You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.07.04 13:45

Dax Index - correction to the bearish reversal; 2.303 support is the key (based on the article)

Daily price is on secondary correction within the primary bullish market condition. The price is breaking Ichimoku cloud to below with descending triangle pattern to be breaking to below together 12.303 support level for the primary daily bearish reversal to be started.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.07.08 17:11

Weekly Fundamental Forecast for DAX (based on the article)

DAX - "Looking ahead to next week, on the data-front the calendar is lacking in ‘high’ impact events. Global markets may respond to Yellen’s testimony on Wednesday and Thursday should she shake things up in the U.S."

Market suggests to buy DAX in a mid-term.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.08.01 12:15

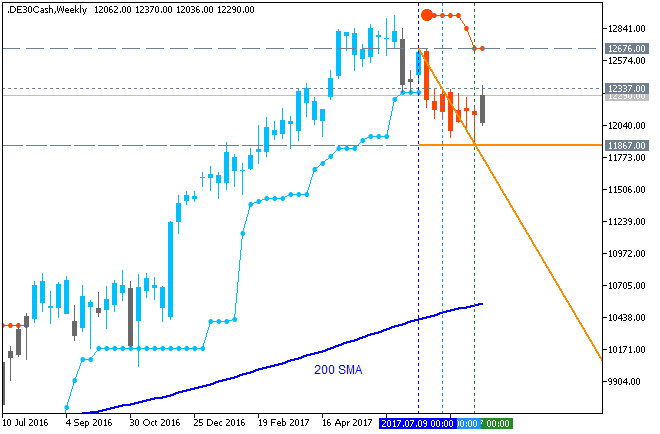

Dax Index - weekly correction; 12,088 support level is the key (based on the article)

The price on weekly chart was bounced from 12,947 resistance level for the descending trianglew pattern to be testing to below together with 12,088 support level to be broken for the secondary correction to be continuing.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.08.03 14:30

DAX Index - ranging bearish continuation; 12,082 is the key (based on the article)

Daily price is below Ichimoku cloud in the bearish area of the chart: price is testing descending triangle pattern to below together with 12,082 support level for the bearish trend to be continuing.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.08.19 09:47

Dax Index - daily bearish; 11,928 support is the key (based on the article)

Daily price broke Ichimoku cloud to below to be reversed to the primary bearish market condition: price is testing 11,928 support level together with descending triangle pattern to below for the bearish rend to be continuing.

"Looking at the German index from a pure technical standpoint, in a bubble, the trend off the June highs after breaking the neckline of the H&S topping formation continues to point towards more weakness. And, as long as it stays below the area surrounding 12300 sellers will continue to be in control. Looking lower, support arrives in the 11950/40 vicinity where the 200-day MA and 8/11 swing-low arrive. After that, 11850, then the measured move target of approximately 11600. The ‘MM’ target isn’t an actual support level but based on the size of the ‘head-and-shoulders’ top (height subtracted from the neckline)."

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.08.23 14:37

DAX Index - daily bearish ranging with ascending triangle (based on the article)

Daily price is below Ichimoku cloud in the bearish area of the chart: the price is on ascending triangle pattern to be tested together with 12,294 resistance level to above for the secondary rally to be started, otherwise - bearish ranging within the levels.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.08.31 12:17

DAX Index - daily bearish ranging; 11,864 is the key (based on the article)

Price is below ichimoku cloud for the bearish ranging within 12,266 bullish reversal resistance level and 11,864 bearish continuation support level. Descending triangle pattern was formed by the price to be crossed to below for the bearish trend to be resumed.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.09.03 10:38

Weekly Fundamental Forecast for Dax Index (based on the article)

Dax Index - "This coming week, the big event will be Thursday’s ECB meeting and how Mario Draghi and company plan to handle the current monetary policy and euro strength. Via Bloomberg on Friday, the ECB said it may not be ready to make a final decision until a couple of weeks before the current program expires. This put pressure on the euro after it initially rallied on weak U.S. jobs data. A euro decline could certainly help bolster European indices higher, and if general risk appetite picks up momentum there may be a double tailwind."

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.09.09 07:34

Weekly DAX Index Outlook: 2017, September 10 - September 17 (based on the article)

"The DAX broke higher during the week, after initially dipping down towards the €12,000 level. By breaking the top of the hammer from the previous week, this is a bullish sign and it looks as if were going to go looking for the €12,500 level above. That is an area that should be resistive, but in the overall look of the market, I believe we will be able to overcome that barrier. The DAX has been in an uptrend for some time, and should continue to be based upon the improving economic conditions in Europe, which of course is heavily influenced by Germany itself. I believe that buying dips continues to be the way forward, although we may get a bit of volatility in the short term, the longer-term uptrend is very much intact."