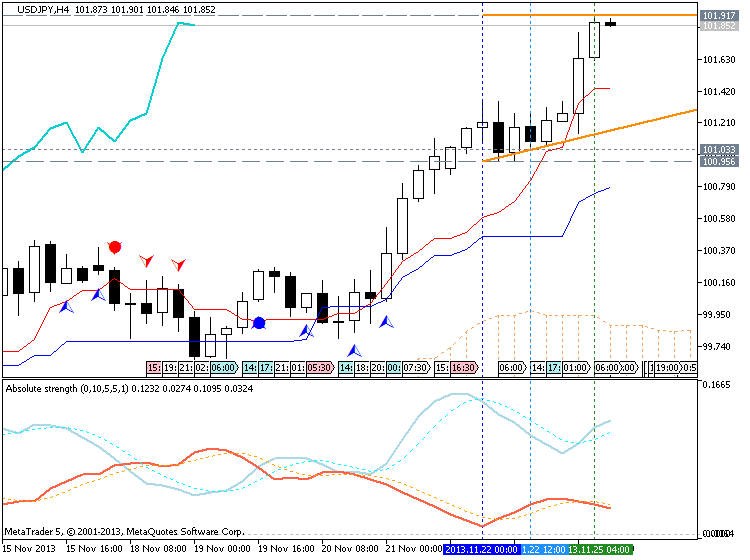

101.35 resistance level was broken for H4 :

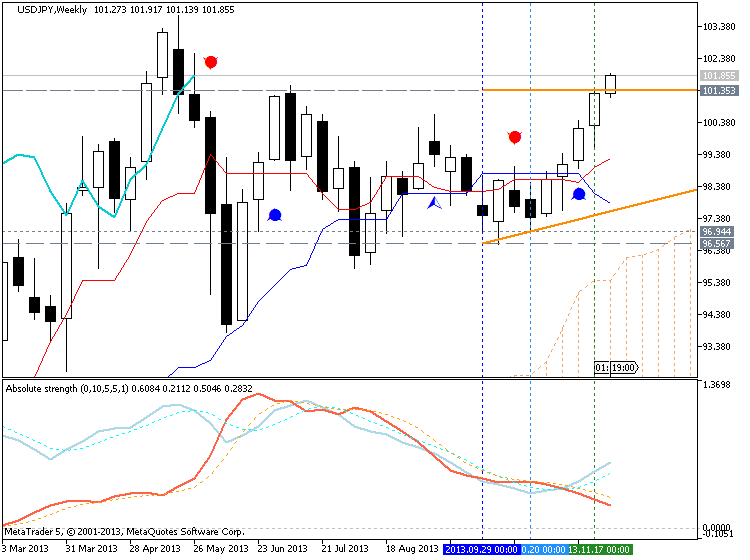

and 100.43 resistance was broken for W1 :

Breakout started

newdigital, 2013.11.26 08:20

2013-11-25 23:50 GMT (or 00:50 MQ MT5 time) | [JPY - Monetary Policy Meeting Minutes]

- past data is n/a

- forecast data is n/a

- actual data is n/a according to the latest press release

==========

Yen strengthens after BoJ minutes

The yen strengthened in Asian trade Tuesday despite three of the nine

Bank of Japan board members seeing a greater downside risk to the

economy than the majority view of balanced risk, according to the

minutes of the Oct. 31 policy meeting released earlier in the day.

USD/JPY traded at 101.49, down 0.19%, in a range of 101.34 - 101.73 after the minutes.

.

Bank

of Japan board member Takehiro Sato said downside risks to weaker

prices is somewhat higher than the upside, while colleague Takahide

Kiuchi repeated his call for greater price target flexibly. Sayuri

Shirai said attention needs to be paid to downside risks to economic

activity and prices.

The Bank of Japan is aiming for sustained

annual inflation at 2% by 2015 through an aggressive easing policy that

is supposed to work in combination with government economic reforms.

At the meeting, the Bank of Japan board, by a unanimous vote, kept the bank's policy target unchanged as expected.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

USDJPY M5 : 16 pips price movement by JPY - Monetary Policy Meeting Minutes

23 pips price movement by USD - Consumer Confidence

newdigital, 2013.11.26 16:29

2013-11-26 15:00 GMT (or 16:00 MQ MT5 time) | [USD - Consumer Confidence]

- past data is 72.4

- forecast data is 72.9

- actual data is 70.4 according to the latest press release

if actual > forecast = good for currency (for USD in our case)

==========

U.S. Consumer Confidence Unexpectedly Continues To Deteriorate In November

After reporting a sharp drop in U.S. consumer confidence in the previous month, the Conference Board released a report on Tuesday showing that confidence unexpectedly saw further downside in November.

The Conference Board said its consumer confidence index dipped to 70.4 in November from an upwardly revised 72.4 in October.

The decrease came as a surprise to economists, who had expected the index to climb to 72.9 from the 71.2 originally reported for the previous month.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

temp_file_screenshot_46514.png

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

temp_file_screenshot_11478.png

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

temp_file_screenshot_20551.png

well ... all resistance lines were broken so it is weekly breakout (read name of the thread for example). But I am sorry - Chinkou Span crossed historical price on open bar only. So, we can wait for the next week with same question : Weekly Breakout or Daily Bullish Correction?

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Chinkou Span line of Ichimoku indicator is crossing historical W1 price on open bar for possible bullish breakout. Besides, W1 price crossed 100.43 resistance level on open bar too which is indicating that this breakout may be really started on the near future depends on where next W1 bar will be open for example.

D1 timeframe - breakout's going on with ranging market condition as a secondary trend.

H4 timeframe - correction was started inside primary bullish. The H4 breakout may be continuing if the price will break 101.35 resistance line (good to open buy trade)

If the price will cross 101.35 resistance level so breakout will be continuing for whole the week.

If the price will cross 100.74 support level from above to below so we can get correction within primary bullish (good to open sell trade)

If new W1 bar will be opened below 100.43 level so we will see ranging market condition for this pair sorry.

UPCOMING EVENTS (high/medium impacted news events which may be affected on USDJPY price movement for this coming week)

2013-11-25 23:50 GMT (or 00:50 MQ MT5 time) | [JPY - Monetary Policy Meeting Minutes]

2013-11-26 15:00 GMT (or 16:00 MQ MT5 time) | [USD - Consumer Confidence]

2013-11-27 23:50 GMT (or 00:50 MQ MT5 time) | [JPY - Retail Sales]

2013-11-28 23:30 GMT (or 00:30 MQ MT5 time) | [JPY - National CPI Core]

2013-11-29 05:00 GMT (or 06:00 MQ MT5 time) | [JPY - Housing Starts]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on USDJPY price movement

SUMMARY : possible ranging

TREND : bullish

Intraday Chart