Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.12.23 06:42

Credit Suisse forecast for EUR/USD in 2017: core target remains in 1.01 (based on the aricle)

- "EUR/USD bounced back as of late as it consolidated recent losses. However, we expect the 1.0506/31 “breakdown point” to cap to keep the trend directly lower. Removal of the 1.0352 recent low can see further downside to test 1.0342/36 next."

- "We maintains a short EUR/USD position."

- "However, although we would expect an initial hold to be seen here, we continue to look for a break in due course for a move to 1.01."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.12.24 12:10

Euro Q1 2017 Forecast - EUR/USD Enters 2017 Positioned for More Downside (based on the article)

Fundamental Analysis

- "On the US Dollar’s side, the decision in December 2016 to signal three rates in 2017 – as opposed to the market-priced two ahead of the policy statement – has sent US Treasury yields higher. As a gauge of long-term growth and inflation expectations, the US Treasury yield curve steepening is a reflection of the market's belief that tighter monetary policy is coming in the near-term."

- "On the Euro side, the European Central Bank’s decision in December 2016 to alter its QE program proved significant. In our Q4’16 forecast, we said “The ECB will very likely be forced to remove the -0.40% barrier (allowing more German bunds to be purchased), or to remove the capital key restriction (allowing more peripheral sovereign debt to be purchased).” By going the former route as opposed to the latter, the ECB has primed the Euro to be in a disadvantageous position if interest rates elsewhere continue to rise."

- "By the end of Q1’17, traders should start to pay more attention to European politics. On March 15, 2017, the Dutch elections will be held, the first of four significant elections in 2017. After the dramatic ‘No’ result on the December 4 constitutional referendum, Italy will likely head to the polls again by mid-2017. Luckily, for the Euro, the lack of reform that cost Matteo Renzi his job as prime minister may keep the Italian political system broken enough to prevent the Five Star Movement from ever achieving enough power to pull Italy out of the European Union. In April and May 2017, French presidential elections will be held, and the country will face its own populist threat in Marine Le Pen. Later in 2017 (date TBD), German elections will be held amid an environment in which Angela Merkel’s popularity Is quickly sliding (at five-year lows in December 2016) thanks to her immigration policy and an expanded terrorism threat in Europe. Needless to say, for those who thought 2016 was a year of surprises and shocks, 2017 is sure not to disappoint."

Technical Analysis

- "We were looking for signs of a turn higher in Q4’16, but that didn’t happen. Instead, EUR/USD broke lower in a significant way. In our Q4’16 EUR/USD forecast, we wrote about the extremely coiled environment persisting in the pair, noting, “according to the measure, EUR/USD is the most coiled in history. It’s been 81 weeks since the last 52-week high or low. The previous record was 77-weeks, which ended with the breakout in May 2002.” Furthermore, “if the March 2015 lows break, then the call for a bottom is wrong and focus would shift to 0.9450-0.9550 (historical inflection point and measured objective).” This zone is in play in Q1’17 and is reinforced by the 61.8% retracement of the 1985-2008 rally at 0.9608."

- "Strength through the median line from the bearish channel, which was resistance throughout 2016, would trigger a major bearish trap and shift focus to the downtrend line in the mid-1.2000s later in the year (fitting with the idea of the US Dollar rising then falling over the course of 20170."

Forum on trading, automated trading systems and testing trading strategies

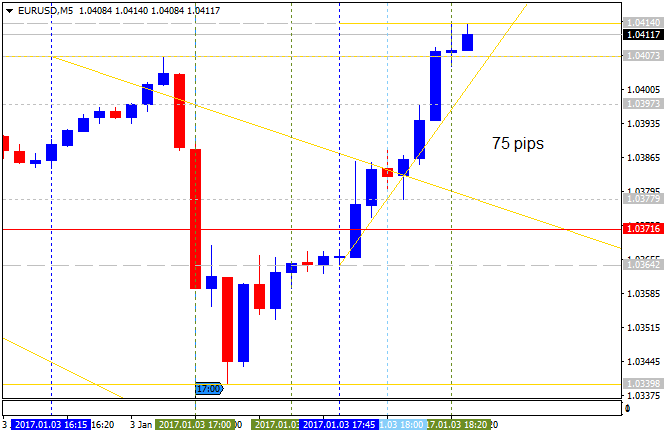

Sergey Golubev, 2017.01.03 17:43

Intra-Day Fundamentals - EUR/USD, GBP/USD and S&P 500: ISM Manufacturing PMI

2017-01-03 15:00 GMT | [USD - ISM Manufacturing PMI]

- past data is 53.2

- forecast data is 53.7

- actual data is 54.7 according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - ISM Manufacturing PMI] = Level of a diffusion index based on surveyed purchasing managers in the manufacturing industry.

==========

From official report:

"The December PMI® registered 54.7 percent, an increase of 1.5 percentage points from the November reading of 53.2 percent. The New Orders Index registered 60.2 percent, an increase of 7.2 percentage points from the November reading of 53 percent. The Production Index registered 60.3 percent, 4.3 percentage points higher than the November reading of 56 percent. The Employment Index registered 53.1 percent, an increase of 0.8 percentage point from the November reading of 52.3 percent. Inventories of raw materials registered 47 percent, a decrease of 2 percentage points from the November reading of 49 percent. The Prices Index registered 65.5 percent in December, an increase of 11 percentage points from the November reading of 54.5 percent, indicating higher raw materials prices for the 10th consecutive month. The PMI®, New Orders, Production and Employment Indexes all registered new highs for the year 2016, and the forward-looking comments from the panel are largely positive."

==========

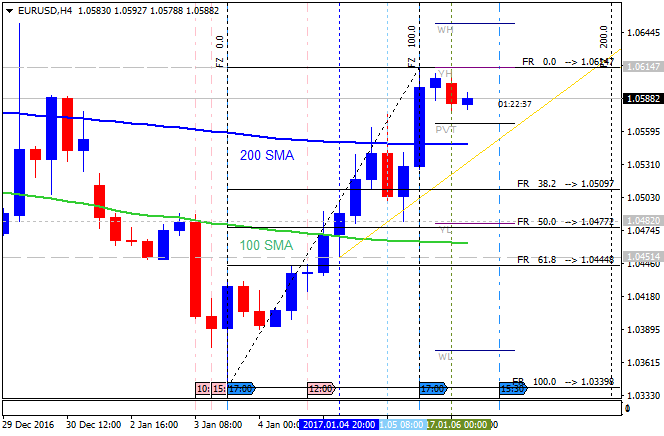

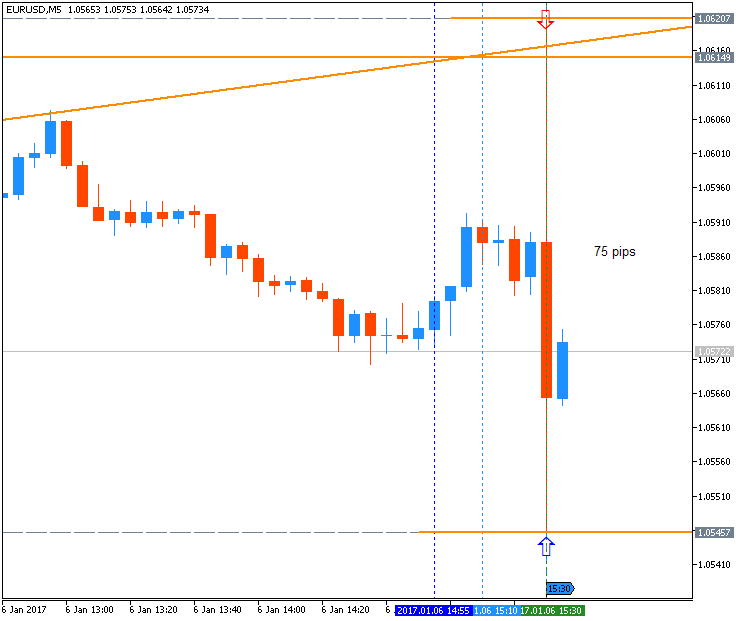

EUR/USD M5: 75 pips range price movement by ISM Manufacturing PMI news events

==========

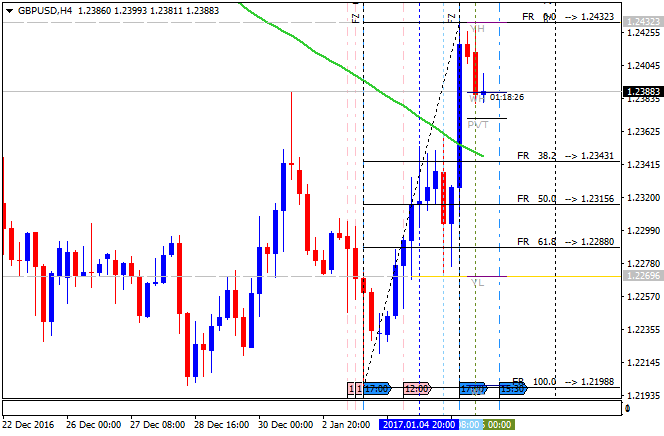

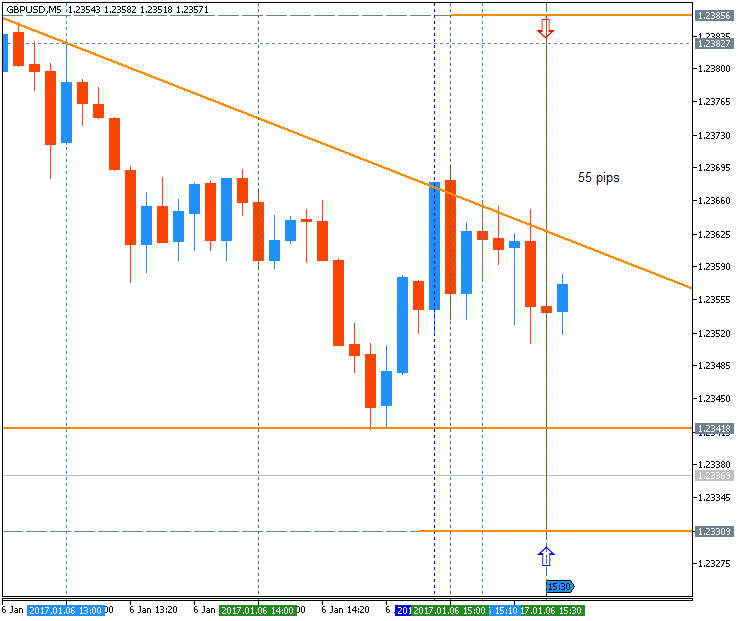

GBP/USD M5: 50 pips range price movement by ISM Manufacturing PMI news events

==========

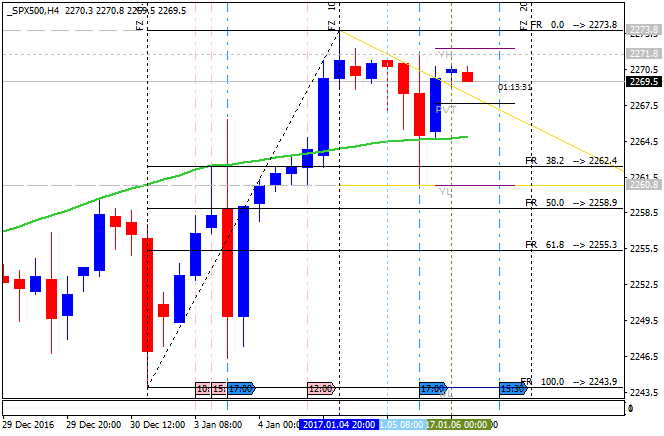

S&P 500: range pips price movement by ISM Manufacturing PMI news events

Forum on trading, automated trading systems and testing trading strategies

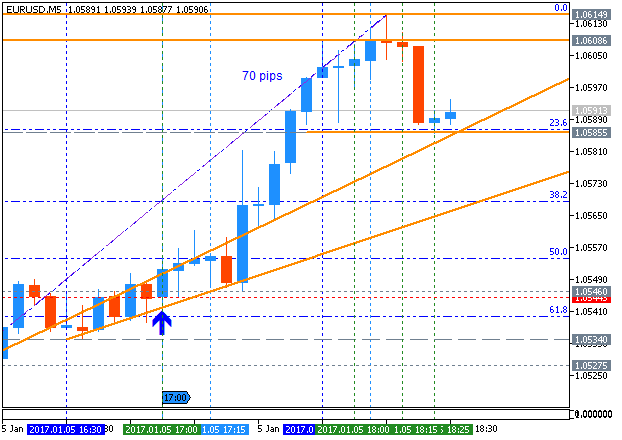

Sergey Golubev, 2017.01.05 17:42

Intra-Day Fundamentals - EUR/USD, AUD/USD and DJIA: ISM Non-Manufacturing PMI

2017-01-05 15:00 GMT | [USD - ISM Non-Manufacturing PMI]

- past data is 57.2

- forecast data is 56.6

- actual data is 57.2 according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - ISM Non-Manufacturing PMI] = Level of a diffusion index based on surveyed purchasing managers, excluding the manufacturing industry.

==========

From official report:

"The report was issued today by Anthony Nieves, CPSM, C.P.M., CFPM, chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee. "The NMI® registered 57.2 percent in December, matching the November figure. This represents continued growth in the non-manufacturing sector at the same rate. The Non-Manufacturing Business Activity Index decreased to 61.4 percent, 0.3 percentage point lower than the November reading of 61.7 percent, reflecting growth for the 89th consecutive month, at a slightly slower rate in December."

==========

EUR/USD M5: 70 pips range price movement by ISM Non-Manufacturing news events

==========

AUD/USD M5: 37 pips range price movement by ISM Non-Manufacturing news events

==========

Dow Jones Industrial Average: pips range price movement by ISM Non-Manufacturing news events

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.01.06 05:39

Intra-Day Fundamentals - EUR/USD, GBP/USD and S&P 500: Non-Farm Employment Change

2017-01-06 13:30 GMT | [USD - Non-Farm Employment Change]

- past data is 178K

- forecast data is 175K

- actual data is n/a according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Non-Farm Employment Change] = Change in the number of employed people during the previous month, excluding the farming industry.

==========

From the article: What To Expect From NFP? - Views From 10 Major Banks

BofA Merrill: "We look for a trend-like 175,000 gain in nonfarm payrolls. We expect 170,000 of this gain to come from the private sector and only 5,000 to come from the government sector. We think there is scope for the labor force participation rate to inch back up to 62.8% from 62.7%, and as a result, for the unemployment rate to move back up towards 4.8%. Smoothing through the volatility of wage growth in the past couple of months, we look for average hourly earnings to gain a trend-like 0.2% mom after a 0.1% mom contraction in November. This would push the year-over-year rate up to a healthier 2.7% from 2.5%."

==========

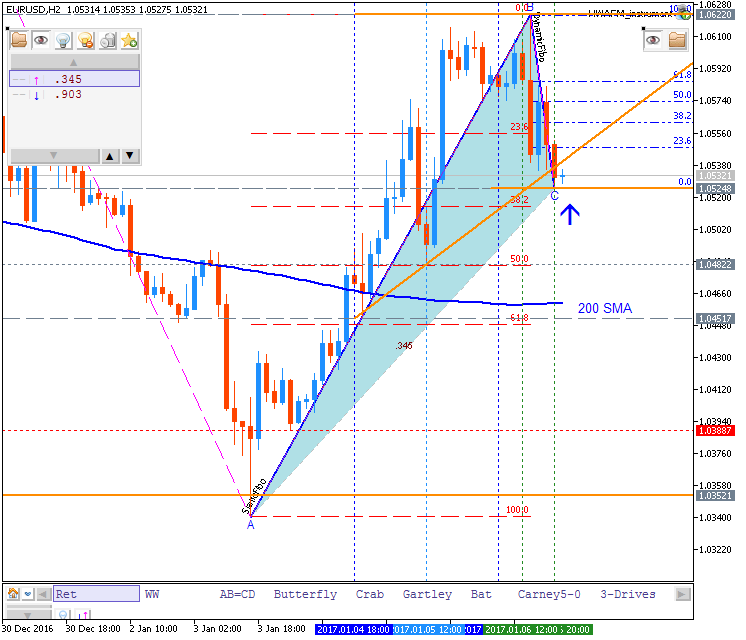

EUR/USD H4 ahead of NFP: bullish reversal with 1.0614 resistance to be broken for the bullish trend to be continuing

==========

GBP/USD H4 ahead of NFP: ranging within 200/100 SMA area waiting for direction

==========

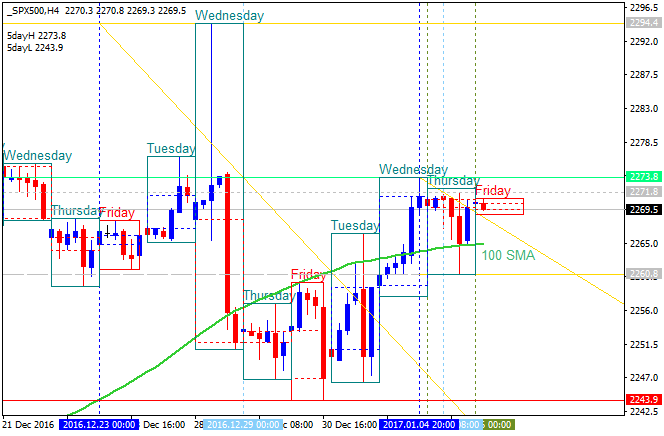

S&P 500 H4 ahead of NFP: trending above 200 SMA and near above 100 SMA for the bullish trend to be continuing or for the ranging condition to be started

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.01.06 13:31

What To Expect From NFP? (adapted from the article)2017-01-06 13:30 GMT | [USD - Non-Farm Employment Change]

- past data is 178K

- forecast data is 175K

- actual data is n/a according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Non-Farm Employment Change] = Change in the number of employed people during the previous month, excluding the farming industry.

==========

So, it means that if actual data > 175K forecasting data = good for USD. In case of EUR/USD - bearish (the price will go to the USD's side); in case of USD/JPY - bullish.

Those are the actual data forecasting by major banks:

Credit Agricole: 185K

EUR/USD - intra-day bearish

Goldman: 180k

EUR/USD - intra-day bearish

UBS: 170k

EUR/USD - intra-day bullish

Danske: 170,000

EUR/USD - intra-day bullish

BofA Merrill: 175,000

EUR/USD - intra-day ranging

Nomura: 175k

EUR/USD - intra-day ranging

Barclays: 175k

EUR/USD - intra-day ranging

SEB: 190k

EUR/USD - intra-day bearish

CIBC: 165K

EUR/USD - intra-day bullish

UOB: 250,000

EUR/USD - intra-day bearish

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.01.06 14:37

Intra-Day Fundamentals - EUR/USD, GBP/USD and S&P 500: Non-Farm Employment Change

2017-01-06 13:30 GMT | [USD - Non-Farm Employment Change]

- past data is 178K

- forecast data is 175K

- actual data is 156K according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Non-Farm Employment Change] = Change in the number of employed people during the previous month, excluding the farming industry.

==========

From the official report:

"Total nonfarm payroll employment rose by 156,000 in December, and the unemployment rate was little changed at 4.7 percent, the U.S. Bureau of Labor Statistics reported today. Job growth occurred in health care and social assistance."

==========

EUR/USD M5: 75 pips range price movement by Non-Farm Payrolls news events

==========

GBP/USD M5: 37 pips range price movement by Non-Farm Payrolls news events

==========

S&P 500: pips range price movement by Non-Farm Payrolls news events

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.01.07 07:04

Weekly EUR/USD Outlook: 2017, January 08 - January 15 (based on the article)

EUR/USD slipped to new 14-year lows in the wake of 2017 but recovered very quickly thanks to weakness in the USD. The second week of January features trade balance and industrial output measures.

Data in the euro-zone has been relatively positive, with a significant drop in German unemployment and a rise in inflation, especially in Germany. Retail sales missed expectations, but this did not stop the euro. In the US, data had a good start with an excellent report from the manufacturing sector but then became sour with ADP. The meeting minutes from the Fed hurt most, as they showed that Yellen and co. got a bit ahead of themselves with expectations for stimulus from Trump. The last word went to the dollar, with the NFP report: wages are up 2.9%, triggering talk about inflationary pressures.

- German Industrial Production: Monday, 7:00. A rise of 0.7% is on the cards.

- German Trade Balance: Monday, 7:00. A similar level of 20.8 billion is estimated for November.

- Sentix Investor Confidence: Monday, 9:30. A bounce to 12.6 is projected.

- Unemployment Rate: Monday, 10:00. A repeat of 9.8% is forecast.

- French Industrial Production: Tuesday, 7:45. An increase of 0.5% is predicted.

- French Final CPI: Thursday, 7:45. This number will likely be confirmed in this final read.

- Industrial Production: Thursday, 10:00. A gain of 0.5% is on the cards.

- ECB Meeting Minutes: Thursday, 12:30. The European Central Bank announced an extension of its QE program through 2017, a removal of some limits on bond buying but also a reduction in the pace of these buys. The bottom line was dovish as seen in the value of EUR/USD The meeting minutes could reveal if the ECB is still very worried about inflation, the reason for extending the program, or actually satisfied with the progress that has been made, the reason for the reduction. It could also tell us something about the next potential moves.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.01.09 10:49

EUR/USD Intra-Day Fundamentals: German Trade Balance and 25 pips range price movement

2017-01-09 07:00 GMT | [EUR - German Trade Balance]

- past data is 20.6B

- forecast data is 20.8B

- actual data is 21.7B according to the latest press release

if actual > forecast (or previous one) = good for currency (for EUR in our case)

[EUR - German Trade Balance] = Difference in value between imported and exported goods during the reported month.

==========

From official report:

"The foreign trade balance showed a surplus of 22.6 billion euros in

November 2016. In November 2015, the surplus amounted to 20.5 billion

euros. In calendar and seasonally adjusted terms, the foreign trade

balance recorded a surplus of 21.7 billion euros in November 2016."

==========

EUR/USD M5: 25 pips price movement by German Trade Balance news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.01.09 12:20

Eurozone Unemployment Remains Unchanged In November, Lowest Since Mid-2009 (based on the article)

- "The seasonally adjusted unemployment rate was 9.8 percent, unchanged from October, and in line with economists' expectations. The rate was the lowest since July 2009. A year ago, the jobless rate was 10.5 percent."

- "The EU28 unemployment rate fell to 8.3 percent from 8.4 percent in October, marking its lowest level since February 2009."

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

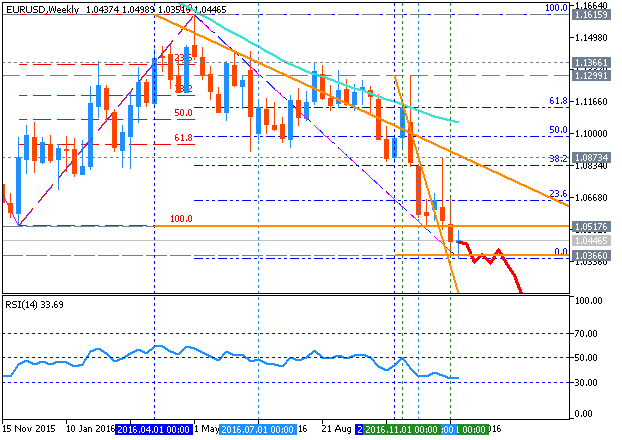

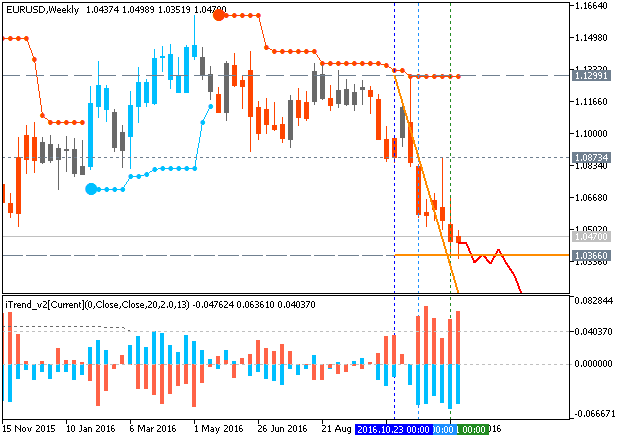

EUR/USD January-March 2017 Forecast: bearish ranging with 1.0324 key support level

W1 price is located below Ichimoku cloud in the bearish area of the chart within the following support/resistance levels:

- 61.8% Fibo level at 1.1123 located near and below Ichimoku cloud and Senkou Span line in the beginning of the bullish reversal to be started, and

- 1.0324 support level located in the beginning of the bearish trend to be resumed.

Chinkou Span line is below the price indicating the ranging bearish condition, Trend Strength indicator is estimating the trend as a bearish, and Absolute Strength indicator is evaluating the trend as a ranging. Anyway. Non-lagging Tenkan-sen/Kijun-sen signal is for the ranging bearish trend to be continuing, and the descending triangle pattern was formed by the price to be crossed to below for the bearish breakdown to be started in the future..Trend:

W1 - ranging bearish