The renkolinebreak indi is already in my folder however when I load the EA, it says : Creating renkolinebreak fails. and the EA was removed.

- In your MT5 platform click on Metaquotes Language Editor button (or press F4)

- In MetaEditor, you have the Navigator window, right-click on Indicators

- In the popup window click on Open Folder, a new window open.

- Copy the indicator source code in this window.

- Once copied, double-click on the file, it opens in MetaEditor, then click on Compile button (or F7).

You can now run the EA.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2013.10.16 08:04

How to Use Renko Bricks and Moving Averages to Find Trades

Talking Points

- Renko bars help filter the noise

- Renko bars reveal clearer entries and exits

- Moving Averages can be used with Renko bars with some minor setting changes to pinpoint entries

Seeing the trend without Forex market noise is the goal of every trader. Too many times, traders get head-faked by the twists and turns of price action.

In addition moving averages can be used to signal entries and exits as well. A couple of settings have to be changed in order to get the moving averages which are usually tied to time, to work with a chart system that is based on price.

To add a 13-period exponential moving average to the Renko chart, choose EMA from the Add Indicator menu then change “Number of periods” to 13.

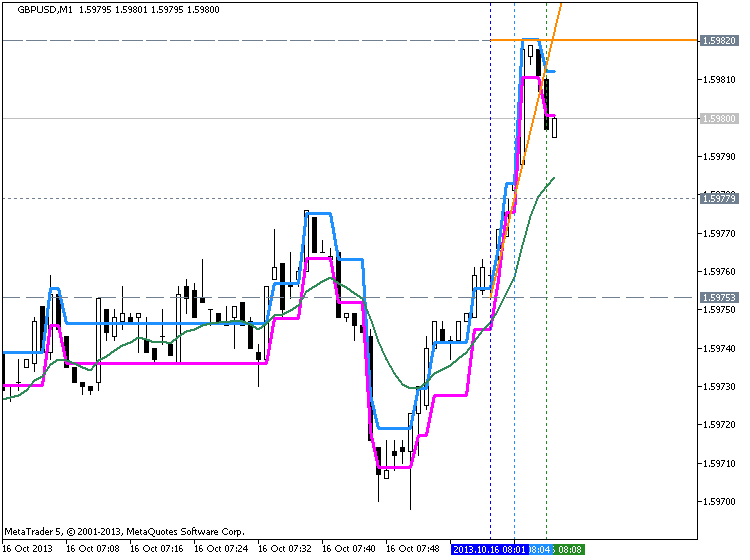

Notice the chart above which displays both Renko bars and a 13-period

exponential moving average. A simple system can be built around the

Renko bars and the moving average. When Renko price bars cross below the

moving average and turns red, traders can enter short and stay with the

trend until the Renko bars cross back above the moving average.

An initial stop could be placed just above the last blue Renko brick.

Keep in mind that in the above example, each brick is equal to five

pips. In the above example, the red circles mark where the Renko bars

crossed below the moving average. A trader can see that a number of pips

could have been gathered as the bars stayed below the moving average.

On the other hand, when the Renko bars change color and cross above the

moving average, traders can enter long placing stop just below the last

red Renko brick. The above chart shows in the green circles, points were

the Renko price bars moved above the moving average generating a clear

buy signal.

Renko charts, without the dimension of time, may take a little getting a little used to. But once you get the hang of them, you may find it difficult to go back to the candles. Adding a moving average gives excellent signals for entry and exit. Marrying them up with other indicators can magnify the benefits of trading without noise and scary wicks!

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2013.10.12 11:16

Trading Trends with Renko Charts

Talking Points

- Renko harts filter out the noise of wicks and are based solely on price without time.

- Renko charts clearly indicate support and resistance.

- Can be used to confirm trends or can be traded on their own.

Have you ever been stopped out of trade only to have it move in the direction you originally thought?

Do you have trouble recognizing trend direction?

If you answered “Yes” to either one of these questions, then you may want to give Renko charts a try.

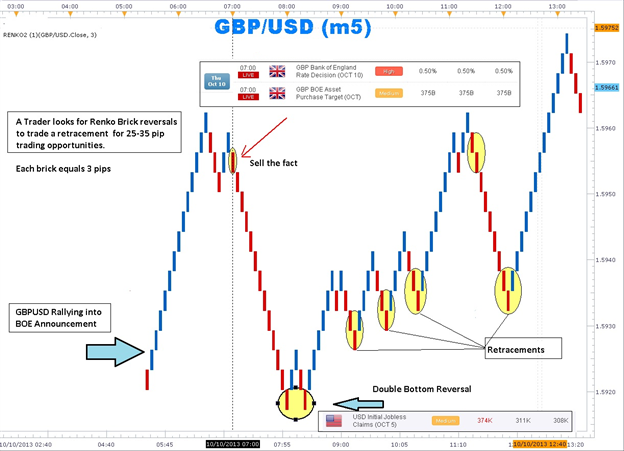

Renko means brick in Japanese. Every brick is the same size and a new

brick is drawn one brick size below or above the brick before it. Bricks

that are adjacent never overlap. Every brick starts where the previous

brick ends. Traders can specify the size of bricks in pips. In the

example above, the distance from the high and low of the brick is three

pips. So a ten brick move is equal to 30 pips (10 bricks times 3-pip

height brick).

Price can move above and below the previous brick until the minimum

number of brick is met. This may be a surprise for most traders who are

used to a new candle being formed at a specific time. We can see 13

bricks in a row heading up going into the Bank of England rate decision.

Once the decision is released the bricks changed in color from blue to

red and there was a lower high leading to a 13 brick decline.

A double bottom that happened when the US Initial Jobless Claims was

released ended the selling and the uptrend resumed on the weaker US

data. The negative sentiment for GBPUSD following the Bank of England

interest rate announcement could be easily seen with streak of red

bricks.

How to Trade Using Renko

A simple system could be used in which if we have 2 bricks of the same color establishes a trend that we could use as a trigger to either get long or short. On the other hand, a 1 brick of the opposite color ends the trend and we would exit the trade.

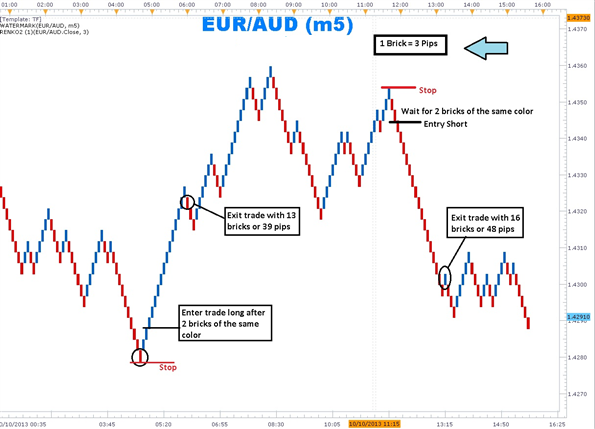

Buy filtering out time and whipsaws, Renko charts were able to map out

market sentiment within small time frames like the 5-minute chart which

usually have a lot of noise. However, Renko has its drawbacks. When a

line of bricks goes into a range changing color after 2 or 3 bricks,

traders can get whipsawed by price action.

It is easier to stand aside and wait for Renko bricks to move from the

congestion channel and begin trending again. This can be clearly seen

at the end of the EUR/AUD chart as the line of bricks breaks out to a

new low clearing past the previous congestion area.

In sum, it is easy to see that Renko charts can provide forex traders

with a new and fresh way to approach price action. Being based on price

action rather than time, traders can stay with trends longer and exit

with confidence with clear signals.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2013.09.03 11:03

Renko (extraction from Achelis - Technical Analysis from A to Z)

============

Overview

The Renko charting method is thought to have acquired its name from "renga" which is the Japanese word for bricks. Renko charts are similar to Three Line Break charts except that in a Renko chart, a line (or "brick" as they're called) is drawn in the direction of the prior move only if prices move by a minimum amount (i.e., the box size). The bricks are always equal in size. For example, in a 5-unit Renko chart, a 20-point rally is displayed as four, 5-unit tall Renko bricks.

Kagi charts were first brought to the United States by Steven Nison when he published the book, Beyond Candlesticks.

Interpretation

Basic trend reversals are signaled with the emergence of a new white or black brick. A new white brick indicates the beginning of a new up-trend. A new black brick indicates the beginning of a new down-trend. Since the Renko chart is a trend following technique, there are times when Renko charts produce whipsaws, giving signals near the end of short-lived trends. However, the expectation with a trend following technique is that it allows you to ride the major portion of significant trends.

Since a Renko chart isolates the underlying price trend by filtering out the minor price changes, Renko charts can also be very helpful when determining support and resistance levels.

Calculation

Renko charts are always based on closing prices. You specify a "box size" which determines the minimum price change to display.

To draw Renko bricks, today's close is compared with the high and low of the previous brick (white or black):

-

If the closing price rises above the top of the previous brick by at least the box size, one or more white bricks are drawn in new columns. The height of the bricks is always equal to the box size.

-

If the closing price falls below the bottom of the previous brick by at least the box size, one or more black bricks are drawn in new columns. Again, the height of the bricks is always equal to the box size.

If prices move more than the box size, but not enough to create two bricks, only one brick is drawn. For example, in a two-unit Renko chart, if the prices move from 100 to 103, only one white brick is drawn from 100 to 102. The rest of the move, from 102 to 103, is not shown on the Renko chart.

- Many Forex traders use weighted moving averages, called EMA’s, to trade currency pairs that are trending.

- Determine the direction of the dominant trend direction with a 200 period EMA.

- Use price crossing a 13 period MA as both an entry trigger and manual trailing stop

Developed in the 18th century in Japan to trade rice, Renko charting is a

trend following technique. It is excellent for filtering out price

“noise” so traders can catch a major part a given Forex trend. It was

believed that the name “Renko” originated from the Japanese word ‘renga’

meaning ‘brick’.

Similar to Kagi and Point and Figure charting, Renko ignores the element

of time used on candlesticks, bar charts, and line charts. Instead,

Renko focuses on sustained price movement of a preset amount of pips.

For example, a trader can set the bricks for as little as 5 pips or as many as 100 or more. A new brick will not be formed until price has moved 100 pips. It could take 24 hours for a new brick to form or it could take just a few hours. However, no bricks will form until the preset limit is achieved.

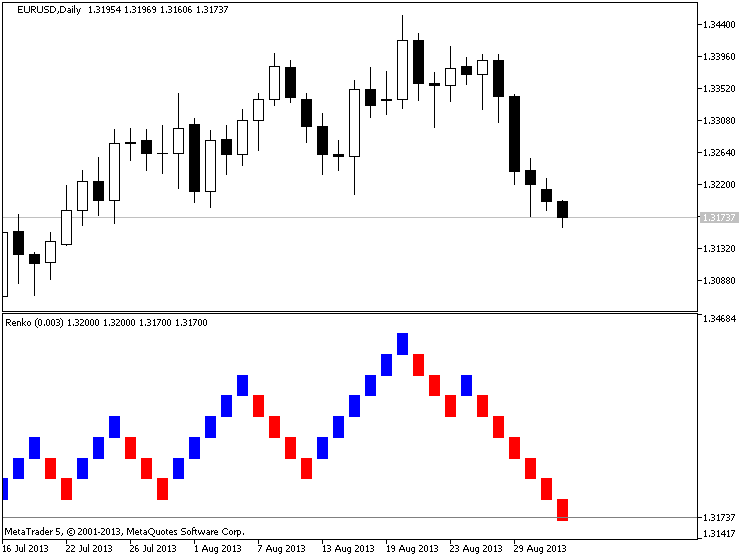

Find the Trend Direction

Renko charts can incorporate many of the usual technical indicators like

stochastics, MACD, and moving averages. Today’s strategy will marry up

Forex Renko charts with a 200 Exponential Moving Average (EMA) to find

trend direction. Very simply, if price is trading above its 200 EMA,

then the trend is up. If price is trading below its 200 EMA, then the

trend is down.

This filter will give us a directional bias much like a compass or GPS. We will look to only take long trades when the Renko bricks are trending above the 200 EMA. On the other hand, in a downtrend, if the Renko bricks are trending below the 200 EMA, then the trend down. Forex traders will only look to short the market. One of the biggest mistakes swing traders make is entering trades that go counter to the dominant trend.

When to Get In

After the dominant trend direction is determined, traders can use the

simplicity of Renko charts with a single 13 period EMA as a ‘trigger’ to

signal an entry in the direction of the major trend. First, wait for at

least two green bricks to appear above the 13 EMA. Then enter long on

the appearance of the second green brick above the 13 EMA.

Exiting for Profit and for Loss

Once a trader is “triggered” into the trade, a protective stop can be

set one-brick size below the 13 EMA. As long as the bricks remain above

the 13 EMA, we look to stay with the trend. Just as the 13 EMA can get

you in a new trade, the same EMA can be used to stop out a winning trade

locking in profits.

Traders will need to manually move the stop one brick-size below 13 EMA

and the current price brick. You can see in the example above how the

combination of Renko and the 13 EMA helps traders stay with the trend a

longer time.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Renko Line Break vs RSI EA:

An Expert Advisor based on two indicators - Renko Line Break and RSI. It trades stop orders.

Author: Serhii Ivanenko