Almost $50billion was wiped out from the global equity markets after concerns that the Cyprus bailout situation will put the Eurozone back in to financial crisis. In a busy trading yesterday the Asian stocks bounced back by the end of the trading session after plummeting earlier in the day.

Almost $50billion was wiped out from the global equity markets after concerns that the Cyprus bailout situation will put the Eurozone back in to financial crisis. In a busy trading yesterday the Asian stocks bounced back by the end of the trading session after plummeting earlier in the day.

The vote has been delayed until today as after the announcement of the proposed deal between the IMF, the EU the ECB and Cyprus Government to raid peoples banks, depositors ran out on to the streets to withdraw money from the cash machines. The banks in Cyprus have been closed for several days. This morning the EUR was trading at USD1.2942 in European session, dropping off from its highest level 0f 1.2970 against the dollar. Meanwhile the EURO STOXX 50 futures lost 0.4 per cent.

Read on for binary options analysis

Cyprus Bailout Vote may be Delayed or Cancelled Altogether

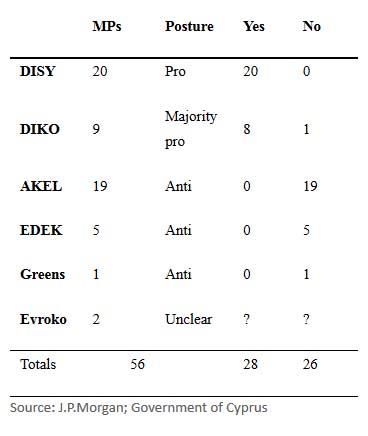

It’s looking like the Cyprus vote won’t pass later today. It may not even go ahead at all in a move that could collapse the banking system entirely and then send the country into default. If lawmakers are certain that the vote will not pass it’s unlikely they’ll even push it forward in the first place.

The vote which has already been postponed twice since the announcement on Sunday has been put down by 3 of the four ruling parties. They have already said that they will not support the deal at all while the 4th party said it cannot support the deal in its current form.

Read the rest of this article on binary options leader

Daily Technical Analysis: Mute reaction from Investors to Cyprus Deal

A rebound of Asian stocks in overnight trading alleviated investor concerns as to the knock-on effect on the Global financial markets. Trading was mixed in Asian session as low volumes were traded as investors remained cautious around the Cyprus problem. Volume began to increase after positive Manufacturing data was released in China.

Meanwhile across the water in the US the Fed reserve started its 2 day policy meeting. It’s widely believed that they will leave the …

Controversially lawmakers in Cyprus unanimously reject the levy on private bank accounts, essentially scuppering the EU bailout agreement that some have called blackmail. In Parliament yesterday 36 lawmakers voted against and 16 members abstained. Overwhelming support against Brussels and in effect calling the EU’s bluff.

This firmly places Cyprus at risk of default and even bankruptcy.

Daily Analysis: Asian Stocks Up On PMI and BOJ Easing Measures

Asia

The Nikkei 225 rose 1.34 per cent on talks of Japan implementing easing measures. The Shanghai Composite in China gained 0.07 per cent on the back off the positive PMI data. The Hang Seng in Hong Kong rose by 0.10 per cent. The NZSE 50 shrunk by 0.23 per cent, which was surprising to the markets after the New Zealand fourth quarter GDP figure which gained by 1.5 per cent. Higher than the expected 1.2 per cent.

Read on for stocks indices and today's outlook

60-Second Financial World News

Cyrpus

Cyprus has closed its banks for the entire week to stop savers making runs on the banks and withdrawing their funds, which could turn out like the Northern Rock fiasco in 200. Northern rock was the first bank in over 150 years to have had a bank run after it approached the Bank of England for a financial loan. The newly elected President Nicos Anasatades is working a plan B proposal to gain the EUR5.8billion requested by the Troika(IMF, EU and ECB) in order to get the further EUR10billion they have pledged to loan the ailing Island.

Asia

Read on for rest of financial world news

EUR at 4 Month Low & European stocks broadly lower as Cyprus Debates their Next Move

Most of the European stocks fell after EU gives Cyprus ultimatum to accept their deal by March 25th or have their emergency banking funds stopped. The EURO STOXX has seen its lowest level in 4 months extended, with 430 of its equities dropping and just 138 gaining in European trading session

Cyprus Receives Ultimatum from EU and Loses Russian Support

Cyprus ultimatum The ECB has now given Cyprus a new deadline – until the start of next week to come up with a package to raise the 7 billion euros or to lose their funding entirely. On the back of this the EUR traded just 0.4 % away from its lowest point in nearly 4 months.

The biggest drop in the 17-nation currency was seen directly after the Finance Minister of Cyprus Michael Sarris mentioned that the Russians had withdrawn their offer of support. The Finance Minister had been in Moscow to garner financial support from the Russians but had been unsucces....

Weekly Analysis: Cyprus Chaos Hits Markets

The ever worsening situation in Cyprus remained in limbo at the weekend as Cypriot policymakers moved closer to making alternative plans having rejected the initial proposal put forward by the EU and the IMF to tax bank deposits in order to raise 5.8 billion eur to assist Cypriot’s troubled banks which face the possibility of losing 4.5 billion eur on Greek investment bonds. The highly unpopular plan would have seen savings in Cypriot banks with under 100,000 euros paying 6.75% and those with savings higher than 100,000 paying 9.9%. The eurozone is offering a 10 billion euros loan but insists that Cyprus raise the 5.8 billion

Read the weekly analysis

Daily analysis: Mixed Messages from the Eurogroup Regarding Future of Bailouts in Eurozone

EU Jeroen Dijsselbloem

A positive day for European stocks yesterday, buoyed by optimistic investor confidence around the new Cyprus deal. The only thing that managed to soften the sentiment were comments made by the head of the Eurogroup Jeroen Dijsselbloem. He said that the bailout plan received by Cyprus is the first of a new type of rescue plan to deal with banking crises in the Eurozone and just like Cyprus other countries need to think about the restructure of their banks. Later on in his comments, he seemed to go back on what he’d said, mentioning Cyprus was a specific case with its own exceptional challenges.

Read on for forex, stocks and commodities analysis

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Read on for forex, commodities and stocks technical analysis