You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Italy's Non-EU Trade Surplus Increases In October

Italy's non-EU trade surplus increased in October due to an improvement in exports amid falling imports, the statistical office Istat showed Monday.

The trade with non-EU countries resulted in a surplus of EUR 2.89 billion in October, which was higher than the EUR 1.43 billion surplus logged in the same period of last year.

Exports to non-EU countries grew 1.5 percent, while imports decreased 8 percent compared with the same month of the previous year. Similarly, exports were up 0.8 percent and imports decreased by 1.3 percent on a monthly basis.

source

ECB's Mersch: Excess Liquidity Policy Must Not Become Permanent

European Central Bank Executive Board member Yves Mersch said on Tuesday that the bank must ensure smooth flow of liquidity to the banking sector, while making sure that the excess liquidity policy will not become a permanent one.

"Excess liquidity policy, however useful and necessary it has been - and still is, should not become a permanent feature," Mersch said in a speech in Frankfurt.

"It should be limited in time to avoid dressing-up non-performing loans or ever-greening bad assets that would undermine incentives to restructure or to address structural weaknesses in banks' balance sheets."

On November 7, the ECB cut the key interest rate by a quarter-point to a record low 0.25 percent, given the combination of low inflation, record unemployment and a stronger currency.

The policymaker urged banks to pass on the favorable financing conditions they enjoy to households and firms to ultimately revive the flow of credit in the euro area. "The ball is in the court of the private sector and the euro area governments," Mersch said.

He also pointed out that the EU Treaty had assigned a precise mandate for the ECB, which is to maintain price stability. "Likewise, the scope of action is limited and some tasks are explicitly prohibited, e.g. the outright purchases of government bonds on the primary market, i.e. the monetization of public debt," the policymaker said.

The effective and successful conduct of monetary policy must not be used as a pretext for complacency in other policy areas, he added.

source

Portugal passes latest austerity budget

Portugal is set for another tough year after its government approved a new set of budget measures.

The country is struggling to come back to financial health and meet the terms of an international bailout.

It has now passed another set of spending cuts, which face strong opposition from workers who will be directly affected.

They also face a court challenge that, if successful, could derail Portugal's goal of exiting the bailout in 2014.

Government workers in particular will be hit by the action which will give Portugal a third year of austerity.

Cuts

Public employees earning more than 675 euros (£565, $915) a month will see their pay cut by between 2.5-12%, pensions above a certain amount will be cut by 10% and working hours raised from 35 to 40 hours a week.

They will also lose three days' holiday a year.

About 80% of the government workforce, or some 600,000 workers, will be affected.

Thousands of workers protested outside the parliamentary building during the vote.

Lisbon needs to cut the budget deficit to 4% of economic output from this year's 5.5%.

read more

French Consumer Sentiment Weakens Unexpectedly In November

Confidence among French households decreased modestly in November from the previous month, survey data released by statistical office Insee revealed Wednesday. Economists had forecast sentiment to remain unchanged.

The consumer confidence index dropped to 84 in November from 85 in the previous month. The index was forecast to stay unchanged at the October level.

Consumers' confidence in their personal finances during the past twelve months remained broadly unchanged. Similarly, their expectations of the financial situation in the next twelve months stayed stable.

Meanwhile, respondents' views of France's economic condition in the past turned more downbeat in November. At the same time, they turned more pessimistic about the future of the economy.

The sub-index that measures consumers' willingness to make major purchases remained unchanged at -29 in November. The indicator of their current saving capacity moved up 1 point to 14.

Households were more concerned about future employment than they were in October. The corresponding indicator rose by 16 points in November, offsetting the declines seen in the past two months.

read more

German jobless claims rise more than expected

Germany's robust labor market showed signs of strain in November, as jobless claims rose for the fourth consecutive month and registered demand for labor eased.

Jobless claims in November were up 10,000 from October when taking account of seasonal swings, leaving the seasonally adjusted jobless rate unchanged at 6.9%, close to a record low, Germany's BA labor agency said Thursday.

Economists polled by The Wall Street Journal had forecast unemployment would increase by just 3,500.

The labor market outlook is also clouded by the prospect of Germany's new government introducing a national minimum wage--with a few, temporary exceptions--and toughening labor market rules. Many economists warn this could lead to job losses, especially at smaller businesses.

The labor agency said 55,000 more people were without a job in November than in the same month last year.

In another sign of a weakening labor market, registered demand for labor eased, with total vacancy notices down 20,000 from November 2012 at 431,000.

read more

Euro Climbs as Inflation Data Damps ECB Speculation

The euro rose to a four-year high against the yen as annual inflation in Germany accelerated in November more than economists forecast, damping bets the European Central Bank will further loosen monetary policy.

The shared currency climbed for a third day against the dollar as separate reports showed consumer-price growth in the German states of Saxony and North Rhine-Westphalia increased for the first time in five months. The ECB cut its benchmark interest rate this month after inflation in the currency bloc slowed to a four-year low in October. The pound rose for a third day versus the dollar as Bank of England Governor Mark Carney said the central bank will end incentives for mortgage lending.

“The more resilient German inflation is, the higher the hurdle is for more easing from the ECB,” said Eimear Daly, a currency-market analyst at Monex Europe Ltd. in London. “The inflation number from Saxony significantly boosted the euro,” she said, referring to the first regional report to be released.

The euro climbed 0.3 percent to 139.07 yen at 10:32 a.m. Toronto time after advancing to 139.18, the highest since June 2009. The shared currency added 0.2 percent to $1.3602. The dollar rose 0.1 percent to 102.25 yen after touching 102.37, the strongest level since May 29.

U.S. financial markets are shut today for a public holiday.

The annual inflation rate in Germany, calculated using a harmonized European Union method, rose to 1.6 percent this month from 1.2 percent in October. The median forecast of analysts in a Bloomberg survey was for a reading of 1.3 percent.

read more

There Is Just No Escape From Mario Draghi's Monetary Zombie Nightmare

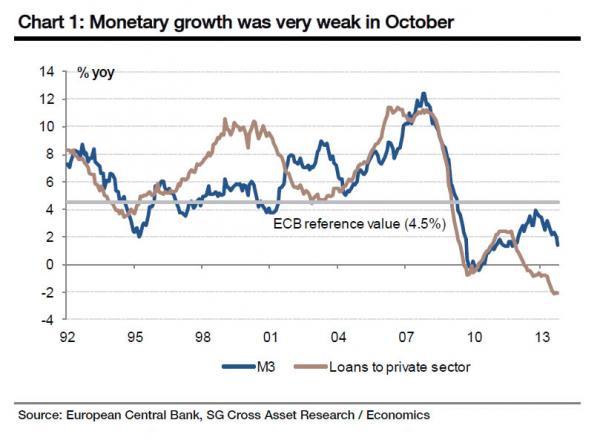

On November 7, when the ECB announced a "surprising" rate cut, 67 out of 70 economists who never saw it coming, were shocked. We were not. As we observed ten days prior, Europe had just seen the latest month of record low private sector loan growth in history. Or rather contraction. Back than we said that "one of our favorite series of posts describing the "Walking Dead" monetary zombie-infested continent that is Europe is the one showing the abysmal state Europe's credit creation machinery, operated by none other than the Bank of Italy's, Goldman's ECB's Mario Draghi, finds itself in." We concluded: "we now fully expect a very unclear Draghi, plagued by monetary zombie dreams, to do everything in his power, even though as SocGen notes, he really has no power in this case, to show he has not lost control and start with a rate cut in the November ECB meeting (eventually proceeding to a full-blown QE) in order to boost loan creation." Less than two weeks later he did just that. The problem, as the ECB reported today, is that not only did M3 decline once more, to 1.4% or the slowest pace in over 2 years and well below the ECB's 4.5% reference growth value, but more importantly lending to companies and households shrank 2.1% in October - the biggest drop on record! Draghi's monetary zombies are winning.

This is what Europe's monetary pipeline zombies look like:

From SocGen:German Retail Sales Drop Unexpectedly

German retail sales declined unexpectedly in October, data from the Federal Statistical Office revealed Friday.

Retail sales fell 0.8 percent month-on-month in October after adjusting to seasonal and working day variations. Economists had forecast a 0.5 percent increase. Sales have now fallen for a second month running.

Compared with October 2012, retail sales dropped 0.2 percent. This was forecast to increase 1.4 percent after a 0.3 percent year-on-year growth in September.

Retail sales of food declined 2.8 percent annually in October, while non-food sales fell 1.5 percent.

source

European Inflation Rises From The Ashes On Rebound In Energy Prices

If October's stunning(ly low) inflation print of 0.7% is what conventional wisdom believes is the reason for the surprising ECB rate cut (it isn't - the culprit was the record low increase in private loan creation), then the just released modest increase in Eurozone November CPI, which was expected to print at 0.8%, instead rising just above that, or 0.9%, will likely mean less surprises out of the ECB in the future. Core CPI (excluding food, energy, alcohol and tobacco) rose 1.0%, following a 0.8% increase in October and 0.9% expected, while the biggest headline bounce was in energy prices which rose from -1.7% to -1.1%, if still rather negative. Looking at the main components of euro area inflation, food, alcohol & tobacco is expected to have the highest annual rate in November (1.6%, compared with 1.9% in October), followed by services (1.5%, compared with 1.2% in October), non-energy industrial goods (0.3%, stable compared with October) and energy (-1.1%, compared with -1.7% in October).

The full breakdown is shown in the table below:

The market response to the better than expected print was subduded with the EUR going nowhere fast. Perhaps this is due to the complete impotence of the ECB to talk down the currency and the fact that it is now at a higher level than where it was when it announce the November 7 rate cut. Furthermore, with strong German inflation prints yesterday, the market may have been expecting an even larger number out of Eurostat.

Finally, what drives the ECB next will once again not be the rigged inflation print but other considerations. Deutsche Bank had a good summary of just these earlier today:

source

EUR/USD little changed, hovers near one-month highs

The euro was little changed against the U.S. dollar in thin trade on Friday, trading close to one-month highs as positive economic reports out of the euro zone continued to support demand for the single currency.

EUR/USD hit 1.3564 during U.S. morning trade, the session low; the pair subsequently consolidated at 1.3601, inching down 0.03%.

The pair was likely to find support at 1.3558, the low of November 27 and resistance at 1.3682, the high of October 17.

Preliminary data earlier showed that the annual rate of inflation in the euro zone rose to 0.9% in November, from October’s four year low of 0.7%, exceeding expectations for a rise to 0.8%.

A separate report showed that the unemployment rate in the single currency bloc ticked down to 12.1% last month, from 12.2% in September. Analysts had expected the unemployment rate to remain unchanged in October.

The data came after a report showed that German retail sales fell 0.8% last month, confounding expectations for a 0.5% rise, after a 0.2% slip in September.

In France, consumer spending ticked down 0.2% in October, disappointing expectations for a 0.2% rise, after a 0.1% fall the previous month.

read more