Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.01.05 12:07

Weekly outlook: January 6 - 10

Monday, January 6

Germany is to release preliminary data on consumer price inflation, which accounts for the majority of overall inflation.

The U.K. is to produce data on service sector activity, a leading indicator of economic health.

The

U.S. is to publish data on factory orders, while the Institute of

Supply Management is to release data on service sector activity.

Tuesday, January 7

Australia is to publish data on the trade balance, the difference in value between imports and exports.

Germany

is to release data on retail sales, the government measure of consumer

spending, which accounts for the majority of overall economic activity,

as well as data on the change in the number of people unemployed.

The euro zone is to produce preliminary data on consumer inflation.

The

Swiss National Bank is to publish data on its foreign currency

reserves. This data is closely scrutinized for indications of the size

of the bank’s operations in currency markets.

Both the U.S. and Canada are to publish reports on the trade balance, while Canada is also to release a report on the Ivey PMI.

Wednesday, January 8

Germany

is to release reports on the trade balance and factory orders.

Meanwhile, the euro zone is to produce data on the unemployment rate and

a separate report on retail sales.

The U.S. is to release the

ADP report on private sector job creation, which leads the government’s

nonfarm payrolls report by two days.

Later Wednesday, the Federal Reserve is to publish what will be the closely watched minutes of its latest policy meeting.

New Zealand is to publish data on building consents, a leading indicator of future construction activity.

Thursday, January 9

Australia is to publish data on building approvals, as well as a report on retail sales.

China is to publish data on consumer inflation.

The U.K. is to release data on the trade balance. Meanwhile, the BoE is to announce its benchmark interest rate.

Later

in the day, the ECB is to announce its benchmark interest rate. The

announcement is to be followed by a press conference with President

Mario Draghi.

Germany is to publish data on industrial production.

Canada is to produce data on building permits and new house price inflation.

In the U.S., the Labor Department is to release its weekly report on initial jobless claims.

Friday, January 10

Switzerland is to publish data on consumer inflation.

The U.K. is to release a report on industrial and manufacturing production, a leading indicator of economic health.

Canada is to release data on the change in the number of people employed and the unemployment rate.

The U.S. is to round up the week with the closely watched government data on nonfarm payrolls and the unemployment rate.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.01.06 09:39

2014-01-06 08:15 GMT (or 09:15 MQ MT5 time) | [EUR - Spanish Services PMI]

- past data is 51.5

- forecast data is 51.5

- actual data is 54.2 according to the latest press release

if actual > forecast = good for currency (for EUR in our case)

==========

Spanish services PMI 54.2 vs. 51.5 forecast

Service sector activity in Spain rose unexpectedly last month, industry data showed on Monday.

In a report, Markit Finacial Information Services said that Spanish

services PMI rose to a seasonally adjusted 54.2, from 51.5 in the

preceding month.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 22 pips price movement by EUR - Spanish Services PMI news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.01.06 17:44

2014-01-06 15:00 GMT (or 16:00 MQ MT5 time) | [USD - ISM Non-Manufacturing PMI]

- past data is 53.9

- forecast data is 54.6

- actual data is 53.0 according to the latest press release

if actual > forecast = good for currency (for USD in our case)

==========

U.S. Service Sector Unexpectedly Expands At Slower Rate In December

Activity in the U.S. service sector unexpectedly grew at a slower rate in the month of December, according to a report released by the Institute for Supply Management on Monday.

The ISM said its non-manufacturing index edged down to 53.0 in December from 53.9 in November, although a reading above 50 still indicates growth in the service sector. With the drop, the index fell to its lowest level since hitting 52.8 in June.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 37 pips price movement by USD - ISM Non-Manufacturing PMI news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.01.07 17:46

EUR/USD dips after upbeat U.S. trade data

But the euro struggled to build on gains after data on Tuesday showed

that the annual rate of inflation in the euro zone slowed to 0.8% in

December from 0.9% the previous month, fuelling fresh concerns over the

threat of deflation in the currency bloc.

Elsewhere, data showed

that the number of people out of work in Germany fell by 15,000 in

December to 2.96 million, better than expectations for a decline of

1,000.

The country’s unemployment rate remained steady at 6.9%.

A separate report showed that German retail sales rose 1.5% in November, more than double expectations for an increase of 0.6%.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.01.08 15:01

2014-01-08 13:15 GMT (or 14:15 MQ MT5 time) | [USD - ADP Non-Farm Employment Change]

- past data is 229K

- forecast data is 200K

- actual data is 238K according to the latest press release

if actual > forecast = good for currency (for EUR in our case)

==========

U.S. Private Sector Adds More Jobs Than Expected In December

In an upbeat sign for the U.S. labor market, payroll processor Automatic Data Processing, Inc. (ADP) released a report on Wednesday showing that private sector employment increased by more than expected in the month of December.

ADP said the private sector added 238,000 jobs in December following an upwardly revised increase of 229,000 jobs in November.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 25 pips price movement by USD - ADP Non-Farm Employment Change news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.01.09 06:31

2014-01-09 01:30 GMT (or 02:30 MQ MT5 time) | [CNY - CPI]

- past data is 3.0%

- forecast data is 2.7%

- actual data is 2.5% according to the latest press release

if actual > forecast = good for currency (for CNY in our case)

==========

China Inflation Eases Again; Producer Prices Extend Decline

China's consumer price inflation eased for a second consecutive month in December to reach its weakest level in seven months, the latest figures from the National Bureau of Statistics revealed Thursday.

Meanwhile, China's producer prices extended its decline to 22 months in December, fueling concerns about industrial overcapacity.

The annual consumer price inflation fell to 2.5 percent in December from 3 percent in November. Economists had forecast a slowdown to 2.7 percent. On a monthly basis, the consumer price index rose 0.3 percent.

In the whole of 2013, inflation was 2.6 percent, well below the government's target of 3.5 percent.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 8 pips price movement by CNY - CPI news event

Forum on trading, automated trading systems and testing trading strategies

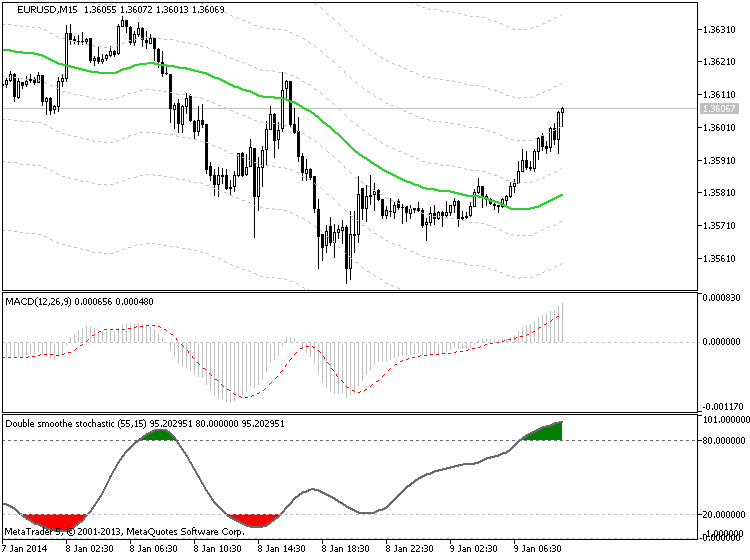

newdigital, 2014.01.09 09:40

Trading the News: European Central Bank Interest Rate Decision (adapted from dailyfx article)

- European Central Bank (ECB) to Retain Current Policy & Forward-Guidance

- President Mario Draghi to Highlight Threat for Disinflation?

The European Central Bank (ECB) may help to prop up the single currency as the Governing Council is widely expected to keep the benchmark interest rate on hold while preserving its forward-guidance for monetary policy.

What’s Expected:

Time of release: 01/09/2014 12:45 GMT, 7:45 EST

Primary Pair Impact: EURUSD

Expected: 0.25%

Previous: 0.25%

Forecast: 0.25%

Why Is This Event Important:

A further delay in the ECB’s easing cycle may instill a bullish outlook

for the EURUSD as President Mario Draghi retains a wait-and-see

approach, but the single currency may struggle to hold its ground should

the central bank head highlight a greater risk for disinflation.

Bearish EUR Trade: ECB Provides More Detailed Monetary Easing Timeline

- Need red, five-minute candle following the decision/statement to consider a short Euro trade

- If market reaction favors a short trade, sell EURUSD with two separate position

- Set stop at the near-by swing high/reasonable distance from cost; at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is met, set reasonable limit

- Need green, five-minute candle to favor a long EURUSD trade

- Implement same strategy as the bearish euro trade, just in the opposite direction

Forum on trading, automated trading systems and testing trading strategies

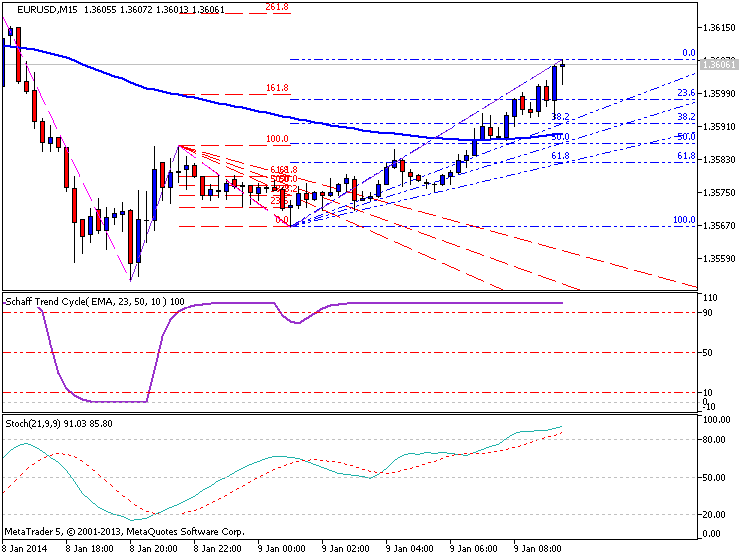

newdigital, 2014.01.09 14:04

2014-01-09 12:45 GMT (or 13:45 MQ MT5 time) | [EUR - Interest Rate]

- past data is 0.25%

- forecast data is 0.25%

- actual data is 0.25% according to the latest press release

if actual > forecast = good for currency (for EUR in our case)

==========

ECB Leaves Interest Rates Unchanged For Second Month

The European Central Bank left its key interest rates unchanged for a second straight month on Thursday, in line with economists' expectations.

Following the meeting in Frankfurt, the Governing Council decided to hold the main refinancing rate at a record low 0.25 percent.

The marginal lending facility rate was held at 0.75 percent. The deposit facility rate was kept at zero, where it has remained since July 2012.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 15 pips price movement by EUR - Interest Rate news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.01.09 14:55

2014-01-09 13:30 GMT (or 14:30 MQ MT5 time) | [EUR - ECB Press Conference]

- past data is n/a

- forecast data is n/a

- actual data is n/a according to the latest press release

==========

Live Video Coverage of ECB Press Conference with Mario Draghi - January 9, 2014The ECB has left the benchmark rate unchanged at historic lows at .25%

Press conference following the meeting of the Governing Council of the European Central Bank on 9 January 2014 at its premises in Frankfurt am Main, Germany, starting at 2:30 p.m. CET:

- Introductory statement by Mario Draghi, President of the ECB.

- Question and answer session. Registered journalists pose questions to Mario Draghi, President of the ECB, and to Vítor Constâncio, Vice-President of the ECB.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 84 pips price movement by EUR - ECB Press Conference news event

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

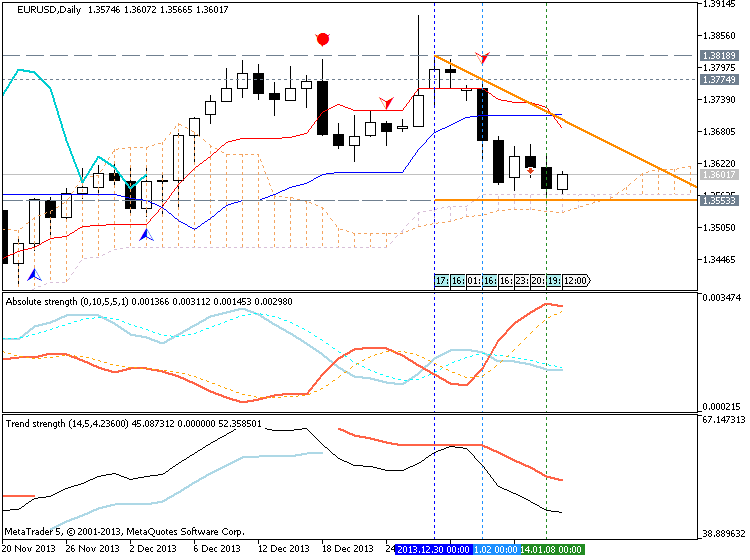

Chinkou Span line of Ichimoku indicator came to be very close to historical price ready for breakdown from above to be for possible price reversal on D1 timeframe from bullish to primary bearish market condition. The primary bearish is already going on for H4 timeframe and H1 timeframe. As to W1 so the correction within primary bullish may be started next week on open bar.

If the price will not break 1.3629 support level from above to below so we may see the ranging market condition with the price floating between 1.3535 and 1.3893If the price will break 1.3535 support level (which is one of kumo border) on close D1 bar - the trend will be reversed to primary bearish

UPCOMING EVENTS (high/medium impacted news events which may be affected on EURUSD price movement for this coming week)

2014-01-06 08:15 GMT (or 09:15 MQ MT5 time) | [EUR - Spanish Services PMI]

2014-01-06 15:00 GMT (or 16:00 MQ MT5 time) | [USD - ISM Non-Manufacturing PMI]

2014-01-06 22:30 GMT (or 23:30 MQ MT5 time) | [USD - Fed Chairman Nomination]

2014-01-07 08:55 GMT (or 09:55 MQ MT5 time) | [EUR - German Unemployment]

2014-01-07 13:30 GMT (or 14:30 MQ MT5 time) | [USD - Trade Balance]

2014-01-08 10:00 GMT (or 11:00 MQ MT5 time) | [EUR - Unemployment Rate]

2014-01-08 13:15 GMT (or 14:15 MQ MT5 time) | [USD - ADP Non-Farm Employment Change]

2014-01-08 19:00 GMT (or 20:00 MQ MT5 time) | [USD - FOMC Meeting]

2014-01-09 01:30 GMT (or 02:30 MQ MT5 time) | [CNY - CPI]

2014-01-09 12:45 GMT (or 13:45 MQ MT5 time) | [EUR - Interest Rate]

2014-01-10 13:30 GMT (or 14:30 MQ MT5 time) | [USD - Non-Farm Employment Change]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on EURUSD price movement

SUMMARY : reversal

TREND : ranging

Intraday Chart