- A stop, once triggered becomes a market order and is opened at the first available price. You can't prevent it.

- If you're using code, don't use stops. Humans can't watch 24/7, EAs can.

For the Deviation setting (i am on a 5 decimal place broker), say i set it to 30 pips (3pips). And i put a Stop Sell at 1.00090. Price is at 1.00100 and then jumps to 1.00040. Based on my Deviation setting, my Sell Stop will not be triggered into a trade right?

That is called "slippage" and you can set limits for it in the OrderSend() function, however, it only has any effect if your broker supports it.

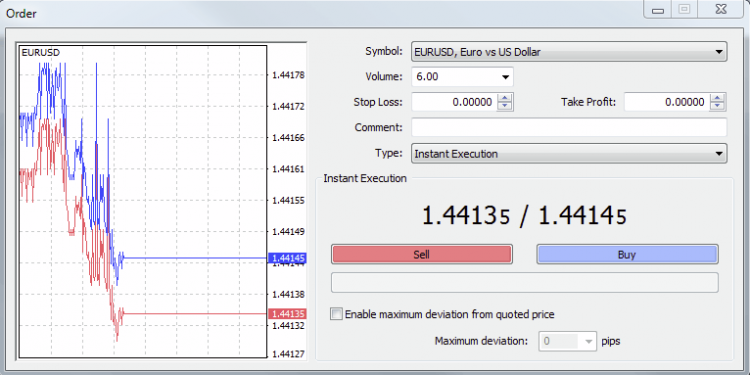

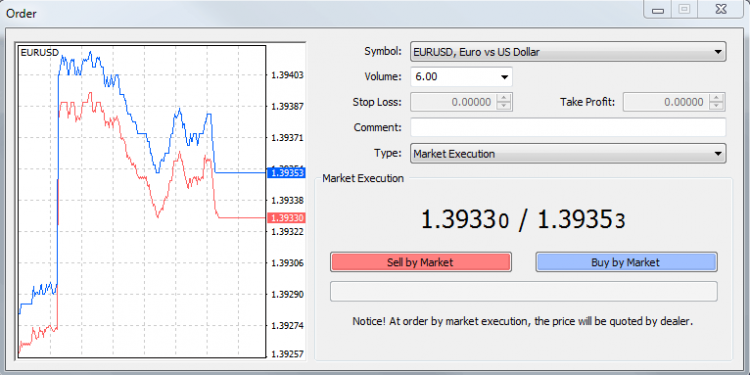

For example, brokers using "Instant Execution" will most probably support it, but brokers using "Market Execution" used by most ECN accounts will not have support for it.

NB! Also note, that the "slippage" parameter is in Points and not Pips!

- A stop, once triggered becomes a market order and is opened at the first available price. You can't prevent it.

- If you're using code, don't use stops. Humans can't watch 24/7, EAs can.

And what do you mean by "if im using code"? pardon me ive just started trading about 6 months now on mt4 and all ive used are limit orders and stop orders, for SL, TP and iniatiation of trades. i dont use robots or codes

That is called "slippage" and you can set limits for it in the OrderSend() function, however, it only has any effect if your broker supports it.

For example, brokers using "Instant Execution" will most probably support it, but brokers using "Market Execution" used by most ECN accounts will not have support for it.

NB! Also note, that the "slippage" parameter is in Points and not Pips!

supercallim: So what does the Deviation in the MT4 Options do?

And what do you

mean by "if im using code"? pardon me ive just started trading about 6

months now on mt4 and all ive used are limit orders and stop orders, for

SL, TP and iniatiation of trades. i dont use robots or codes

oh yes i have been seeing this Order Send() thing in the forum but i have no idea how to set that :/ may i know how to do it?

As I wrote, "Deviation" in manual orders is the same as "slippage". When coding EA's it is always referred to as slippage, hence why I mentioned "OrderSend()" because this forum is mostly about coding MQL4.

However, it seems you are not referring to code and only to manual trading. In either case, when a Pending Order is triggered, it is always converted into a Market order (you must consider what type of execution your broker uses)!

So, does your broker use "Instant Execution" or "Market Execution"?

If it is "Market Execution" then the "deviation/slippage" option will have no effect and you will suffer that slippage whether it is positive or negative, be it small or huge and you will have no control over it.

As I wrote, "Deviation" in manual orders is the same as "slippage". When coding EA's it is always referred to as slippage, hence why I mentioned "OrderSend()" because this forum is mostly about coding MQL4.

However, it seems you are not referring to code and only to manual trading. In either case, when a Pending Order is triggered, it is always converted into a Market order (you must consider what type of execution your broker uses)!

So, does your broker use "Instant Execution" or "Market Execution"?

If it is "Market Execution" then the "deviation/slippage" option will have no effect and you will suffer that slippage whether it is positive or negative, be it small or huge and you will have no control over it.

Yes i am trading manually! I rang up my broker and she mentioned Instant and Market execution are the same thing. I beg to differ since of what you have mentioned here. When setting a trade, be it Limit or Stop, i can set my Tp and Sl price too. So i suppose that makes my broker Market Execution? What is the difference between Instant and Market execution anyway?

Both "Instant" and "Market" execution can have S/L and T/P on pending orders!

"Instant" brokers are usually "Dealing Desks" that take your side of the trade which can be quickly filled and allow slippage control but then can have requotes.

"Market" brokers are usually "Non-dealing Desk" or "ECN" and provide direct Market liquidity (which can be slightly slower to execute, but not always), and never have requotes.

Some brokers have both execution types depending on what type of account you have.

Send me a PM with your Broker link and your Account type and I will tell you which execution type you have!

Both "Instant" and "Market" execution can have S/L and T/P on pending orders!

"Instant" brokers are usually "Dealing Desks" that take your side of the trade which can be quickly filled and allow slippage control but then can have requotes.

"Market" brokers are usually "Non-dealing Desk" or "ECN" and provide direct Market liquidity (which can be slightly slower to execute, but not always), and never have requotes.

Some brokers have both execution types depending on what type of account you have.

Send me a PM with your Broker link and your Account type and I will tell you which execution type you have!

Gosh youre realy helpful! thank you!! :D okay whats a "PM with your Broker link and your Account type"?

my broker is apparently terrible. they dont know anything really <deleted>

<deleted>

However, so you can better understand how to find out for yourself, look at the execution "Type:" on your Order placement dialog box (non pending orders). See the following two examples and spot the differences:

Please note however, that for "Pending Orders" you can still set

Stop-Loss and Take-Profit, irrespective of it being "Market" or

"Instant" execution.

I never used them, because I personally have nothing good to say about them (hint, hint)!

However, so you can better understand how to find out for yourself, look at the execution "Type:" on your Order placement dialog box (non pending orders). See the following two examples and spot the differences:

Please note however, that for "Pending Orders" you can still set Stop-Loss and Take-Profit, irrespective of it being "Market" or "Instant" execution.

Oh what which broker are you using then? Oanda's spread goes crazy like 40 over pips during news

Mine is Market Execution! So my Tools-Options-Trade Deviation setting will not work at all then?

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Hello!

i just got a much lower price on the stop sell price i placed. How do i set it on MT4 that if market price differs too much of an amount, orders will not be executed? Do i go to the Deviation setting on MT4?

For the Deviation setting (i am on a 5 decimal place broker), say i set it to 30 pips (3pips). And i put a Stop Sell at 1.00090. Price is at 1.00100 and then jumps to 1.00040. Based on my Deviation setting, my Sell Stop will not be triggered into a trade right?

thank you!