I have recently been reading up on how useful currency futures COT data is for determining positions of large speculators and how the FX market moves according to their involvement. There are indicators available for futures traders representing COT data, has anybody heard of or could produce an indicator that would provide signals involving this valuable data inside FX charts?

Hello Stu,

Yes COT Data can be very useful. Some very big high rollers use this data to trade alone. Although I do not, I have seen it been done. I think the COT data is only availble at specific time though. If im not mistaken, which i might, its a graphical representation of commercial traders, non-commercial traders, and smaller retail traders. The way I see it used is similar to a moving average cross over system. But, I beleive this will only be relative to long term trading. Attached is a picture of the graphical indicator. I found it an a currency trader article. It might help. Good luck.

- secXces

Thanks for the graphic, I have never seen it depicted like that before! If I am analyzing this correctly, the green lines represent Large Speculative and the blue lines represent Commercial. We should be following Large Spec if what I have read thus far is accurate, and it appears to be so now that I can visualize it. How cool would it be to have this as an indicator? If a coder out there was able to create such a thing for Metatrader it would be immensely valuable! I have included an attachment of a graphic I have seen for COT data...

COT indicator available

There is a COT indicator available for MT4 ...

thanks

TheImperialOne

Has anybody used this with any success? It's not expensive at all.

yes, I am a subscriber and it works nicely. The data is sent out pretty fast after the government publish it unlike some other sites/offerings. last week it came at jsut after 4pm.

As you say, not very expensive .. half a pip a month.

TheImperialOne

Free Commitments of Data report

Folks,

We're providing the weekly report free to download on our site. But there is a more exciting development - at cot4metatrader.com we have taken it to a new dimension - the COT data right and price action in one place on your MetaTrader4 console.

Take care and happy trading.

TheImperialOne

ps. commercials are shortest ever this week on the Cable. Go check it out at cot4metatrader.com

New verstion of the popular COT indicator is now available - great new function

Traders

COT4.metatrader.com is pleased to announce a new version of its highly popular Commitments of Traders indicator for the MetaTrader platform. We have included some exciting new function.

We now support

- Index of net positions

- actiual net positions

- open interest - long and short for the three trading groups

- 7 currencies - CHF, EUR, GBP, CAD, AUD, MXP, JPY

- additionally supports US Dollar

- data feed to 2004

- works on any timetrame upto and including weekly

- works on all Metatrader 4 platforms - not just Interbank FX.

You can download the indicator free with a free demo file at www.COT4.metatrader.com

Unbeatable value

- No initial sign up fee

- 1 month free when you subscribe for initial 3 months

- $5 low monthly fee

- compare to others limited offerings that only work on Interbank fx and yet charge nearly $100 for initial sign up and $24.95 every month.

Come join the hoards of traders who are leveraging the COT data to their trading success at www.cot4metatrader.com

thanks

Free COT charting

I believe this is the source for the chart picture you posted.

Commodity Futures Trading Charts

I personally have yet to find a strategy that works.

Matt

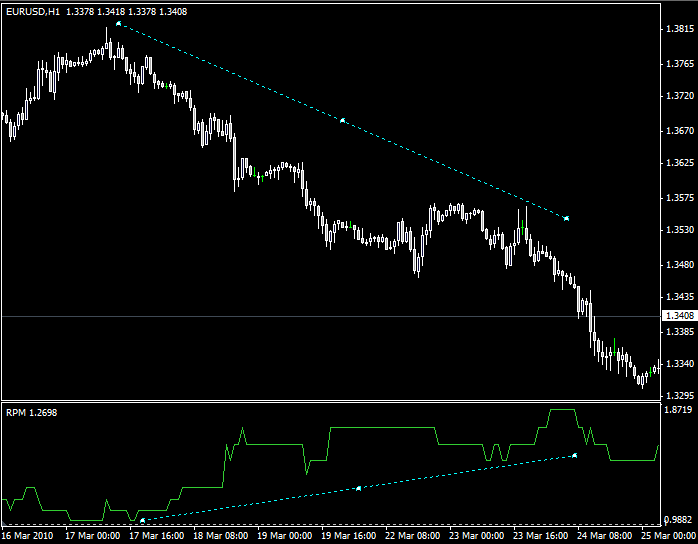

Retail Positioning on the EurChf

According to our retail positioning data, retail fx traders continue to add to their long EurChf positions as the EurChf continues to make new lows.

Our indicator has reached a new high, showing 7 traders long for every 1 retail trader short.

Retail traders are long the EurUsd and long the UsdChf as well. If the retail market had a strong bias to be long or short the USD then the UsdChf and EurUsd would be opposite sides.

The Retail Positioning Meter reflects the current state of the sideways dollar movement.

Retail Positioning - The Ultimate Contrarian Indicators

Why is it important?

Crowds move markets and at major market turning points, the crowds are almost always wrong. When crowd sentiment is overwhelmingly positive or overwhelmingly negative ? it's a signal that the trend is exhausted and the market is ready to move powerfully in the opposite direction. Sentiment has long been a tool used by equity, futures, and options traders.

-FXCM analyst Jaime Saettele

Retail positioning can be used with news trading, scalping, elliot waves, and swing trading.

You can see in the image below how retail positions increased as price decreased. This is a common occurrence in trending markets as retail traders try to pick bottoms and larger funds pick their stops.

How to trade positioning information:

The strategy below was published in 'Sentiment In The FOREX Market' by Jamie Saettele.

1. Retail Sentiment is a contrarian indicator during trending markets.

2. The flipping of the ratio is a more accurate signal of a turn in price than extreme positioning.

3. The Retail Sentiment confirms the price action during range bound markets.

4. Retail Sentiment moves inversely to price.

5. Follow the slope of the Retail Sentiment ; a change in the slope means a change in trend.

6. The other way of looking at speculative positioning is to look at the percentage of open orders that are long.

7. Net positioning=long orders+short orders.

8. More than 50% favors weakness.

9. Less than 50% favors strength.

10. Higher net positioning means that more traders are entering the market.

11. Higher net positioning suggests more confidence in the direction of the current trend.

12. Many times a significant increase in net positioning precedes a bull market because many of the traders who entered the market are leaving their stop losses just above the current price action.

13. Lower net positioning means that more discouraged traders are leaving the market.

14. Rising prices and a big fall in net positioning is bearish because short covering is fueling the current trend. When the short covering has ended, prices will likely decline.

15. Lower net positioning suggests profit taking and hence consolidation.

16. Lower net positioning suggests higher risk aversion.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

I have recently been reading up on how useful currency futures COT data is for determining positions of large speculators and how the FX market moves according to their involvement. There are indicators available for futures traders representing COT data, has anybody heard of or could produce an indicator that would provide signals involving this valuable data inside FX charts?