Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.01.20 14:17

Apple - Meeting In India On January 22 (based on the article)

- "Apple management is set to meet with Indian government officials on Sunday, January 22. According to a report in Indian newspaper, Economic Times, management will meet with officials from the Ministry of Electronics and Information Technology along with bureaucrats from the departments of Commerce and Revenue on Sunday."

- "We can bring in global majors such as Apple, which will come together with its entire ecosystem and consider this as a marquee investment," Sundararajan said. "India’s domestic manufacturing is increasing as it is, becoming a cheaper destination, while China’s growth is plateauing due to the growing production cost," she added.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.01.23 17:36

How To Trade Apple In 2017 (based on the article)

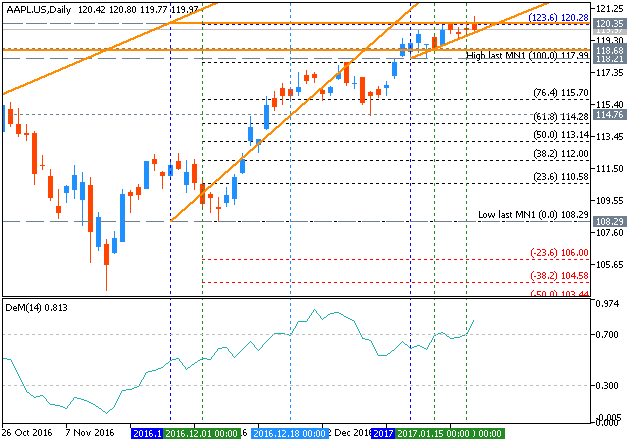

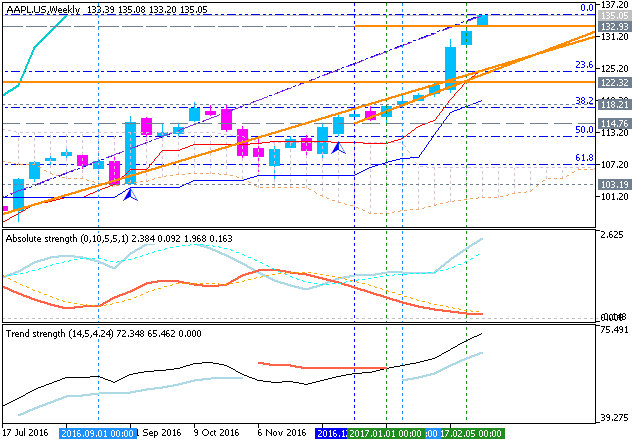

- "Apple (AAPL) closed at $120.00 last week, up 3.6% year-to-date and in bull market territory, 34.1% above its May 12, 2016 low of $89.47. The stock is still in correction territory, 10.8% below its all-time intraday high of $134.54, set on April 28, 2015."

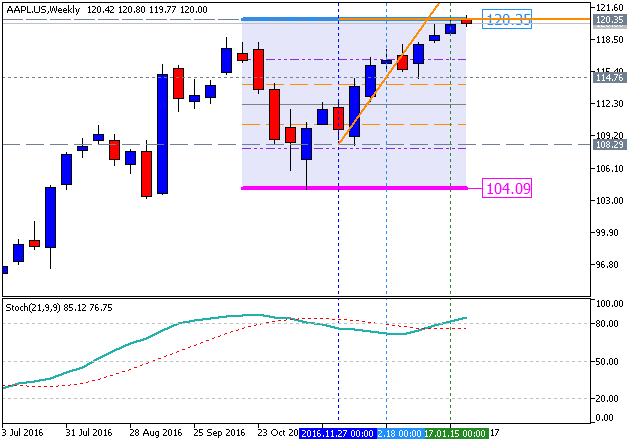

- "Apple's weekly chart is positive but overbought with the stock above its five-week modified moving average of $116.38 and above its 200-week simple moving average of $98.14, last tested as the “reversion to the mean” during the week of July 1 when the average was $93.31. Apple’s 12x3x3 weekly slow stochastic reading rose to 86.00 last week, up from 80.97 on Jan. 13, moving further above the overbought threshold of 80.00. The down trend resistance comes in at $123.50 this week."

- "Investors looking to buy Apple should do so on weakness to $115.11 and $112.56, which are quarterly and annual value levels, respectively. Investors looking to reduce holdings should do so on strength to $122.82 and $123.54, which are my monthly and semiannual risky levels, respectively. The upside for all of 2017 is $151.69."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.01.25 12:55

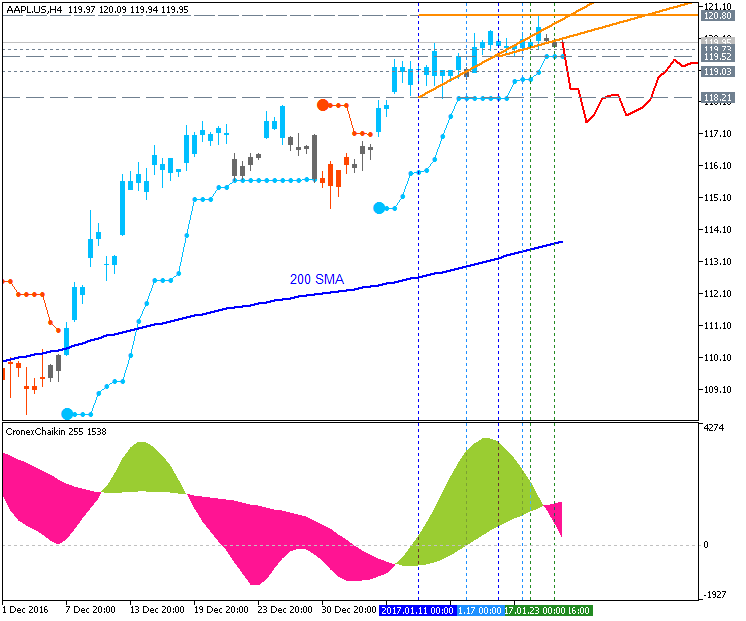

AAPL Intra-Day Technical AnalysisL bullish ranging within 120/121 - 118 levels waiting for direction of the strong trend to be started (based on the article)

Intra-day shares price is located far above 200 SMA in the bullish area of the chart: the price is tersting 120.80 resistance level for the bullish trend to be continuing. Alternative, breaking the support level at 118.21 to below will lead to the trend to ne changed to the secondary correction.

The most linely scenario for the intra-day price movement for the near future is the following: bullish ranging within 120/121 - 118 levels waiting for direction of the strong trend to be started.

- "Apple finally has a solution for locating your lost AirPods remotely. The company has added Find My AirPods, a tracker function for the $159 bluetooth headphones, to the Find My iPhone app."

- "The finder function comes bundled with the iOS 10.3 beta that began rolling out on Tuesday, and it'll also be available on the desktop version of Find My iPhone. If your AirPods are set up with an iPhone, iPad, or iPod Touch that already has Find My iPhone enabled, the new feature will automatically be available. A third party had beaten Apple to releasing an AirPods tracker, but the company booted it from the App Store on Jan. 9."

- "AirPods, which were announced alongside the iPhone 7 and shipped in December after an uncharacteristic delay, hit the market without a way to locate them if they disappeared. The small, cordless headphones connect to phones via Bluetooth, and a single replacement AirPod costs $69, so customers have expressed concerns over losing them since their announcement."

- "Because the headphones aren't connected to the internet, the tracker can only locate them in real-time if they are in range of one of your bluetooth-enabled devices that's also logged into your iCloud account. If they're not nearby, the app will display where they were last paired with one of your iOS devices. Similarly, if your AirPods are dead or inside the charging case, the app will display where they were last connected to one of your devices."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.02.15 06:45

Apple (AAPL) - Warren Buffett has been buying shares of Apple hand over fist (based on the article)

Apple shares broke 122.32 resistance level to above for good breakout: the price broke 132.93 resistance level as well for the long-term bullish breakout to be continuing.

- "Shares of Apple have climbed 42% in the last twelve months and notched a new all-time record on Tuesday, in a show of renewed investor confidence in the iPhone maker. If Buffett hasn't touched his position since the end of last year, it's now worth a whopping $7.7 billion."

- "In a regulatory filing on Tuesday, Buffett's Berkshire Hathaway disclosed that it has almost quadrupled its stake in Apple. As of year-end, it owned some 57 million shares, up from 15 million shares in the third quarter. That stake was worth approximately $6.6 billion as of December 31."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.04.07 17:41

Intra-Day Fundamentals - EUR/USD, USD/CNH, Apple shares and McDonald's shares: Non-Farm Payrolls

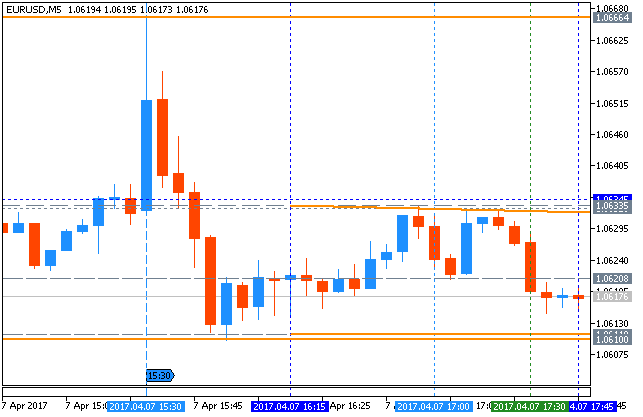

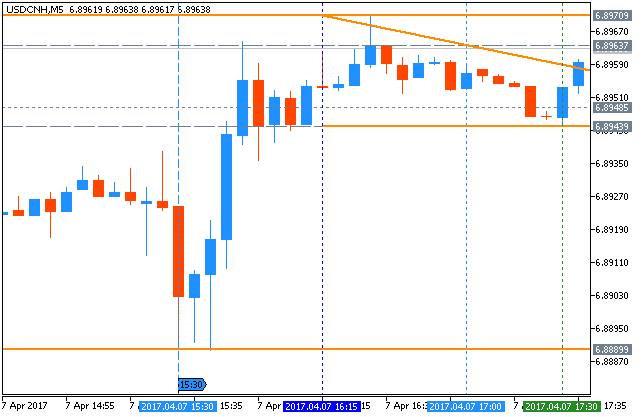

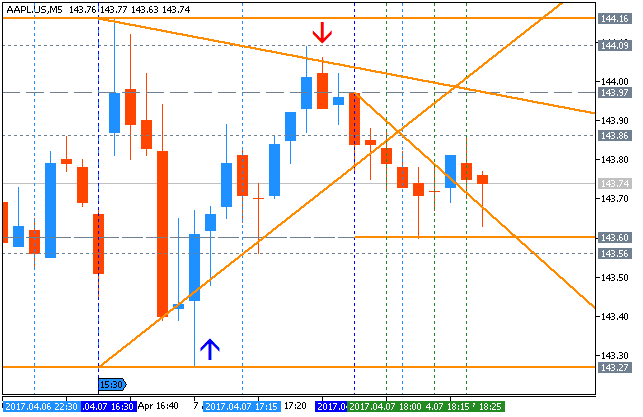

2017-04-07 13:30 GMT | [USD - Non-Farm Employment Change]

- past data is 219K

- forecast data is 174K

- actual data is 98K according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Non-Farm Employment Change] = Change in the number of employed people during the previous month, excluding the farming industry.

==========

From official report:

- "The unemployment rate declined to 4.5 percent in March, and total nonfarm payroll employment edged up by 98,000, the U.S. Bureau of Labor Statistics reported today. Employment increased in professional and business services and in mining, while retail trade lost jobs."

==========

EUR/USD M5: range price movement by Non-Farm Payrolls news events

==========

USD/CNH M5: range price movement by Non-Farm Payrolls news events

==========

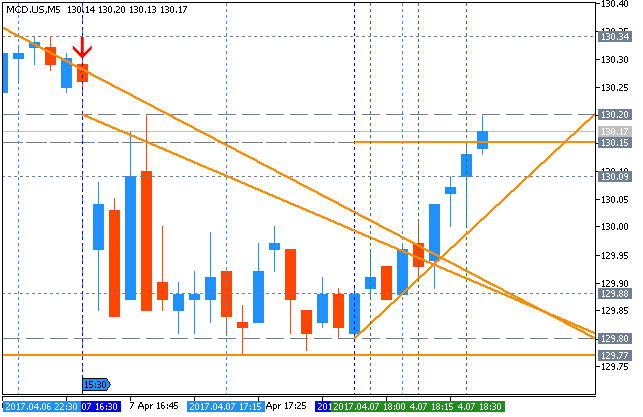

Apple M5: range price movement by Non-Farm Payrolls news events

==========

McDonald's M5: range price movement by Non-Farm Payrolls news events

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.04.25 08:47

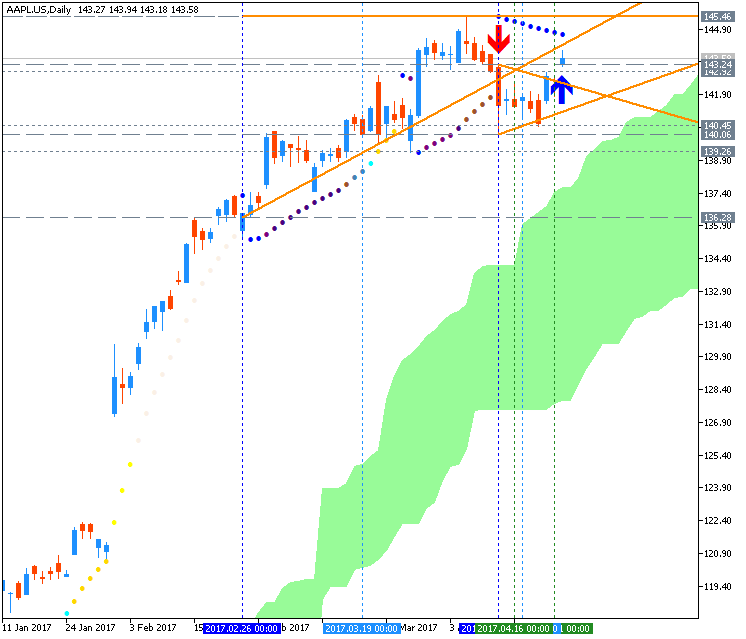

Apple share with iPhone 8 launch - bullsh trend with 145.46 resistance as a key (based on the article)

Daily share price is located above Ichimoku cloud in the bullish area of the chart. The price broke symmetric triangle pattern to above for the key resistance level at 145.46 for the bullish trend to be continuing.

- "This morning, there was an interesting note out from the analysts at UBS, which speculated that Apple would delay launching the high-end iPhone 8 because the company is working on game changer' technology. The firm's analysts stated that they think the company is working on facial recognition technology in its OLED model (the rumored $1,000/unit iPhone8), which could replace Touch ID."

- "We believe combing combining 3-D sensing and the location, as well as payment information, could bring up more personalized services and this could be one step towards potential augmented reality (AR) applications."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.05.02 16:00

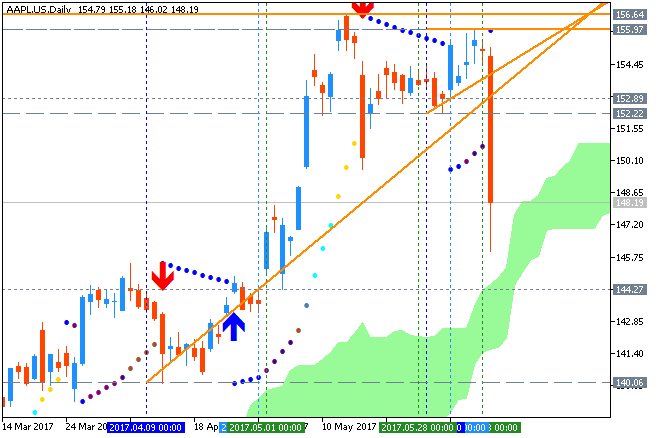

Apple shares - daily bullish breakout (based on the article)

Daily shares price broke 145.46 and 147.19 resistance levels together with ascending triangle pattern to above for the bullish breakout to be continuing.

- "KGI Securities speculated in a report yesterday that Apple would be unveiling a Siri-based smart home product in order to take on Amazon's Echo. The analyst at KGI, Ming-Chi Kuo, stated that there is a greater than 50% chance that Apple will debut the device at their World Wide Developer Conference (WWDC) scheduled for June 5-9."

- "So, maybe Apple is late to the game. However, if they are indeed going to unveil an Echo-like device next month at WWDC, get ready for another hit product from Apple and from an investment point of view, get ready for Street estimates to move higher as well. As the title suggests, from product and investment points of view, better late than never indeed."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.06.06 09:07

Nasdaq will hit 10,000 in the very near future (based on the article)

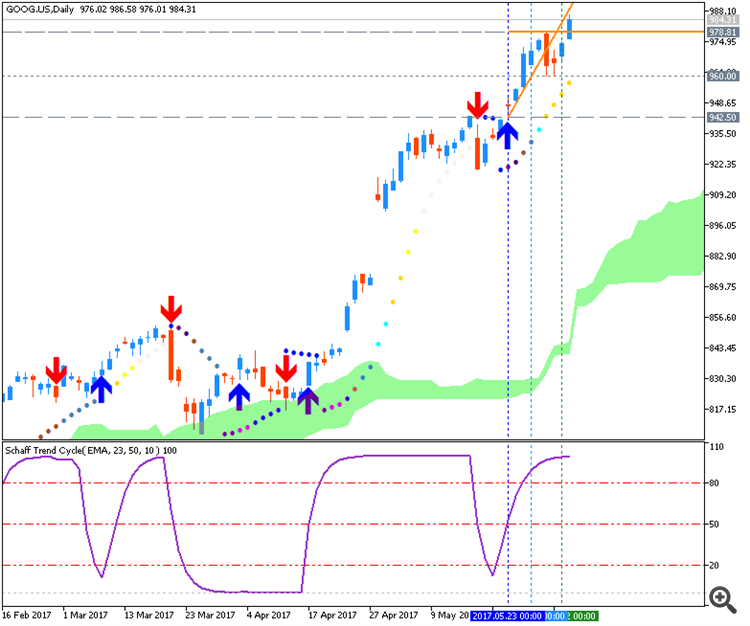

Google share price is located far above Ichimoku cloud in the bullish area of the chart: daily price is breaking 978 resistance level to above for the bullish trend to be continuing.

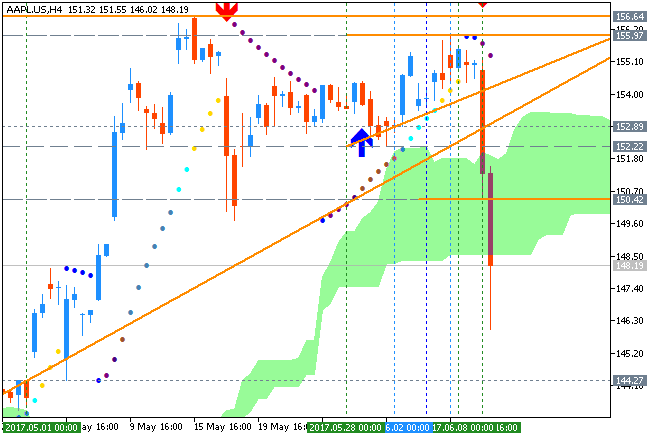

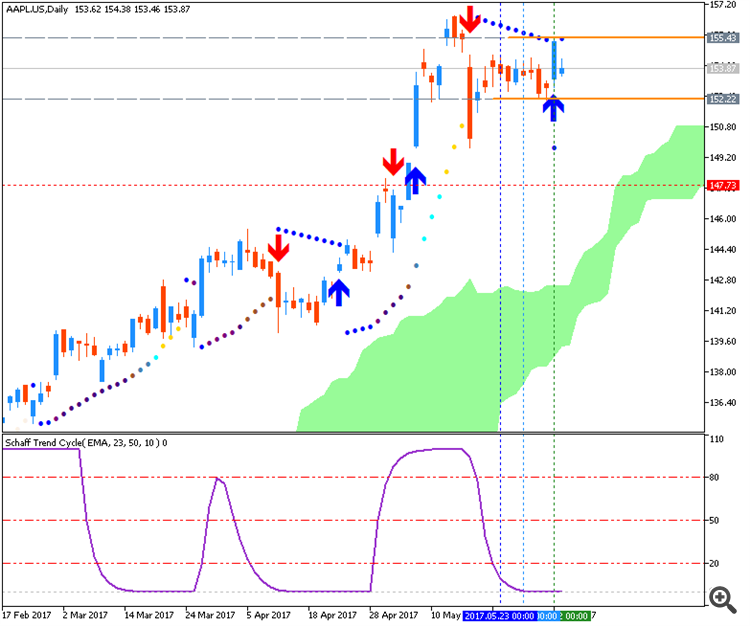

Apple shares are on bullish ranging within 155/152 s/r level to be above Ichimoku cloud: the price is testing 155 resistance to above for the bullish trend to be resumed.

- "Are we ready to concede the fact that the Nasdaq will hit 10,000 in the very near future? Probably within the next couple years."

- "Amazon just hit $1000/share. Google $975. Apple is likely to become the first company ever to have a total valuation of $1trillion dollars. If you don’t think it’s worth it, remember that stock ownership means you own a small piece of the company. And the company owns $250billion of cash. One quarter of the $1trillion valuation is in cold, hard cash. Only three quarters of the value is in floating stock."

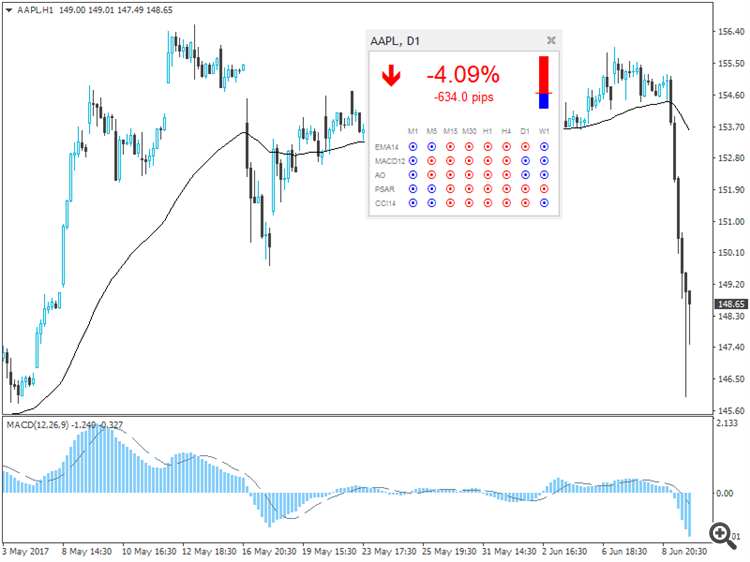

looks like Friday doesn't do any good for Apple stock.

Yes, that's right: the intra-day (H4) price broke Ichimoku cloud to below for the bearish reversal with 144.27 support level as a target.

And daily price broke 152 support levels for the correction with 144.27 daily bearish reversal target.

So, 144.27 is the key level for now.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

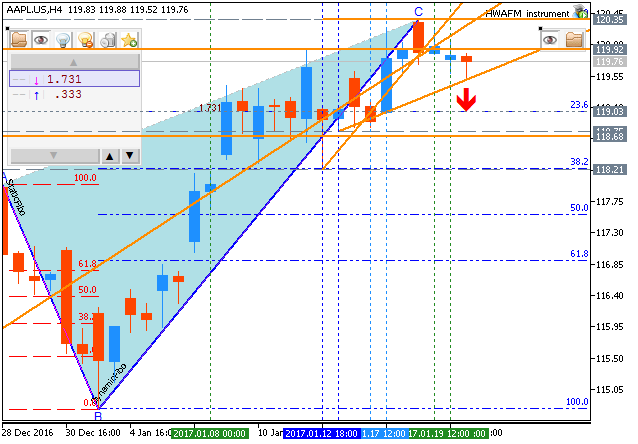

AAPL Technical AnalysisL daily bullsh with 120.35 resistance to be testing for the bullish trend to be resumed

Daily share price is located far above 200 SMA in the bullish area of the chart: the price is on testing resistance level at 120.35 to above for the bullsh trend to be continuing.

If the price breaks 120.35 resistance level on cloe daily bar so the primary bullish trend will be continuing.

If the price breaks 110.80/110.29 support area to below so the reversal of the price movement to the primary bearish market condition will be started.

If not so the price will be on bullish ranging within the levels.