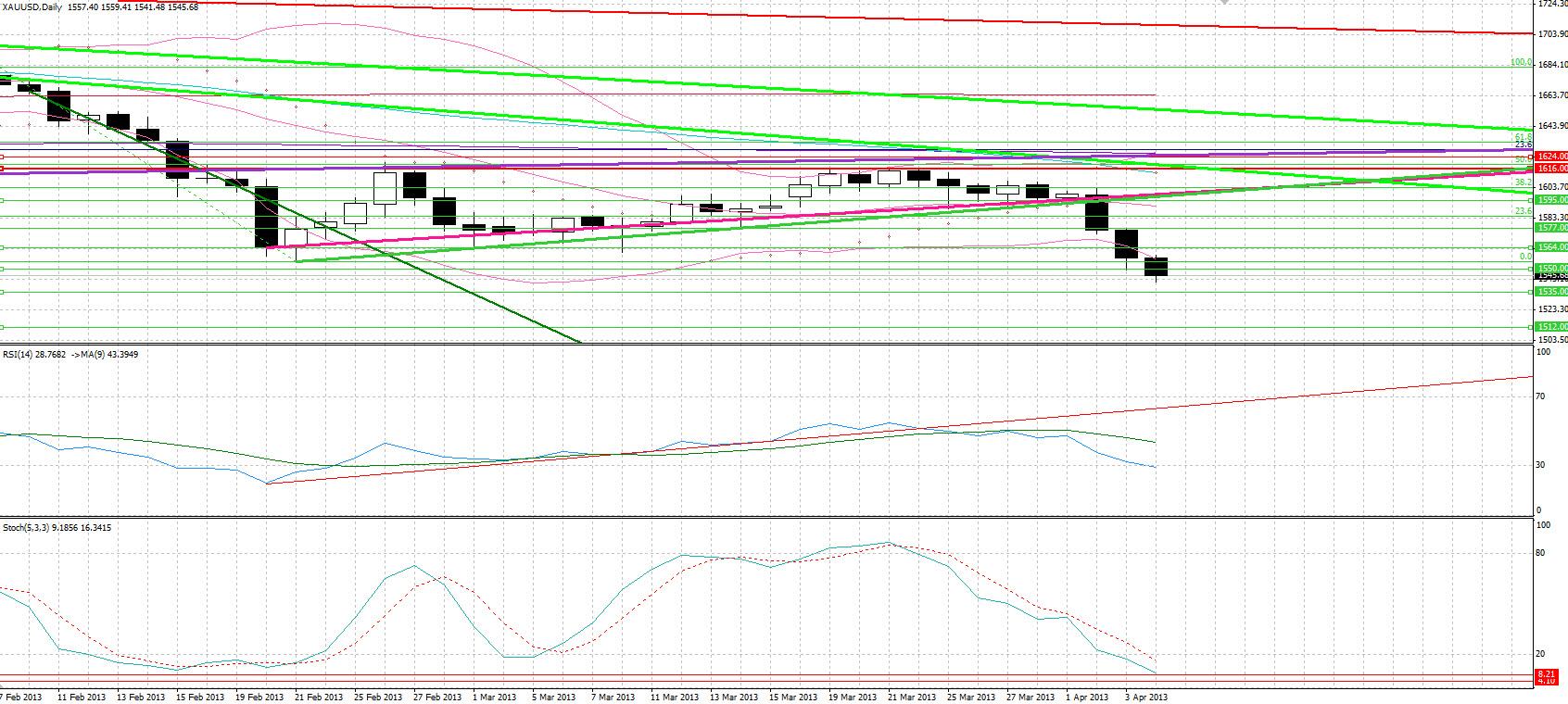

Market Analysis 03-04-2013: Ailing Eurozone trailing U.S.

Daily Commentary03.04.2013

The Big PictureAiling Eurozone trailing U.S.:The divergence between the prospects for the Eurozone and the U.S. economies increased yet again yesterday, as the Eurozone hit a record-breaking 12% unemployment level for both January and February, with the figure for the former month being revised upwards. This news comes ahead of the U.S. employment change data today forecast to show an increase in job gains. The better-than-expected Eurozone manufacturing PMI did not pacify Eurozone concerns as the figure worsened, the two largest peripheral economies (Italy and Spain) missed their estimates by a margin, and Germany’s slightly better-than-anticipated 49-figure was still contractionary. The dollar gained further with the announcement of the U.S. factory orders that beat estimates, coming in at 3% versus the 2.9% consensus, marking the second biggest increase in 2 years.

Japanese stocks today look to end a two-day sell-off following the missed estimates on the large manufacturers’ confidence index and the U.S. manufacturing PMI. The rebound was triggered by the stronger dollar versus the yen, and the boost in demand for cars in the U.S., increasing overseas earnings expectations for Japanese exporters, ahead of Kuroda’s first policy meeting as BoJ Governor.

News out today includes the start of the BoJ 2-day Monetary Policy meeting, the ADP Employment Change that is set to show a 200K increase in the number of people employed in the U.S., the preliminary Eurozone CPI due to show a slower increase in prices, and the U.K. Construction PMI that is expected to indicate an improvement, yet well below expansionary levels.

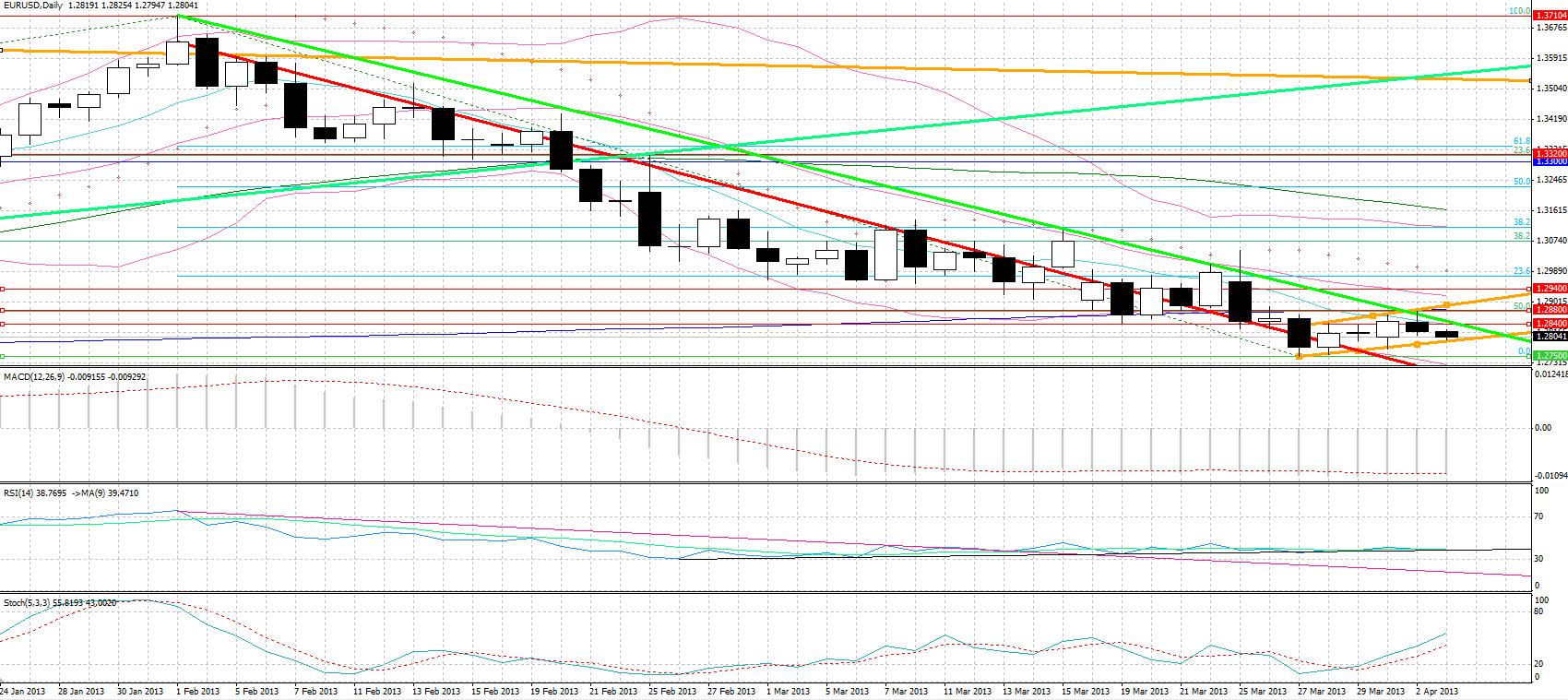

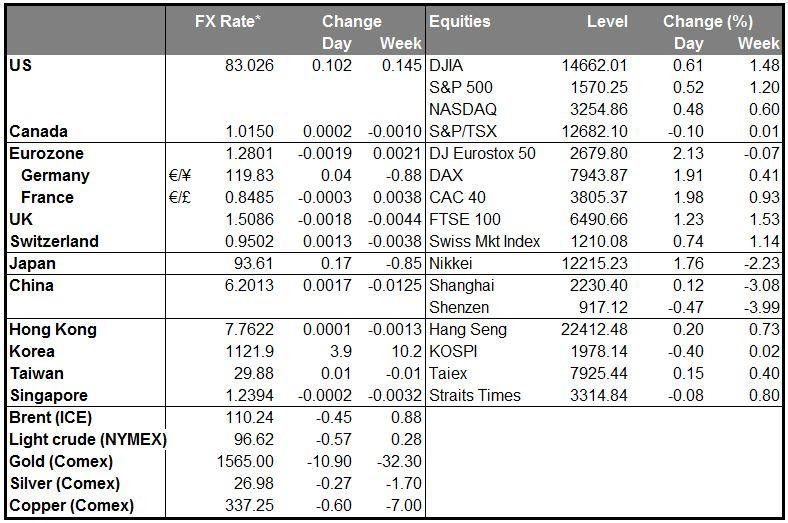

The MarketEUR/USD

• Although the pair did not have a major trading range yesterday, the data that was constantly coming out of the Eurozone and the U.S. spiked volatility. The pair was on a sustained downtrend as the news that came out yesterday where generally euro bearish and dollar bullish, however, short-lived rebounds where seen as the Eurozone and German manufacturing PMIs beat forecasts. Nonetheless, the further contraction of their manufacturing did have a bearing, as did the much weaker than anticipated Spanish and Italian PMIs, and the worsened situation in the Eurozone labour market. Volatility for the day is likely to be much lower, ahead of the ECB interest rate decision tomorrow, with the U.S. employment change and preliminary Eurozone CPI being the only significant news for the day. Resistance at 1.2880 seems to hold with trendline support at 1.2800 and further support at 1.2750.

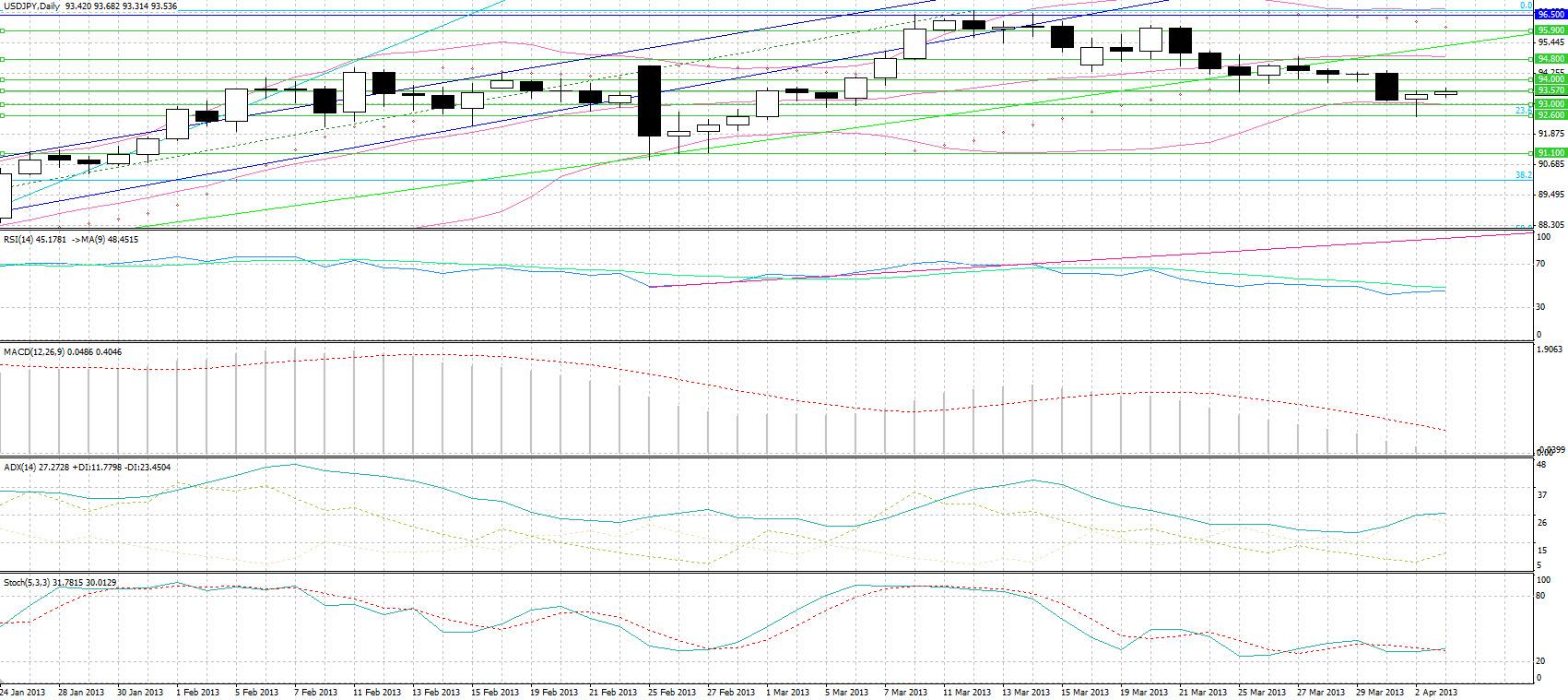

USD/JPY

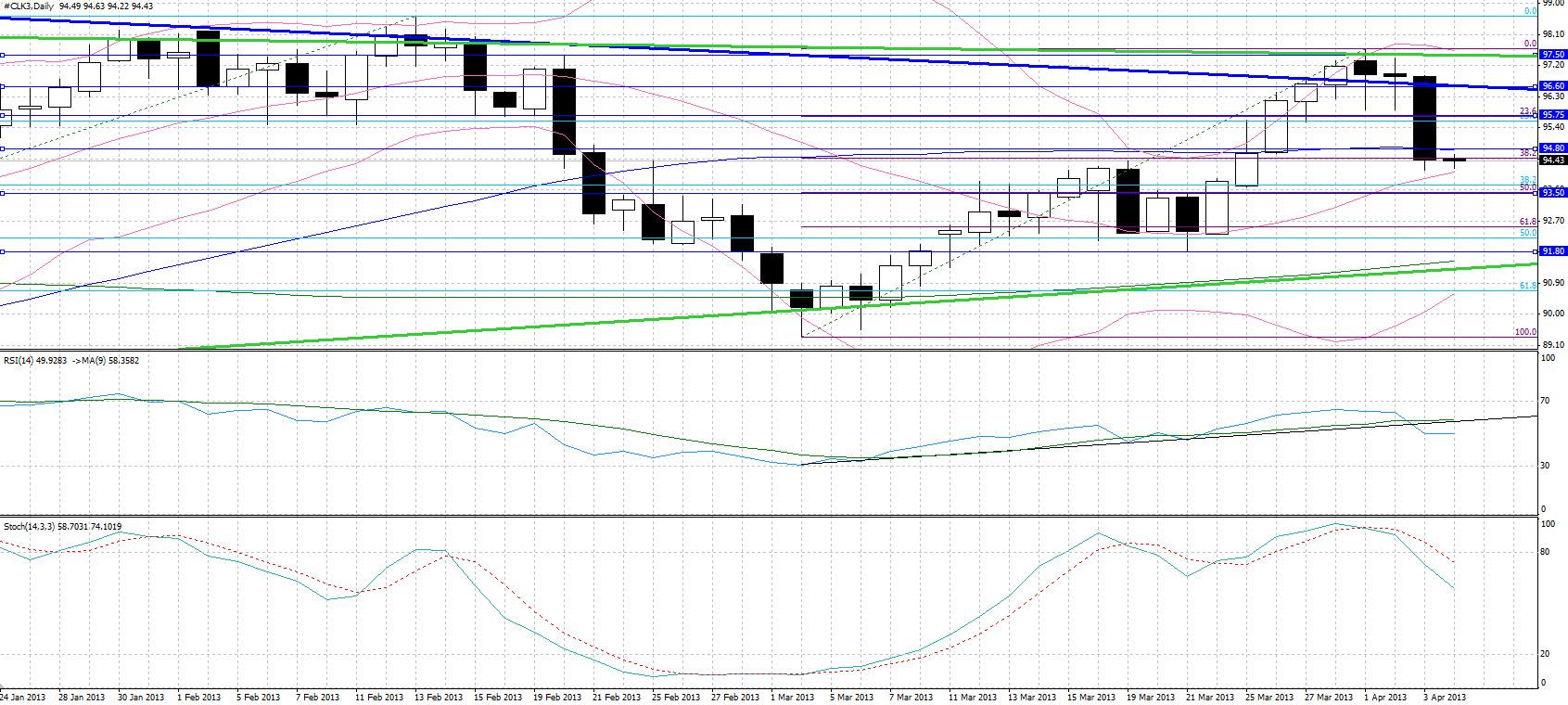

• USD/JPY is likely to show decreased movement today as all ears wait to hear whether Governor Kuroda will put money where his mouth is, increasing stimulus in an attempt to do whatever it takes to resolve Japan’s prolonged deflation. Resistance may come at 94.00, with support at 93.00, which also sees the lower Bollinger band. Should the BoJ not announce any further stimulus tomorrow, we will most likely see a steep fall on the pair, as a change in policy is likely priced in the market. In that case we may see support at 91.10, with resistance in case of a drastic revamp of policy coming at 95.90, with 94.80 seeming more likely.

GBP/USD

• The pound lost against all 16 of its major counterparts yesterday, experiencing the greatest decline versus the dollar. The pair plummeted from the 1.5260 strong resistance level as the U.K. Manufacturing PMI and mortgage approvals came in worse than expected. This marked a stark contrast to the economy’s prospects relative to the U.S. that had showed, just two days ago, an expansionary manufacturing PMI and renewed strength in the housing industry. Some support came at 1.5100, before cable continued with its decline, likely finding support thereafter at 1.5030. The anticipated improvement in construction PMI is unlikely to have a major impact on the pair, ahead of tomorrow’s BoE MPC meeting, where there is a small chance we may hear of an increase in quantitative easing to avert recession.

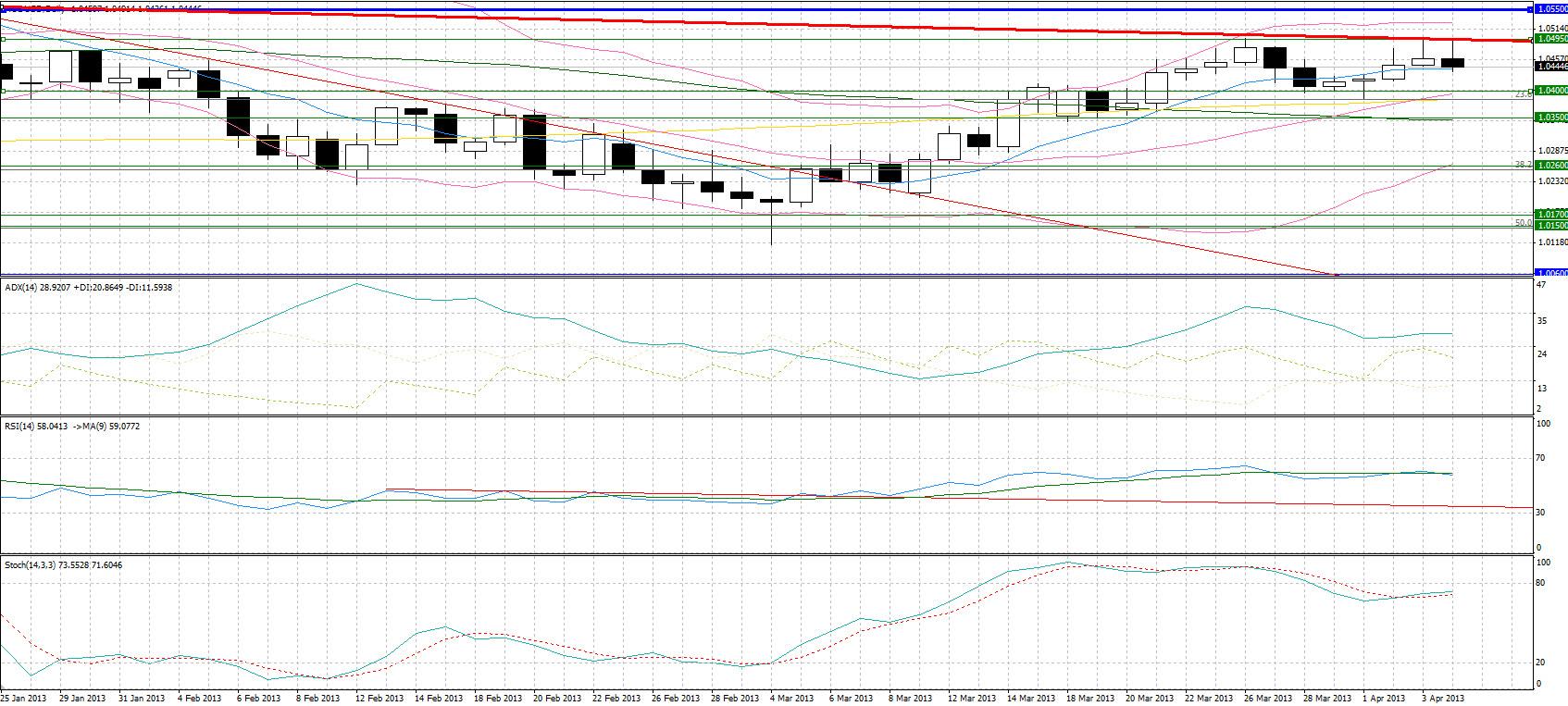

Gold

• The precious metals plummeted as the strong U.S. factory orders boosted equities and the dollar, and withered the appeal of the havens. Gold’s decline was accentuated by the break of the upward sloping trendline in its pennant formation, sparking a technical sell-off as it became apparent that we were experiencing the breakdown from the pattern. Having already violated the $1577 seemingly support level, which now may act as resistance, we see some weak support at $1564, noting a $1550 target based on the pennant breakdown measurement. The collapse from the continuation pattern that formed over the past couple of weeks reinforces our longer term bearish view on the asset.

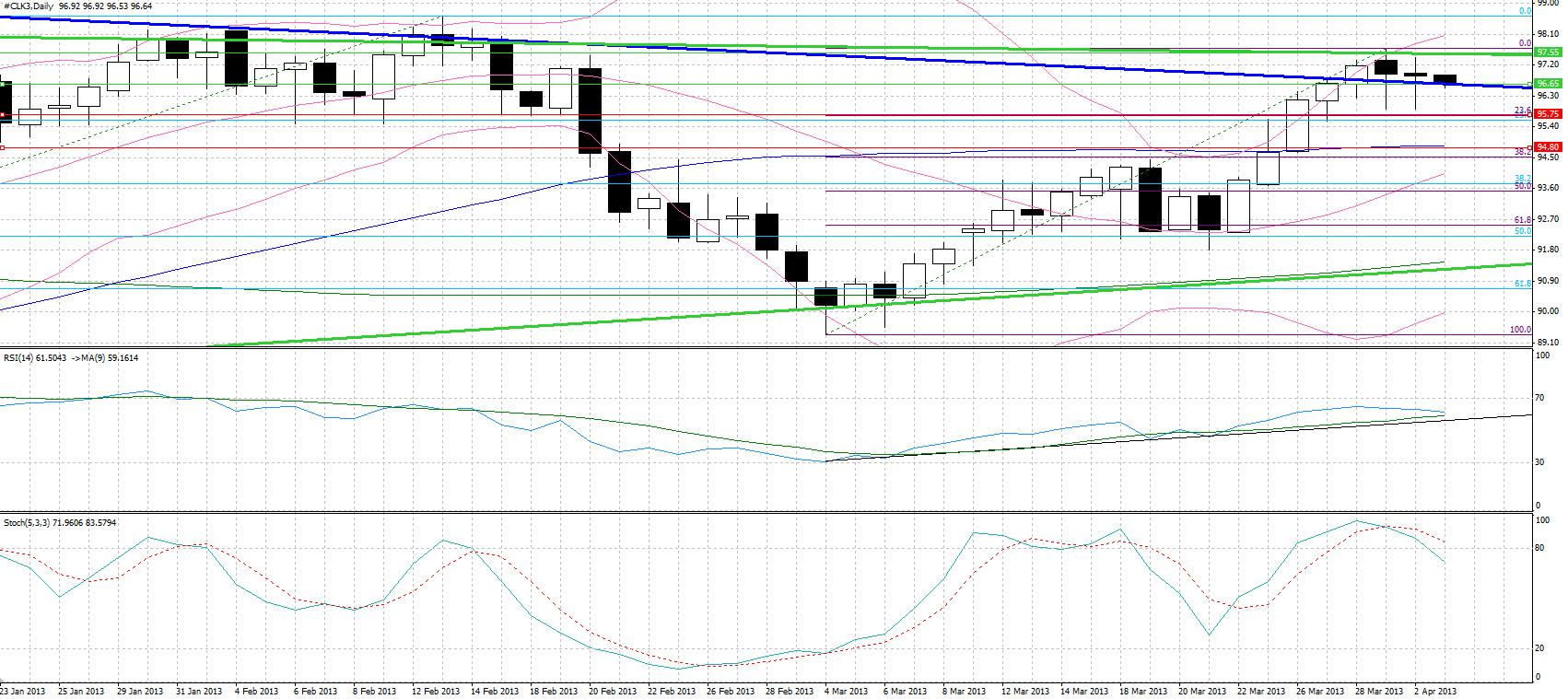

Oil

• WTI rebounded after initially finding, for a second consecutive day, support at $95.91. The gains on all three major U.S. equity indices on the back of strong U.S. factory orders, particularly automobiles and commercial aircraft, signaled a growing U.S. economy and demand for fuel, narrowing the spread with Brent. Crude tested yet again resistance around $97.50, at the upper trendline of its ascending triangle, before retracing to find support on its 5-year old downward sloping trendline. Data today due to show a further increase in crude stockpiles may see WTI trading yet again below $96, although record stockpile levels of late do not seem to have the price effects one would expect.

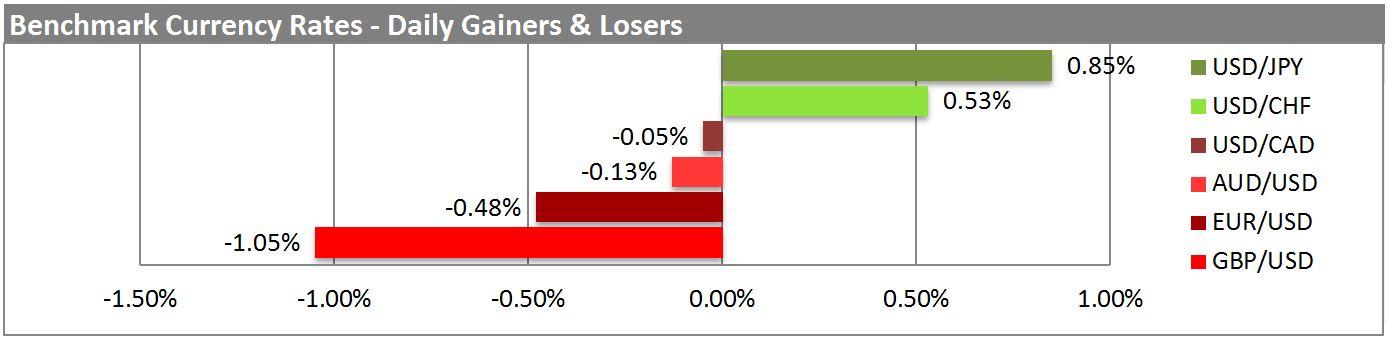

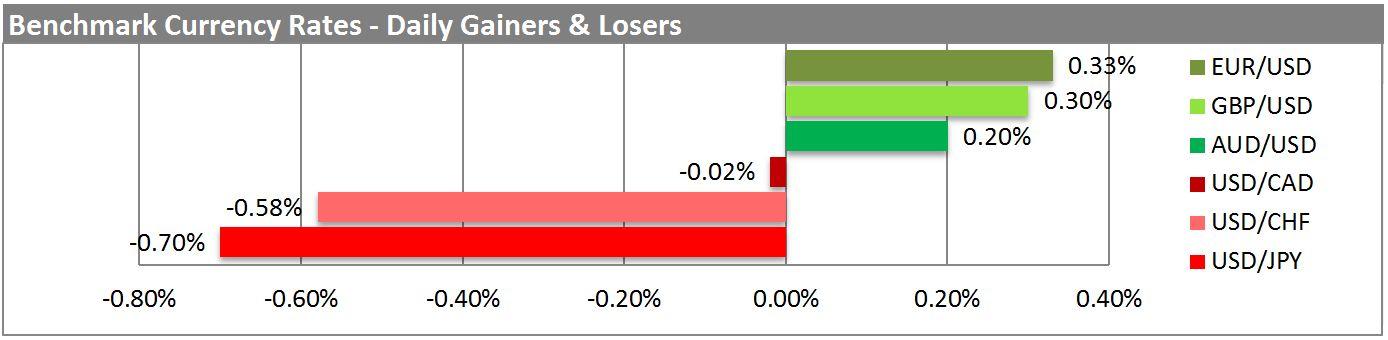

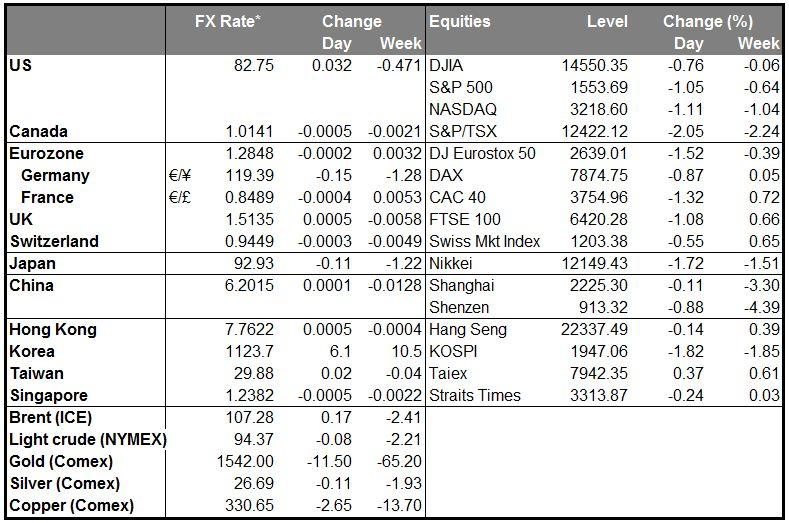

BENCHMARK CURRENCY RATES - DAILY GAINERS AND LOSERS

MARKETS SUMMARY

Read less

Market Analysis 04-04-2013: Central banks at the centre of market sentiment

Daily Commentary 04.04.2013

The Big Picture U.S. equity indices tumbled yesterday as the job gains and ISM non-manufacturing PMI figures came in considerably less than expected, with the former being the lowest number since November and the latter since October. The dollar also declined on the news as it became apparent that U.S. economic recovery was not taking place at a speed that would motivate the Fed to cut down on its stimulus any time soon.

The policy announcements by three major central banks, the BoJ, BoE, and ECB, will be followed with vigour today. The BoJ’s new stimulus programme came a bit as a surprise for the markets that were speculating disappointment from Kuroda. The U.K.’s flirt with a triple-dip recession has 3 out of 37 economists surveyed by Bloomberg forecasting a GBP 25bn increase in quantitative easing, with the remainder seeing the asset-buying programme staying level at GBP 375bn, despite BoE Governor King’s will to expand stimulus. The ECB is also set to keep its benchmark interest rate at its current, record-low level although there is a minor probability the rate will be lowered by 25bp in order to stimulate growth in the region.

Other news today includes Eurozone Markit Services PMI and the Producer Price Index as well as the U.S. Initial Jobless Claims. However, these pieces of information are likely to reserve limited attention in light of the central banks’ statements today and the Eurozone GDP and retail sales figures and the U.S. Nonfarm Payrolls reported tomorrow.

The Market EUR/USD

• The euro rebounded yesterday from its trendline support at 1.2800 as the Eurozone CPI eased to 1.7% from 1.8%, coming in below the 2% target and thus giving the ECB room to announce today further loosening of its monetary policy should it wish to do so to spur growth in the plagued bloc. The disappointing U.S. data added to the euro gains, with the pair finding resistance near its 200-day MA and the 50% retracement level of the July – February rally. That seems to be the resistance for today as well, with trading likely to be limited, save for a change in ECB policy, given the significant figures being released by the Eurozone and the U.S. tomorrow. Trendline support seems to lie at 1.2800.

USD/JPY

• The BoJ today decided to scrap its previous stimulus programme and adopt a more pluralistic one in its attempt to fight Japan’s chronic deflation. This had Japanese equities recovering and the yen plunging, losing its gains following the release of the U.S. data that took the markets by surprise yesterday. The BoJ’s decision to complement quantitative easing with qualitative easing was well-accepted by the markets, since the central bank won’t just increase its annual asset buying stimulus by about JPY 50 trillion, but it will extend the average maturities of it purchases by 4 years and will also increase its purchases of ETFs and REITs. USD/JPY may find some temporary resistance at 95.90, with support now likely coming at 94.00.

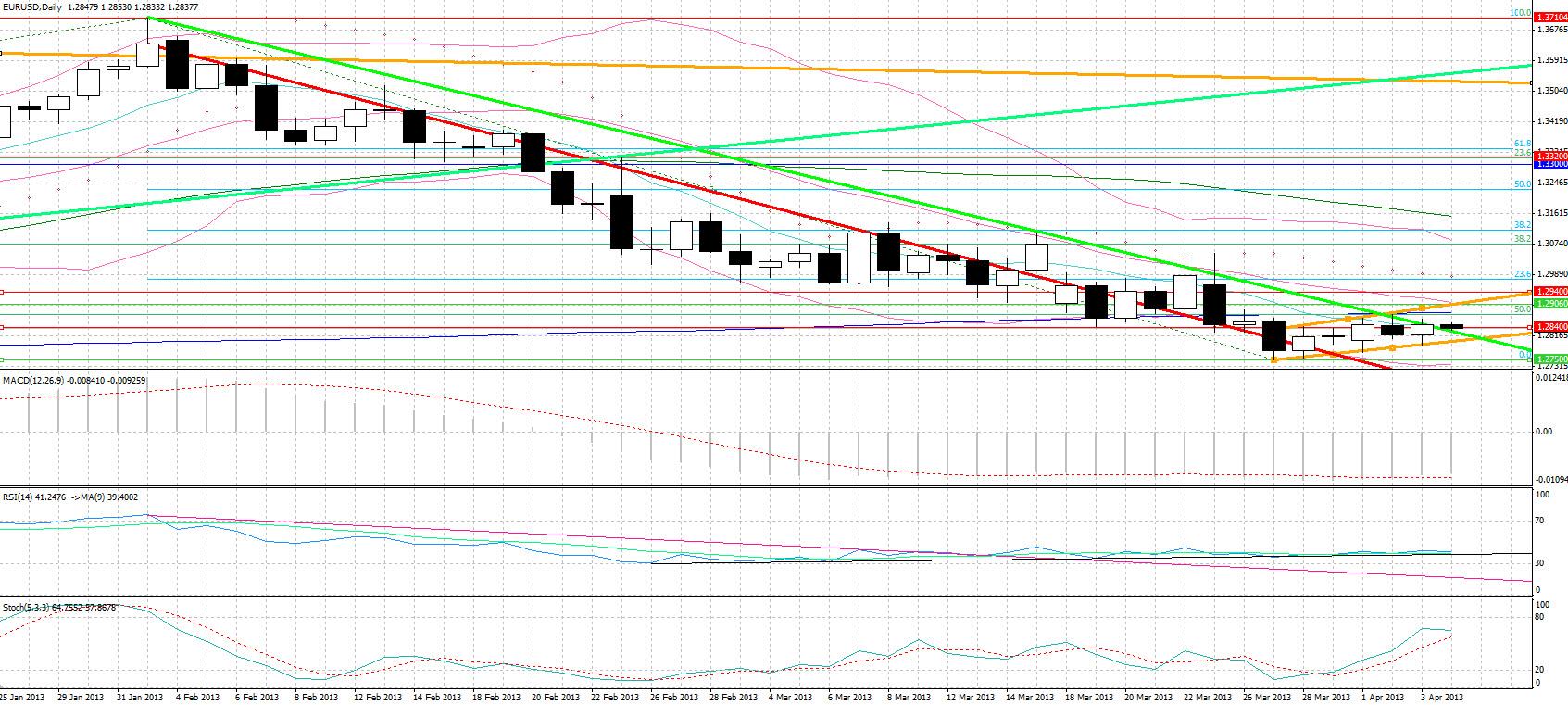

AUD/USD

• The Aussie was not able to capitalise on the weak U.S. data, retracing from 1.0495 trendline resistance as the metals plunged on the U.S. missed forecasts. However, the Aussie rebounded on improved building permits and retail sales data, finding yet again trendline resistance. A failure to breakout from the 1.0495 – 1.0550 area will be a bearish signal, with likely resistance currently still lying at 1.0495 and initial support possibly at the 200-day MA, at 1.0400.

Gold

• The falling U.S. equities and USD did not give the precious metals support, which seem to have lost their shine following Cyprus’ rescue and the lack of inflationary pressures in the U.S. Gold continued with its technical plunge from its pennant, finding initially support at $1550, before continuing with the bearish trend, that sees the next strong support at $1535, which has been a low three times the past 1 ½ years. A breakdown from that level may be driving us to a primary bear market for the asset, with initial support thereafter possibly coming at $1512. A rebound may find resistance around $1555, near the recent lows and in light of the lower Bollinger band.

Oil

• WTI was a major loser yesterday, marking its biggest decline in 2013 as it retraced from its 5-year trendline, on the weak U.S. job gains and the further, larger-than-expected increase in oil supplies that increased stockpiles to an almost 23-year record. The signs of slower recovery than previously thought, as signaled through the job gains, and the likely unutilized supply of crude brought price below the 50-day MA. Given the weakness to breakout from the $96.60 – 97.50 significant resistance level, it is likely that we will test yet again support at the upward sloping trendline which extends from February 2009. This continuation of the triangle formation sees support at around $91.80, near the 200-day MA.

BENCHMARK CURRENCY RATES - DAILY GAINERS AND LOSERS

MARKETS SUMMARY

click here to read less

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Daily Commentary 02.04.2013

The Big Picture Mixed up U.S. vs. messed up Eurozone? The disappointing U.S. ISM Manufacturing PMI figure caught all economists by surprise as it trailed even the most pessimistic of estimates, coming in at the modestly expansionary 51.3 versus the 54.1 consensus. This added downward pressure on the dollar against most currencies, particularly the majors, as it became apparent that it is likely the U.S. recovery is not taking place at a rate that would significantly reduce unemployment, thus initiating a cutback in Fed stimulus. U.S. construction spending data, however, appeased any recovery concerns as they showed a larger-than-expected increase, boosted by the highest level of residential construction since the outset of the 2008 Financial Crisis.

The yen was the biggest gainer against the dollar following the missed U.S. manufacturing data, with the Japanese stocks today continuing their decline from where they left off yesterday. A reminder earlier today by BoJ Governor Kuroda that the central bank is willing to do whatever it can to combat the chronic deflation did not help support USD/JPY, as PM Abe stated that the BoJ should not pursue the 2% inflation target “at all costs”.

News out today includes the Eurozone unemployment rate, which is expected to show a continuation of the creeping unemployment trend; Eurozone and UK Manufacturing PMI that are due to show further contraction; German CPI, which is forecasted to remain stable on a year-on-year basis; U.S. factory orders, where we anticipate a significant increase, and UK mortgage approvals for February, where we expect to see the weakest figure since October.

The Market EUR/USD

• EUR/USD gained following the weak U.S. manufacturing data, finding resistance at 1.2880, the 50% retracement level of the July – February rally. With data today being rather euro-centric, we anticipate substantial volatility, waiting to see whether the Eurozone’s woes will continue with further deteriorations in the labour market and manufacturing. Unlikely further euro gains may find resistance at the 20-day MA, around 1.2940, with weak support coming at 1.2840, and stronger support at 1.2745.

USD/JPY

• The pair broke the 93 level, finding support at 92.6, the 23.6% retracement level of the rally that has been taking place the past months in anticipation of further BoJ stimulus. Given the near oversold levels we have reached on the RSI and Stochastics due to the recent correction and in light of the BoJ press conference on Thursday where we may hear that stimulus will commence before the expected 2014, it is likely that we are seeing a bottoming of the recent trend.

AUD/USD

• The Reserve Bank of Australia decided earlier today to keep its interest rate unchanged, as the 9-month exchange rate above parity with the dollar limits imports, assisting the RBA to stay well-within its targeted inflation range. The low inflation gives the RBA flexibility with regard to its monetary policy, being able to further loosen policy, should that be necessitated to boost demand, which currently seems strong with improved retail sales and consumer confidence. The pair’s gains today came close to the downward sloping resistance trendline in a pattern formation that sees two converging trendlines since the summer of 2011. Future closing resistance may come at 1.0495, with subsequent resistance likely lying at 1.0550, which has seen four peaks the since August 2012. Support seems to come at 1.04, which sees the 23.6% retracement level of the uptrend that took place in the second half of 2012.

Gold

• Gold marginally gained yesterday as the weaker than expected U.S. PMI data added downward pressure on the dollar. The precious metal lies around its 20-day MA and seems to continue to follow its upward sloping trendline, with support for the day moving up, to $1595, and weak resistance coming at $1605. Stronger resistance lies in the $1616 – 1624 area.

Oil

• WTI declined initially on the announcement of the worse-than-expected, yet improved, U.S. Markit Manufacturing PMI and furthered its losses, finding support near the 23.6% retracement level of the recent rally, following the totally missed ISM Manufacturing PMI estimate. However, the light sweet crude swiftly rebounded, closing above the 5-year old trendline resistance level shown in blue. It is left to be seen whether the trendline will now act as support at $96.65, noting that U.S. stockpiles are at a 9-month high and 12% above the 5yr average, with inventories at Cushing being 54% higher than average. Resistance at $97.55, which sees the rather horizontal line of the ascending triangle formation, may be tested should factory orders do indeed show the second biggest increase in almost two years.

BENCHMARK CURRENCY RATES - DAILY GAINERS AND LOSERS

MARKETS SUMMARY

Read more

Read less

More...