EUR/USD formed a spinning top candlestick on the one-hour time-frame

at 1.0900 and there will likely be a move to the downside towards 1.0850

again, but the sideways consolidation continues for now.

USD/CAD Analysis

GBP/USD forecast

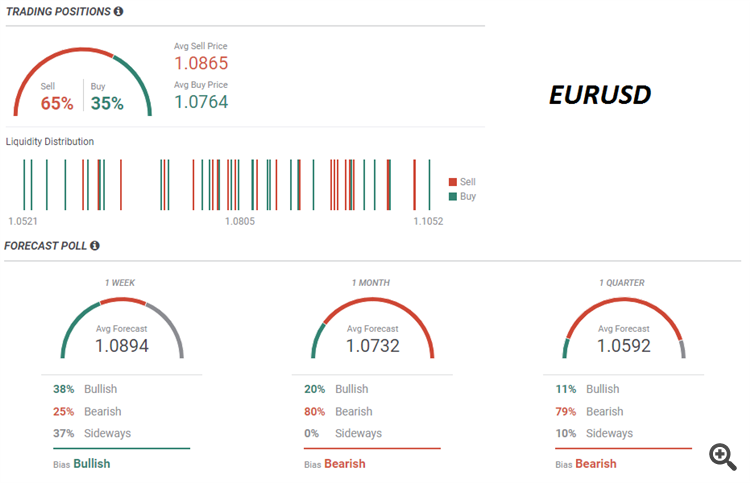

Eur/usd

Gbp/Usd is slowly building up some gains but still within the range, upside seems limited, 1.0900 act as psychological resistance level.

EUR/USD continued moving to the upside and reached a high at 1.0950, but it appears that move to the upside is over for now. The pair formed a double top at that same level on the one-hour time-frame and started dropping. Next target is likely the support at 1.0850 which is the (MA)89 indicator on the one-hour time-frame.

USD/CAD Analysis

GBP/USD forecast

Eur/usd

Cable continues to be trading within a narrow range in positive territroy , there is no clear directional strength, the consolidation would probably continue until Friday preliminary Q1 GDP release.

Finally, Gbp/Usd confirmed a bullish break out of 1.2910/1.2900 zone after multi-week consolidation. On the upside, 1.2950 and follow by 1.30 psychological level might be in sight.

EUR/USD dropped sharply after the ECB press conference earlier today

and is now testing the support at 1.0850. If it breaks out below that

support it could reach 1.0800 again.

The EUR/USD sideways consolidation continues for now and the pair

bounced off from 1.0950 once again, forming a shooting star candlestick

on the four-hour time-frame right below that level. Whether

there will be a move to the downside depends on whether the pair will

break out below 1.0850 - 1.0820.

GBP/USD forecast

USD/CAD Analysis

Eur/usd

The EUR/USD pair continued to trade to the downside this week as price reached close to 1.0850 and closed the weekly candle at 1.0896. Interesting week coming ahead!

The pair is showing small pull back, but risk remains on the upside. I'm expecting Gbp/Usd would consolidating further until break above 1.2965 and lead to next resistance zone at 1.3.

USD/JPY Analysis

GBP/USD forecast

Eur/usd

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register