Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.12.25 06:34

AUD/USD Q1 2017 Forecast (based on the article)

Australian Dollar to US Dollar forecast for January 2017.

"The forecast for beginning of January 0.72. Maximum rate 0.73, while minimum 0.71. Averaged rate for month 0.72. The exchange rate at the end 0.72, change for January 0.00%."

AUD to USD forecast for February 2017.

"The forecast for beginning of February 0.72. Maximum rate 0.74, while minimum 0.72. Averaged rate for month 0.73. The exchange rate at the end 0.73, change for February 1.39%."

Australian Dollar to US Dollar forecast for March 2017.

"The forecast for beginning of March 0.73. Maximum rate 0.73, while minimum 0.71. Averaged rate for month 0.72. The exchange rate at the end 0.72, change for March -1.37%."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.01.05 17:42

Intra-Day Fundamentals - EUR/USD, AUD/USD and DJIA: ISM Non-Manufacturing PMI

2017-01-05 15:00 GMT | [USD - ISM Non-Manufacturing PMI]

- past data is 57.2

- forecast data is 56.6

- actual data is 57.2 according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - ISM Non-Manufacturing PMI] = Level of a diffusion index based on surveyed purchasing managers, excluding the manufacturing industry.

==========

From official report:

"The report was issued today by Anthony Nieves, CPSM, C.P.M., CFPM, chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee. "The NMI® registered 57.2 percent in December, matching the November figure. This represents continued growth in the non-manufacturing sector at the same rate. The Non-Manufacturing Business Activity Index decreased to 61.4 percent, 0.3 percentage point lower than the November reading of 61.7 percent, reflecting growth for the 89th consecutive month, at a slightly slower rate in December."

==========

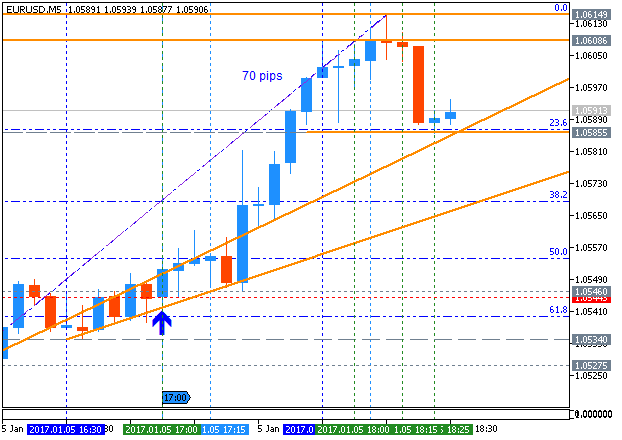

EUR/USD M5: 70 pips range price movement by ISM Non-Manufacturing news events

==========

AUD/USD M5: 37 pips range price movement by ISM Non-Manufacturing news events

==========

Dow Jones Industrial Average: pips range price movement by ISM Non-Manufacturing news events

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.01.07 09:57

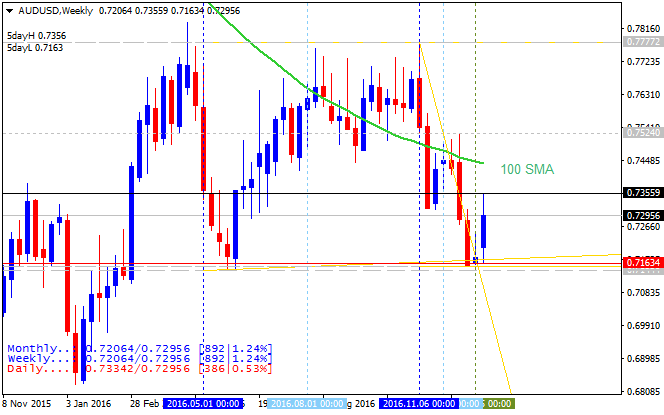

Weekly Fundamental Forecast for AUD/USD (based on the article)AUD/USD - "The Australian Dollar’s wildcard this week probably comes from Chinese data, of which there is a little more. Tuesday’s consumer price index and Friday’s trade data could see the Australian Dollar playing its sometime role as the markets’ favorite liquid China proxy."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.01.08 07:15

Weekly Update: AUD/USD - bearish ranging within 0.73/0.71 levels for direction (based on the article)

"AUD/USD sports good looking symmetry with respect to the time between major lows. It’s one reason that I like the idea of the 2016 low at .6847 holding. The other reason to get bullish in the event of constructive price action on the daily or weekly charts is the relationship between the 2011 high and 2016 low. The .618 absolute retracement of the 2011 high at 1.1080 is .6847 (1.1080 x .618). The 2016 low is .6827. Over the next few weeks, watch .7000 (maybe just above) for support. Strength through .7535 would be viewed in a bullish light."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.01.09 06:11

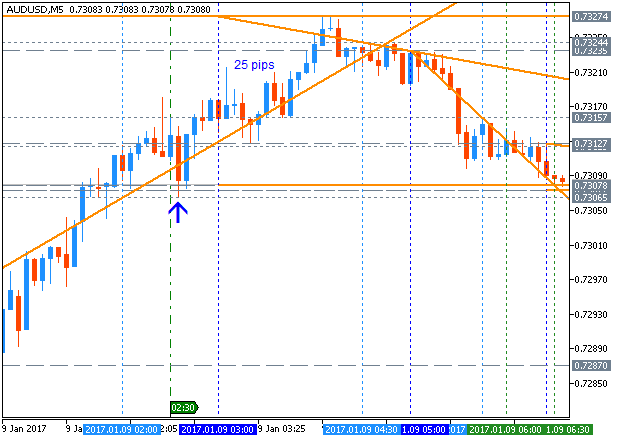

AUD/USD Intra-Day Fundamentals: Australian Building Approvals and 25 pips range price movement

2017-01-09 00:30 GMT | [AUD - Building Approvals]

- past data is -11.8%

- forecast data is 4.6%

- actual data is 7.0% according to the latest press release

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - Building Approvals] = Change in the number of new building approvals issued.

==========

From official report:

- "The trend estimate for total dwellings approved fell 2.9% in November and has fallen for six months."

- "The seasonally adjusted estimate for total dwellings approved rose 7.0% in November after falling for three months."

==========

AUD/USD M5: 25 pips price movement by Australian Building Approvals news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.01.10 07:46

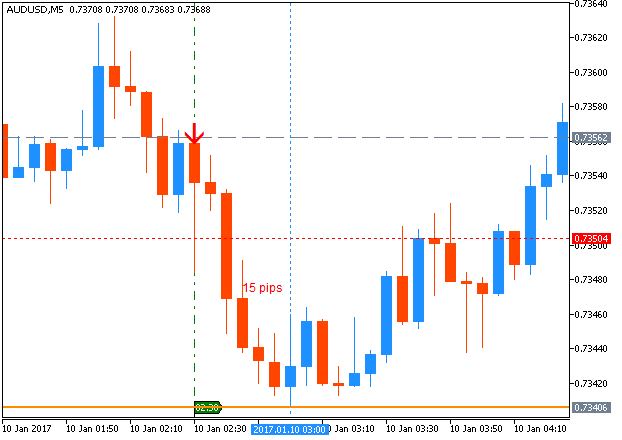

AUD/USD Intra-Day Fundamentals: Australian Retail Sales and 15 pips range price movement

2017-01-10 00:30 GMT | [AUD - Retail Sales]

- past data is 0.5%

- forecast data is 0.4%

- actual data is 0.2% according to the latest press release

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - Retail Sales] = Change in the total value of sales at the retail level.

==========

From official report:

- "The trend estimate rose 0.4% in November 2016. This follows a rise of 0.4% in October 2016 and a rise of 0.4% in September 2016."

- "The seasonally adjusted estimate rose 0.2% in November 2016. This follows a rise of 0.5% in October 2016 and a rise of 0.6% in September 2016."

==========

AUD/USD M5: 15 pips range price movement by Australian Retail Sales Index news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.01.11 08:40

AUD/USD Daily Opens New High (based on the article)

- "The AUD/USD has started Tuesday’s trading breaking out to a new 2017 high at .7384. However, the pair was quickly rejected by resistance found at a 61.8% retracement value at .7385. As seen in the image below, this retracement has been measured using the distance between the December 2016 high and low, found at.7524 and .7159 respectfully. If prices continue to trade beneath this value, it may suggest a daily turn back in the direction of the pairs primary trend. Alternatively if the AUD/USD rebounds intraday, it may suggest that the pair may make an attempt to reach the next point of resistance found at .7446."

- "Intraday, the AUD/USD first turned overnight at resistance found at the R3 Camarilla pivot at .7375. Now after an early morning decline, the pair is finding support against the S3 pivot at .7325. This movement suggests that the AUD/USD is trading in a range bound environment going into the opening of US Session trading. If prices continue to bounce between these points, traders may continue to look for range trading opportunities between these values."

- "In the event that range bound conditions end, bullish breakouts may be sighted above the R4 pivot at .7399. A bullish breakout here would suggest a continuation of last week’s trend, and traders may begin to target higher highs. Initial targets may be found at .7449 by extrapolating a 1X extension of today’s 50 pip range. Alternatively in the event that the AUD/USD trades lower, bearish breakouts may begin under .7300. Again using a 1X extension of the range, initial bearish targets may be found near .7250."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.01.17 07:12

AUD/USD Intra-Day Fundamentals: Australian Dwelling Finance Commitment and 16 pips range price movement

2017-01-17 00:30 GMT | [AUD - Home Loans]

- past data is -0.6%

- forecast data is 0.1%

- actual data is 0.9% according to the latest press release

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - Home Loans] = Change in the number of new loans granted for owner-occupied homes.

==========

From rttnews article:

- "The total number of new home loans in Australia issued in November climbed a seasonally adjusted 0.9 percent on month, the Australian Bureau said on Tuesday - standing at 54,603."

==========

AUD/USD M5: 16 pips range price movement by Australian Dwelling Finance Commitment news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.01.18 08:20

AUD/USD Intra-Day Fundamentals: Westpac-Melbourne Institute Consumer Sentiment and 18 pips range price movement

2017-01-17 23:30 GMT | [AUD - Westpac Consumer Sentiment]

- past data is -3.9%

- forecast data is n/a

- actual data is 0.1% according to the latest press release

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - Westpac Consumer Sentiment] = Change in the level of a diffusion index based on surveyed consumers.

==========

From official report:

Following December’s 3.9% decline, Sentiment was little changed in January, rising just 0.1%. At 97.4, pessimists clearly outnumbered optimists for a second consecutive month in January (100 being the neutral point).

==========

AUD/USD M5: 18 pips range price movement by Westpac-Melbourne Institute Consumer Sentiment news event

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

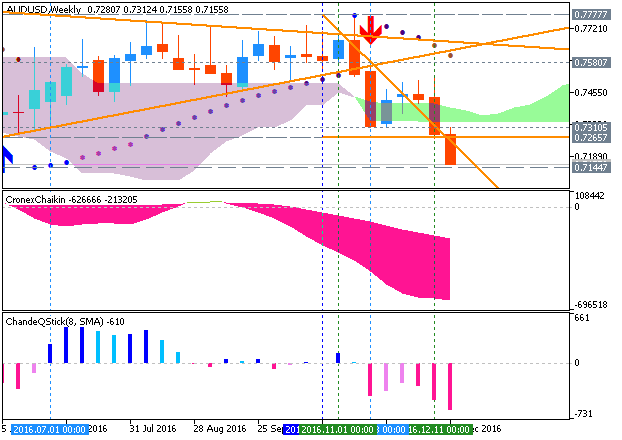

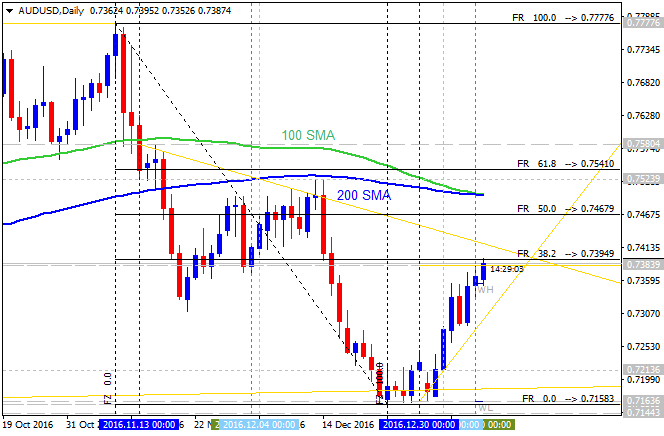

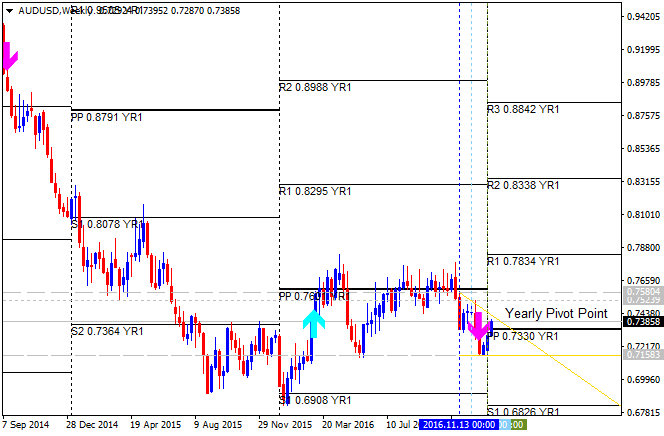

AUD/USD January-March 2017 Forecast: ranging bearish with 0.7144 key support level

W1 price was on the reversal of the price movement from the ranging bullish to the primary bearish market condition: the price broke Ichimoku cloud to below together with key support levels and Senkou Span lines which are the virtual border between the primary bearish and the primary bullish trend on the chart. The price was bounced from 0.7144 support level to above for the ranging condition to be started within the following support/resistance levels:

- 0.7310 resistance level located near and below Senkou Span line in the beginning of the bullish reversal to be started, and

- 0.7144 support level located in the bearish area of the chart.

Chinkou Span line is located below the price indicating the ranging bearish condition, Trend Strength indicator is estimating the trend as the primary bearish, and Absolute Strength indicator is evaluating the future trend to be ranging bearish. Tenkan-sen line is near and below Kijun-sen line for the ranging bearish trend to be continuing.Trend:

W1 - ranging bearish