- Candel Sticks Indicator and Filters

- Exotic Waves indicator system

- The Moving Average Channel

Does anyone use the Wavy tunnel? I have seen a couple things on it but cannot seem to find any specific information. Does this strategy actually work?

Never used it, but here is some info I found:

Easy Wave Tunnel

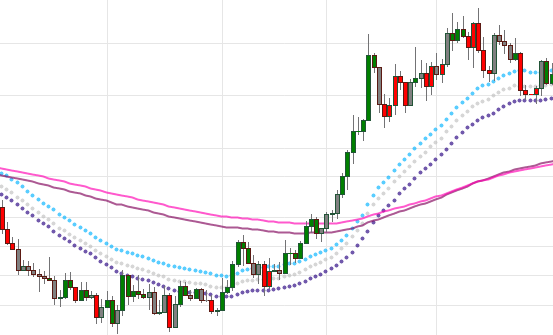

Wavy Line: ema34 - 3 lines = High, Close , Low

Tunnel Line: ema144 (close) and ema169 (close)

5 Rules to use WaveTunnel:

- Wavy Lines and Tunnel Lines are the natural Resistant and Support line.

- Price above both Wavy & Tunnel = Uptrend , Price below both Wavy & Tunnel = Downtrend

- Break Wavy Line , price run to Tunnel Line

- Not Pass Tunnel Line, price run back Wave Line

- Hit Tunnel and retrace less then 61.8% , then Break out, Price go AB=CD pattern

Wavy Tunnel By Wave Riders Style

// Pseudo Code, not MQL code

study("Wavy Tunnel", overlay=true)

wavy_h = ema(high, 34)

wavy_c = ema(close, 34)

wavy_l = ema(low, 34)

tunnel1 = ema(close, 144)

tunnel2 = ema(close, 169)

plot(wavy_h, color=aqua, linewidth=2,style =6)

plot(wavy_c, color=silver, linewidth=2,style =6)

plot(wavy_l, color=navy, linewidth=2,style =6)

plot(tunnel1, color=purple, linewidth=2)

plot(tunnel2, color=#FF00FF,linewidth=2)

- www.mql5.com

Also found this:

Wavy Tunnel

The Raghee Wave and the Vegas Tunnel are separate,

tradable strategies, that have been combined into one strategy that creates

potentially higher-probability trades.

Setting up the Wave: You will want to do this on 1-hour and 4-hour charts. It can be used on 30-minute charts as well.

You are setting up 3 different 34-period Exponential Moving Averages (EMAs)- these are averages of the candlestick Highs, Closes and Lows. You do this as follows: Go to 'Indicators' on the top of your chart and drop that menu down, then select 'Moving Average' . Then select 'Moving Average (Exponential)'. Click on 'New’ and that gives you another drop down menu with several blocks to be completed as follows:

|

Wave EMA Parameters |

Upper |

Middle |

Lower |

|

EMA Period* |

34 |

34 |

34 |

|

With (on) |

High |

Close |

Low |

|

Color |

Purple |

Purple |

Purple |

|

Thick(ness)** |

Medium |

Medium |

Medium |

* Reasonable1-hour reference approximations on other charts are (but always check the 1-hour chart before trading):

4-hr (1/4th) - 8 or 9 30-min (x 2) - 68 15-min (x 4) - 136

** Your choice

Setting up the 1 Hour Tunnel: on 1-hour charts only, set up 3 EMAs: 144, 169 and 12. If you have the FX lines on your chart, the slower line (FXline2) is the same as the 12 EMA.

|

Tunnel EMA Parameters |

Fast |

Slow |

Filter*** |

|

EMA Period* |

144 |

169 |

12 |

|

With (on) |

Close |

Close |

Close |

|

Color* |

Black/White, Blue |

Black/White, Red |

Green, Yellow |

|

Thick(ness)** |

Medium |

Medium |

Medium |

* Reasonable1-hour reference approximations for the Tunnel on other charts are (but always check the 1-hour chart before trading, and leave 12 EMA as is):

4-hr (1/4th) - 36 / 42 30-min (x 2) - 288 / 338 15-min (x 4) - 576 / 676

However, some traders use the Raghee-Wave as is (34 EMAs) as a confirmation (filter) to take trades and make exits

** Your choice

*** Same as FXline2 (usually yellow)

Entry points: Enter a buy when your candle is forming on the same side of the Wave and the 12 EMA, just as it breaks through the Tunnel. Breaking through the Tunnel means that it has gone through both EMA lines. If you have gone through the Tunnel in a single clean strong candle you may be able to set your stop loss just the other side of the Tunnel. If your chart shows chop around the Tunnel then you need a bigger stop loss – like behind the first, even second or third line of the Wave. If you do not have a clean break through the Tunnel and things are choppy then you may need to wait for a break of support or resistance lines that mark the barriers of that choppy sideways action.

Wavy Tunnel Entry Point Criteria (for high percentage trade):

- Right time of day for the pair (Who’s Awake?)

- Break the Wave

- Break the Tunnel*

- Trading beyond the 12 EMA

- Candlestick exhaustion point not reached (less than average daily High-Low)

- If a major barrier is close, or the currency is chopping around the Wavy Tunnel (creating additional barriers), wait for break through the barrier(s).

Stop Loss (include spread on a Short/Sell)

- Clean (one candle) break of Tunnel: SL on other side of Tunnel

- Not clean (several candles): SL on one of the Wave lines, depending on your risk tolerance

Exits when currency closes between the 12 EMA (FxLine2) and the Wave, OR …

Add-ons: Optionally, if the other side of the Wave is the stop loss, one can add on to the trade if the currency touches or enters the Wave, then “bounces” out again. Conservative: add on the break out of the Wave. Aggressive: add as currency bounces somewhere in the Wave.

Also found this:

Thank you very much Fernando! I will be looking into this!

Next Time, just use Google, I found all that info on the first page of the search results.

I did and this is all that I was able to find were the courses and advertisements. That is why I came here to the forum to see if I could find anyone who has used it that I could discuss it with.

Exactly! 3rd link (in your image) and also further down the page. Did you just give up after looking at just a few of the links? We are not here to "serve you", so please put in some effort in the task next time!

I am not looking to be serverd. I passed up that link as it clearly states indicator script which I was not looking for. I did search and most of the things seemed to be ads that is why I posted in a forum.

fo·rum

[ˈfôrəm]

NOUN

a place, meeting, or medium where ideas and views on a particular issue can be exchanged.

Hm and posted under trading systems. I am looking to network meet people discuss ideas. Fernando ill just request you don't respond to my posts. I said thank you and i would use the information you were able to find for me. you can also see I had clicked some links. There was some information but I was looking for someone who has used it one knew more about it that I could discuss with as I clearly was not satisfied with just google.

Next Time, just use Google, I found all that info on the first page of the search results.

So thank you have a nice day!

I meant no disrespect, just wanted you to understand that more effort is required and that you should not just give up on the first "hick-up". However, as you can see, the "clearly states indicator script" is the one on my first post! And the second one, is from further down the search results page.

I meant no disrespect, just wanted you to understand that more effort is required and that you should not just give up on the first "hick-up". However, as you can see, the "clearly states indicator script" is the one on my first post! And the second one, is from further down the search results page.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use