MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

M6 timeframe - 3-drives (bearish)

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

M6 timeframe - retracement (bearish)

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

bullish butterfly on H12

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2013.12.15 16:35

Gold Outlook Hinges on FOMC- Taper Talk to Drive Prices

Gold prices were firmer on the week with the previous metal climbing 0.60% to trade at $1235 ahead of the New York close on Friday. The weekly tally downplays a substantial rally early in the week that saw prices climb as high as $1267 before sharply reversing course over the next two sessions. Although the broader outlook for gold remains weighted to the downside, all eyes turn to the FOMC next week for the medium-term as the investors look to Bernanke and Co. for clues as to the taper timeline.

From a technical standpoint, gold remains at risk below $1268/70 with support seen lower at $1209/10. Look for the FOMC to offer guidance with a break below the monthly low targeting key technical support at $1179/81. Subsequent support targets are seen at $1151/57. A breach above the $1270 threshold risks a more meaningful correction into resistance targets at $1286 and $1304 with only a break above $1325 invalidating the broader downtrend. Note that although daily momentum has remained bearish territory the slope has flattened out and such indicators are likely to offer little guidance as we head into next week’s event risk. Things are likely to simmer down as we head into the policy decision and be wary of emotional price breaks as liquidity thins out ahead of the Holidays.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2013.12.16 13:50

Gold prices up in Asia (adapted from investing article)

Gold prices in Asia gained early Monday, carrying over an uptrend from last week as investors eye demand for the holiday season. On the Comex division of the New York Mercantile Exchange, gold futures for February delivery gained 0.11% to USD1,236 a troy ounce in Asia. Last week, gold prices fell to a session low of USD1,219.50 a troy ounce, the weakest level since Dec. 6.

Gold is down approximately 27% this year, heading for the first annual loss in 13 years, as solid U.S. economic data underlined expectations the Fed will begin curbing stimulus.

In the week ahead, investors will be focusing on Wednesday’s outcome of the Fed’s monthly policy meeting, and a press conference with Chairman Ben Bernanke will be closely watched.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2013.12.17 16:25

Gold forming a base (based on dailyfx article)

Before we left on holiday we wrote about the potential for a low in Gold during the first week in December. Despite numerous intraday probes below, the low close in the metal for the month remains the idealized turn window date of December 2nd. While the strength in Gold exhibited since then has admittedly been rather pathetic there is still a very real possibility in our view that this is all part of a basing process. Last week’s high of 1267.75 is an important near-term pivot with traction above needed to confirm that a more important low is indeed in place. On the other hand, weakness below 1211 on an intraday basis or a close below 1219 would negate the potential for a more important cyclical low.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2013.12.18 16:53

Key Levels to Watch Ahead of the FOMC

- XAU/USD has traded in a sideways to higher range since finding support near the 1st square root relationship of the year’s low earlier in the month

- Our near-term trend bias remains lower in the metal while below last week’s high near 1268

- The low close of the month at 1219 is an important pivot with weakness below on a closing basis needed to singal a downside resumption

- A medium-term cycle turn window is seen around the latter part of next week

- Traction over 1268 is needed to turn us positive on Gold

=============

AUD/USD recorded a new low close for the year on Tuesday (by 1/10th of a pip on the FXCM platform). The decline to this point has been impressive with the exchange rate losing more than 8 big figures since its failure at the 200-day moving average back in October. However, the decline is now more than 40 trading days old. One of our favorite trend cycle lengths is around 45 days as this marks a Gann Commodity “Death cycle” where short-term reversals are more frequent. Interestingly this day count will roughly coincide with the Winter Solstice (in the Northern Hemisphere) this weekend which is another potentially important inflection point in Gann theory. It is also worth pointing out that the last few weeks of December are one of the stronger periods of the year for the exchange rate on a seasonal basis. Factors certainly seem to be aligning for at least a short-term reversal in the Aussie over the next week. Tempting as it might be to try to catch the bottom tick, we prefer to wait for strength that confirms our notion before positioning. Any continued weakness into the latter part of next week will negate the potential positive cyclicality.

Ohhh Gold My Gold Please go to 1500+

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2013.12.19 09:18

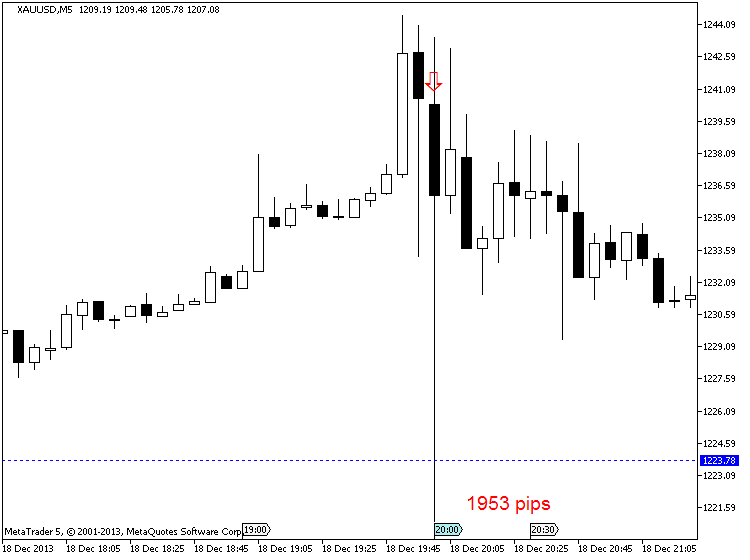

2013-12-18 19:00 GMT (or 20:00 MQ MT5 time) | [USD - Federal Funds Rate]

- past data is 0.25%

- forecast data is 0.25%

- actual data is 0.25% according to the latest press release

if actual > forecast = good for currency (for USD in our case)

==========

Fed Tapers Bond-Buying But Vows Low Interest Rates

The Federal Reserve on Wednesday tapered its massive bond-buying program by $10 billion to $75 billion per month, citing recent improvement in the U.S. jobs market.

Beginning in January, the Fed will buy mortgage-backed securities at a pace of $35 billion per month rather than $40 billion per month, and will add to its holdings of longer-term Treasury securities at a pace of $40 billion per month rather than $45 billion per month.

"In light of the cumulative progress toward maximum employment and the improvement in the outlook for labor market conditions, the Committee decided to modestly reduce the pace of its asset purchases," the Fed said in a statement accompanying today's decision.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

XAUUSD M5 : 1953 pips price movement by USD - Federal Funds Rate news event

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

XAUUSD price is ranging between 1211.74 and 1267.79 support/resistance levels on D1 timeframe with primary bearish market condition. The same situation we see on W1 and MN timeframes : secondary ranging market condition within primary bearish.

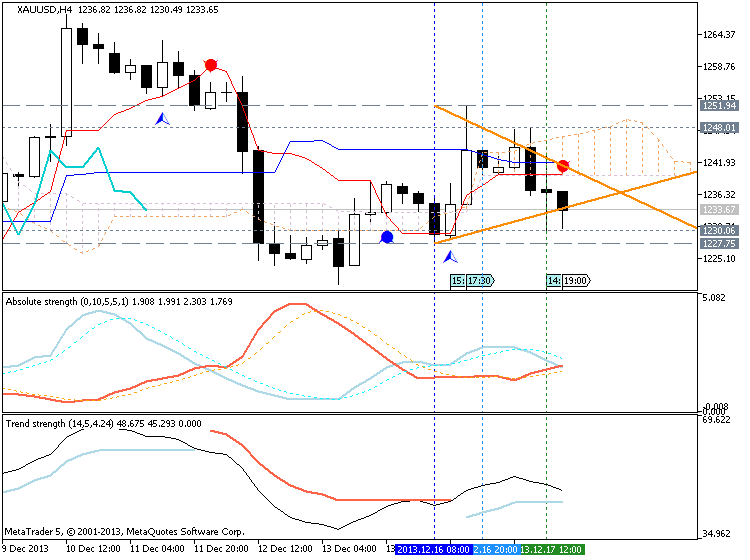

H4 timeframe.

Ichimoku cloud/kumo is very thin - it is not wide enough to stop the price from bullish reversal. And price was reversed to primary bullish with good signal to buy on open H4 bar. But the situation is a risky : Chinkou Span line is going along historical price ready to cross it for good breakdown from above to below for ranging market condition to be continuing

If the price will cross 1211.74 support level so the bearish market will be continuing for whole the week. If not so the price will be in ranging market condition for this and more weeks.

UPCOMING EVENTS (high/medium impacted news events which may be affected on XAUUSD price movement for this coming week)

2013-12-18 19:00 GMT (or 20:00 MQ MT5 time) | [USD - Federal Funds Rate]

2013-12-18 19:30 GMT (or 20:30 MQ MT5 time) | [USD - FOMC Press Conference]

2013-12-18 09:30 GMT (or 10:30 MQ MT5 time) | [GBP - Bank of England Minutes]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on XAUUSD price movementSUMMARY : ranging

TREND : bearish

Intraday Chart