Forum on trading, automated trading systems and testing trading strategies

newdigital, 2013.12.29 18:10

EURUSD Technical Analysis : December 30 - January 3

The euro surged to the highest level since October 2011 against the U.S. dollar on Friday, with moves amplified in poor year-end liquidity after European Central Bank Governing Council member Jens Weidmann warned against keeping interest rates low.

Monday, December 30

Italy is to hold an auction of five-and-ten-year government debt.

Meanwhile, the U.S. is to release private sector data on pending home sales, a leading indicator of economic health.

Tuesday, December 31

Markets

in Germany will remain closed for New Year’s Eve. Meanwhile, the U.S.

is to produce private sector data on consumer confidence and house price

inflation, as well as a report on manufacturing activity in the Chicago

region.

Wednesday, January 1

Markets in Europe and the U.S. will remain closed for the New Year’s holiday.

Thursday, January 2

The euro zone is to release revised data on its manufacturing PMI, while Spain and Italy are also to release individual reports.

Later

in the day, the Institute of Supply Management is to release its

manufacturing PMI, while the Labor Department is to release its weekly

report on initial jobless claims. The U.S. is also to publish data on

construction spending.

Friday, January 3

In the euro zone, Spain is to publish data on the change in the number of people employed.

The U.S. is to round up the week with official data crude oil stockpiles and natural gas inventories.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2013.12.31 12:41

EUR/USD steady in thin year-end trade

EUR/USD hit 1.3729 during late Asian trade, the session low; the pair subsequently consolidated at 1.3794, easing 0.04%.

The pair was likely to find support at 1.3729, Monday's low and

resistance at 1.3894, the high of December 27 and a 26-month high.

The dollar remained supported amid expectations for further stimulus

tapering by the Federal Reserve. The U.S. central bank will start

reducing its bond-buying stimulus program by USD10 billion a month in

January, amid indications of an improving U.S. economy.

The

single currency had gained some ground on Friday, after European Central

Bank Governing Council member Jens Weidmann said keeping interest rates

low may endanger political reforms.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.01.02 08:48

EUR/USD edges lower ahead of PMI data

EUR/USD hit 1.3741 during late Asian trade, the session low; the pair subsequently consolidated at 1.3748, edging down 0.07%.

The pair was likely to find support at 1.3693, the low of December 27 and resistance at 1.3813, the high of December 31.

The greenback remained supported after the Conference Board on Tuesday

said that its index of U.S. consumer confidence improved to 78.1 in

December from 72.0 in November. Analysts had expected the index to rise

to 76.0 this month.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.01.02 17:24

EURUSD Technical Analysis (adapted from dailyfx article)

- EUR/USD failed near the 1.3895 61.8% retracement of the 2009/2010 decline heading into the important cycle turn window this week

- A move under the 2nd square root relationship of last year’s high at 1.3655 will turn us negative on the Euro

- The 1st square root relationship of the 2012 high at 1.3775 is now important resistance with a move above needed to relieve immediate downside pressure

- An important long-term cycle is in effect over the next few days

- A daily close under the 2nd square root relationship of the year’s high at 1.3655 will turn us negative on the Euro

On D1 timeframe - it is still ranging bullish with the corrected started on open D1 bar :

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

ranging bullish

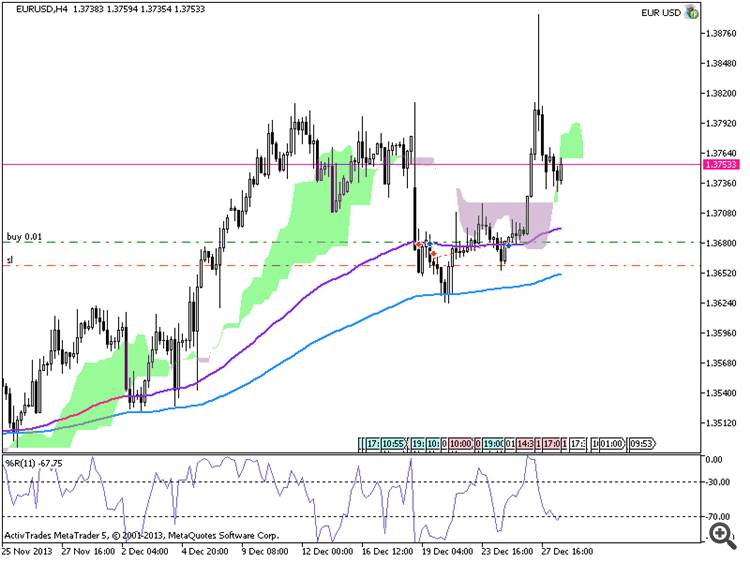

On H4 timeframe - bearish with ranging started on open H4 bar :

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

bearish with ranging started on open bar

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.01.03 16:50

Intraday Technical Analysis For EURUSD (based on this article)

EURUSD is moving down in third leg of decline, labeled as wave C/3 that should be made by five waves. We see current sideways price action as fourth wave so be aware of more downside as long as 1.3740 holds.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

The price is started with primary bullish on open bar after secondary ranging finished on D1 timeframe trying to break 1.3716 and 1.3811 resistance levels on close bar.

On H4 timeframe - the price is ranging between 1.3688 support and 1.3893 resistance for ranging with secondary correction started. If Chinkou Span line will break historical price from above to below, and if the price will break 1.3688 support - we may see good downtrend with the trend reversal from bullish to primary bearish.

W1 timeframe - the flat is going on for the few weeks, and if the price will breal 1.3817 resistance so the primary bullish will be continuing with good possibility to open buy trade, otherwise - flat and ranging market condition will be continuing.

If the price will break 1.3811 resistance level on D1 timeframe so the primary bullish will be continuing.If the price will break 1.3688 and 1.3679 supports on H4 timeframe - the trend will be reversed to primary bearish for H1 and to secondary correction on D1 which may be risky to open sell trade.

UPCOMING EVENTS (high/medium impacted news events which may be affected on EURUSD price movement for this coming week)

2013-12-30 15:00 GMT (or 16:00 MQ MT5 time) | [USD - Pending Home Sales]

2013-12-31 14:45 GMT (or 15:45 MQ MT5 time) | [USD - Chicago PMI]

2013-12-31 15:00 GMT (or 16:00 MQ MT5 time) | [USD - Consumer Confidence]

2014-01-01 01:00 GMT (or 02:00 MQ MT5 time) | [CNY - Manufacturing PMI]

2014-01-02 01:45 GMT (or 02:45 MQ MT5 time) | [CNY - HSBC Final Manufacturing PMI]

2014-01-02 08:15 GMT (or 09:15 MQ MT5 time) | [EUR - Spanish Manufacturing PMI]

2014-01-02 13:30 GMT (or 14:30 MQ MT5 time) | [USD - Unemployment Claims]

2014-01-02 15:00 GMT (or 16:00 MQ MT5 time) | [USD - ISM Manufacturing PMI]

2014-01-03 01:00 GMT (or 02:00 MQ MT5 time) | [CNY - Non-Manufacturing PMI]

2014-01-03 08:00 GMT (or 09:00 MQ MT5 time) | [EUR - Spanish Unemployment Change]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on EURUSD price movement

SUMMARY : bullish

TREND : ranging

Intraday Chart