Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.01.18 10:40

GBP/USD Technical Analysis (adapted from this article)

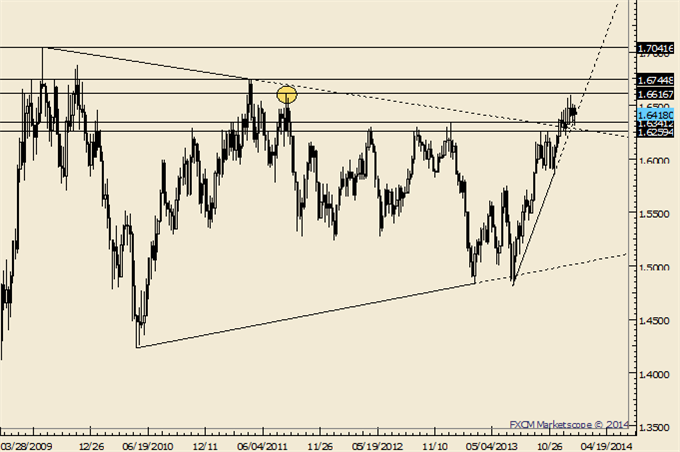

- GBPUSD broke above the line that extends off of the 2009 and 2011 highs the week that ended 11/29/13. The rally has so far failed just shy of the August 2011 high. Price is on the cusp of testing that line from above but a drop below 1.6259 would indicate a failed breakout attempt.

- Do not dismiss the January 2nd bearish outside reversal. In fact, that day’s close (1.6449) was resistance on Friday. The area around 1.6450 was resistance in December as well.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.01.18 15:19

Fundamental Forecast for the British Pound: Bullish

- British Pound Soars as UK Retail Sales Rise Most in 3 Years

- Price & Time: Sell GBP/USD Next Week?

The British Pound appears to be coiling up for another run at the 1.6600 handle as the positive developments coming out of the U.K. economy raises the Bank of England’s (BoE) scope to normalize monetary policy ahead of schedule.

There’s speculation that the BoE will lower the unemployment threshold to 6.5% from 7.0% in its quarterly inflation report scheduled for February 12, and this theme presents the largest risk to the bullish British Pound forecast as market participants weigh the outlook for monetary policy. Nevertheless, Credit Suisse overnight index swaps are starting to show expectations for higher interests over the next 12-months as the BoE moves away from its easing cycle, and the shift policy outlook should continue to prop up the sterling over the near to medium-term as the central bank starts to unwind its non-standard measures.

With that said, we will continue eye the topside targets for the GBPUSD as long as it holds above the 1.6300 handle, and the rebound from key support may spark fresh highs in the pound-dollar as it continues to carve a series of higher highs paired with higher lows.Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.01.19 17:12

GBPUSD Fundamentals January 20 - 24 - based on investing.com article

The pound rose against the dollar on Friday after data showing that U.K. retail sales rose sharply in December bolstered the outlook on the economic recovery, fuelling expectations that the Bank of England may rise interest rates ahead of other central banks.

GBP/USD rose to highs of 1.6457, the strongest since January 14 and was last up 0.42% to 1.6420. For the week, the pair rose 0.20%.

Cable is likely to find support at 1.6308, Friday’s low and resistance at 1.6500.

Monday, January 20

Markets in the U.S. are to remain closed for the Martin Luther King Day holiday.

Tuesday, January 21

The U.K. is to publish a private sector report on industrial order expectations.

Wednesday, January 22

The U.K. is to release official data on the change in the number of people unemployed and the unemployment rate, as well as data on average earnings and public sector borrowing. Meanwhile, the Bank of England is to publish the minutes of its most recent policy setting meeting.

Thursday, January 23

The U.S. is release the weekly report on initial jobless claims and a private sector report on existing home salesForum on trading, automated trading systems and testing trading strategies

newdigital, 2014.01.20 09:38

GBP/USD in consolidation mode after Friday’s huge gains

GBP/USD is trading around 200SMA at 1.6417, rebounding from Friday’s high at 1.6457, but not ready to go below 1.64.

The Pound may get some more fuel, but later

The

pair got huge support from the recently released UK retail sales adding

almost 150 pips during the hour of the release. Nevertheless, we

wouldn’t be too optimistic about the record rise of the numbers.

According to ONS, there might be the case of seasonal effect, thus we

may see significant revisions next month. As for this week, we will get

some quite important reports for digestion, and the labor data scheduled

for Wednesday is one of them. We expect quite positive developments in

this sector, thus, the pair has good potential to go higher. The

released today Rightmove house price index met the expectations, and

there is no more UK data scheduled for today, thus we expect tight

ranges during the whole Monday close to 1.6420 area.

What are today’s key GBP/USD levels?

Today's

central pivot point can be found at 1.6393, with support below at

1.6359 (S1), 1.6318 (S2) and 1.6277 (S3), with resistance above at

1.6511 (R1), 1.6552 (R2), and 1.6594 (R3). Hourly Moving Averages are

largely bullish, with the 200SMA at 1.6417 and the daily 20EMA flat at

1.6410. Hourly RSI is neutral at 55.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.01.20 10:26

2013-01-20 02:00 GMT (or 03:00 MQ MT5 time) | [CNY - GDP]

- past data is 7.8%

- forecast data is 7.6%

- actual data is 7.7% according to the latest press release

if actual > forecast = good for currency (for CNY in our case)

==========

China's Economic Growth Slows to 7.7%

The nation's economy grew 7.7% in the fourth quarter from a year ago, slower than the 7.8% it posted in the third quarter, according to data released Monday by China's National Bureau of Statistics. For the year it also posted 7.7% growth, matching the revised pace it recorded in 2012.

"There was steady economic progress [last year] and this was no small achievement," the bureau said in a statement. But it added that the Chinese economy still faces imbalances, while "fundamentals of the economic recovery are still not stable."

The fourth-quarter increase was higher than a median 7.6% gain forecast by 13 economists in a Wall Street Journal survey.

"We don't see any areas that would support an economic rebound in the first quarter," said Ma Xiaoping, economist with HSBC Holdings PLC.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

GBPUSD : 18 pips price movement by CNY - GDP news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.01.20 14:19

E&Y Item Club Urges BoE To Tie Rate Hike To Real Wage Growth (based on rttnews article)

The Ernst and Young Item Club on Monday urged the Bank of England to tie interest rate hike to real wage growth as unemployment target is set to be achieved this year.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.01.21 07:09

GBP/USD survived after Hilsenrath’s comments

GBP/USD was injured in the morning by the WSJ Hilsenrath predictions of further tapering during the January FOMC meeting, though the pair lost only 16 pips from 1.6426 at open to 1.6410 low.

Market has some good expectations on UK data

Hilsenrath’s

story was not able to trigger big moves, as the comments are largely in

line with expectations. The scheduled for today UK CBI Industrial Order

Expectations has limited potential to trigger any currency moves,

though positive development will only fuel the interest to the Pound.

The rumored revision of UK GDP growth forecasts to 2.4% (from 1.9%) by

the IMF may give additional support to the pair, if confirmed during the

American session. We also expect the early positioning of the pair

before the Wednesday’s key labor data release which is potentially

GBP-bullish with the initial target at 1.6463 resistance level.

What are today’s key GBP/USD levels?

Today's

central pivot point can be found at 1.6429, with support below at

1.6404 (S1), 1.6370 (S2) and 1.6345 (S3), with resistance above at

1.6463 (R1), 1.6488 (R2), and 1.6522 (R3). Hourly Moving Averages are

largely bullish, with the 200SMA at 1.6419 and the daily 20EMA flat at

1.6413. Hourly RSI is neutral at 52.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.01.21 13:44

2013-01-21 11:00 GMT (or 12:00 MQ MT5 time) | [GBP - CBI Industrial Order Expectations]

- past data is 12

- forecast data is 10

- actual data is -2 according to the latest press release

if actual > forecast = good for currency (for GBP in our case)

==========

U.K. Manufacturing Order Growth Strongest Since 2011

British manufacturing order growth during three months to January hit the highest since April 2011, survey data from the Confederation of British Industry showed Tuesday.

Moreover, manufacturers are optimistic about continued expansion in the next quarter and they are increasingly confident in the recovery.

The balance for new domestic orders came in at 11 percent, the strongest since 2011, but the new export orders balance fell to zero, the Industrial Trends Survey showed. About 38 percent of firms reported a rise in output volumes and 20 percent a decline, giving a balance of +18 percent.

Further, around 38 percent of manufacturers expect total new orders to increase and 16 percent expect them to fall, resulting in a balance of +22 percent, the highest since April 2012.

Manufacturers' investment intentions improved sharply and firms citing uncertainty about demand as a constraint on investment fell to the lowest since October 2010.

However, in January, the order book balance fell to -2 from 12 in December. The expected level for January was 10 percent.

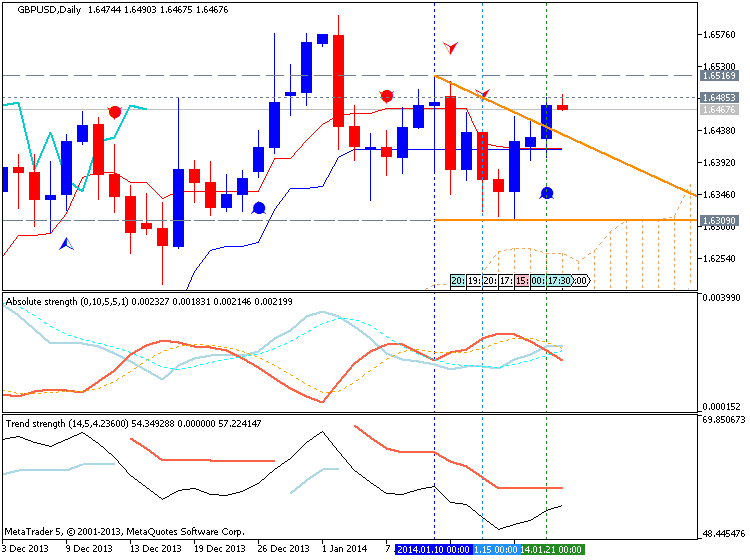

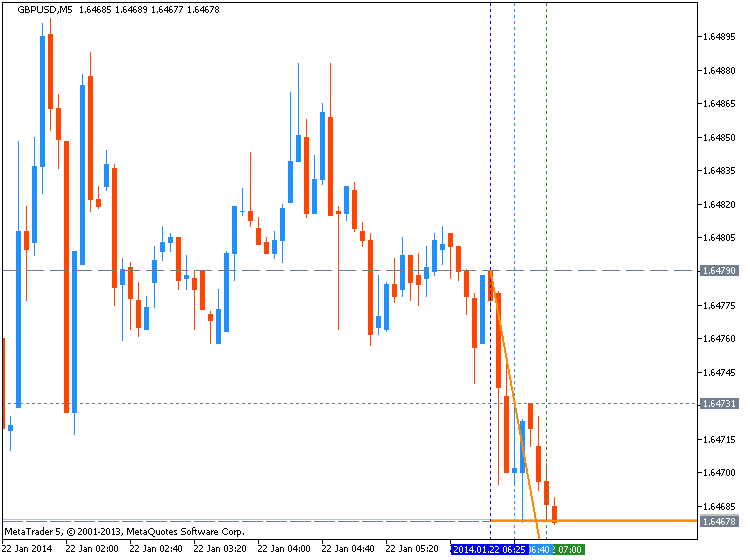

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

GBPUSD M5 : 42 pips price movement by GBP - CBI Industrial Order Expectations news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.01.21 19:57

Pound gains on IMF forecast, U.K. data

The pound rose against the dollar earlier Tuedsday after the International Monetary Fund said it was hiking the U.K.'s 2014 growth forecast by more percentage points than any other major European country, while mixed-but-solid British data also bolstered the pair.

In U.S. trading on Tuesday, GBP/USD was trading at 1.6467, up 0.24%, up from a session low of 1.6400 and off a high of 1.6486.

Cable was likely to find support at 1.6396, Monday's low, and resistance at 1.6508, the high from Jan. 13.

The

pound enjoyed support after the IMF hiked Britain’s 2014 growth

forecast to 2.4% from 1.9% in October, more than any other major

European economy.

Also in the U.K., the Confederation of British

Industry said its index of industrial order expectations fell to -2 this

month from 12 in December, well below expectations of a reading of 10.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.01.22 07:14

Trading the News: U.K. Jobless Claims Change (based on dailyfx.com article)

U.K. jobless claims are projected to fall another 32.0K in December and

the ongoing improvement in the labor market may trigger fresh highs in

the GBPUSD as it raises the outlook for growth and inflation.

What’s Expected:

Time of release: 01/22/20149:30 GMT, 4:30 EST

Primary Pair Impact: GBPUSD

Expected: -32.0K

Previous: -36.7K

Forecast: -30.0K to -35.0K

Why Is This Event Important:

Indeed, the stronger recovery in the U.K. raises the scope of seeing the Bank of England’s (BoE) 7% unemployment threshold being breached later this year, and the central bank may implement a dovish twist for its forward-guidance on monetary policy as the real economy remains far from full-capacity.

Bullish GBP Trade: U.K. Jobless Claims Fall 32.0K or Greater

- Need green, five-minute candle following the print to consider a long GBPUSD trade

- If reaction favors a buy trade, long GBPUSD with two separate position

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

- Need red, five-minute candle to favor a short GBPUSD trade

- Implement same setup as the bullish British Pound trade, just in reverse

- Bias Remains Bullish Above 1.6300; Looking for Higher High

- Relative Strength Index Breaks Out of Bearish Momentum

- Interim Resistance: 1.6550 (78.6 expansion) to 1.6600 Pivot

- Interim Support: 1.6300 Pivot to 1.6310 (50.0 expansion)

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Chinkou Span line of Ichimoku indicator is crossing historical price on open bar for H4 timeframe. The price is in still on bearish located below Ichimoku cloud/kumo and below Sinkou Span A line which is virtual border berween bearish and bullish on D1/H4/H1 charts.

D1 timeframe : the price is ranging between 1.6516 resistance and 1.6314 support, and Chinkou Span line is crossed the the price on open bar for possible breakout on bullish market condition.

The price is on bullish for W1 and H1 timeframes with possible uptrend started after W1 flat and H1 ranging.

If Chinkou Span will cross the price on close bar, and if the price will break 1.6458 resistance from below to above so we may see the trend reversal from bearish to bullish with good possibility to open buy trade on H4 timeframe.

If If Chinkou Span will not cross the price on close bar, and if the price will not break 1.6458 resistance from below to above so we may see the ranging market condition for all timeframes starting with H1 for example.

UPCOMING EVENTS (high/medium impacted news events which may be affected on GBPUSD price movement for this coming week)

2013-01-20 02:00 GMT (or 03:00 MQ MT5 time) | [CNY - GDP]

2013-01-21 11:00 GMT (or 12:00 MQ MT5 time) | [GBP - CBI Industrial Order Expectations]

2013-01-22 09:30 GMT (or 10:30 MQ MT5 time) | [GBP - Claimant Count Change]

2013-01-22 09:30 GMT (or 10:30 MQ MT5 time) | [GBP - Unemployment Rate]

2013-01-22 09:30 GMT (or 10:30 MQ MT5 time) | [GBP - Flash Manufacturing PMI]

2013-01-23 11:00 GMT (or 12:00 MQ MT5 time) | [GBP - CBI Realized Sales]

2013-01-23 15:00 GMT (or 16:00 MQ MT5 time) | [USD - Existing Home Sales]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on GBPUSD price movementSUMMARY : ranging

TREND : bullish

Intraday Chart