Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.01.11 09:15

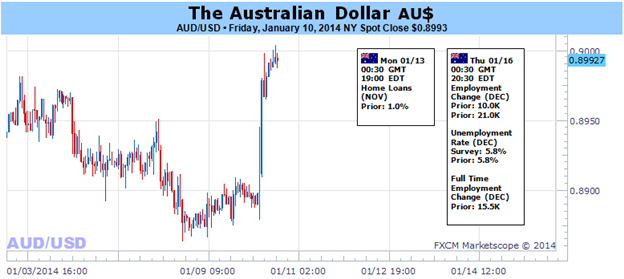

AUDUSD Technical Analysis (adapted from this article).

- Last week’s (week that ended 1/3) outside reversal broke a string of 10 consecutive down weeks, something that had not happened since 1982.

- The bounce from the 12/18 low is shallow and corrective. Still, the specter of 5 waves down from the Oct high at least warns of a stronger rally attempt. .9167 (former 4th wave price extreme) to .9267 (former range low) is likely resistance.

Trading Strategy: Flat (trading long intraday) but looking higher towards .9167-.9267 for the next top.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.01.11 15:41

Australian Dollar to Rise Further as Markets Ponder Fed Outlook (adapted from this article)

Fundamental Forecast for Australian Dollar: Bullish

- December’s Australian Jobs Report Unlikely to Derail Stable RBA Outlook

- Aussie Bounce to Continue as Markets Ponder Fed Policy After Dismal NFP

We’ve argued that the Australian Dollar has room to correct higher in early 2014 as the fundamental argument for Aussie weakness becomes increasingly flimsy while speculative traders remain heavily net-short (per futures market positioning data from the CFTC). Absent new evidence to advance the case against the currency, we said a period of profit-taking that drives the Australian unit higher is probably ahead.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.01.12 17:04

AUD/USD weekly outlook: January 13 - 17 (based on this article)

Monday, January 13

Australia is to publish data on the number of new home loans granted, a strong indicator of demand in the housing market.

Tuesday, January 14

The U.S. is to produce data on retail sales, the government measure of consumer spending, which accounts for the majority of overall economic activity. The nation is also to release data on import prices and business inventories.

Also Tuesday, Federal Reserve Bank of Philadelphia President Charles Plosser and Dallas Fed President Richard Fisher are to speak.

Wednesday, January 15

Australia is to publish data on new vehicle sales, a leading indicator of consumer confidence.

The U.S. is to release data on producer price inflation and a report on manufacturing activity in the New York region.

Thursday, January 16

Australia is to publish data on the change in the number of people employed and the unemployment rate, as well as a private sector report on inflation expectations.

The U.S. is to publish reports on consumer price inflation and initial jobless claims, in addition to data on manufacturing activity in Philadelphia. Meanwhile, Federal Reserve Chairman Ben Bernanke is to speak at an event in Washington.

Friday, January 17

The U.S. is to wrap up the week with the closely watched preliminary reading of the University of Michigan consumer sentiment index. The U.S. is also to release data on building permits, housing starts and industrial production.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.01.13 05:51

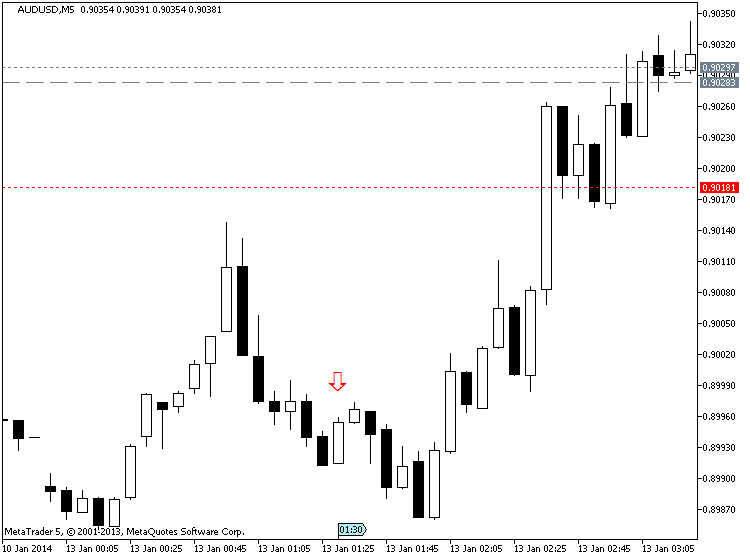

2013-01-13 00:30 GMT (or 01:30 MQ MT5 time) | [AUD - Home Loans]

- past data is 1.1%

- forecast data is 1.1%

- actual data is 1.1% according to the latest press release

if actual > forecast = good for currency (for AUD in our case)

==========

AUD/USD down ahead of Australian home loan data

The Australian dollar fell against U.S. dollar ahead of Australia

November home loans data that indicates demand in housing market and is

due at 1130 local time (0030 GMT).

Released by Australian Bureau of Statistics, the figures are expected to

project a month-on-month gain of 1.0%, compared to a 1.0% increase in

October.

The Australia and New Zealand Banking Group job

advertisements report for December will also be released at the same

time. Measuring the change in the number of jobs advertised in the major

daily newspapers and websites in the capital cities, in November the

report showed a decline of 0.8%.

The Japanese markets are closed for a public holiday.

Forum on trading, automated trading systems and testing trading strategies

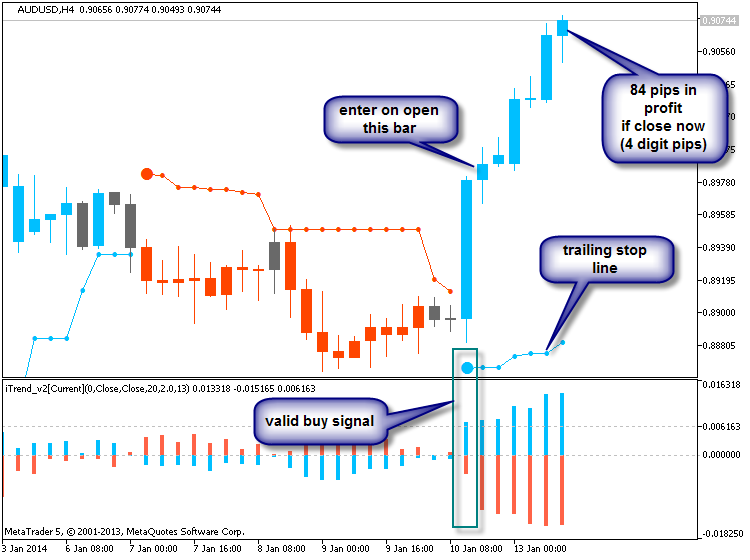

newdigital, 2014.01.13 15:30

The power of Brainwashing system BRAINTRADING SYSTEM HowTo :

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.01.14 08:25

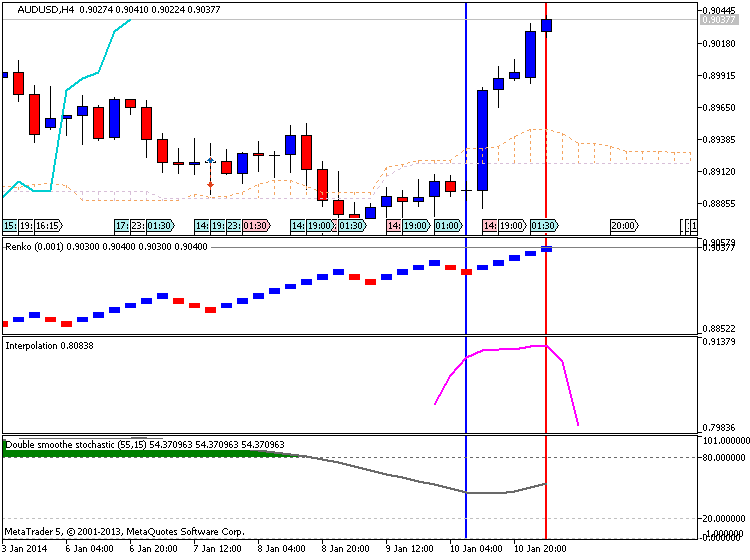

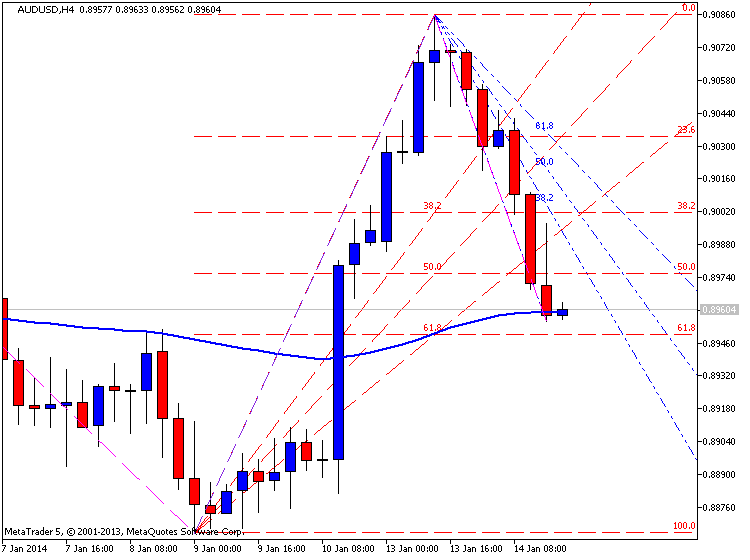

AUD/USD: 2nd breakout attempt successful (based on investing.com article)

The AUD/USD pair has recovered after its first failed breakout attempt and has moved higher again, succeeding instead on its second attempt to break above the major trend-line and out of the sideways consolidation range at the lows. This move now means that the evidence is strong for a short-term change from bear to bull trend, given the break above the trend-line and out of the reversal pattern, as well as two higher highs and lows on the 4hr chart. There is a chance of a pull-back before more upside, down to perhaps 0.9000, but then it will probably continue higher, with the next target sitting at 0.9120 where the R1 monthly pivot and the 50-day MA are situated together combining the already considerable resistance provided by each individually.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.01.14 20:38

AUD/USD tips over through stops to a low of 0.8966

Bids and support are smoked in the 0.8980/87 area and we hit some stops down to a new low. Further stops are seen through 0.8960 and bids roll in at 0.8950, 0.8930, 0.8910, 0.8900, 0.8850.

The move also creamed the 50.0 fib from the Jan lo/hi at 0.8974.

==========

Two MT5 CodeBase indicators are used for this analysis:

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.01.15 06:34

2013-01-15 02:11 GMT (or 03:11 MQ MT5 time) | [CNY - New Loans]

- past data is 625B

- forecast data is 600B

- actual data is 483B according to the latest press release

if actual > forecast = good for currency (for CNY in our case)

==========

China December New Yuan Loans Miss Expectations

Chinese banks extended CNY 482.5 billion in new yuan loans in December, less than CNY 570 billion forecast by economists, data released by the People's Bank of China showed Wednesday.

In November, banks extended a total of CNY 624.6 billion in local currency loans.

The broad money aggregate, M2 money supply, increased 13.6 percent year-on-year in December, compared with expectations for a 13.9 percent rise. This was also slower than 14.2 percent growth in November.

China's aggregate social financing came in at CNY 1.23 trillion in December, unchanged from November, but higher than the expected CNY 1.14 trillion.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

AUDUSD M5 : 31 pips price movement by CNY - New Loans news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.01.16 05:58

2013-01-16 00:30 GMT (or 01:30 MQ MT5 time) | [AUD - Employment Change]

- past data is 5.8%

- forecast data is 5.8%

- actual data is 5.8% according to the latest press release

if actual < forecast = good for currency (for AUD in our case)

==========

Australia Unemployment Rate Unchanged At 5.8%

Australia posted a seasonally adjusted unemployment rate of 5.8 percent in December, the Australian Bureau of Statistics said on Thursday.

That was in line with expectations and unchanged from the November reading.

But the Australian economy lost 22,600 jobs last month to 11,629,500 versus expectations for an increase of 10,000 jobs following the addition of 21,000 jobs a month earlier.

Full-time employment decreased 31,600 to 8,067,700 and part-time employment increased 9,000 to 3,561,800.

The participation rate was 64.6 percent - also shy of forecasts for 64.8 percent, which would have been unchanged from November.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

AUDUSD M5 : 87 pips price movement by AUD - Employment Change news event

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

temp_file_screenshot_24143.png

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.01.17 08:58

2014-01-16 15:00 GMT (or 16:00 MQ MT5 time) | [USD - Philly Fed Manufacturing Index]

- past data is 7.0

- forecast data is 8.6

- actual data is 9.4 according to the latest press release

if actual > forecast = good for currency (for USD in our case)

==========

Philly Fed Index Rises In January But Details Are Mixed

Manufacturing growth in the Philadelphia-area continued in January, according to a report released by the Federal Reserve Bank of Philadelphia on Thursday, with the index of regional manufacturing activity rising by more than expected.

The Philly Fed said its diffusion index of current activity rose to 9.4 in January from a revised 6.4 in December, with a positive reading indicating an increase in regional manufacturing activity. Economists had expected the index to climb to 8.7.

While the index rose more than expected, Amna Asaf, an economist at Capital Economics, said the details of the survey suggest that manufacturing activity is a little bit softer than indicated by the headline index.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

AUDUSD M5 : 12 pips price movement by USD - Philly Fed Manufacturing Index news event

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

It was flat for the several days on D1 timeframe but Chinkou Span line came to be very close to historical price to be ready for breakout for the next few days. if this thing is happened so we will see marlet rally within primary bearish market condition. We may see exact same situation with W1 timeframe - Chinkou Span line is located near the price ready to break it for good local uptrend within primary bearish.

We had good breakout on H4 timeframe realted to NFP news event, and the price is fully reversed from primary bearish to primary bullish located above Ichimoku cloud/kumo for now trying to break 0.8998 resistance level.

If the price will break 0.9004 on D1 close bar from below to above - we may see good rally withing primary bearish (good to open buy trade).If the price will break 0.8842 so we may see the bearish market continuing (good to open sell trade).

UPCOMING EVENTS (high/medium impacted news events which may be affected on AUDUSD price movement for this coming week)

2013-01-13 00:30 GMT (or 01:30 MQ MT5 time) | [AUD - ANZ Job Advertisements]

2013-01-13 00:30 GMT (or 01:30 MQ MT5 time) | [AUD - Home Loans]

2013-01-15 00:30 GMT (or 01:30 MQ MT5 time) | [AUD - New Motor Vehicle Sales]

2013-01-16 00:30 GMT (or 01:30 MQ MT5 time) | [AUD - Employment Change]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on AUDUSD price movementSUMMARY : bearish

TREND : bearish

Intraday Chart