You know your account leverage when you open your account, right? Why need to calculate it separately?

I know the max leverage I am allowed to use, not the one I am currently using. For example, I might be allowed to use 1:500 but want to use only 1:5.

Even more, I might want to decrease my lotsizes as I approach that number, or I might want to control exposure changes due to currency fluctuations.

That is why knowing the real leverage used in the account is important.

double real_leverage = {total value of the open trades}/AccountEquity();

order value = (OrderClosePrice - OrderOpenPrice)*DIR * OrderLots * DeltaValuePerLot( OrderSymbol )

order value = (OrderClosePrice - OrderOpenPrice)*DIR * OrderLots * DeltaValuePerLot( OrderSymbol )

To prevent a margin call you must verify that there will be free margin at MAE. Contract Size - MQL4 forumHi @WHRoeder,

Thanks for your reply, it has been very useful. Kindly note I want the total trade size, not the current value of the trades. This is how I have coded the two functions:

/** * Returns the total leverage used in the account at the time * @return double */ double GetRealLeverageInUse2() { double exposure = 0; double equity = AccountEquity(); string basecurrency = AccountCurrency(); if(equity <= 0) return(0); for(int i = OrdersTotal()-1; i >= 0; i--) { if(OrderSelect(i, SELECT_BY_POS, MODE_TRADES)) { // Pair string symbol = OrderSymbol(); // Lots traded double lots = OrderLots(); // Contract size in currency double size_in_currency_base = SymbolInfoDouble(symbol, SYMBOL_TRADE_CONTRACT_SIZE)*lots; string currency_base_for_trade = SymbolInfoString(symbol, SYMBOL_CURRENCY_BASE); double trade_size_in_local_currency = DeltaValuePerLot(symbol)*lots; Print(lots +" of "+ symbol +" are "+ size_in_currency_base +" in size ("+ currency_base_for_trade +"), "+ "and "+ trade_size_in_local_currency +" in base currency ("+ basecurrency +")"); // Add to exposure exposure += trade_size_in_local_currency; } } return(exposure/equity); } /** * Returns the base currency value per lot * @param string pair * @return double */ double DeltaValuePerLot(string pair="") { if(pair == "") pair = Symbol(); return(MarketInfo(pair, MODE_TICKVALUE)/MarketInfo(pair, MODE_TICKSIZE)); }

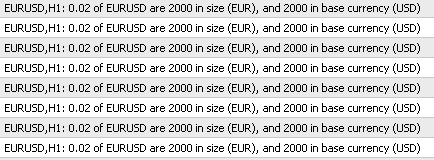

However, it does not seem to work as it should. When I backtest EURUSD with an EUR account...

When I backest EURUSD with and USD account...

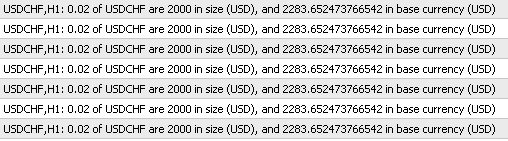

And when I backtest USDCHF with an USD account...

I believe these numbers are not right.

0.02 lots of EURUSD are always 2,000€ of trade size on an EUR accont.

0.02 lots of USDCHF are always 2,000$ of trade size on an USD account.

And the trade size for 0.02 lots of EURUSD on the USD account should be around 2,700$ instead of 1,400$.

Am I doing something wrong? Maybe DeltaValuePerLot() needs a change? Kindly clarify =)

Thanks in advance =)

A.

Aren't free margin required showed when you open any buy/sell orders? Can't we just use that?

No. Suppose that the broker gives you a leverage of 1:500 but you have a conservative investor who wants to use only 1:3.

This forces you to calculate the leverage currently used and stop trading there, even if you have plenty of free margin left.

Are you over-complicating the thinking here?

I have no open orders so I cannot test, but I think that this should do the job

double equity =AccountInfoDouble(ACCOUNT_EQUITY); double margin_used =AccountInfoDouble(ACCOUNT_MARGIN); int leverage =(int)AccountInfoInteger(ACCOUNT_LEVERAGE); double real_leverage = margin_used/equity*leverage; Print(real_leverage);

Please forgive me if I am wrong :)

Are you over-complicating the thinking here?

I have no open orders so I cannot test, but I think that this should do the job

Please forgive me if I am wrong :)

Hi GumRai,

Thanks for your message. You were right, I was over-complicating things =D This works. The other issue now is that I do not want to consider hedging in my leverage calculation.

I will update the functions and post it. Thanks!

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Good morning,

I hope you are fine. I have been having quite a problem calculating the real leverage used by the trading account. We can define real leverage as:

I am using the SymbolInfoDouble function to calculate the value of open trades. This is what I have so far:

But since the base currency of the instruments used is not the same, my real leverage is not properly calculated. The SymbolInfoDouble function returns, for example...

The nasty work-around would be reading the counter-currency using SubStr and use the different pairs available to calculate the value of contract. This solution of course can be quite a problem because the symbol name, which is an arbitrary string, can change from broker to broker: fxEURUSD, EURUSDfx, EURUSDm or EURUSDf are different names I have seen. It is quite problematic, does anyone have a more elegant solution?

Thanks in advance!