You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.02.20 14:49

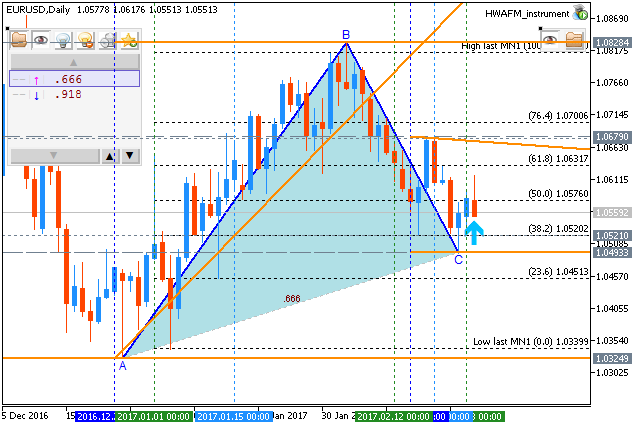

EURUSD technical Outlook - bearish ranging within Fibo levels (based on the article)Daily price is located below 100 SMA/200 SMA in the bearish area of the chart for the ranging between Fibo support level at 1.0521 and Fibo resistance level at 1.0828.

If the price breaks 1.0521 support so the primary bearish trend will be resumed, if the price breaks 1.0828 resistance so the secondary rally will be started, otherwise - ranging.

Forum on trading, automated trading systems and testing trading strategies

EUR/USD to retest resistance line

Cuong Truong, 2017.02.24 22:32

It looks like a fake break out after all. The central bank is keeping the price of their USD up.

The price of EUR/USD will most likely retest that resistance line. I don't think it will hold, the price will then continues to drop to retest that support line.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.02.25 07:25

Weekly EUR/USD Outlook: 2017, February 26 - March 05 (based on the article)

EUR/USD had a relatively balanced week, dipping to the downside but never going too far. The upcoming week is packed with PMI data, inflation figures and more. Will the pair move decidedly to one direction or another?

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.02.27 15:25

Intra-Day Fundamentals - EUR/USD, NZD/USD and Dollar Index: U.S. Durable Goods Orders

2017-02-27 13:30 GMT | [USD - Durable Goods Orders]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Durable Goods Orders] = Change in the total value of new purchase orders placed with manufacturers for durable goods.

==========

From rttnews article:

==========

EUR/USD M5: 19 pips range price movement by U.S. Durable Goods Orders news events

==========

NZD/USD M5: 11 pips range price movement by U.S. Durable Goods Orders news events

==========

Dollar Index M5: range price movement by U.S. Durable Goods Orders news events

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.02.28 15:43

Intra-Day Fundamentals - EUR/USD and Brent Crude Oil: U.S. GDP Second Release

2017-02-28 13:30 GMT | [USD - GDP]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - GDP] = Annualized change in the value of all goods and services produced by the economy.

==========

From official report:

==========

EUR/USD M5: 16 pips range price movement by U.S. Gross Domestic Product news events

==========

Brent Crude Oil M5: 19 range price movement by U.S. Gross Domestic Product news events

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.03.02 11:33

EUR/USD - daily bearish trend to be started with 1.0493 support level (based on the article)

Daily price broke Senkou Span line which is the border of the Ichimoku cloud the the border between the primary bearish and the primary bullish trend on the chart. The price is trying to test 1.0493 support level to below for the bearish trend to be continuing with 1.0324 daily bearish target.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.03.03 11:38

Trading News Events: U.S. ISM Non-Manufacturing (adapted from dailyfx)

Bullish USD Trade: Gauge for Service-Based Activity Beats Market Expectations

Bearish USD Trade: ISM Non-Manufacturing Survey Disappoints

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.03.04 09:17

Weekly EUR/USD Outlook: 2017, March 05 - March 12 (based on the article)

EUR/USD struggled but eventually chose the lower end of the range, due to USD strength. Will it totally break down or drift back up? The big event of the week is undoubtedly the ECB decision, which also consists of new forecasts.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.03.06 18:29

EUR/USD Intra-Day Fundamentals: U.S. Factory Orders and range price movement

2017-03-06 15:00 GMT | [USD - Factory Orders]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Factory Orders] = Change in the total value of new purchase orders placed with manufacturers.

==========

From rttnews article:

==========

EUR/USD M5: range price movement by U.S. Factory Orders news event

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.03.07 13:05

EUR/USD Intra-Day Fundamentals: German Factory Orders and range price movement

2017-03-07 07:00 GMT | [EUR - German Factory Orders]

if actual > forecast (or previous one) = good for currency (for EUR in our case)

[EUR - German Factory Orders] = Change in the total value of new purchase orders placed with manufacturers.

==========

From official report:

==========

EUR/USD M5: range price movement by German Factory Orders news event