forex market outlook 15 nov 2011

Daily Market Outlook

Posted by ACFX on November 15, 2011

Currencies

EUR/USD The euro declined for a second day before a report forecast to show German investor confidence fell to a three-year low as Europe’s debt crisis threatens to curb economic growth.

The euro fell 0.2 percent to $1.36 at 1:56 p.m. in Tokyo from the close in New York yesterday, when it slid 0.9 percent.

NZD/USD The New Zealand dollar declined for a second day as concern Europe will struggle to contain its sovereign-debt crisis sapped demand for riskier assets.

New Zealand’s dollar declined 0.5 percent to 77.63 U.S. cents as of 12:31 p.m. Sydney time.

USD/CAD Canada’s dollar fell for the first time in three days against its U.S. counterpart on concern European nations may have difficulty repaying their debt, discouraging demand for higher-yielding assets.

Canada’s currency depreciated 0.6 percent to C$1.0167 per U.S. dollar by 5 p.m. in Toronto. One Canadian dollar buys 98.36 U.S. cents.

Commodities

Spot gold prices traded little changed on Tuesday, as investors unnerved by an Italian bond auction focused on the scope of the task faced by new governments in Italy and Greece in keeping the region’s sovereign debt crisis under control.

Spot gold was little changed at $1,778.64 an ounce by 0016 GMT. * U.S. gold edged up 0.1 percent to $1,780.60.

Oil fell for a second day in New York as concern that Europe will struggle to contain its debt crisis countered signs of declining fuel stockpiles in the U.S., the world’s largest crude consumer.

Crude for December delivery declined as much as 43 cents to $97.71 a barrel in electronic trading on the New York Mercantile Exchange.

Equities

European Stocks dropped as Italy’s borrowing costs rose after the nation sold 3 billion euros ($4.1 billion) of bonds at the highest yield since 1997.

The benchmark Stoxx Europe 600 Index retreated 1 percent to 238.47 at the close in London, with all 19 industry groups declining.

U.S Stocks declined, snapping a two-day advance in the Standard & Poor’s 500 Index, as an increase in Italian borrowing costs deepened concern Europe will struggle to contain its sovereign debt crisis.

Morgan Stanley and Citigroup Inc. (C) fell more than 2.6 percent

The S&P 500 retreated 1 percent to 1,251.78 at 4 p.m. New York time.

The Dow Jones Industrial Average decreased 74.70 points, or 0.6 percent, to 12,078.98

Asian stocks fell, paring yesterday’s advance, after Italian borrowing costs surged, reviving concern Europe’s sovereign-debt crisis is spreading, damping the outlook for earnings.

Japan’s Nikkei 225 (NKY) Stock Average 225 Stock Average fell 0.7 percent.

Hong Kong’s Hang Seng Index declined 1.2 percent.

Australia’s S&P/ASX 200 dropped 0.4 percent

forex market outlook 15 nov 2011

Daily Market Outlook

Posted by ACFX on November 15, 2011

Currencies

EUR/USD The euro declined for a second day before a report forecast to show German investor confidence fell to a three-year low as Europe’s debt crisis threatens to curb economic growth.

The euro fell 0.2 percent to $1.36 at 1:56 p.m. in Tokyo from the close in New York yesterday, when it slid 0.9 percent.

NZD/USD The New Zealand dollar declined for a second day as concern Europe will struggle to contain its sovereign-debt crisis sapped demand for riskier assets.

New Zealand’s dollar declined 0.5 percent to 77.63 U.S. cents as of 12:31 p.m. Sydney time.

USD/CAD Canada’s dollar fell for the first time in three days against its U.S. counterpart on concern European nations may have difficulty repaying their debt, discouraging demand for higher-yielding assets.

Canada’s currency depreciated 0.6 percent to C$1.0167 per U.S. dollar by 5 p.m. in Toronto. One Canadian dollar buys 98.36 U.S. cents.

Commodities

Spot gold prices traded little changed on Tuesday, as investors unnerved by an Italian bond auction focused on the scope of the task faced by new governments in Italy and Greece in keeping the region’s sovereign debt crisis under control.

Spot gold was little changed at $1,778.64 an ounce by 0016 GMT. * U.S. gold edged up 0.1 percent to $1,780.60.

Oil fell for a second day in New York as concern that Europe will struggle to contain its debt crisis countered signs of declining fuel stockpiles in the U.S., the world’s largest crude consumer.

Crude for December delivery declined as much as 43 cents to $97.71 a barrel in electronic trading on the New York Mercantile Exchange.

Equities

European Stocks dropped as Italy’s borrowing costs rose after the nation sold 3 billion euros ($4.1 billion) of bonds at the highest yield since 1997.

The benchmark Stoxx Europe 600 Index retreated 1 percent to 238.47 at the close in London, with all 19 industry groups declining.

U.S Stocks declined, snapping a two-day advance in the Standard & Poor’s 500 Index, as an increase in Italian borrowing costs deepened concern Europe will struggle to contain its sovereign debt crisis.

Morgan Stanley and Citigroup Inc. (C) fell more than 2.6 percent

The S&P 500 retreated 1 percent to 1,251.78 at 4 p.m. New York time.

The Dow Jones Industrial Average decreased 74.70 points, or 0.6 percent, to 12,078.98

Asian stocks fell, paring yesterday’s advance, after Italian borrowing costs surged, reviving concern Europe’s sovereign-debt crisis is spreading, damping the outlook for earnings.

Japan’s Nikkei 225 (NKY) Stock Average 225 Stock Average fell 0.7 percent.

Hong Kong’s Hang Seng Index declined 1.2 percent.

Australia’s S&P/ASX 200 dropped 0.4 percent

Quality of operations via Exchange-Lite guaranteed by LiteForex

A reserve fund will be jointly setup by the LiteForex group of companies and the administration of Exchange-Lite.com Service. The reserve find will be offering insurance of the exchange operations conducted by means of the Service.

Specialists at Exchange-Lite.com completely recognize the responsibility associated with secure service and technical support provision and make every possible effort for providing quality and reliable service in the sphere of online exchanges. The approach combined with the presence of an insurance reserve fund and a powerful program-technical component acts as a guarantee of Exchange-Lite.com’s long-term cooperation with every client.

Registration on the official site enables the users to take advantage of additional advantages and profitable exchange rates.

Source:ForexPulse

16 nov 2011 forex market news

Currencies

EUR/USD The euro sank to five-week lows against the dollar and the yen as Spain and France prepare to sell securities tomorrow after a slump in euro-area debt signaled the region’s debt crisis is spreading.

The euro fell 0.6 percent to $1.3456 as of 6:51 a.m. London from the close in New York, after touching $1.3433, the weakest level since Oct.

USD/JPY The Bank of Japan (8301) cut its economic assessment as a global slowdown erodes exports, underscoring the nation’s vulnerability to Europe’s deepening debt crisis.

The yen traded at 77.01 versus the dollar as of 3:26 p.m. in Tokyo from 77.07 before the announcement.

USD/CAD Canada’s dollar depreciated against its U.S. counterpart for a second day on concern the sovereign- debt crisis in Europe is spreading, reducing demand for higher returning assets.

Canada’s currency dropped 0.4 percent to C$1.0211 per U.S. dollar at 5 p.m. in Toronto, after falling as much as 0.9 percent to C$1.0263.

Commodities

Gold declined for a second day in New York as a stronger dollar curbed demand for the metal as an alternative asset. Billionaire investor John Paulson cut his holdings by 36 percent in the SPDR Gold Trust last quarter.

Gold for December delivery fell 0.4 percent to $1,770.90 an ounce by 7:59 a.m. on the Comex in New York. Immediate-delivery gold was 0.6 percent lower at $1,769.88 in London.

Oil dropped from the highest level in more than three months after U.S. crude stockpiles increased and a surge in Italian bond yields stoked speculation Europe is failing to contain its debt crisis.

Crude oil for December delivery slid as much as 98 cents to $98.39 a barrel in electronic trading on the New York Mercantile Exchange and was at $98.61 at 5:36 p.m. Sydney time.

Equities

European stock markets finished lower Tuesday but pared session losses following a string of better-than-anticipated U.S. economic data. However, Italy’s 10-year bond yields climbing back above the critical 7% mark continued to pressure markets as concerns escalated regarding the country’s ability to push through vital austerity measures.

The Stoxx Europe 600 banks index was down 2.0%.

U.S Stocks rose, rebounding from earlier losses, on speculation Italian Prime Minister designate Mario Monti will succeed in forming a new government to battle the debt crisis and after growth in retail sales beat estimates.

The S&P 500 gained 0.5 percent to 1,257.81 at 4 p.m. New York time, rebounding from a loss of 0.6 percent.

The Dow Jones Industrial Average advanced 17.18 points, or 0.1 percent, to 12,096.16. About 6.3 billion shares changed hands on U.S. exchanges, 24 percent below the three-month average.

Asian stocks fell for a second day after Italian bond yields rose amid concern Italy’s new government will struggle to trim its debt and keep Europe’s crisis from spreading.

The MSCI Asia Pacific Index slipped 1.7 percent to 115.73 as of 3:07 p.m. in Tokyo. More than five stocks fell for each that rose on the gauge.

The Nikkei 225 (NKY) Stock Average dropped 0.9 percent as the Bank of Japan cut assessment of the country’s economy.

23 november 2011 market outlook

Currencies

EUR/USD The euro slid for the sixth time in eight days against the dollar before data that may add to signs that Europe’s debt crisis is damping economic growth.

Europe’s shared currency lost 0.3 percent to $1.3470 as of 6:59 a.m. London time from $1.3505 in New York yesterday.

USD/JPY The yen may rally through 70 per dollar next year as global financial stability in the second half damps investor appetite for the greenback, according to JPMorgan Chase & Co.

The yen dropped 0.1 percent to 76.96 per dollar at 1:40 New York time

USD/CAD Canada’s dollar advanced against the majority of its most-traded counterparts after a report showed retail sales grew in September at the fastest pace in a year, improving the outlook for economic growth

Canada’s currency, known as the loonie, appreciated 0.2 percent to $1.0383 per U.S. dollar at 5 p.m. in Toronto.

Commodities

Oil dropped from a three-day high in New York as investors speculated that rising gasoline stockpiles in the U.S. and slowing economic growth in Europe will reduce demand for fuel.

Crude oil for January delivery slid as much as $1.62 to $96.39 a barrel in electronic trading on the New York Mercantile Exchange and was at $96.53 at 12:14 p.m. in Singapore.

Equities

Asian stocks fell, with a regional gauge heading for its lowest close in a month, as a mining tax was approved in Australia and reports showed the U.S. economy grew slower than expected and China’s manufacturing may have contracted.

The MSCI Asia Pacific excluding Japan Index fell 2.2 percent to 379.90 as of 1:18 p.m. in Hong Kong.

Australia’s S&P/ASX 200 sank 2 percent, while South Korea’s Kospi Index declined 2.5 percent.

Hong Kong’s Hang Seng Index dropped 1.9 percent.

European Stocks declined, extending their biggest drop in three weeks, as borrowing costs rose in the euro area, outweighing rating companies’ reaffirmation of America’s credit grades.

The benchmark Stoxx Europe 600 Index slipped 0.7 percent to 223.27 at the close as banks and technology companies retreated France’s CAC 40 Index and Germany’s DAX Index lost 3.4 percent.

The U.K.’s FTSE 100 Index dropped 2.6 percent.

US stocks fell, driving the Standard & Poor’s 500 Index to its longest slump in almost four months, as slower-than-estimated economic growth overshadowed signs the Federal Reserve may provide more stimulus.

The S&P 500 declined 0.4 percent to 1,188.04 at 4 p.m. New York time.

The Dow retreated 53.59 points, or 0.5 percent, to 11,493.72

by acfx

Technical Analysis by ACFX

EUR/USD The Euro gapped up earlier today in Asian session opened at 1.3308, 70 pips higher from Friday’s close.

Gold gained more than 1 percent to above $1,700 an ounce on Monday as the euro rose on hopes Europe will take a bolder step to resolve a crippling debt crisis.

Oil climbed for a second day in New York on speculation that Europe’s steps to tame its debt crisis may sustain demand and sanctions against Syria will threaten Middle East stability.

Crude oil for January delivery advanced as much as $1.77 to $98.54 a barrel in electronic trading on the New York Mercantile and was at $98.21 at 3:20 p.m.

Daily Technical Analysis by ACFX

EUR/USD The dollar fell against 14 of its 16 major counterparts as advancing stocks damped demand for safer assets.

The U.S. currency dropped 0.2 percent to $1.3349 per euro as of 1:50 p.m. Tokyo time from the closing level in New York yesterday.

USD/JPY The yen fell against all its major peers as Asian stocks rallied a second day and on prospects Japanese policy makers will do more to stem currency gains..

The yen slid 0.3 percent to 78.19 per dollar as of 10:40 a.m. in Tokyo and reached 78.29, the weakest level since Nov. 2.

Oil pared its earlier decline in New York..

Crude for January delivery was at $98.13 a barrel, down 8 cents, in electronic trading on the New York Mercantile Exchange at 5:20 p.m. Sydney time, after earlier sliding as much as 1 percent.

Technical Analysis& Market outlook by ACFX

EUR/USD The euro dropped versus the majority of its most-traded counterparts amid speculation Europe’s effort to expand its bailout fund to 1 trillion euros ($1.3 trillion) is falling short.

The euro was little changed at $1.3317 at 5 p.m. New York time, after earlier gaining to as high as $1.3442, the strongest level since Nov. 23.

AUD/USD Australia’s dollar maintained earlier gains after reports showed capital expenditure surged while bank lending slowed.

The so-called Aussie traded at $1.0033 as of 11:32 a.m. in Sydney, from $1.0022 before the data.

USD/CAD Canada’s dollar rose as oil prices climbed and American consumer confidence increased in November by the most in more than eight years, boosting appetite for higher-yielding assets.

Canada’s currency, also known as the loonie for the image of the aquatic bird on the C$1 coin, gained 0.2 percent to C$1.0321 per U.S. dollar by 5 p.m. in Toronto.

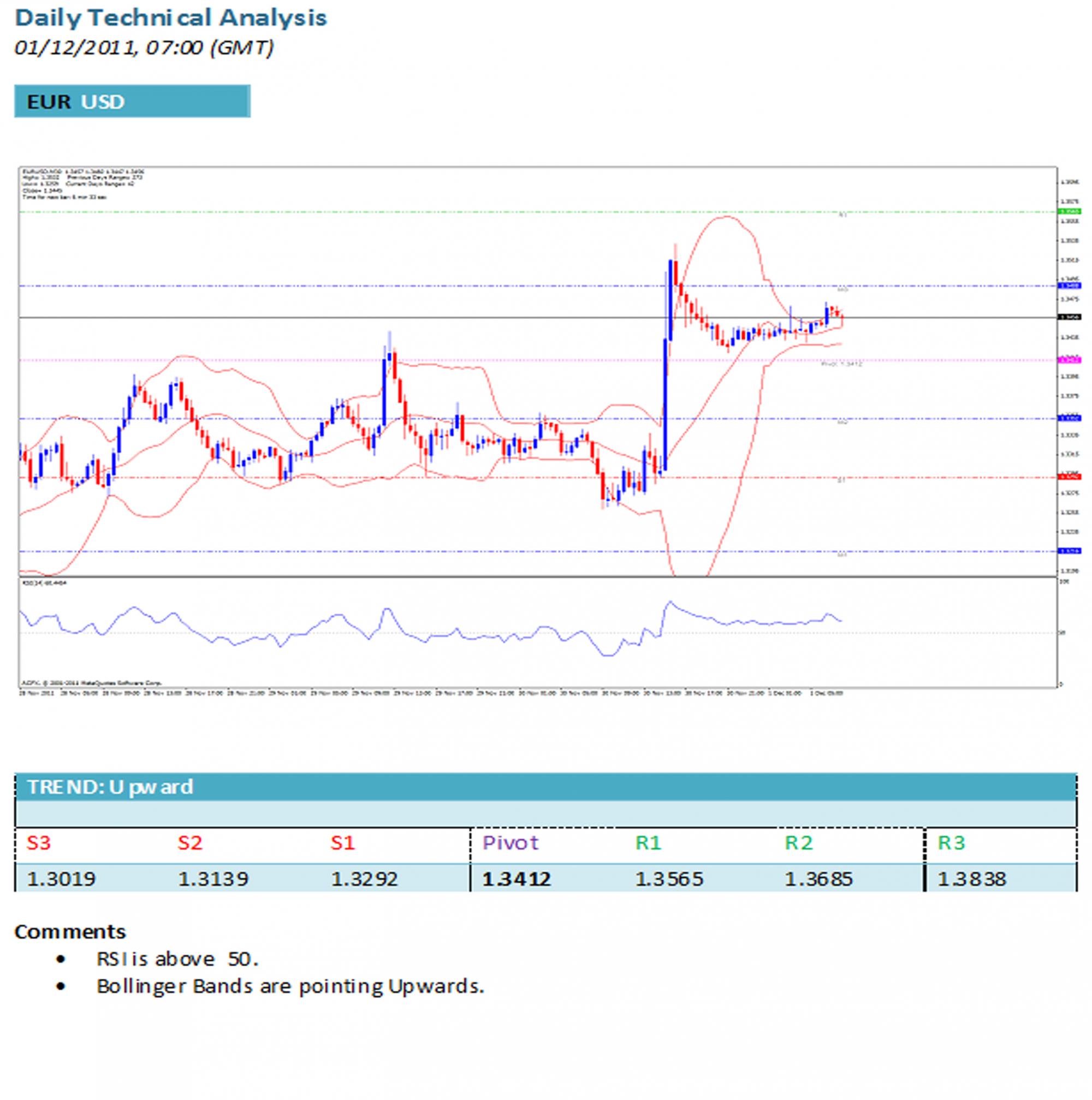

Technical Analysis & Market outlook by ACFX 1/12/11

EUR/USD The euro gained the most in a month against the dollar after the Federal Reserve and five other central banks acted to make more funds available to lenders as Europe’s debt crisis threatens global economic growth.

The euro strengthened 1 percent to $1.3446 at 5 p.m. in New York and reached $1.3533, the strongest level since Nov. 22.

USD/JPY The yen weakened against 14 of its 16 most-traded counterparts as Asian stocks extended a global equity rally, curbing demand for haven assets.

Yen was at 77.68 per dollar from 77.62.

USD/CAD The Canadian currency rose the most since May 2010 as central banks including the Bank of Canada reduced the cost of emergency dollar funding to ease Europe’s sovereign-debt crisis, buoying riskier assets.The loonie appreciated 1.4 percent to C$1.0174 per U.S. dollar at 5 p.m. Toronto time.

Technical Analysis & Market outlook by ACFX 2/12/11

EUR/USD

GBP/USD

USD/JPY

Market outlook

EUR/USD The euro pared gains versus the dollar and yen as concern increased that European leaders will struggle to resolve the region’s debt crisis even after central banks moved to ease dollar borrowing for banks.

The euro appreciated 0.1 percent to $1.3461 at 5 p.m. in New York after surging as much as 1.6 percent yesterday, the most on an intraday basis since Oct. 27.

NZD/USD New Zealand dollar set for a weekly gain against most major peers before U.S. data forecast to show employers added workers at a faster pace, boosting demand for higher-yielding assets..

New Zealand’s dollar bought 78 U.S. cents from 77.94, rising 5.3 percent since Nov. 25.

AUD/USD Australia’s dollar fell from almost a two-week high versus its U.S. counterpart after government reports showed consumer spending slowed and building approvals dropped.

Australia’s dollar fell 0.7 percent to $1.0213 at 12:21 p.m. in New York

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Daily Market Outlook

Posted by ACFX on November 14, 2011

Currencies

EUR/USD The euro maintained a two-day gain on prospects confidence in Italy’s ability to curb its debt will be revived after Mario Monti, a former European Union competition commissioner, takes over as prime minister.

The euro was unchanged at $1.3750 as of 6:23 a.m. in London from its level in New York after last week it touched $1.3859.

NZD/USD The New Zealand dollar climbed for a second day after a government report showed retail sales increased by the most since 2006, adding to signs the domestic economy remains resilient.

The New Zealand dollar strengthened 0.2 percent to 78.69 U.S. cents at 4:36 p.m. in Sydney and was trading at 78.674 U.D. cents around 7 a.m. London time.

GBP/USD Sterling strengthened last Friday against the dollar as data showed U.K. factory output prices were unchanged in October as costs for chemicals, pharmaceuticals and electrical equipment dropped.

The British currency climbed 0.4 percent to $1.5990 on Friday and was trading at $1.60721 around 7 a.m. London time.

Commodities

Gold futures climbed as investors bet leadership changes in the Italian and Greek governments would ease the risk of further financial deterioration in the euro zone.

The front-month contract, for November delivery, rose $28.60, or 1.6%, to settle at $1787.50 a troy ounce on the Comex division of the New York Mercantile Exchange.

Oil traded near the highest level in more than three months as Japan reported its first economic growth in a year and Italy started building a new government that may help contain the European debt crisis.

Crude for December delivery was at $99 a barrel, up 1 cent, in electronic trading on the New York Mercantile Exchange at 1:14 p.m. Singapore time.

Equities

US Stocks rose last week as improving economic data and leadership changes in Greece and Italy bolstered investor optimism.

Walt Disney Co. (DIS) and Cisco Systems Inc. (CSCO) advanced more than 5.4 percent.

The S&P 500 rose 0.9 percent to 1,263.85.

The Dow advanced 170.44 points, or 1.4 percent, to 12,153.68.

European Stocks climbed last week as Italy’s Senate approved austerity measures, easing concern the country will need a bailout, and U.S. consumer confidence rose in November more than economists had predicted.

The U.K.’s FTSE 100 Index rose 0.3 percent.

France’s CAC 40 Index (CAC) gained 2.8 percent and Germany’s DAX Index jumped 1.5 percent.

Asian stocks rose amid optimism new governments in Greece and Italy will help contain Europe’s debt crisis and after top economists said China will have a “soft landing.”

The MSCI Asia Pacific Index gained 1.3 percent to 118.89 as of 3:06 p.m. in Tokyo.

Japan’s Nikkei 225 (NKY) Stock Average added 1.1 percent.

Hong Kong’s Hang Seng Index advanced 2.2 percent and Shanghai’s Composite Index increased 1.9 percent.