Forum on trading, automated trading systems and testing trading strategies

EURUSD GANN ANGLE

Ahmed Saad Soliman, 2016.11.12 11:38

EURUSD GANN ANGLE

after the decline on EURUSD after the US election price reached 1 x 1536 weekly Gann angle overlapping with 6.66 Gann percentage

this is an indication that EURUSD will move higher

Please watch this video for more information

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.11.12 08:39

Weekly EUR/USD Outlook: 2016, November 13 - November 20 (based on the article)

EUR/USD had a volatile week around the US elections and eventually closed lower. Speeches by Draghi, inflation, and GDP data stand. Will the euro continue lower?. Here is an outlook for the highlights of this week.

- Industrial Production: Monday, 10:00. A drop of 0.9% is on the cards now.

- Mario Draghi talks: Monday, 15:00. The President of the European Central Bank will speak in Rome, in his home country of Italy. Any comments about the future of the QE program will be closely watched.

- German GDP: Tuesday, 7:00. Slightly slower growth is expected: 0.3%.

- Italian GDP: Tuesday, 9:00. Economic output is expected to rise by 0.2%.

- Flash GDP: Tuesday, 10:00.

- German ZEW Economic Sentiment: Tuesday, 10:00. Another rise is expected, up to 7.9 points, reflecting more optimism.

- Trade Balance: Tuesday, 10:00. Thanks to German exports, the euro-zone enjoys a wide surplus. A small squeeze is on the cards for September: 22.3 billion after 23.3 billion in August.

- CPI (final): Thursday, 10:00.

- ECB Meeting Minutes: Thursday, 12:30. In the latest ECB meeting in October, the European Central Bank left all policy measures unchanged, but Draghi sounded slightly dovish.

- German PPI: Friday, 7:00. A rise of 0.3% is expected to follow now.

- Draghi speaks: Friday, 8:00 Draghi’s second appearance this week could be more meaningful, as he speaks in Frankfurt, where the headquarters of the ECB are located.

- Current Account: Friday, 9:00. This is expected to grow from 29.7 billion to 31.3 billion this time.

- Jens Weidmann talks: Friday, 10:30. The President of the German central bank, the Bundesbank, speaks in Frankfurt, in the same event as Draghi.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.11.14 16:50

EUR/USD Intra-Day Fundamentals: ECB President Draghi Speaks and 16 pips range price movement

2016-11-14 15:00 GMT | [EUR - ECB President Draghi Speaks]

- past data is n/a

- forecast data is n/a

- actual data is n/a according to the latest press release

[EUR - ECB President Draghi Speaks] = Speech at the Italian Treasury, in Rome.

==========

From Forex Crunch article: EUR/USD finds support only at 2016 lows – why and what’s next

- "The US dollar continues storming forward, and EUR/USD sees no mercy. The world’s No. 1 currency pair is trading at the lowest levels since early 2016. So far, it has reached 1.0728, above support at 1.0710. The pair did break below the low of 1.0825 seen in March. At that time, the ECB presented a lot of new measures but also said they were done for the time."

- "If 1.0710 breaks, we will be in areas where the pair spent little time. 1.0630 is a stepping stone on the way down. Stronger support awaits at 1.0520, the level the pair visited on another ECB rate event: the December 2015 meeting. And the last line in the sand belongs to 1.0460, last seen in March 2015, and the lowest level in well over a decade. Some even see an open door to parity Resistance awaits at 1.0820, 1.0960 and 1.10."

==========

EUR/USD M5: 16 pips range price movement by ECB President Draghi Speaks news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.11.14 21:38

ECB's Constancio Cautions Against 'Hasty & Positive' Conclusions On Trump Win (based on the article)

"Markets have rushed into concluding that the U.S. economy is poised for more growth on an expansionary budget policy, after Donald Trump won the presidential election last week, European Central Bank Vice President Vitor Constancio said Monday."

"This may be the case in the short-term but the real negative effects of heightened uncertainty can come later," he said.

"We should be cautious in drawing hasty, positive conclusions from those market developments because they may not necessarily indicate that the world economy will have an accelerating recovery with higher growth."

"However, considerable risks and uncertainties to financial stability remain."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.11.15 09:01

Intra-Day Fundamentals - EUR/USD, USD/CAD and AUD/USD : German Gross Domestic Product

2016-11-15 07:00 GMT | [EUR - GDP]

- past data is 0.4%

- forecast data is 0.3%

- actual data is 0.2% according to the latest press release

if actual > forecast (or previous one) = good for currency (for EUR in our case)

[EUR - GDP] = Change in the inflation-adjusted value of all goods and services produced by the economy.

==========

From official report:

"German economic growth is losing some momentum. In the third quarter of 2016, the gross domestic product (GDP) rose 0.2% on the second quarter of 2016 after adjustment for price, seasonal and calendar variations; this is reported by the Federal Statistical Office (Destatis). In the first half of the year, the GDP had increased somewhat more, by 0.4% in the second quarter and 0.7% in the first quarter."

==========

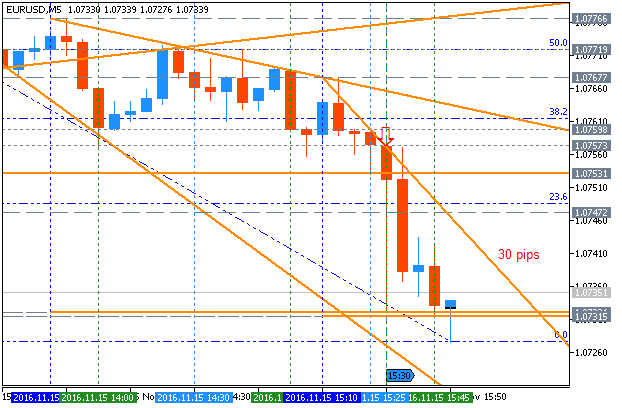

EUR/USD M5: 30 pips range price movement by German Gross Domestic Product news events

==========

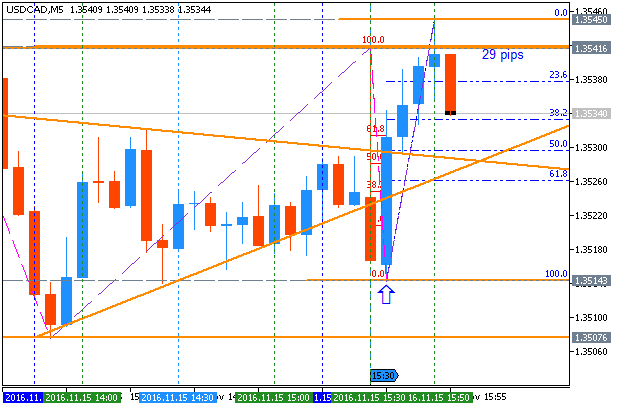

USD/CAD M5: 25 pips range price movement by German Gross Domestic Product news events

==========

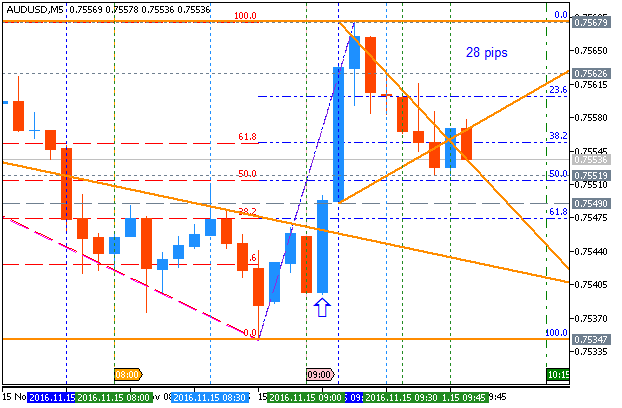

AUD/USD M5: 28 pips range price movement by German Gross Domestic Product news events

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.11.15 15:01

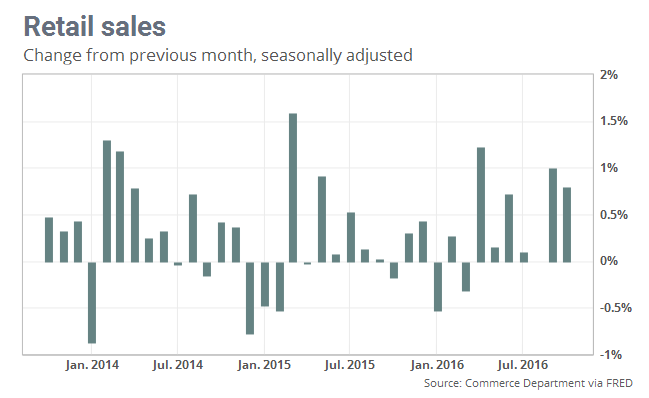

Intra-Day Fundamentals - EUR/USD, USD/CAD and GOLD (XAU/USD): Advance Retail Sales2016-11-15 13:30 GMT | [USD - Retail Sales]

- past data is 1.0%

- forecast data is 0.6%

- actual data is 0.8% according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Retail Sales] = Change in the total value of sales at the retail level.

==========

From Market Watch article: U.S. retail sales post biggest back-to-back sales since 2014

"Retail sales jumped 0.8% last month after a revised 1% gain in September, the government said Tuesday. Economists surveyed by MarketWatch had forecast a seasonally adjusted 0.7% advance."

==========

EUR/USD M5: 30 pips range price movement by U.S. Retail Sales news events

==========

USD/CAD M5: 29 pips range price movement by U.S. Retail Sales news events

==========

GOLD (XAU/USD) M5: range price movement by U.S. Retail Sales news events

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.11.16 14:59

Intra-Day Fundamentals - EUR/USD, USD/CNH and NZD/USD: Producer Price Index (PPI)2016-11-16 13:30 GMT | [USD - PPI]

- past data is 0.3%

- forecast data is 0.3%

- actual data is 0.0% according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - PPI] = Change in the price of finished goods and services sold by producers.

==========

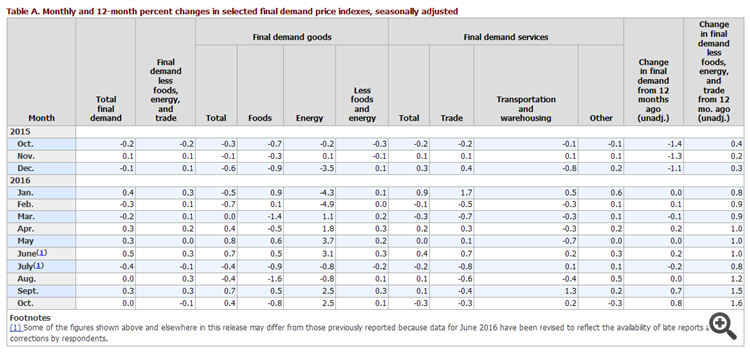

From official report:

"The Producer Price Index for final demand was unchanged in October, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. Final demand prices rose 0.3 percent in September and were unchanged in August. On an unadjusted basis, the final demand index increased 0.8 percent for the 12 months ended in October, the largest 12-month rise since advancing 0.9 percent in December 2014."

==========

EUR/USD M5: 14 pips range price movement by Producer Price Index news events

==========

USD/CNH M5: 46 pips price movement by Producer Price Index news events

==========

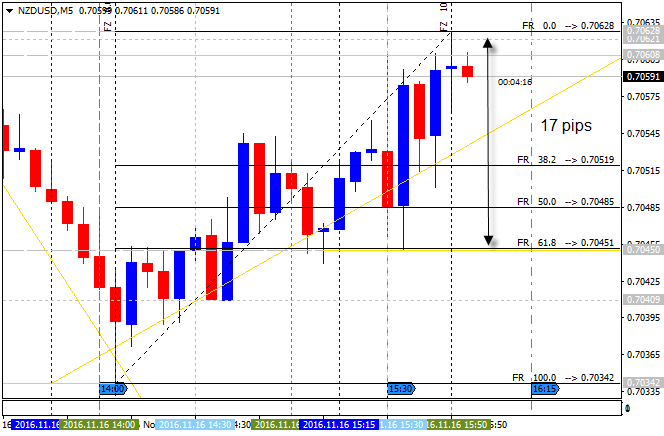

NZD/USD M5: 17 pips range price movement by Producer Price Index news events

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.11.17 14:57

Intra-Day Fundamentals - EUR/USD, S&P 500 and Dax Index: U.S. Consumer Price Index and Residential Building Permits2016-11-17 13:30 GMT | [USD - CPI]

- past data is 0.3%

- forecast data is 0.4%

- actual data is 0.4% according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - CPI] = Change in the price of goods and services purchased by consumers.

==========

2016-11-17 13:30 GMT | [USD - Building Permits]

- past data is 1.23M

- forecast data is 1.19M

- actual data is 1.23M according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Building Permits] = Annualized number of new residential building permits issued during the previous month.

==========

From official reports:

"The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.4 percent in October on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index rose 1.6 percent before seasonal adjustment."

==========

EUR/USD M5: 38 pips range price movement by CPI and Building Permits news events

==========

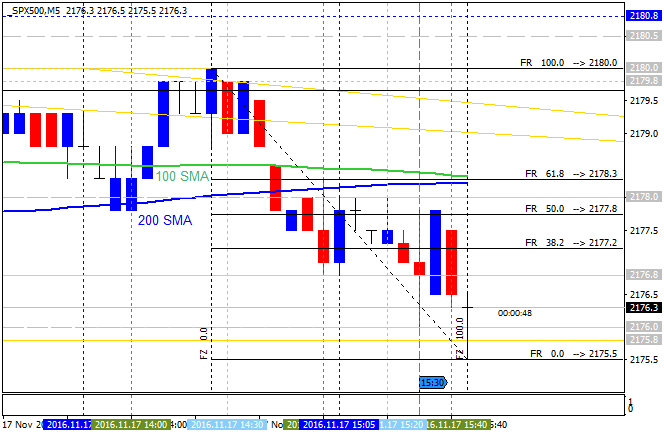

S&P 500 M5: range price movement by CPI and Building Permits news events

==========

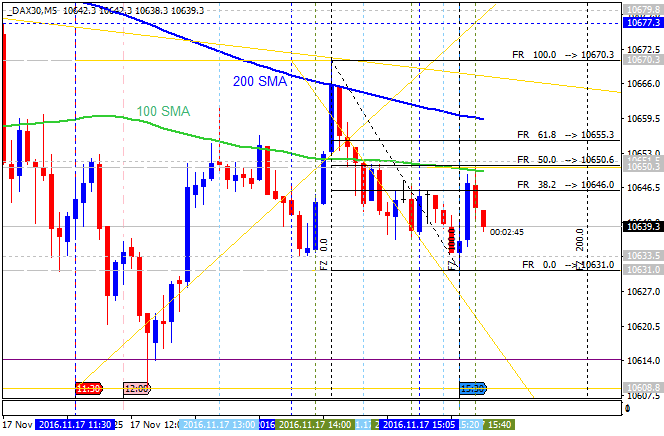

Dax Index M5: range price movement by CPI and Building Permits news events

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Daily price is on bearish breakout by 1.0850 support level to be testing to below for the bearish trend to be continuing with 1.0821 nearest target to re-enter. Chinkou Span line of Ichimoku indicator is located below the price indicating the bearish breakout to be continuing, Trend Strength indicator and Absolute Strength indicator are estimating the trend as the bearish breakout to be continuing.

By the way, the fast non-lagging signals of Kijun-sen line/Tentan-sen line are estimating the future trend as the ranging so the most likely scenarios in this case are the following:

- the price breaks 1.0821 support to below for the primary bearish continuation, or

- the price will be on bearish ranging within the levels.

If D1 price breaks 1.0821 support level on close bar so the primary bearish trend will be continuing with 1.0814 bearish target.If D1 price breaks 1.1243 resistance level on close bar from below to above so we may see the reversal of the daily price movement from the ranging bearish to the primary bullish market condition with 1.1283 target.

If not so the price will be on bearish ranging within the levels.

SUMMARY: bearish

TREND: breakdown