Forum on trading, automated trading systems and testing trading strategies

newdigital, 2013.12.15 16:33

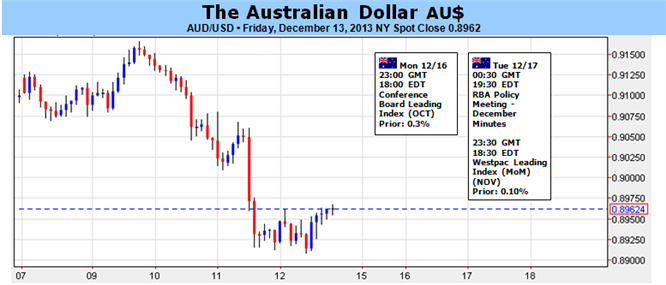

Australian Dollar Faces Make-or-Break Event Risk as FOMC Meets

Fundamental Forecast for Australian Dollar: Neutral

The Australian Dollar

accelerated downward last week, losing nearly 2 percent against its US

namesake and entering the weekend at the lowest level in three months.

The move lower over the past eight weeks has closely mirrored a recovery

in benchmark 10-year US Treasury bond yields, suggesting the

liquidation reflects building speculation about an imminent cutback of

the Federal Reserve’s QE3 asset purchases.

On the domestic front, December’s HSBC Chinese Manufacturing PMI report represents the only bit of noteworthy event risk. Expectations call for a slight pickup in factory-sector activity. As a stand-alone release, this might have helped the Aussie higher, but taken against a backdrop of Fed-related macro gyrations across the financial markets the data may not even register on investors’ radar.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2013.12.16 08:34

2013-12-16 01:45 GMT (or 02:45 MQ MT5 time) | [CNY - HSBC Manufacturing PMI]

- past data is 50.8

- forecast data is 51.0

- actual data is 50.5 according to the latest press release

if actual > forecast = good for currency (for CNY in our case)

==========

China HSBC Flash Manufacturing PMI Falls

A key indicator of China's manufacturing sector performance declined slightly in December, but still managed to hold above the neutral mark indicating a moderate pace of expansion, preliminary survey data published by Markit Economics revealed Monday.

The HSBC purchasing managers' index fell to 50.5 in December from 50.8 in November. A PMI reading above 50 indicates expansion of the sector.

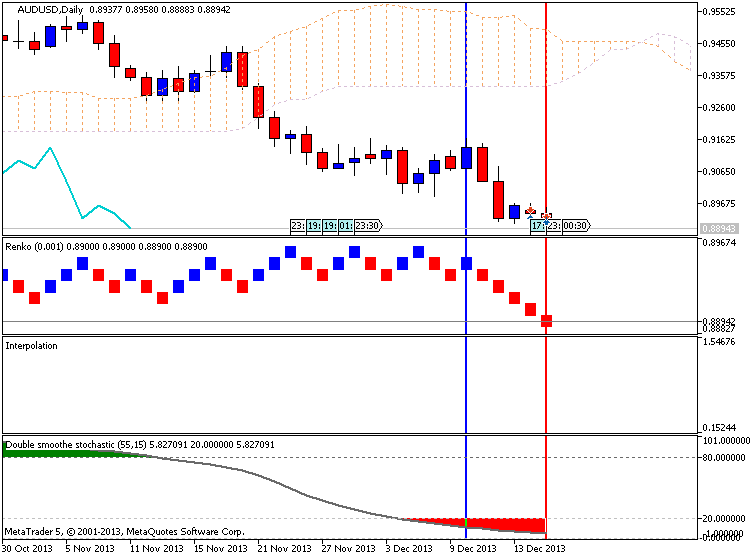

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

AUDUSD M5 : 25 pips price movement by CNY - HSBC Manufacturing PMI

it depends on timeframe. If M5 timeframe so it is too late :

- price is already on the first profit level on MA Channel

- stochastic is in oversold situation

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2013.12.17 10:17

2013-12-17 00:30 GMT (or 01:30 MQ MT5 time) | [AUD - Monetary Policy Meeting Minutes]

- past data is n/a

- forecast data is n/a

- actual data is n/a according to the latest press release

==========

Forex - AUD/USD steady after RBA minutes, economic outlook

The Australian dollar was steady against its U.S. counterpart on

Tuesday, after the Reserve Bank of Australia signalled the possibility

for further rate cuts and comments by the country's Treasurer, while

investors eyed the Federal Reserve's upcoming policy meeting.

AUD/USD hit 0.8930 during late Asian trade, the session low; the pair subsequently consolidated at 0.8940, easing 0.06%.

The pair was likely to find support at 0.8904, the low of September 1 and resistance at 0.9014, the high of September 2.

The minutes of the RBA's December policy meeting earlier showed that

the bank maintained the option of loosening monetary policy further due

to an "uncomfortably high" currency.

The report added that "given the substantial degree of policy stimulus

that had been imparted, it was prudent to hold the cash rate steady."

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

AUDUSD M5 : 25 pips price movement by AUD - Monetary Policy Meeting Minutes

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2013.12.17 16:22

AUDUSD closing in on the lows of the year (based on dailyfx article)

- AUDUSD has come under steady pressure since failing last week at a key Gann convergence near .9160

- Our near-term trend bias remains lower in the Aussie while below the 2nd square root relationship of the year’s low at .9035

- Immediate downside attention is on the 1st square root relationship of the year’s low at .8910 with weakness below likely exposing the intraday extremes of the year

- A cycle turn window is seen around the end of the year

- Only a daily close back over .9035 would turn us positive on the Aussie

Week 51- H8 Chart: agree still bearish. Probably we will see soon a new pull-back. the fourth one since October High.

As detailed by Newdigit at .9035 a possible pull-back could be a reverse of bearish situation.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2013.12.18 07:11

AUDUSD and Fibonacci levels in trading (based on dailyfx article)

- AUDUSD has been on a downtrend and may continue to push lower.

- Previous levels of Fibonacci support can act as resistance levels

- When one Fibonacci level is broken, price often moves down to the next level of Fibonacci support.

One way traders like shorting after price breaks below a trendline or other significant level of support is to use breakout technique. This involves getting short immediately after price moves through a level of support. However, price oftentimes, retraces to retest the breakout area and traders have to endure time wasted and negative drawdown that comes along with this retrace.

One solution to this issue is to wait until a retrace happens following

the initial move. This requires patience on the Forex trader’s part as

the thought of missing a big move may outweigh the cool logic of waiting

for a better price to short at a higher level. Remember, while bulls

look to “buy low and sell high,” bears look to “sell high and buy low.”

Therefore, selling at the highest price possible before a drop is the

goal. Fibonacci can help us “pick tops” in a downtrend

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

The AUDUSD price is on primary bearish with secondary ranging on D1 timeframe floating between 0.8913 support and 0.9166 resistance levels. W1 price is on bearish as well trying to break 0.8990 support on close W1 bar. Monthly AUDUSD price is inside Icvhimoku cloud/kumo wioth bearish ranging market condition since the July this year.

H4 timeframe : the price is on secondary rally within primary bearish trend trying to break 0.8963 resistance from below to above for the rally to be continuing, or trying to break 0.8909 support level for breakdown (good for sell trades).

If the price will cross 0.8913 and 0.8909 support levels on close bar so it may be good breakdown and primary bearish will be continuing for whiole the week. If not so we may expect ranging market condition for the price floating between main support/resistance levels.

UPCOMING EVENTS (high/medium impacted news events which may be affected on AUDUSD price movement for this coming week)

2013-12-16 01:45 GMT (or 02:45 MQ MT5 time) | [CNY - HSBC Manufacturing PMI]

2013-12-16 23:00 GMT (or 00:00 MQ MT5 time) | [AUD - Leading Index]

2013-12-17 00:30 GMT (or 01:30 MQ MT5 time) | [AUD - Monetary Policy Meeting Minutes]

2013-12-17 22:30 GMT (or 23:30 MQ MT5 time) | [AUD - RBA Gov Stevens Speaks]

2013-12-17 23:30 GMT (or 00:30 MQ MT5 time) | [AUD - Westpac leading Index]

2013-12-18 19:00 GMT (or 20:00 MQ MT5 time) | [USD - Federal Funds Rate]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on AUDUSD price movementSUMMARY : ranging

TREND : bearish

Intraday Chart