Technical Analysis and Trading Recommendations

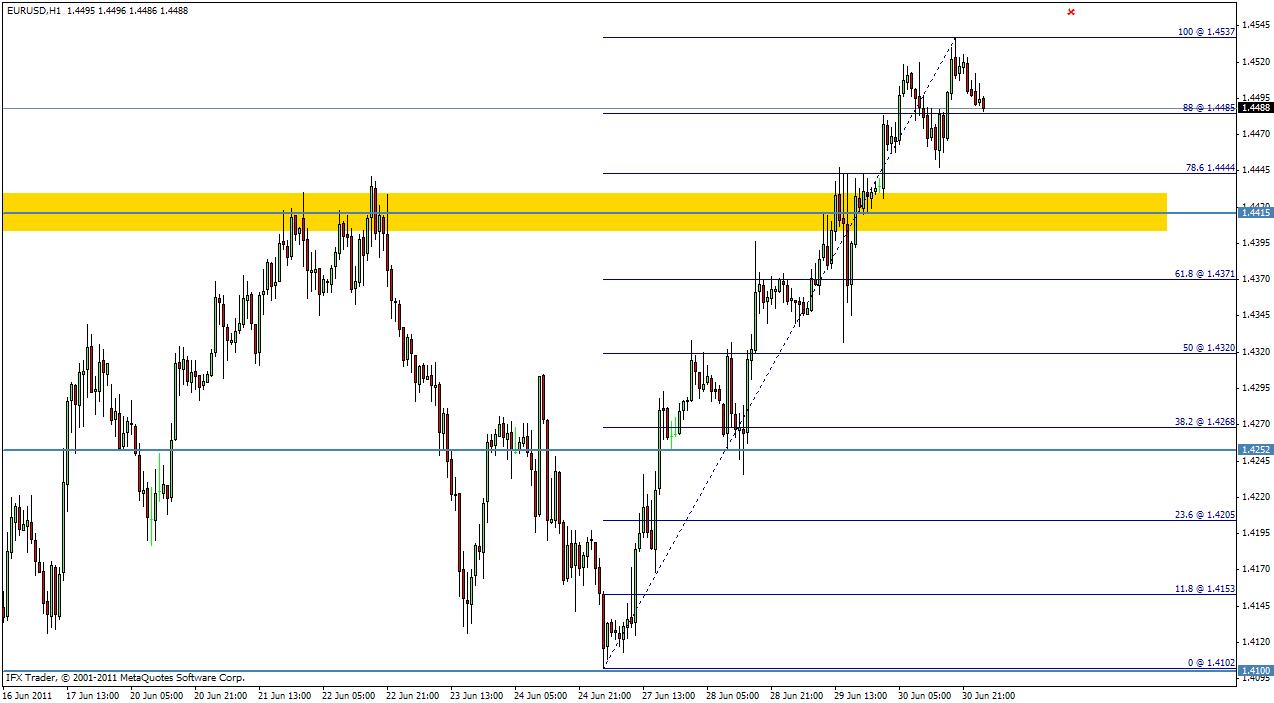

EUR/USD

June 27, 2011.

Expertise: Fundamental and Technical Analysis

Average Time Frame of Trades: 2 days to 5 days.

Pivot Point: 1.4212

The EUR/USD's subsequent sharp fall suggests that decline from 1.4430 and close at 1.4189. On the downside this week should break level of 1.4100 as a major Support.

Therefore, EUR/USD should be resuming the set of impulsive fall to 1.4040 as first target and continue towards 1.3980.

The best location for placing stop loss, if break in 1.4252 and close up the moving average (200).

Recommendations:

It will be a good sign to sell at 1.4215 with a first target of 1.4115 and continue towards 1.4000 for a week. Meanwhile it should care

of level 1.4252 since if it breaks, it will be a good sign to buy, it might resuming to 1.4400.

EUR/USD

June 28, 2011.

Pivot Point: 1.4227

As expected, the EUR/USD couldn't break the major support level at 1.4100 for that the pair has rebounded on its support,

it might resuming to 1.4400. With a 1.4415 minor resistance if won't break easily then will know a range day between 1.4415 and 14215.

R3 1.4542

R2 1.4418

R1 1.4351

PP 1.4227

S1 1.4160

S2 1.4036

S3 1.3969

Signals:

1. Below 1.4415 look for further downside with 1.4300 and 1.4230 targets.

2. Buy positions above 1.4415 with target 1.4502.

Technical Analysis and Trading Recommendations

EUR/GBP

June 29, 2011.

Expertise: Technical Analysis

Average Time Frame of Trades: 1 days to 3 days.

Pivot Point: 0.8965

The EUR/GBP has rebounded from a strong Resistence at 0.9020 (in May 5, 2011 at 08:00 GMT+2), it is now approaching its resistance around the spot between 0.8990 and 0.9040, it will probably start downside movement at this area and recovery again. Moreover the RSI calls for a new whole decline. Therefore it should ask for a high price to sell at this spot with a first target of 0.8940 and continue towards 0.8875 On other hand if a break in 0.9125 will be a good location for placing stop loss

Recommendations:

Short Selling at 0.9000 / 0.9040

Take Profit at 0.8880

Stop Loss at 0.9115

Technical Levels:

R3 0.9063

R2 0.9024

R1 0.9004

PP 0.8965

S1 0.8945

S2 0.8906

S3 0.8886

Technical Analysis

EUR/USD

June 28, 2011.

Pivot Point: 1.4227

As expected, the EUR/USD couldn't break the major support level at 1.4100 for that the pair has rebounded on its support,

it might resuming to 1.4400. With a 1.4415 minor resistance if won't break easily then will know a range day between 1.4415 and 14215.

R3 1.4542

R2 1.4418

R1 1.4351

PP 1.4227

S1 1.4160

S2 1.4036

S3 1.3969

Signals:

1. Below 1.4415 look for further downside with 1.4300 and 1.4230 targets.

2. Buy positions above 1.4415 with target 1.4502.Technical Analysis.

EUR/USD

June 30, 2011.

Pivot Point: 1.4402

H4:

EUR/USD: The market continues to show signs of strength following the break above 1.4415 Resistance and close at 1.4433.

Therefore it will be turned to a minor Support. In such case, stronger rise should be seen towards 1.4535 Resistance for confirmation.

Moreover the trend is still above 50% Fibonacci retracement level, thus it will be a good sign to buy above 1.4400 and sell below 1.4360.

Daily:

(1.4100 has called as a major Support, in June 27, 2011.)

The EUR/USD's choppy rise from 1.4100 extended further last April 2011. Nevertheless, downside momentum is rather convincing and the structure of fall looks to test 1.4141, after reach the trend around 1.4500/1.4550.

Technical Levels:

R3: 1.4598

R2: 1.4522

R1: 1.4478

PP: 1.4402

S1: 1.4358

S2: 1.4282

S3: 1.4238

Technical Analysis and Trading Recommendations

EUR/USD

July 1, 2011.

Expertise: Technical Analysis

Average Time Frame of Trades: 1 day.

Pivot Point: 1.4489

EUR/USD: According to previous events, the market still continues to show signs of strength following the break above 1.4415 Resistance. And the Resistance has now become Support, therefor the market indicates a Bullish opportunity above 1.4515 after wards. Moreover on Daily chart the RSI calls further upside in short-term from the level of Support is still progress and would probably target 1.4535 and continue toward 1.4600. However, the best location for placing stop loss below 1.4400.

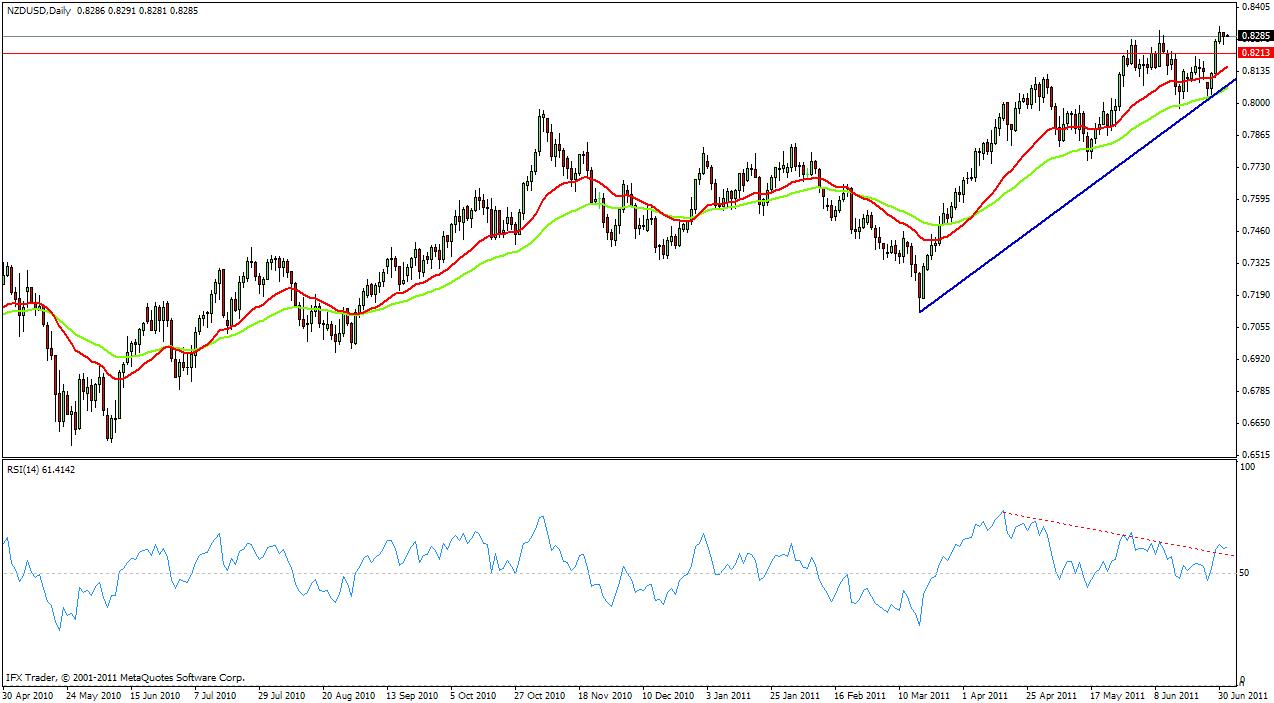

Technical Analysis and Trading Recommendations

NZD/USD

July 4, 2011.

Pivot Point: 0.8277

Daily:

Overview:

The NZD/USD has continued straight from 0.8200, hence the Kiwi is shown signs of strenght following the break of the highest level of 0.8213 and open today above the pivot point (0.8277), thus it will be a good sign to buy above the level of 0.8213 with a first target of 0.8333 and futher to 0.8380. However, in case of reversal takes place and the NZD/USD breaks through the Support level of 0.8200 then the market will lead to futher decline to 0.8125, in order to indicating the correction movement. Moreover should note a point of view that the EMA25 (Red) have to cross over the EAM50 (Green), it would be more of a confirmation for downtrend.

July 5, 2011.

Strategy # BR/S #

Currencies Pairs: All

Frame: H1 and/or H4

All traders have to know two important points in trading:

1. Buyers are BIDding at a lower price.

2. Sellers are ASking for a high price.

Through those points is evident that profit is buying cheap and Selling at a high price, thus it should care too much about the entry of the peaks and/or bottoms.

1st Case: #BUY#

Look at the graphic time frame H1 and determine the last three Supports since a week.

Support1

Support2

Support3

The best accurate breakout level for BUYing trade at: (Support1 + Support2 + Support3)/3 + 0.0020

If the trend is strong to breakout 20pips the level that already found, it does mean: it'll continue and it's a good breakout trade and not a fake one.

Taking Profit:

We have to place Take Profit at 25pips below the top Resistance3.

Stop Loss:

The best location for placing Stop Loss is: 20pips below the last swing low.

Note: Take Profit = 5/3 * Stop Loss

Example:

If the Stop Loss is 75pips, then:

Take Profit = 5/3 * Stop Loss

Take Profit = 5/3 * 75pips

Take Profit = 125pips

Confirmation:

We Drag the Fibonacci from the Resistance3 to Support3, if our level is around 38.2% Fibonacci Retracement, it is a good convincing proof to BUY.

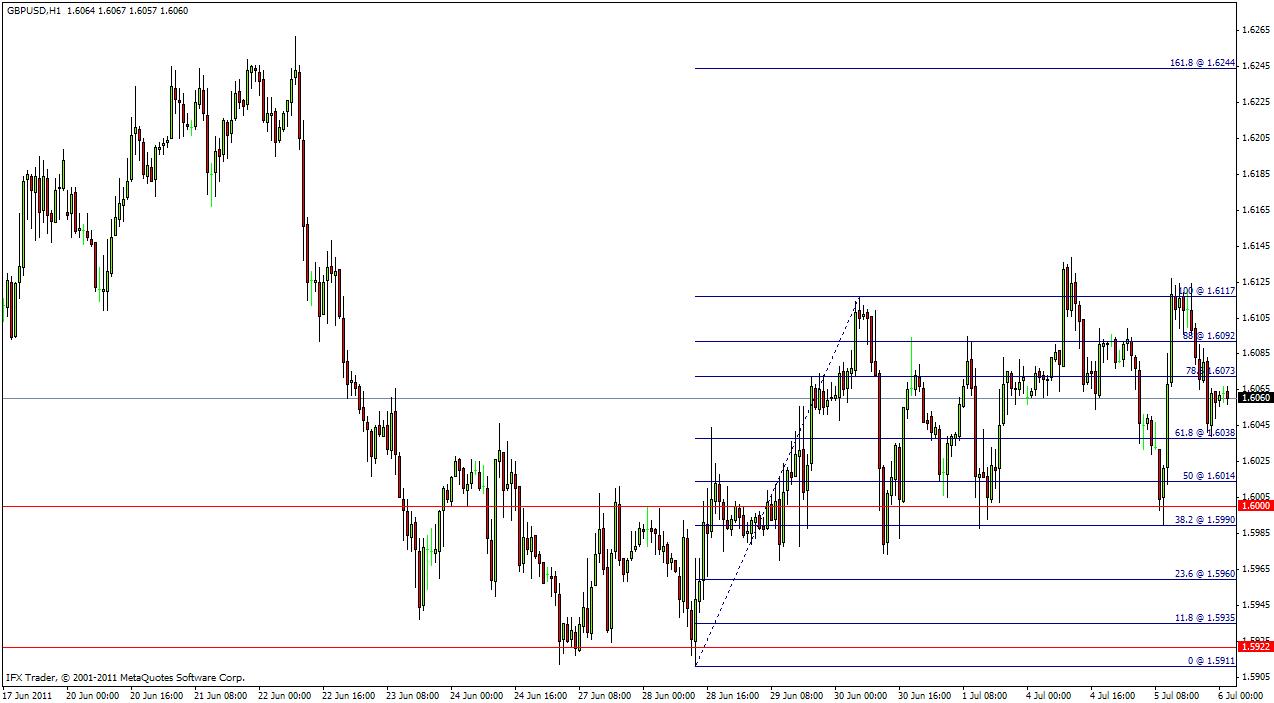

Technical Analysis and Trading Recommendations

GBP/USD

July 6, 2011.

Yesterday Historic (July 5, 2011 - Note: we use historic prices to determine future prices)

Open 1.6089

High 1.6127

Low 1.5990

Close 1.6062

We have found:

Pivot Point: 1.6060

OCTO= * 100

OCTO = 50.2133

Volatility= Average * Rang

Test the Volatility, if use 1lot with leverage of 1:200.

Then the Volatility is 220.0015 that does mean the trend's movement is enough strong, moreover the trend is still above the 50% Fibonacci Retracement is .

Look at the chart:

50% Fibonacci Retracement = 1.6014

Recommendations:

1. Buy positions above 1.6040 with a target of 1.6120, then if a break the peak point at 1.6140 it might resuming to 1.6210.

2. Closure below 1.6000 would invalidate this outlook..

Technical Levels:

R3: 1.6266

R2: 1.6197

R1: 1.6129

PP: 1.6060

S1: 1.5992

S2: 1.5923

S3: 1.5855

Short Overview:

The GBP/USD has rebounded from a minor Support at 1.6047, and it is now approaching its Support, it will probably start upside movement at this area and recovery again. Therefore it will a good sign to Buy at this spot with a first target of 1.6120, and continue towards 1.6200. On other hand if a break in 1.6000 will be a good location for placing stop loss below 1.5992 (Support 1).

July 5, 2011.

Strategy # BR/S #

Currencies Pairs: All

Frame: H1 and/or H4

All traders have to know two important points in trading:

1. Buyers are BIDding at a lower price.

2. Sellers are ASking for a high price.

Through those points is evident that profit is buying cheap and Selling at a high price, thus it should care too much about the entry of the peaks and/or bottoms.

1st Case: #BUY#

Look at the graphic time frame H1 and determine the last three Supports since a week.

Support1

Support2

Support3

The best accurate breakout level for BUYing trade at: (Support1 + Support2 + Support3)/3 + 0.0020

If the trend is strong to breakout 20pips the level that already found, it does mean: it'll continue and it's a good breakout trade and not a fake one.

Taking Profit:

We have to place Take Profit at 25pips below the top Resistance3.

Stop Loss:

The best location for placing Stop Loss is: 20pips below the last swing low.

Note: Take Profit = 5/3 * Stop Loss

Example:

If the Stop Loss is 75pips, then:

Take Profit = 5/3 * Stop Loss

Take Profit = 5/3 * 75pips

Take Profit = 125pips

Confirmation:

We Drag the Fibonacci from the Resistance3 to Support3, if our level is around 38.2% Fibonacci Retracement, it is a good convincing proof to BUY.2nd Case: #SELL#

Look at the graphic time frame H1 and determine the last three Resistances since a week.

Resistance1

Resistance2

Resistance3

The best accurate breakout level for SELLing trade at: (Resistance1 + Resistance2 + Resistance3)/3 - 0.0020

Taking Profit:

We have to place Take Profit at 25pips above the top Support3.

Stop Loss:

The best location for placing Stop Loss is: 20pips above the last swing high.

Note: Take Profit = 5/3 * Stop Loss

Example:

If Take profit is 195pips, then:

Take Profit = 5/3 * Stop Loss

Stop Loss = (3 * Take Profit) / 5

Stop Loss = (3 * 195pips) / 5

Stop Loss = 117pips

Confirmation:

We Drag the Fibonacci from the Resistance3 to Support3, if our level is around 78.6% Fibonacci Retracement, it is a good convincing proof to SELL.

Technical Analysis

GBP/USD

July 7, 2011.

Psychological Level at 1.5930

Overview:

The GBP/USD's subsequent sharp fall suggests that decline from 1.6448 and had resumed to 1.5957 yesterday. And it is now approaching from the psychological level of 1.5930, moreover, it is also between the 50% Fibonacci Retracement and 38.2% (daily chart). If the trend will break this level and closure below it, then it will be a downside momentum is rather convincing and the structure of the fall looks is not corrective, therefor the market will indicate a Bearish opportunity below 1.5930 then the Support will be become a Resistance, hence it will a good sign to Sell below 1.5930. Meanwhile, if the pair can't break this level, it will probably recovery and choppy rise from this level extended further next days, for that it will be a good sign to buy above 1.5960.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Good morning,

In this post, will share some Technical Analysis and Signals daily.

TECHNICAL ASPECT

Numerical analysis: Probabilities, equations/Formulas and techniques of applying Fibonacci levels.

Classical analysis: Breakout startegy and trend indicators.