Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.12.19 06:32

How McDonald's Wins (based on the article)

"Over the past five decades, McDonald's has managed to fend off many challenges, always rising after a brief pause.What's behind McDonald's endurance to the test of time?" :

- "First comes franchise, a business model that allows its franchisee-members, management and shareholders to share the risks and rewards from the discovery and exploitation of new business opportunities - McDonald’s model has become the norm for other franchise organizations."

- "Second comes location. As a first mover in the restaurant franchise space, McDonald's has acquired and developed prime real estate location, which it leases to its franchisees."

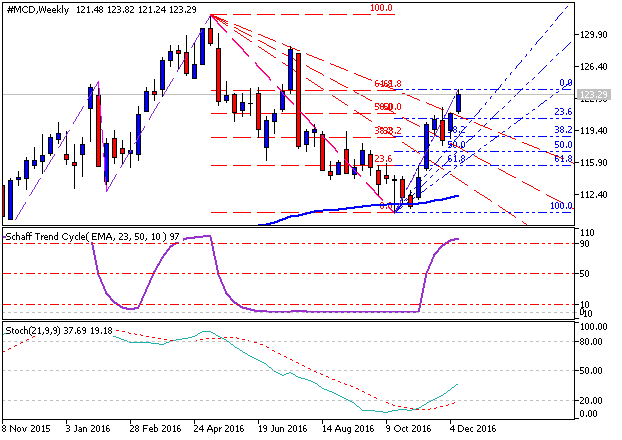

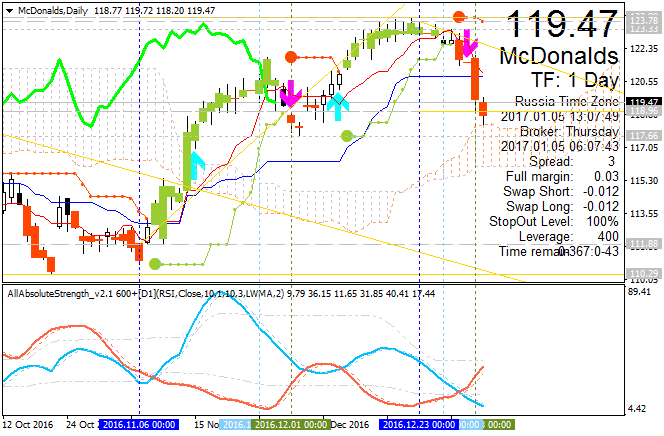

The daily share price is on breakdown to be testing the support level at 118.96 to below for the daily breakdown to be continuing

If D1 price breaks 118.96 support level to below on close bar so the bearish reversal may be started on the secondary ranging way - the price will be inside Ichimoku cloud.

If daily price breaks 123.78 resistance level on close bar so the bullish trend will be resumed.

If not so the price will be on ranging within the levels.

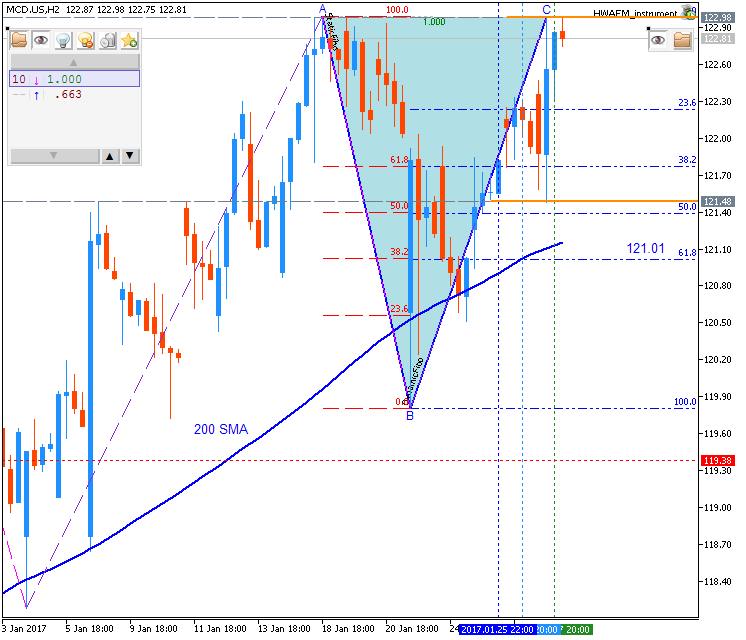

Daily shares price is located above 200-day SMA in the bullish area of the chart. The price is testing 122.98 resistance level to above for the bullish trend to be continuing. Alternative, the bearish retracement pattern was formed by the price, and if the price crossed 121.48 support level together with 121.01 key support so the price will be started with the reversal to the primary bearish market condition.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.01.28 11:57

Weekly Outlook: 2017, January 29 - February 05 (based on the article)

The US dollar was mixed in Trump’s first week in office. Rate decisions in Japan, the US and the UK, GDP data in Canada and the buildup to the US Non-Farm Payrolls on Friday promise a busy week. These are the main events on forex calendar.

- Japan rate decision: Tuesday. The Bank of Japan maintained its monetary policy in its December meeting amid modest pace of growth. The decision was in line with market forecast.

- Canadian GDP data: Tuesday, 13:30. The Canadian economy is expected to grow by 0.3% in November.

- US CB Consumer Confidence: Tuesday, 15:00. A score of 112.6 is on the cards now.

- US ADP Non-Farm Employment Change: Wednesday, 13:15. A gain of 165K private sector jobs is expected for January.

- US ISM Manufacturing PMI: Wednesday, 15:00. A score of 55 points is likely for January.

- US Crude Oil Inventories: Wednesday, 15:30.

- US FOMC Rate Statement: Wednesday, 19:00. The Federal Reserve decided to raise its benchmark interest rate in December as widely anticipated. Federal funds rate was increased by 25 basis points, to a range of 0.50 to 0.75%. This was the second rate hike in a decade. Economists expect these steps will spur economic growth and inflation while supporting company earnings.

- UK rate decision: Thursday, 12:00. The Bank of England kept interest rates unchanged at 0.25% but warned that higher inflation and slower wage growth will weigh in household budgets in 2017. In addition to the rate statement and the accompanying meeting minutes, the BOE also publishes its quarterly inflation report.

- US Unemployment Claims: Thursday, 13:30. Economists expected claims to reach 247,000. A level of 251K is predicted now.

- US Non-Farm Payrolls report: Friday, 13:30. In January, 170K are estimated. Wages are projected to rise by 0.3%. The unemployment rate is forecast to remain at 4.7%.

- US ISM Non-Manufacturing PMI: Friday, 15:00. A score of 57 points is on the cards.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.04.07 17:41

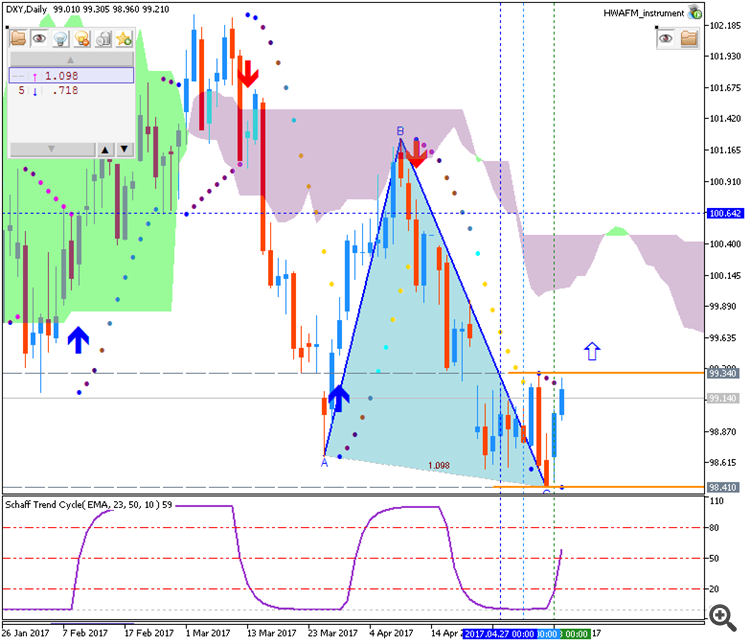

Intra-Day Fundamentals - EUR/USD, USD/CNH, Apple shares and McDonald's shares: Non-Farm Payrolls

2017-04-07 13:30 GMT | [USD - Non-Farm Employment Change]

- past data is 219K

- forecast data is 174K

- actual data is 98K according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Non-Farm Employment Change] = Change in the number of employed people during the previous month, excluding the farming industry.

==========

From official report:

- "The unemployment rate declined to 4.5 percent in March, and total nonfarm payroll employment edged up by 98,000, the U.S. Bureau of Labor Statistics reported today. Employment increased in professional and business services and in mining, while retail trade lost jobs."

==========

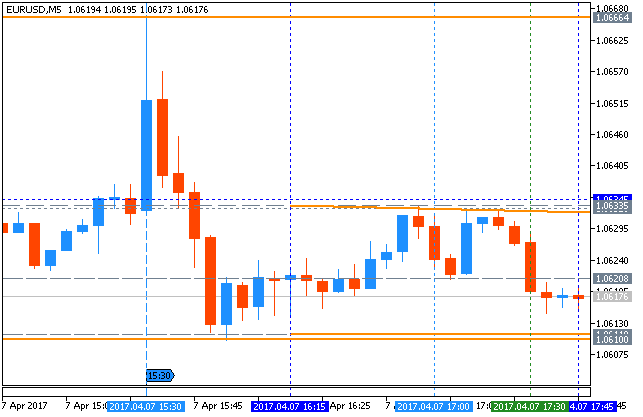

EUR/USD M5: range price movement by Non-Farm Payrolls news events

==========

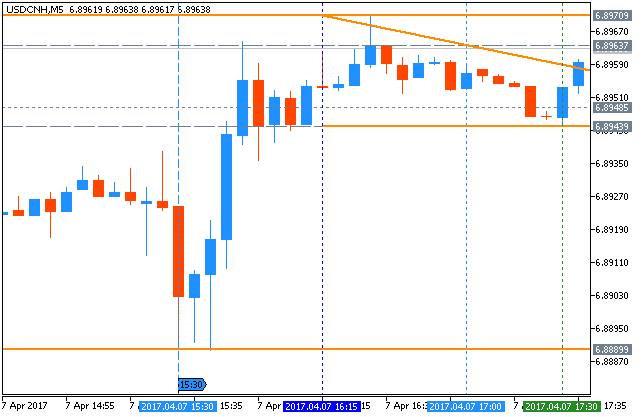

USD/CNH M5: range price movement by Non-Farm Payrolls news events

==========

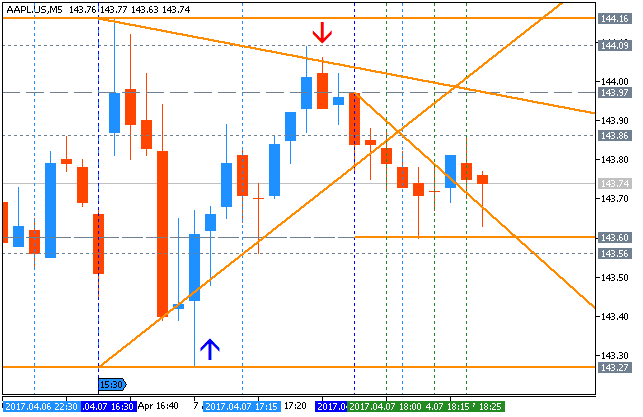

Apple M5: range price movement by Non-Farm Payrolls news events

==========

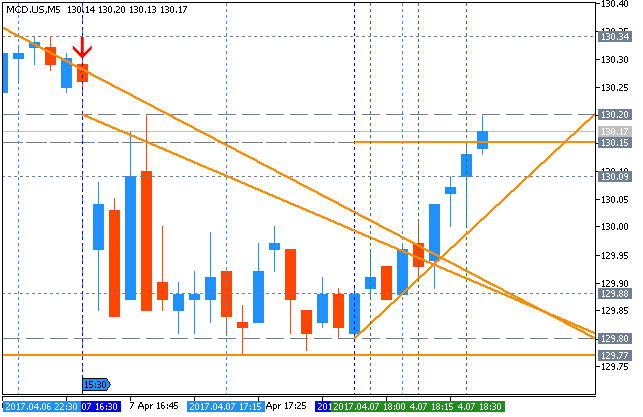

McDonald's M5: range price movement by Non-Farm Payrolls news events

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.05.13 08:00

Weekly Outlook: 2017, May 14 - May 21 (based on the article)

The second week of May saw the dollar gaining ground against many currencies despite a political controversy. A mix of events awaits us now: GDP from Japan, jobs from Australia, and housing data from the US.

- Chinese Industrial Production: Monday, 2:00. After a surprising rise of 7.6% last time, the figure for April could be weaker: 7% is expected.

- Euro-zone GDP: Tuesday, 9:00. No change is expected.

- US housing data: Tuesday, 12:30. Building permits are projected to remain at 1.27 million and housing starts to rise to 1.27 million.

- UK jobs report: Wednesday, 8:30. Wages are predicted to advance to 2.4% y/y and the unemployment rate is likely to stay at 4.7%.

- Oil inventories: Wednesday, 14:30.

- Japanese GDP: Wednesday, 23:50. The economy of the third-largest global economy probably expanded also in early 2017: +0.4% is forecast.

- Australian jobs report: Thursday, 1:30. A modest gain of 5.2K is estimated and the unmeployment rate will likely stay at 5.9%.

- US jobless claims: Thursday, 12:30. A small rise from 236K to 240K is expected.

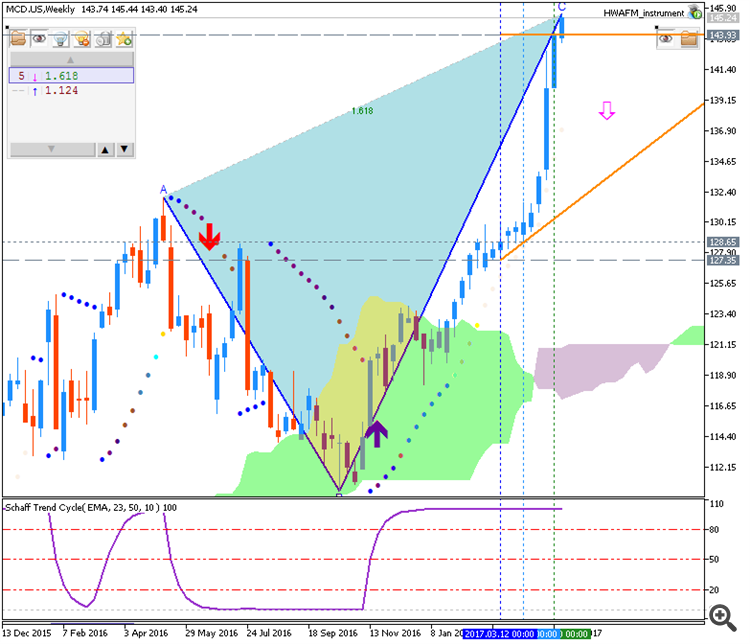

The weekly share price stopped the bearish reversal and it was bounced from 110.32 support level to above to came back to Ichimoku cloud to the ranging market condition. Fow now, the price is on testing 121.85 resistance level to above for the reversal to the trendy primary bullish market condition with the 128.58 as the next target to the bullish reversal.

If W1 price breaks 110.32 support level to below on close bar so the primary bearish trend will be resumed.

If weekly price breaks 121.85 resistance level on close bar so the bullish reversal will be started.

If not so the price will be on ranging condition within Ichimoku cloud waiting for direction.

| Resistance | Support |

|---|---|

| 121.85 | 111.82 |

| 128.58 | 110.32 |

SUMMARY: bullish reversal

TREND: ranging for direction

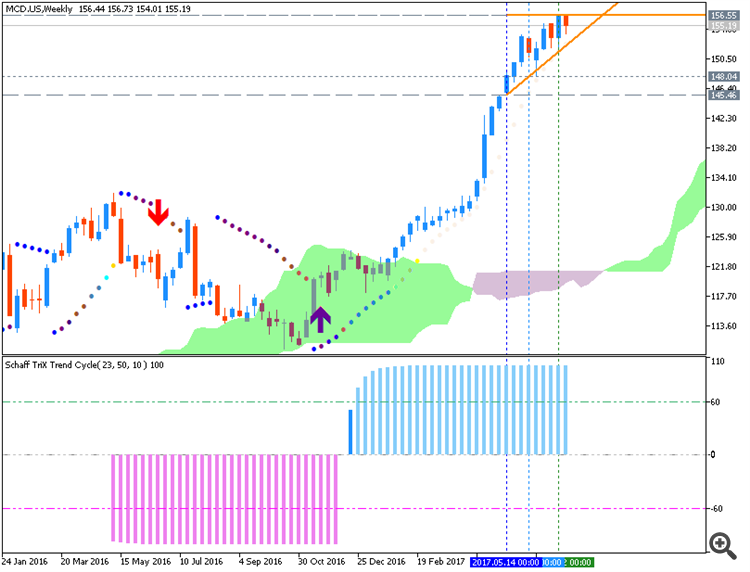

Weekly share price is on bullish breakout for ascending triangle pattern to be testing to below together with 156.55 for the bullish trend to be continuing.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.10.02 06:50

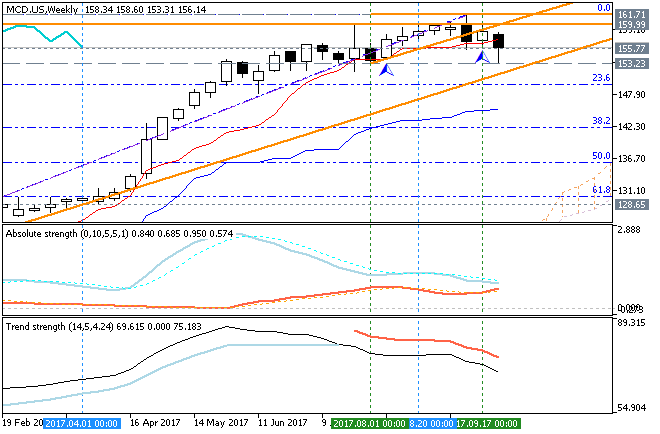

McDonald's - ranging bullish; 161.71 is the key (based on the article)

Weekly price is far above Ichimoku cloud in the bullish area of the chart: the price is ranging within narrow s/r levels for the bullish trend to be continuing or to the secondary correction to be started.

Ascending triangle pattern was formed by the price to be crossed to above for the bullish trend continuation.

- "McDonald’s is back on Wall Street in 2017, beating every major franchise company big time, including mighty Starbucks."

- "While this was the case back in the old good days when McDonald’s was the pioneer in the emerging fast food market, it is no longer the case in today’s mature fast food market, crowded with competitors that have gained appeal among the younger generations."

==========

The chart was made on D1 timeframe with Ichimoku market condition setup (MT5) from this post (free to download for indicators and template) as well as the following indicator from CodeBase:

- ZigZag + Fibo - indicator for MetaTrader 5

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2018.01.10 08:35

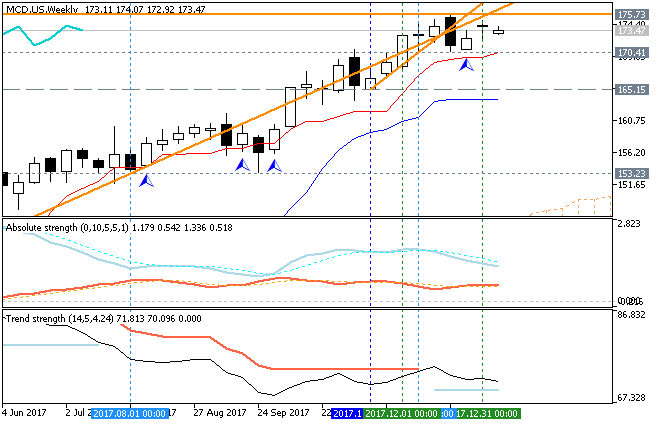

McDonald's - strong bullish; 175.73 is the key (based on the article)

Weekly price is on strong bullish market condition by testing the resistance level at 175.73 to above for the primary bullish trend to be continuing.

- "Over the past few years, McDonald’s has been working aggressively on several initiatives to add healthier products and suit changing customer preferences. These changes have started showing results, with positive comparable sales leading to growth in profits. The company registered a nearly 45% increase in its stock price in 2017. We expect this momentum to continue in 2018 as the company launches several new initiatives to attract both value-conscious and health-conscious customers."

- "McDonald’s started 2018 by launching its $1, $2, and $3 menu aimed toward its value-conscious customers. While such menus can impact margins adversely, this time around McDonald’s is confident that other cost efficiencies (around marketing and lower fixed costs due to higher traffic) will ensure that its margins remain healthy. The company’s promotions in 2017 around $1 meals have largely been successful, and this menu is likely to drive growth for the company in 2018."

============

The chart was made on D1 timeframe with Ichimoku market condition setup (MT5) from this post (free to download for indicators and template) as well as the following indicator from CodeBase:

- MaksiGen_Range_Move MTF - indicator for MetaTrader 5

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

The weekly share price stopped the bearish reversal and it was bounced from 110.32 support level to above to came back to Ichimoku cloud to the ranging market condition. Fow now, the price is on testing 121.85 resistance level to above for the reversal to the trendy primary bullish market condition with the 128.58 as the next target to the bullish reversal.

If W1 price breaks 110.32 support level to below on close bar so the primary bearish trend will be resumed.

If weekly price breaks 121.85 resistance level on close bar so the bullish reversal will be started.

If not so the price will be on ranging condition within Ichimoku cloud waiting for direction.

SUMMARY: bullish reversal

TREND: ranging for direction